The top three companies that dominate the global digital advertising space are Alphabet (NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and Amazon.com (NASDAQ: AMZN), in that order. Together, they account for over 70% of global public companies’ digital ad revenues, with Chinese companies coming in second. Here, we discuss the debates among analysts about future prospects for the big three.

Total digital advertising revenue growth

Based on the 64 public companies aggregated by Visible Alpha that comprise the global digital advertising universe, analysts now expect global ad revenue to grow nearly 8% in 2023 from $505B in 2022 and to deliver a two-year CAGR of 10%. These estimates have been revised up from March 30, 2023 levels to $545B (previously $537B) in 2023, and a further 11% in 2024 to $604B (previously $598B), adding an additional $99B (previously $93B) over the two-year period with 72% of that new growth, or $71B (previously $63B), coming from the top three: Alphabet, Meta Platforms, and Amazon.com.

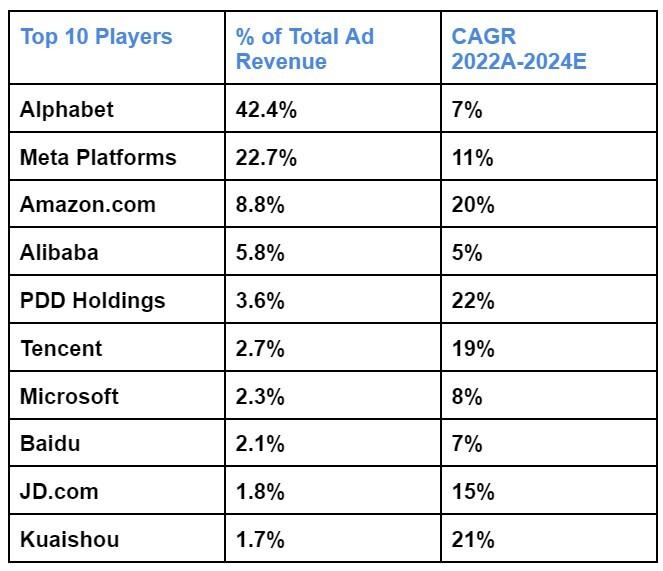

Advertising revenue and growth in the space are overwhelmingly dominated by a handful of large U.S. and Chinese players, with the remaining 54 companies each generating less than 1% of total ad revenues.

Much of the overall new growth estimated by analysts for the digital advertising space has been driven by upward revisions for META after its recent Q1 2023 earnings release.

Figure 1: Top 10 Players – Total Ad Revenue and CAGR

Source: Visible Alpha (May 10, 2023)

Key Takeaways:

|

Expected growth drivers in digital advertising revenues at GOOGL, META, and AMZN in 2023 and 2024

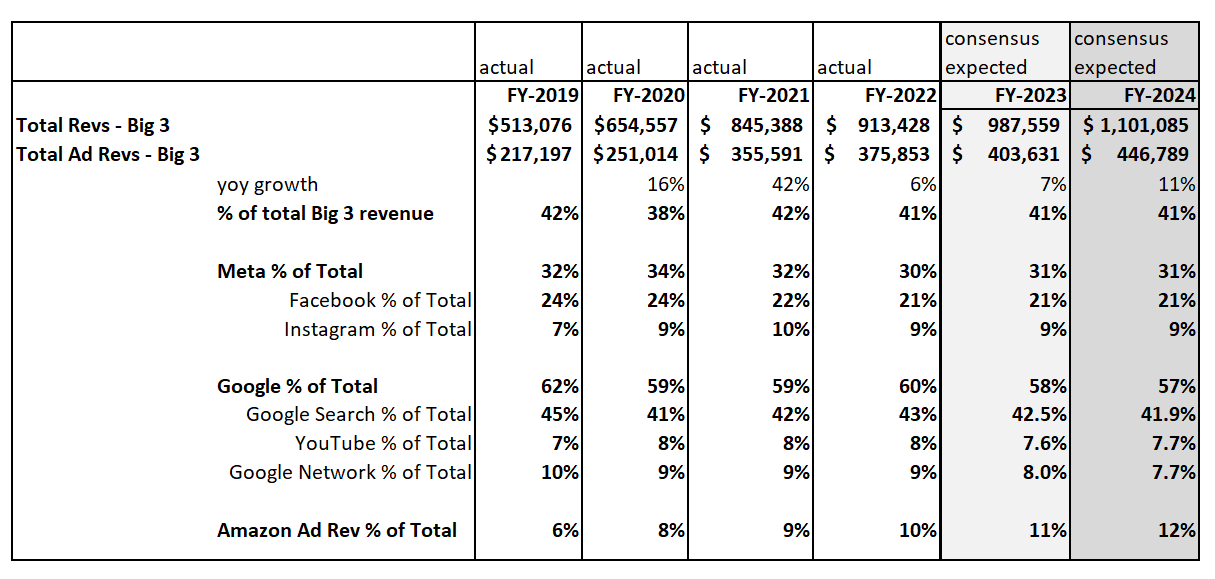

The combined digital advertising revenue of the Big 3 from 2022 to 2023 is expected to increase 7% (adding $28B) and a further 11% from 2023 to 2024 (adding another $43B), with growth driven largely by Facebook/Instagram, Google Search, and Amazon Advertising. In particular, Facebook core revenues have been revised up since March 30, 2023.

Figure 2: Big 3 Ad Revenue

Source: Visible Alpha (May 10, 2023)

The debates in these growth drivers

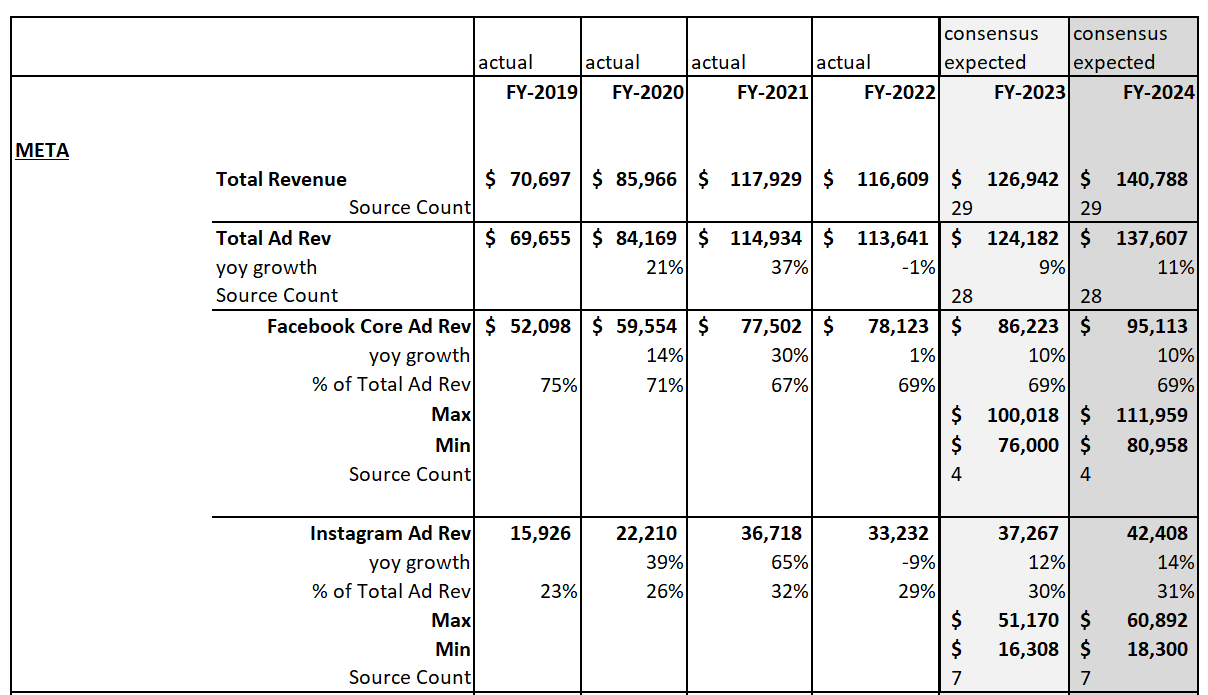

1. META: What is driving the upside in Facebook’s revenues?

On the earnings call, CEO Mark Zuckerberg noted that AI recommended ~20% of the content in the Facebook/Instagram feeds and has supported Reels monetization. Analysts have started to revise up revenue estimates to reflect ad revenue increases driven by AI-supported enhancements to content, messaging, and Reels.

Facebook core ad revenues: Of the 4 analysts providing data on META’s ad revenue for Facebook, the consensus estimates have been revised upward. In particular, the most conservative estimates have come up post-Q1, increasing $9B and narrowing the range. For 2023, the low-end estimate is now $76B (previously $67B), which is -12% (previously -17%) below consensus of $86B (previously $81B). The high-end estimate is now $100B (previously $95B), which is 14% (previously 17%) ahead of consensus.

In 2024, there is still debate about the expected performance of Facebook. The range widens further to 18% above and -15% below consensus of $95B, a spread of $31B.

Instagram ad revenues: Of the 7 analysts forecasting Instagram ad revenue for META, there is significant debate about the performance of Instagram over the next two years. Analysts vary substantially on their views and calculations of the Instagram business and its projected growth.

For 2023, analysts are expecting $37B in ad revenues for Instagram. However, the high end of $51B is 38% above consensus and the low of $16B is -56% below, a range of almost $35B.

In 2024, the range is further increased, with the high of $61B contributing a whopping 45% to total revenues and coming in 43% above consensus of $42.4B, and the low -57% below.

Figure 3: META Ad Revenue

Source: Visible Alpha (May 10, 2023)

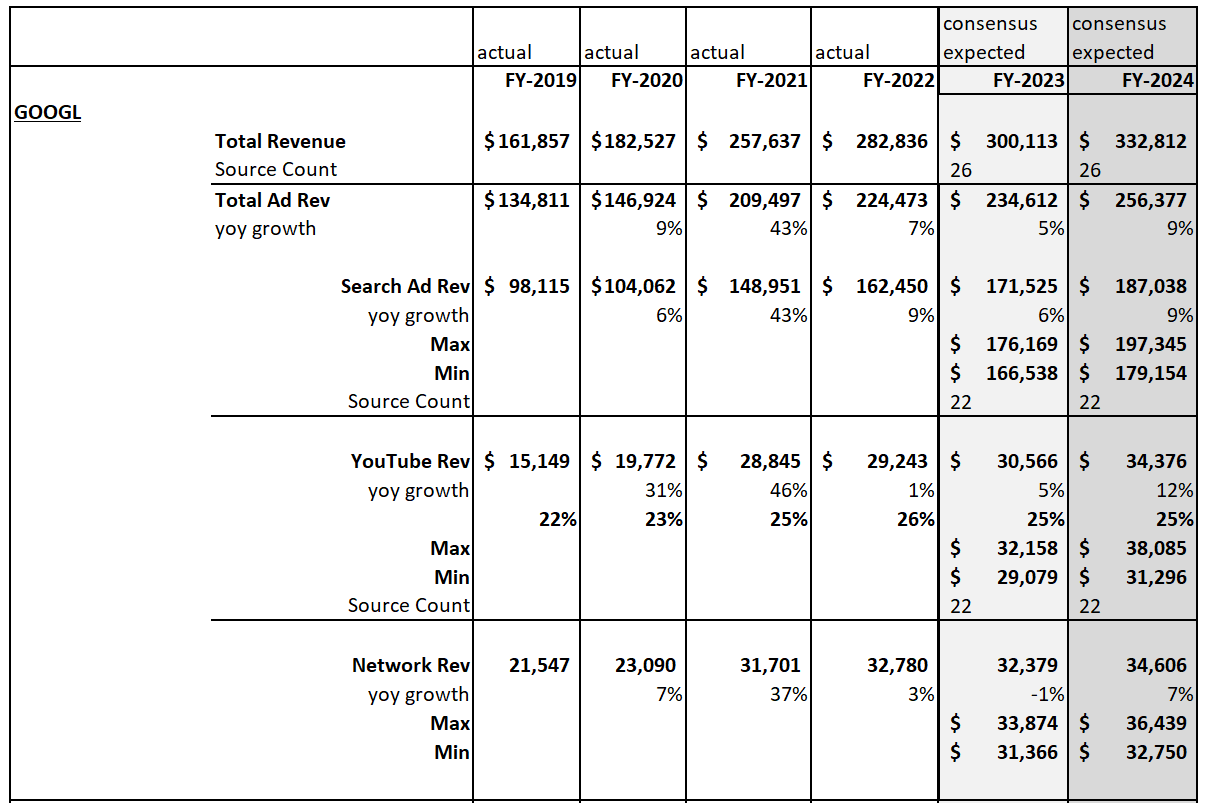

2. GOOGL: How are ad revenues from Search shifting?

At the Google I/O conference on May 10, 2023, AI was a central theme and CEO Sundar Pichai highlighted that Search, Cloud, and Maps will be increasingly incorporating AI enhancements.

Estimates are tracking in a tighter range with more debate in 2024 around Search and YouTube. The range of estimates narrowed for Search post-Q1 with low-end estimates coming up.

Search: Of the 22 analysts estimating GOOGL’s Search ad revenue in 2023, the top estimate of $176B is 3% above consensus of $171B and the low end is $166B, which is -3% below consensus, an improvement from earlier, more bearish estimates of $153B prior to Q1 earnings.

In 2024, analysts’ estimates have been diverging on Search with the high estimate of $197B, 5% above consensus of $187B, but $179B at the low end, which is -4% below consensus, an improvement from $160B prior to Q1 earnings.

YouTube: Of the 22 analysts estimating GOOGL’s YouTube ad revenue in 2023, the top estimate of $32B is 5% above consensus of $30B, and the low end of $29B is -5% below.

In 2024, analysts have greater variance in their views on YouTube, with the high estimate of $38B, or 10% above consensus of $34B, but $31B at the low end, which is -9% below.

Figure 4: GOOGL Ad Revenue

Source: Visible Alpha (May 10, 2023)

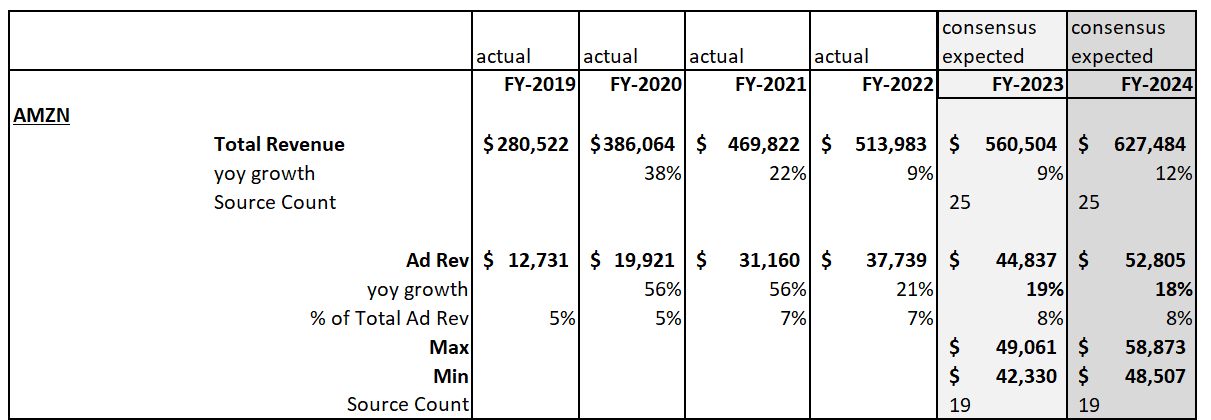

3. AMZN: When will they hit $50B in ad revenue?

Analysts expect AMZN’s year-over-year ad revenue growth of 19% in 2023 to generate $45B, and a further 18% increase in 2024 to deliver $53B, outpacing META, GOOGL and MSFT, and highlighting AMZN’s emerging position in the space. The ad business is also expected to drive better profitability.

There is, however, debate about the trajectory of AMZN’s ad revenue growth. In 2023, the high estimate of $49B is 9% ahead of consensus, and the low estimate of $42B is -5.5% below consensus of $45B.

In 2024, the most bullish forecast is now expecting $59B from ad revenue, down from $70B, but still 12% ahead of the $53B consensus estimate, while the low end of $48.5B is -8% below consensus.

Figure 5: AMZN Ad Revenue

Source: Visible Alpha (May 10, 2023)