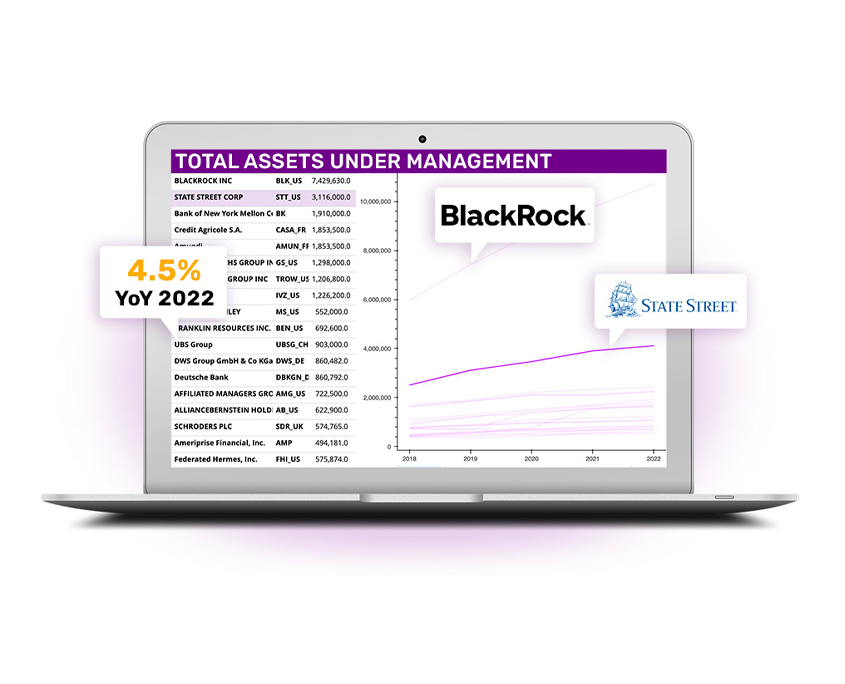

Visible Alpha Insights For Buy Side Clients

Elevate your buy-side workflow with Visible Alpha’s suite of analytical tools and data services.

Designed for Today’s Institutional Investment Professionals

Dive Deeper:

Hone in on the fundamental drivers of companies important to you with granular consensus estimates, broker models, and company filings.

Increase Efficiency:

Unlock new tools to analyze sectors in greater depth, stay in the know during earnings season, instantly integrate Visible Alpha data to your financial models.

Customize Your Experience:

Set custom alerts, build automatically updated financial models, and organize how you view company data.