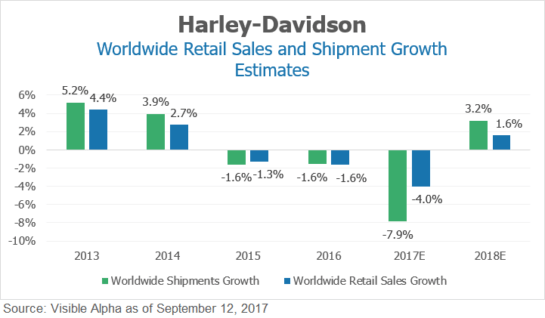

Harley-Davidson is facing several headwinds. The stock has declined 19% year-to-date amid weakening retail sales for its motorcycles. Last quarter, worldwide retail sales declined 7.2% year-over-year vs. the consensus expectation of a 5.6% decline. This continued a broader trend of mid-single digit declines in 4 of the last 5 quarters. And shipments have seen similar levels of weakness. Investors and senior management have attributed the weakness to a variety of reasons, ranging from aging demographics, to softer used pricing, to regional weakness in oil/gas markets.

Senior management has several initiatives to fight off these headwinds. First, the company is launching an elevated number of new models next year, which they hope will attract a younger audience. The company is rolling out 13 new models. These models will incorporate the new Milwaukee-Eight engine and design changes such as a lighter chassis and LED lighting. However, there is some risk that the company may alienate its core customer group. Analysts expect both worldwide retail sales and shipments to grow slightly in 2018 after a weaker performance in 2017.

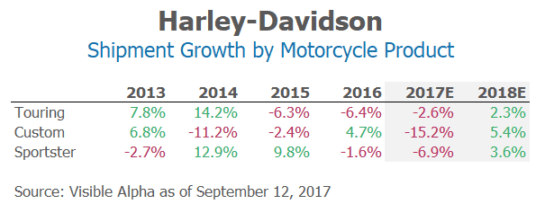

By motorcycle product, analysts expect a milder shipment decline and subsequent growth rate in the Touring motorcycles, and a greater decline and stronger subsequent growth rate in the Custom motorcycles.

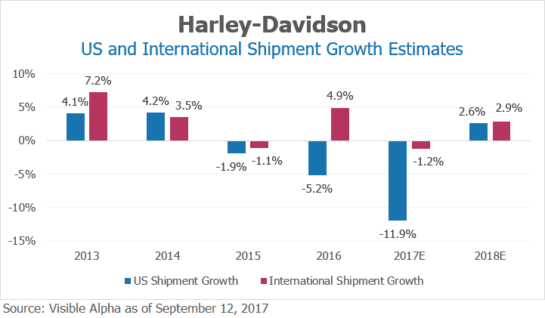

The company is also focused on growing internationally. To that end, management has established many new independent dealers in emerging markets. The company hopes that people in these markets will gradually trade up from their less expensive, lighter bikes to a Harley-Davidson as their incomes grow. Analysts expect less shipment weakness internationally in 2017 and slightly stronger growth in 2018.