Wet age-related macular degeneration (AMD) is an area of intense drug development focus, given the large markets and unmet need. Innovation in wet AMD drug development threatens current market leaders and the standard of care.

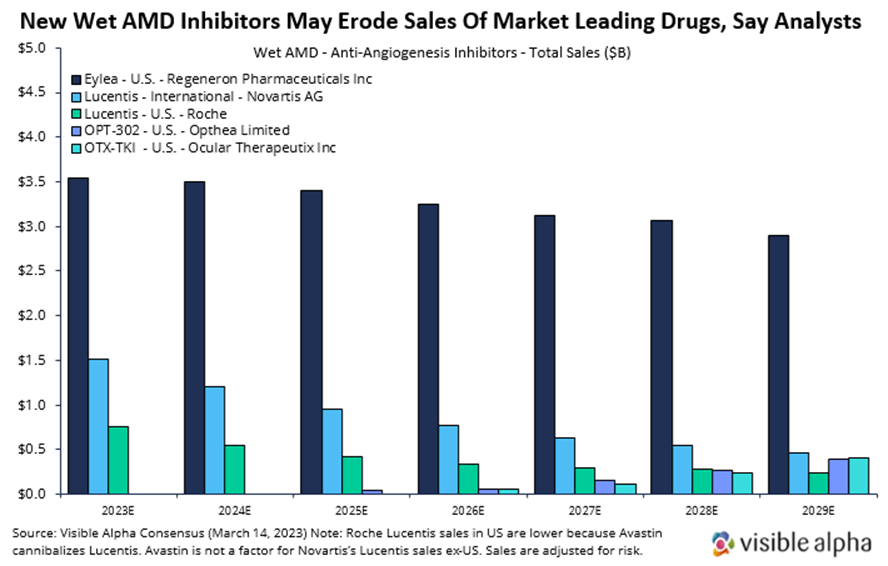

Here, we briefly summarize wet AMD markets and discuss recent clinical data from two emerging players in the wet AMD landscape, Opthea and Ocular Therapeutix. We also provide consensus revenue projections for Opthea’s and Ocular Therapeutix’s drugs to contrast with projections for the market leader, Regeneron’s Eylea. Visible Alpha consensus shows declining Eylea revenue estimates in the next several years due to the emergence of new drugs like those from Opthea and Ocular Therapeutix.

Background on age-related macular degeneration

Macular degeneration results from damage to the macula, the part of the eye in the center of the retina responsible for central vision and the ability to see fine details clearly. Dry Age-Related Macular Degeneration (AMD), the early form of AMD, accounts for 90 percent of diagnosed cases. Wet (exudative or neovascular) AMD, the more advanced form, accounts for approximately 10 percent of cases but results in 90 percent of legal blindness. It’s the most common cause of visual impairment among elderly patients in developed countries.

Here’s more about wet AMD and its treatment:

- Around 14 million people are affected by wet AMD worldwide.

- The current standard to care for wet AMD is Regeneron’s (RGEN) aflibercept — brand name Eylea had global revenues of over $7.6 billion in 2022 — across ocular indications, wet AMD and diabetic macular edema. The other blockbuster drug for wet AMD is Lucentis, with global sales of $2.8 billion in 2022. Lucentis is marketed in the U.S. by Roche (ROG_CH) and outside of the U.S. by Novartis (NVS).

- Wet AMD drugs are anti-angiogenesis inhibitors. They block the excessive and unregulated blood vessel growth (neovascular) and subsequent inflammation in the eye (retina).

- Eylea and Lucentis are administered by intravitreal injection, typically an injection in the eye every 4-8 weeks. This frequent injection protocol can cause problems such as endophthalmitis, ocular hemorrhage, and damage to the lens or retinal detachment due to repeated injections. Furthermore, these frequent injections in the eye may be a burden on patients.

- New drugs aim to either reduce the number of injections or improve visual acuity.

- Wet AMD drugs are also applicable to related retinal diseases of the eye — diabetic retinopathy and diabetic macular edema, among others.

Ocular Therapeutix and Opthea: Developing novel drugs for wet AMD

Ocular Therapeutix (OCUL) and Opthea (OPT_AU) are developing novel drugs for wet AMD. Ocular Therapeutix reported on Phase 1 clinical data and Opthea reported on Phase 2b clinical data. There are also several other drugs in clinical development for wet AMD, ranging from Phase 1 to Phase 3 clinical trials (not discussed here) that would impact the competitive landscape. Our focus here is to highlight the data recently released by Ocular Therapeutix and Opthea and provide consensus revenue projections.

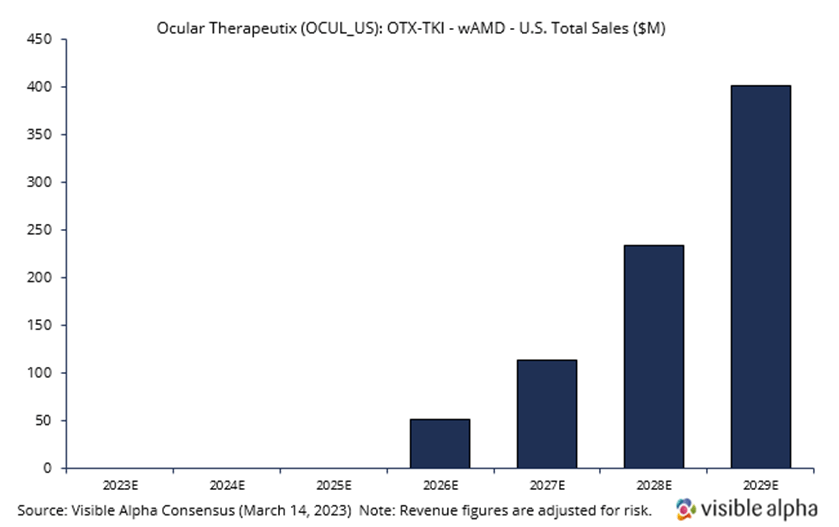

OTX-TKI – Ocular Therapeutix (OCUL)

Ocular Therapeutix is developing OTX-TKI, a slow-release or sustained-release drug in combination with the Eylea injection that would allow a reduction in the frequency of intravitreal (in the eye) Eylea injections. Visible Alpha consensus revenue estimates project OTX-TKI wet AMD sales of $400.7 million, adjusted for risk, in the US in 2029, three years after market launch in 2026. Analysts peg the current probability of success at 40%. Consensus analyst estimates suggest the annual treatment price in 2029 will be around $10,200, consisting of an expected two doses (note: there is a vast difference in analyst estimates for price per annual treatment, ranging from around $2,000 to over $20,000). Phase 1 studies are ongoing, but interim positive data has been reported. The company intends to initiate a pivotal trial in wet AMD in the third quarter of 2023, subject to FDA agreement.

|

OTK-TKI Phase 1 interim data

|

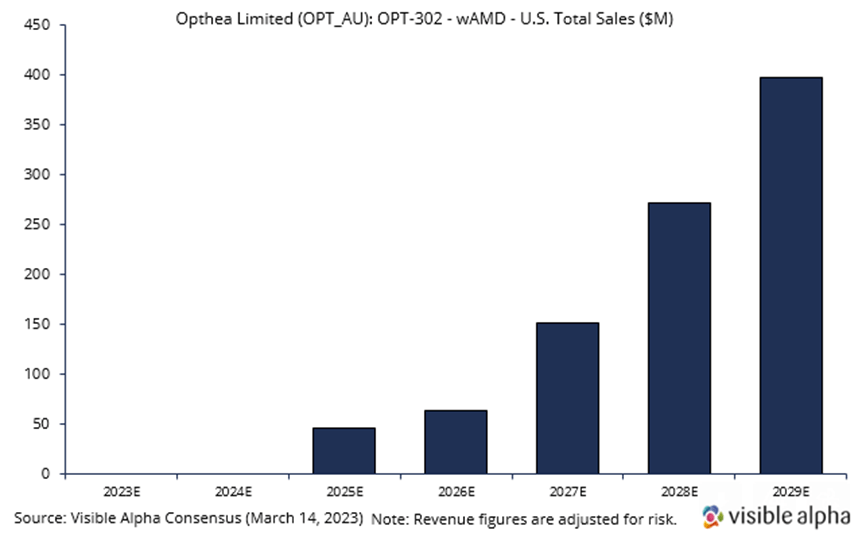

OPT-302 – Opthea Limited (OPT_AU)

Opthea is developing OPT-302 in combination with Novartis’ Lucentis. Visible Alpha consensus revenue estimates project OPT-302 wet AMD sales of $397.2 million, adjusted for risk, in the US in 2029, four years after market launch in 2025. Analysts peg the current probability of success at 66%. Consensus analyst estimates imply the price per dose in 2029 will be around $1,500. OPT-302 is administered in combination with Lucentis every four weeks. On average, patients receive 5 injections per year. Phase 3 studies are ongoing, with positive data reported in Phase 2b.

|

OPT-302 Phase 2b data

|

What’s more important for patients – lower frequency of injections or improved eyesight?

Professor Tim Jackson, lead author and consultant ophthalmic surgeon at King’s College London commented: “Recently, a focus in wet AMD has been on emerging approaches to extend dosing intervals, which is important, but patient surveys indicate that they rank their main goal as achieving better vision over durability.”

However, many other factors may come into play as well. These include patient wet AMD disease status, patient age, and patient comorbidities. Long-term data in a larger population will provide more clarity.

Why Lucentis sales in the U.S. are dramatically lower than Lucentis sales ex-U.S.: Lucentis was licensed to Novartis for ex-US sales by Genentech in 2003. In the U.S., Avastin, which was approved for cancer, cannibalizes the Lucentis market. Both Lucentis and Avastin were developed by Genentech (Roche/Genentech now). Because Avastin (full-length antibody to VEGF-A) binds the same target as Lucentis (Lucentis is the Fab fragment of Avastin that binds VEGF-A), their effect for wet AMD in blocking VEGF-A is generally interchangeable. Avastin is effective at lower doses and is much cheaper, therefore ophthalmologists often use Avastin dispensed by compounding pharmacies. Note that Avastin dispensed at compounding pharmacies comes with some risk of infection, but the occurrence is low, and the FDA allows it.

The bottom line

Novel drugs targeting unregulated angiogenesis pathways in wet AMD are in development. These novel drugs must have one or more superior attributes to overcome the entrenched therapies on the market. Intravitreal injections can be burdensome for patients. New approaches, such as OPT-302 and OTX-TKI, among others, in combination with the current standard of care, or as single agents, must compete on improved safety, improved visual acuity, durability, and/or reduced frequency of injections.