The U.S. Bureau of Labor Statistics published new inflation numbers recently; consumer prices eased to 8.3% in August after climbing 9.1% in June 2022 from the prior year, the highest inflation rate in the U.S. since 1981. To curb inflationary pressures, the Federal Reserve hiked interest rates by 75 basis points in September for the third time this year, to a 3%-3.25% range. In an environment of high inflation, subsequent rising interest rates, and recessionary fears, we look at the top 10 U.S. banks by net loans – JP Morgan & Chase (JPM_US), Bank of America (BAC), Wells Fargo (WFC_US), Citi Group (C_US), US Bancorp (USB_US), Truist Financial Corporation (TFC), PNC Financial Services (PNC), First Republic Bank (FRC_US), Citizens Financial Group (CFG), and M&T Bank (MTB_US) – as they come out of 2Q FY22 earnings.

For a more in-depth look at the revenue drivers and other KPIs in the banking industry, as well as forecasts across other industries, visit Visible Alpha’s KPI Dashboards. For a primer on the banking industry, featuring key metrics that will aid in identifying trends to project future company performance, please visit our Guide to Commercial Bank KPIs.

Revenue Picture

Revenue across the 10 banks grew by 1.6% in 2Q FY22. The investment banking segment underperformed for most banks as dealmaking fees slumped due to the larger economic stresses. Earnings from lending operations, however, benefited from rising interest rates. Despite the economic concerns and the Fed rate hike, net loans for the 10 banks increased by 9.1% in 2Q FY22 from the prior year, and analysts project they will grow by 9.0% in FY22 and 3.7% in FY23.

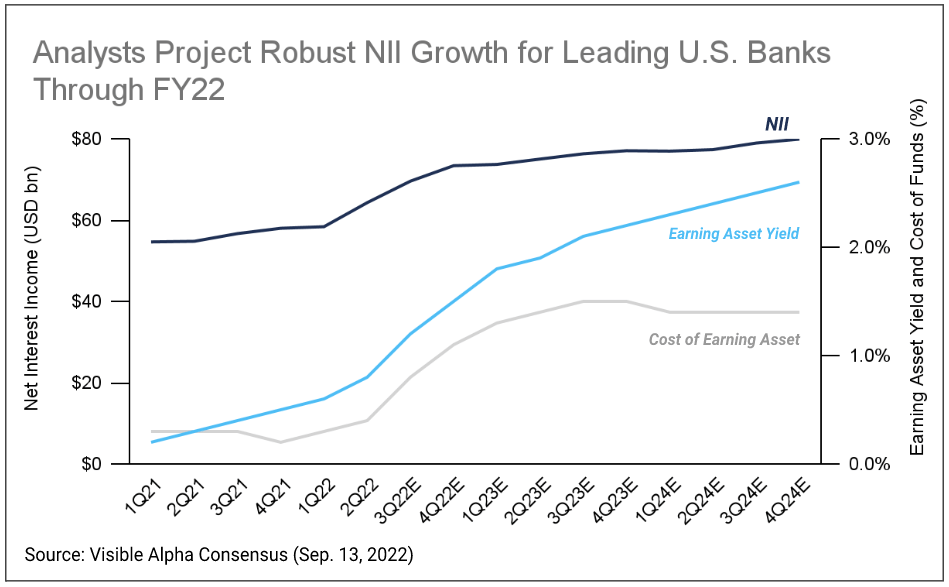

Across all the leading banks, better loan growth along with high-interest rates have driven net interest incomes (NII) to record levels. NII for the 10 banks rose by 17.4% in 2Q FY22 from the prior year. Analysts project year-on-year NII growth to be even more robust for these banks in the coming quarters. NII is expected to rise by 18.7% in FY22 for the 10 banks.

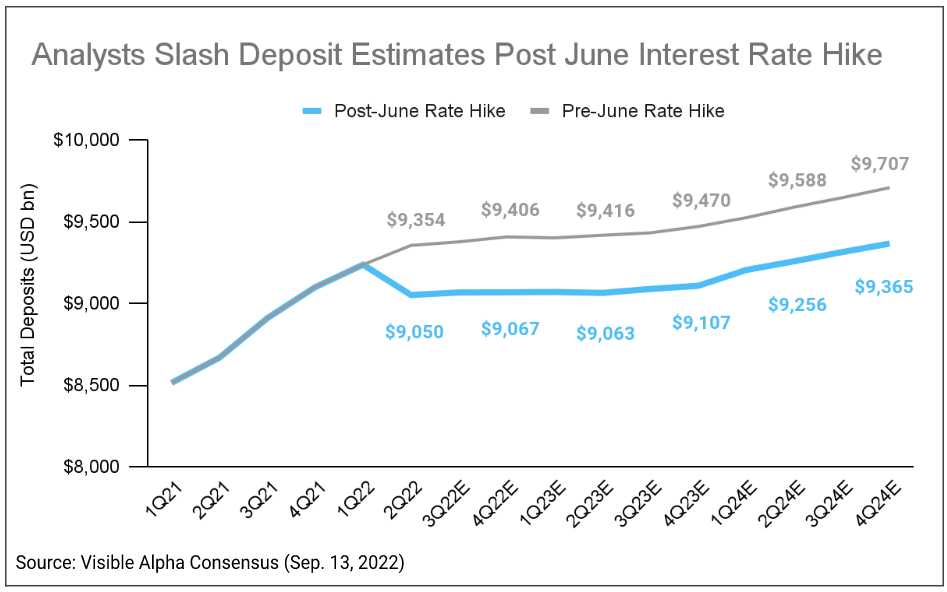

Deposit Outlook Weakens

Historically, bank deposits have mostly been on an upward trajectory. However, with a benchmark rate of 2.25%-2.5%, higher tax payments, and inflation-induced increased spending, analysts project aggregate deposits for the 10 banks to decline, starting 2Q FY22. Based on analyst expectations, total bank deposits are expected to fall by 0.3% in FY22 from the prior year after declining by 2% in 2Q FY22 on a quarterly basis. Before the interest rate hike in June, analysts projected deposits would increase by 3.3% in FY22 and by 7.9% in 2Q FY22 from the prior year.

Funding Mix

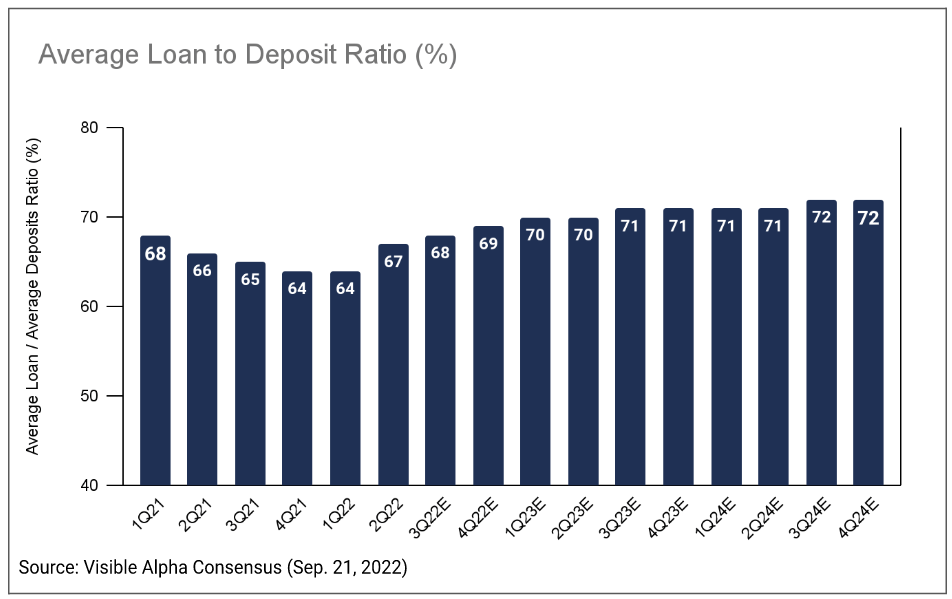

This, however, may not have a large impact; even with recent declines in deposits, total deposits remain significantly more than loans across all leading banks, which should benefit banks in a rising interest rate environment.

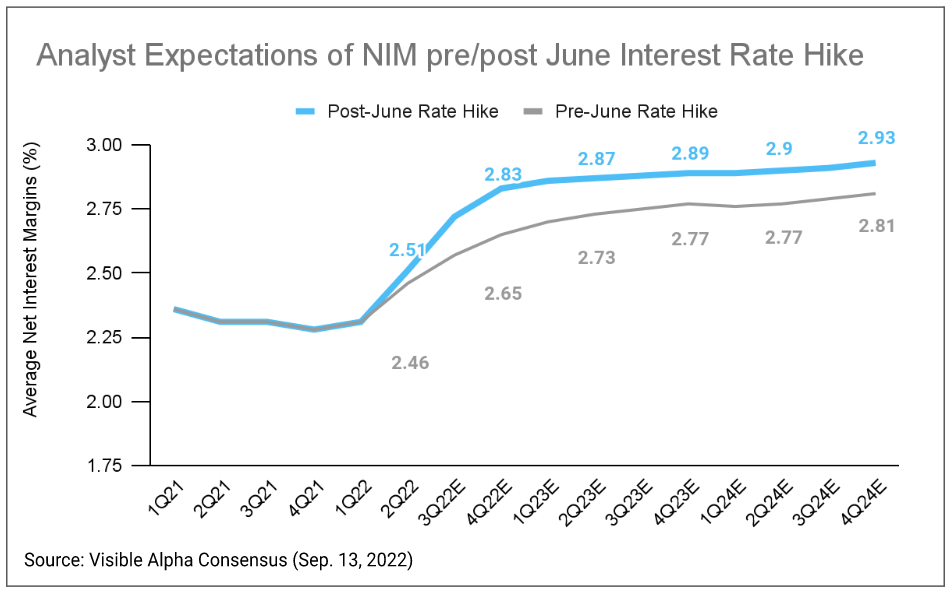

As a result, analysts estimate net interest margins (NIM) will continue to improve across all banks in the coming quarters, driven in part by the rise in interest rates.

Conclusion

Rising interest rates and loan growth have provided a tailwind to revenue growth, offsetting weaknesses in their non-credit-related segments. However, as inflation constrains consumer spending and recessionary pressures loom, the impact of future credit losses remains to be seen.

Note: All charts and figures referenced computed using the aggregate (for $ values) or average (percents) of the 10 largest U.S. banks by loans that we cover: JP Morgan & Chase, Bank of America, Wells Fargo, Citi Group, US Bancorp, Truist Financial Corporation, PNC Financial Services, First Republic Bank, Citizens Financial Group, and M&T Bank.