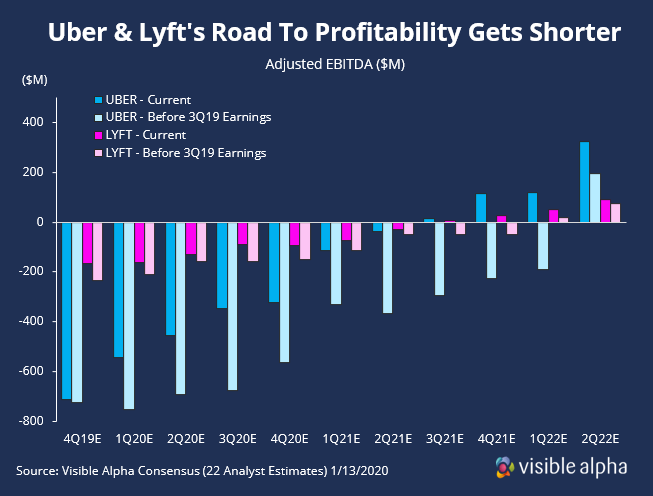

Analysts are expecting ridesharing companies Uber & Lyft to achieve profitability on an adjusted EBITDA basis sooner than previously expected. Recently issued guidance from both Uber & Lyft highlight improved monetization and expense leverage by raising prices, reducing headcount, optimizing payments and insurance, cutting back on couponing and promotions, and exiting unprofitable markets.

Uber’s new segmentation disclosed that their ridesharing operation has been generating profitable adjusted EBITDA for the last 8 quarters and can completely cover overhead corporate expenses. While both companies may have profitable ridesharing segments, large investments in other businesses and autonomy continue to have a drag on profits in the near term.

Analysts pushed both Uber and Lyft’s first profitable adjusted EBITDA quarter up to 3Q21 from 2Q22 and 1Q22 respectively.

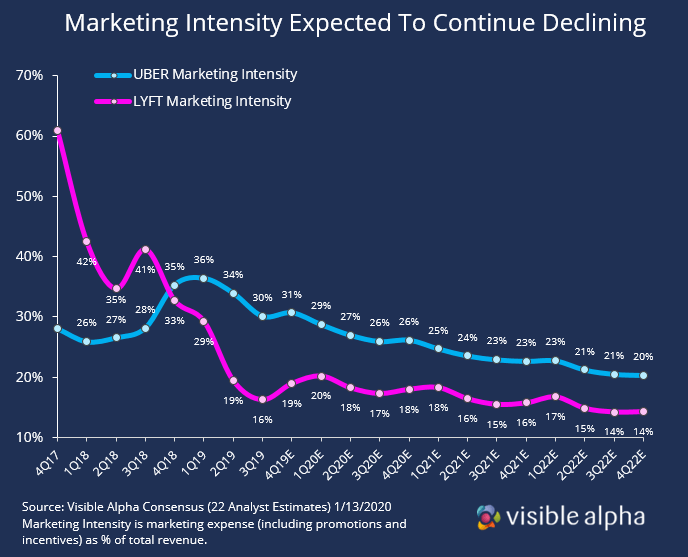

Cutting Promotional Spending

Uber and Lyft are both committed to reducing promotional spending and lowering overall sales and marketing expenses. Lyft has made greater progress in reducing marketing intensity, down to 16% of sales in 3Q19 from 41% a year earlier as rider incentives were reduced much quicker than expected. Analysts expect both companies will continue to reduce marketing intensity over time as pricing becomes more rational, promotional activity abates, and the competitive environment improves – with some pointing to Juno closing NYC operations as an example.

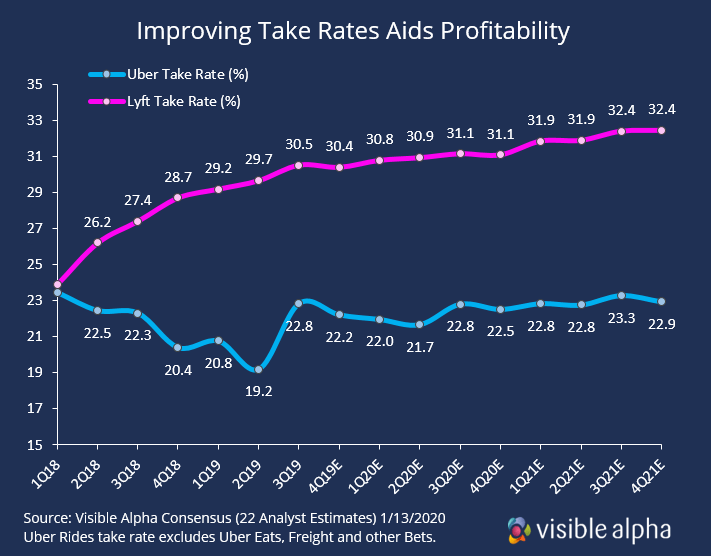

Pricing and Better Technology Lift Take Rates

Increasing ride prices to more “rational” levels improved take rates for both Lyft and Uber in 3Q19. Lyft’s focus on higher value rides and less competitive markets has given them a take rate advantage, but they’ve also been able to leverage an improved ride matching system and app redesign that unlocked efficiencies and improved rider demand. Analysts believe take rates will improve for both companies if they remain rational by either raising prices or exiting unprofitable markets. Lyft recently exited six scooter markets while Uber left South Korea last year.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.