Analysts Forecast EUV Delivery Upside

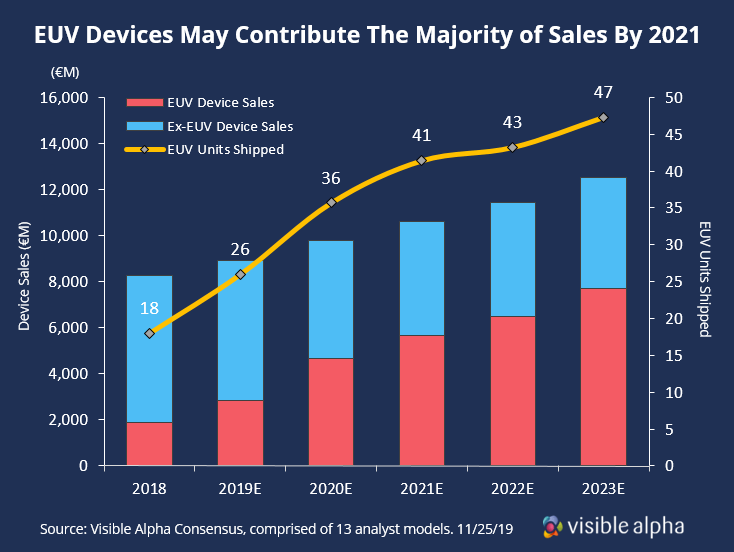

ASML’s breakthroughs in Extreme Ultraviolet Lithography (EUV) created a natural monopoly for them to supply an essential technology needed to shrink semiconductors for high performance applications such as 5G, Artificial Intelligence, Autonomous Driving, and Big Data. Currently, all mainstream chipmakers have multi-year shrinkage roadmaps that require EUV, which should drive demand for the foreseeable future. Analysts believe the company will sell 36 EUV systems in 2020 (above company guidance of 35) with an average selling price of over $131M. By 2021, the majority of ASML’s revenue is projected to be generated from EUV devices.

Persistent Logic Demand, Potential Memory Recovery

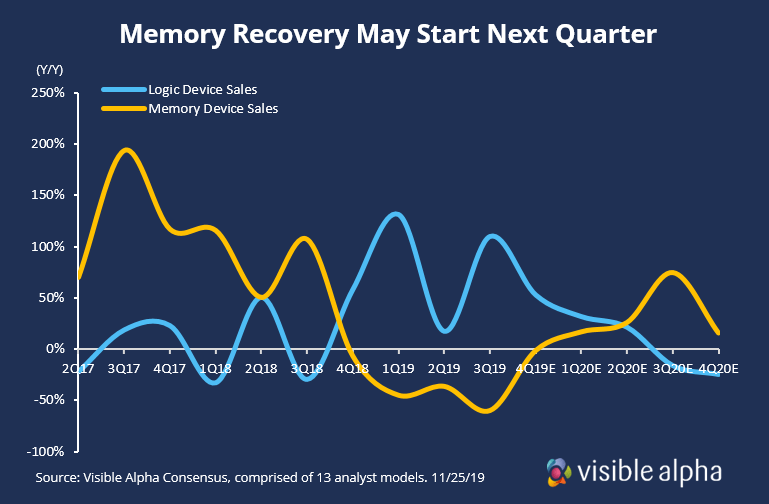

Analysts are forecasting the possibility of a modest recovery in memory demand starting next quarter. Since 2018, logic has been the primary driver of ASML’s system sales while memory has gone through a cyclical downturn. However, analysts see the potential for a return to growth next year as a new generation of DRAM begins ramping production, like at Samsung’s Pyeongtaek fab, which is opening in 2020 and expected to operate a DRAM EUV line.

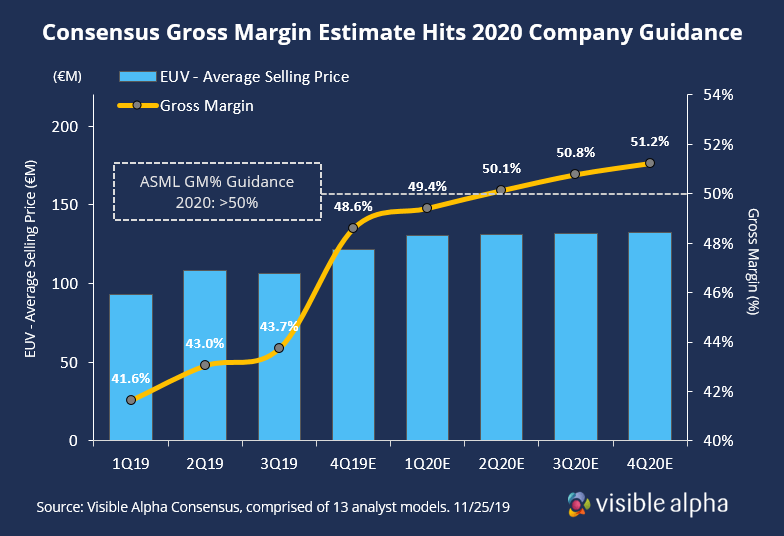

Higher Prices, Services Among Factors Improving Margin

ASML guided for greater than 50% gross margin next year, a milestone Wall Street analysts expect will occur in 2Q20 with improvement through year-end driven by several contributing factors. Beginning in 4Q19, ASML will only be shipping their latest EUV model (NXE3400C) which is priced about 30% higher than the former model. Fixed costs leverage is also being realized as production ramps and efficiencies in the assembly process are discovered. A new service model linked to wafer output will also be margin accretive as their installed base production increases and finally new field upgrades that carry about 70% gross margin plan to be introduced in 2020.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.