Rivals Lure “Promiscuous” Customers

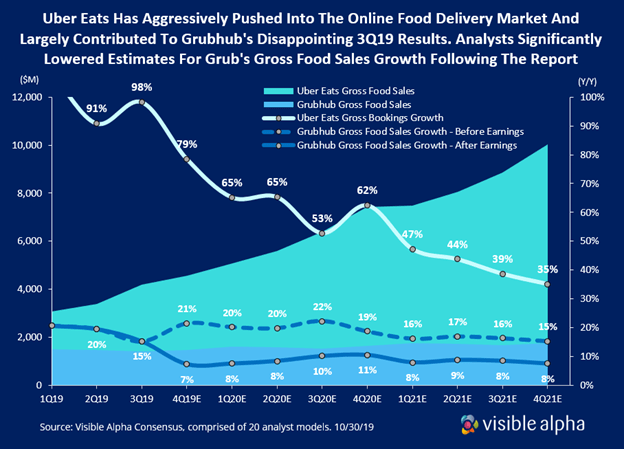

Grubhub (GRUB) customers have become increasingly less loyal as rival services like Uber Eats, DoorDash and others aggressively compete for business with generous promotions and larger restaurant selection.

The company began noticing daily average orders trending lower in August and that newly acquired customers had more “promiscuous” purchasing behavior than customers in previously established markets. Following their latest earnings report analysts drastically cut estimates for gross food sales growth and are now projecting just high single-digit growth through 1H20.

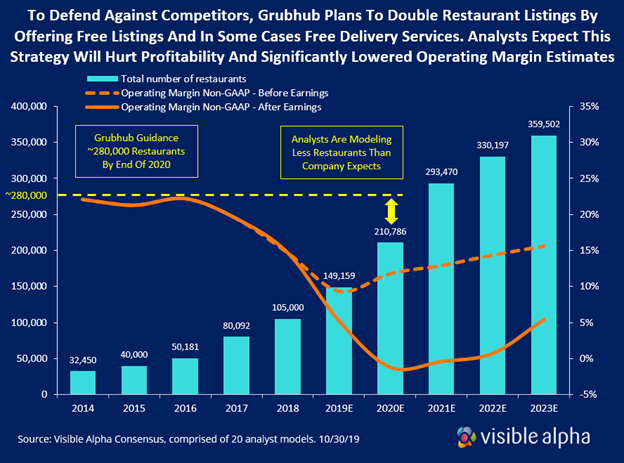

Defending Against Competitors

Grubhub plans to double restaurants listings by the end of 2020 by offering non-partnered restaurants free listings and free delivery service in some cases. With no competitive advantage or ability to scale delivery, analysts are concerned this strategy will erode profitability and therefore significantly lowered operating margin estimates throughout 2020, with no recovery until 2021. However, analysts are modeling far less restaurants than the company has guided for, which opens the possibility that these already bearish assumptions could still be too optimistic.

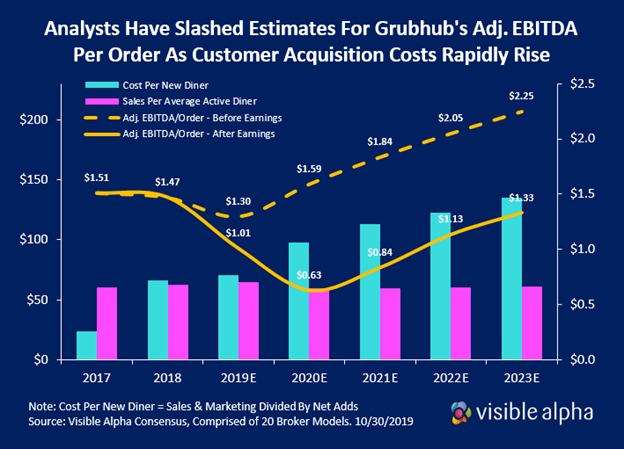

EBITDA Estimates Slashed

Analysts see Grubhub increasingly spending more money to acquire customers with relatively lower lifetime value. Estimates for FY2020 adjusted EBITDA per order have been revised down to $0.63 from $1.59 since the company reported third quarter results. Without headwinds, the company believes they could have earned up to $2.00 of adjusted EBITDA per order in 2020.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.