The Financial Conduct Authority (FCA) is being fairly lenient after the implementation of MiFID II, announcing that they won’t take immediate action against firms as long as they are moving toward full compliance. That being said, the FCA has also noted they will take action against any firm that is deliberately disregarding the rules of MiFID II.

Though there have been complaints of fairness – such as the threat of a lawsuit on fairness against the FCA – the FCA has warned that their leniency will only last so long. Firms of all sizes need to ensure they are at least on the road to full compliance under MiFID II, if not double checking that they are already there.

Though the reach of MiFID II is far and wide, when looking at the regulation in terms of the investment research workflow, broker liaisons, COOs, compliance officers and other senior management can ensure every aspect of their investment research practices are compliant.

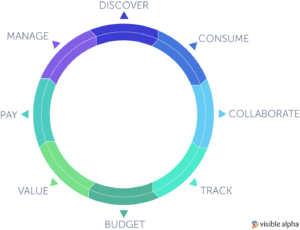

Here’s the investment research workflow:

MiFID II impacts every stage. Let’s break it down to ensure your firm is covered.

Discover → Consume → Collaborate

Analysts and portfolio managers are constantly discovering and consuming various content sets, including research reports, analyst models and corporate access events. Discovery and consumption occurs in email, research discovery and consumption platforms, onsite (meetings, conferences), phone calls, research data feeds and other software platforms, such as Visible Alpha Insights.

Throughout the discovery and consumption process, it’s important to encourage your investment team to collaborate and to provide an easy way of doing so. An RMS, or research management solution, is a great way to increase collaboration in a safe, entitlements-based environment.

Learn how to improve buy-side collaboration to increase performance

MiFID II Impact

The impact of MiFID II crosses all three of these stages, and the theme here is to have a comprehensive inducements management solution. In other words, you want to ensure that the investment team is only receiving research that they have permission to see; otherwise, it can count as an inducement. For example, even though the sell side is in control of managing which buy-side firms are entitled to access their content, you need to have controls in place to make sure your investment team is safely discovering, consuming and collaborating on the right research through a reverse entitlements process. Here’s a full post on how to avoid inducements under MiFID II.

Track

While the investment team is busy discovering, consuming and collaborating on investment research reports, analyst models and corporate access events, the broker liaison is working with the sell side to track all interactions. Brokers and research providers are getting a lot better at tracking interactions and submitting this information to their buy-side clients to then rate and value. That being said, the broker liaison is responsible for collecting all of the tracked interactions and making it easy to move to the valuation and payment stages.

MiFID II Impact

MiFID II requires that research is unbundled from trading and that consumed content is paid for separately. In order to pay for research separately, there must be a tracking mechanism in place to know what is consumed. Tracking can be done manually, but keep in mind there is more room for human error in a manual methodology. Instead, consider investing in a resource tracking tool that leverages clean broker interactions and enables the broker liaison to monitor and analyze all broker interactions in one place.

Budget

As mentioned above, prior to MiFID II, a firm could essentially have one budget for research and trading, as research was bundled with trade execution.

MiFID II Impact

Now research budgets must be separated from any trading payments and agreed upon by investment managers and their clients. Broker liaisons, or whomever is in charge of paying brokers and research providers, need to have a way of managing the overall research budget. With the right tool, managers or administrators can allocate the research budget across teams and individuals and across time periods and providers.

Value

After creating a budget, determine the value of the consumed content. Before MiFID II, the value of research was rather arbitrary, as it was bundled together with trade execution and based more on gut feelings and relationships than actual value.

MiFID II Impact

Under MiFID II, the sell side is under pressure to demonstrate true value through research reports, analyst models and corporate access events. In fact, the sell side is already experiencing pressure to set prices on their content sets and offering a menu of content sets to clients. However, the buy side can use rate cards, calculators and broker votes to assess the value of sell-side services. These tools assure there is a consistent and documented method of tracking and valuing research that’s not based on gut feelings or biased by recent interactions.

Refresh your knowledge of broker vote fundamentals

Pay

Prior to MiFID II, buy-side firms paid for research through trading commissions.

MiFID II Impact

Firms must choose to either set up research payment accounts or pay for research out of their own P&L to ensure research payments are not associated with trading. The majority of firms have gone with P&L.

Manage

Administrators live in the “manage” stage of the investment research workflow. They are managing the ongoing processes and procedures, including trial and contract management, entitlements and broker/research provider relationships.

MiFID II Impact

There are new rules regarding broker trials, and broker liaisons will find it helpful to have a trial and contract management system. Under MiFID II, a buy-side firm can engage in one trial per year with a broker and that trial can only last three months. It’s very important that everyone in the firm knows when a trial is happening and has insight into the stage of the trial. With a trial management system, notifications and alerts can be automated to alert the investment team of new trials and when trials are ending.

Broker liaisons also need to manage reverse entitlements, which feeds right back into the “discovery” stage of the investment research workflow. Consider this: Broker A turns on entitlements for your firm, but you don’t have a formal agreement with them. Who gets fined? You do. Reverse entitlements protects you by flagging what you should have access to versus what you do have access to. This function is not only important to protect against inducements, but to restrict any individuals or teams from accessing research the firm hasn’t budgeted for either.

Whatever investment research valuation methodology your firm sets up, it’s important that it’s flexible, scalable and sustainable. What works for your firm today may not work a year from now as your firm grows and takes on new clients, so think long term about the direction your firm is heading. Don’t get caught in non-compliance but don’t be a bottleneck for your firm’s potential growth and expansion, either.