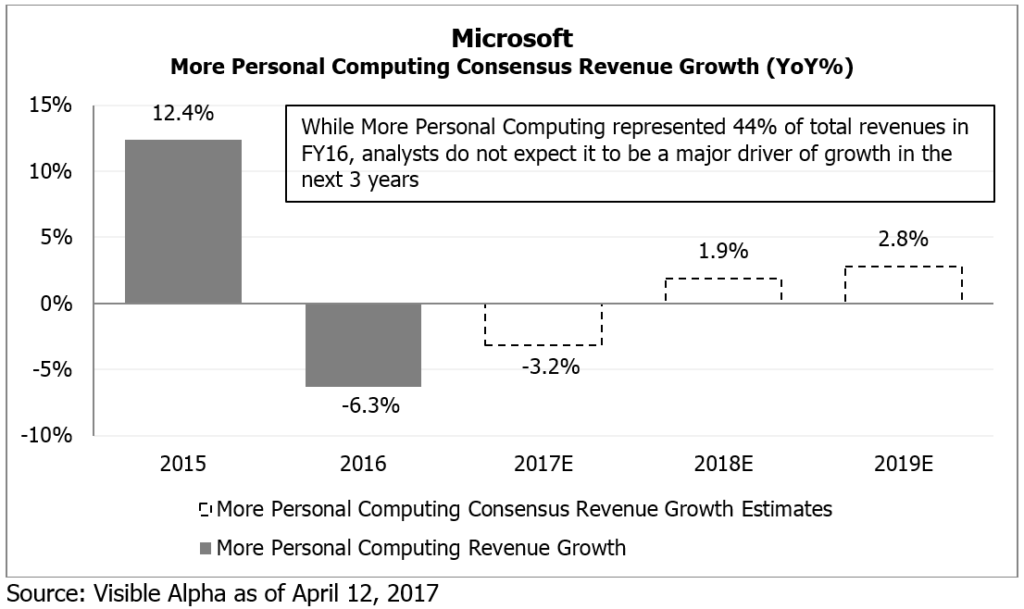

Microsoft’s core franchise, the More Personal Computing segment, remains a large portion of the business at 44% of revenue, but Visible Alpha’s consensus estimates suggest the segment is not expected to be a major driver of future growth with low-single digit changes over the next three years.

Learn more about how you can get access to Visible Alpha.

A Focus on Microsoft’s Cloud Products

Instead, investors are focused on their cloud products, Office and Azure, as they’re expected to drive much of the company’s growth (similar to Adobe’s repositioning to the cloud, as we wrote about earlier in March). Azure has been of particular focus as the product continues to gain traction.

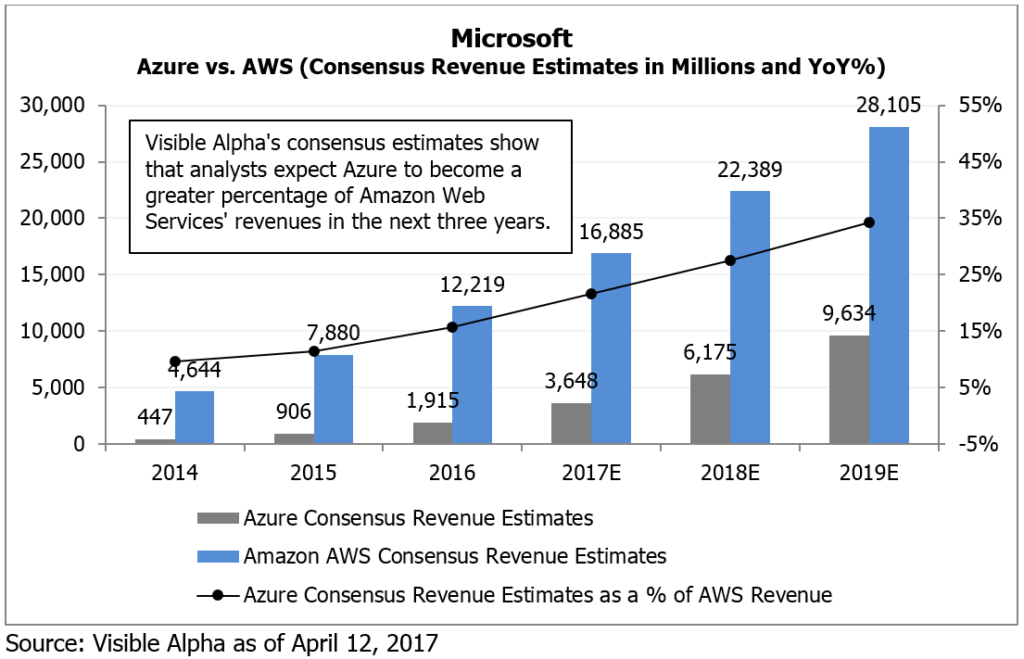

But exactly how bullish has the sell-side become on Azure now, with the stock up 20% over the last year alone? And to what degree do investors expect it to gain share on its main competitor, Amazon Web Services (AWS)?

Azure is Expected to Become More Competitive Over the Next 3 Years

While AWS has enjoyed a first mover advantage and is significantly larger than Azure, many investors believe Azure will become more competitive over the next three years as large enterprises take advantage of Microsoft’s product breadth. In fact, consensus data shows that analysts expect Azure to grow from $1.9B in 2016 (~16% of consensus AWS revenue) to $9.6B in 2019 (34% of consensus AWS revenue).

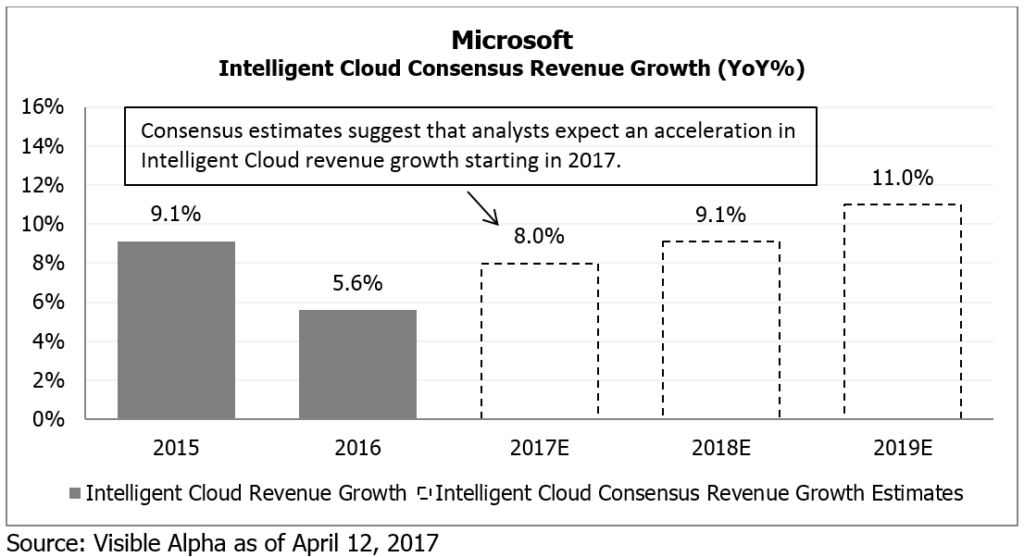

From a segment perspective, consensus estimates show that Azure is expected to drive essentially all of the growth in Intelligent Cloud. Analysts expect Intelligent Cloud growth to accelerate over the next three years from 2016.