Weak MAU Growth and Inefficient Monetization Continue to Trip Twitter

While SNAP has been dominating the headlines with its IPO, analysts have become increasingly bearish behind the scenes on another social media platform: Twitter. Key analyst concerns include Twitter’s ability to attract new users and the platform’s ability to capitalize on its existing 300 mn+ monthly active user base in generating additional revenue.

Growing User Base Remains A Challenge

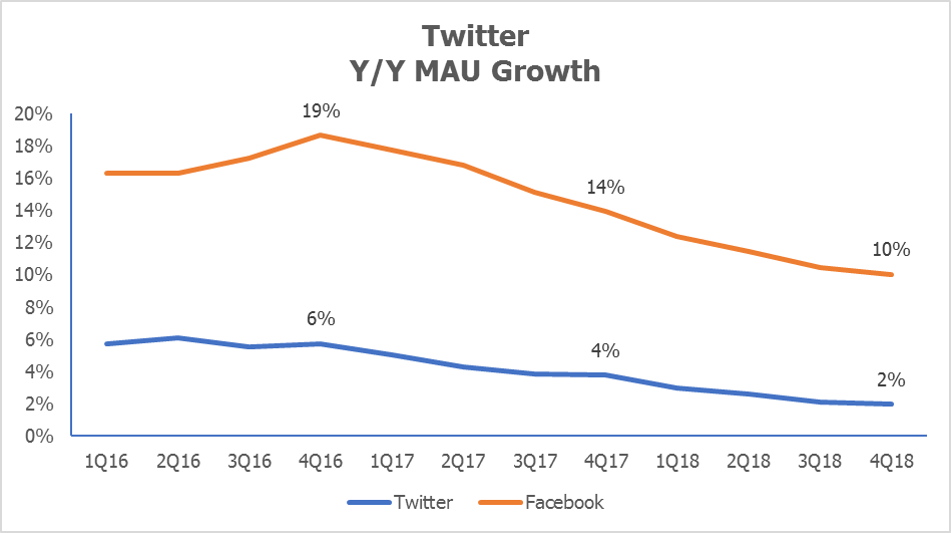

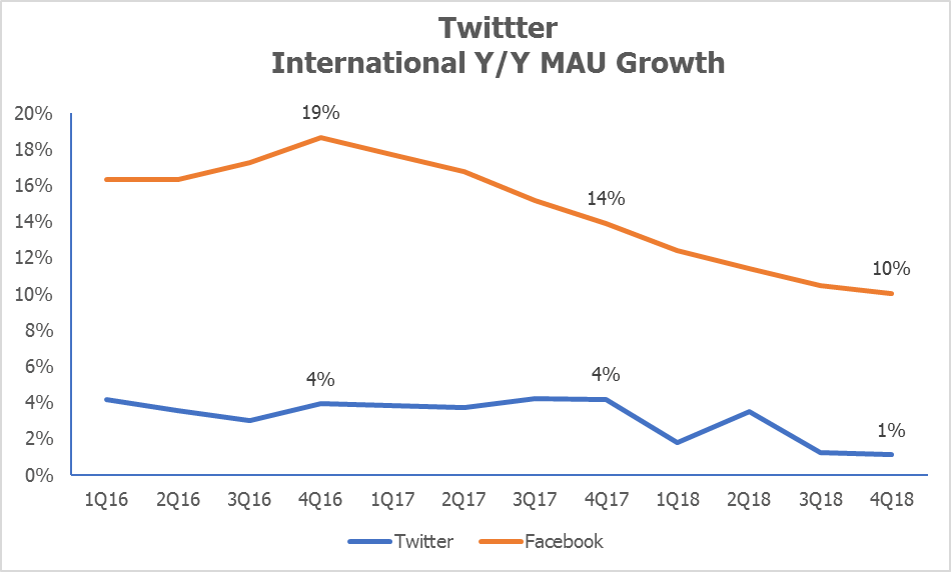

In 4Q16, TWTR’s Monthly Active Users (MAU) grew to 319 million, up 4% year over year following year over year growth of 3% in 1Q, 2Q and 3Q16 respectively. Analysts are pessimistic on Twitter’s ability to improve upon this number with projections of 4% growth in 2017 and 1% growth in 2018. In contrast, Facebook’s (FB) MAU is expected to grow 13% in 2017 and 9% in 2018. A key reason for FB’s superior growth is its international segment, which is projected to grow 14% and 10% in 2017 and 2018, compared to Twitter’s projected growth of 4% and 1% in 2017 and 2018, respectively.

Source: Visible Alpha. For illustrative purposes only. Learn more about Visible Alpha.

Source: Visible Alpha. For illustrative purposes only.

Increasing Competition for Ad Spend is Increasing Cost of User Acquisition

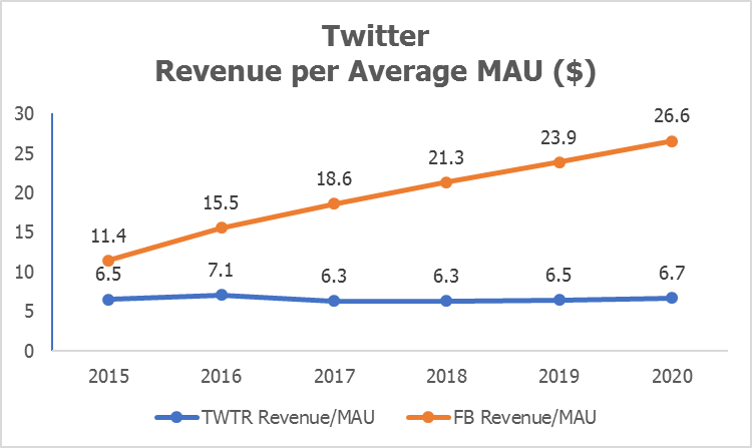

On Twitter’s most recent investor conference call, company officials discussed the expectation for revenue growth to lag user growth due to increasing competition for digital media ad- spending. VA consensus for Revenue per Monthly Active User growth, a metric for revenue efficiency, is expected to dip into negative territory in 2017 and 2018, before recovering slightly in 2019-2020.

Source: Visible Alpha. For illustrative purposes only. Learn more about Visible Alpha.

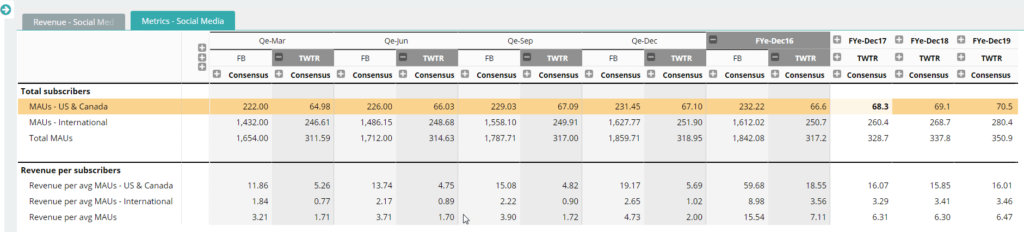

Takeaway: Use the Visible Alpha Industry Comps To Compare FB and TWTR Across Key Financial and Operational Metrics

Source: Visible Alpha. For illustrative purposes only.