Apple (NASDAQ: AAPL) will be reporting earnings for Q2 2023 after the market close on Thursday, May 4, 2023. Going into the earnings release, what are the questions we’re focusing on?

-

What is happening with iPhone sales?

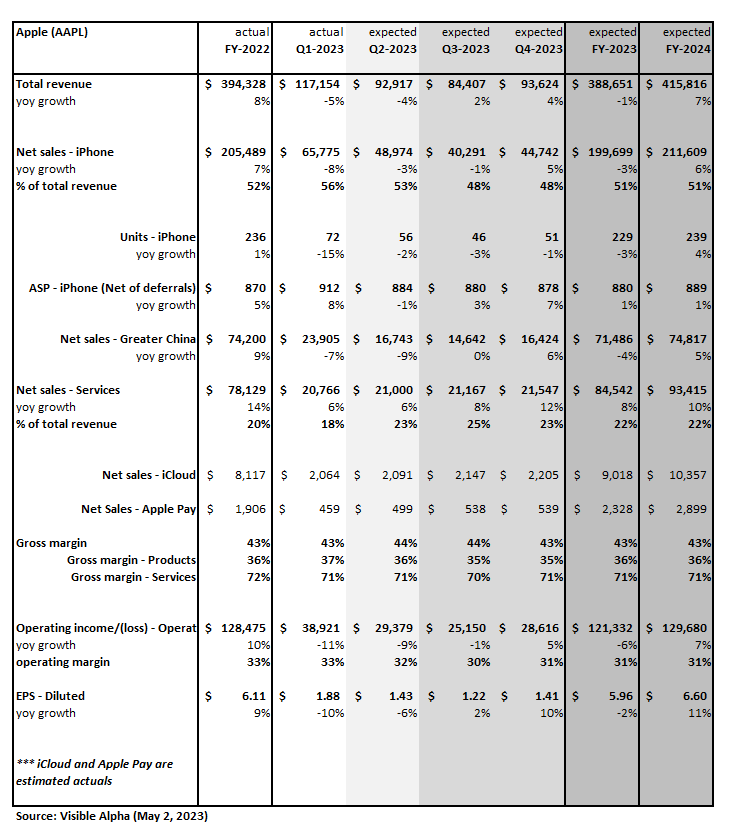

Analysts are expecting Q2 total company revenues to come in at $93B, driven by iPhone.

There is some debate about the outlook for iPhone sell-through units. Analysts’ estimates for iPhone units range from 51M to 63M in Q2, and the range of unit expectations further widens to 40M to 54M in Q3.

Looking ahead to Q3, several analysts are expecting the company to guide to total company revenues of ~$80B, below consensus expectations of $84.4B, driven by an iPhone outlook that may come in lower than analysts currently expect.

-

How will the Services segment perform?

For Q2, Services is expected to generate $21B in revenue, up 6% year-over-year, and for 2023, $85B, up 8% from 2024. Services currently generate a 71% gross margin, nearly double the 36% for the Product segment.

The company’s total operating profit margin is expected to dip to 29% in 2023 and 2024. Could growth in the Services segment bring the operating profit margin back to 30% levels?

Cloud: Given that AMZN noted slowing in their cloud outlook and GOOGL’s cloud business broke even in the past quarter, it will be interesting to hear what AAPL has to say about the space. Analysts are expecting iCloud to generate $2.1B in sales in Q2 with more aggressive analysts projecting $2.7-3B. For 2023, AAPL is projected to generate $9B in cloud sales with more bullish analysts estimating $11-12B.

Apple Pay: There has been increasing buzz around the potential for AAPL’s payments business, due to its partnership with Goldman Sachs. This business is projected to generate $500M in revenues in Q2, but there is a wide range of estimates. For 2023, analysts, on average, are projecting a 20% increase in transaction volume, and for sales to range from $2-4B.

-

What will AAPL’s performance in China reveal?

With questions about China’s emergence from lockdown and the strength of iPhone builds, there is some debate about what the region will deliver for sell-through units and what the supply chain is indicating.

China sales are expected to drop -9% year-over-year to $16.7B in Q2, a decline from Q1’s $24B. For 2023, analysts project China to deliver $71.5B in revenues, down -4% from 2022 levels.