Apple (NASDAQ: AAPL) reported earnings for Q2 2023 after the market close on Thursday, May 4, 2023. After the earnings release and looking ahead to the WWDC (Worldwide Developers Conference) in June, what are the questions we’re focusing on?

-

What happened with iPhone sales and what does the outlook look like?

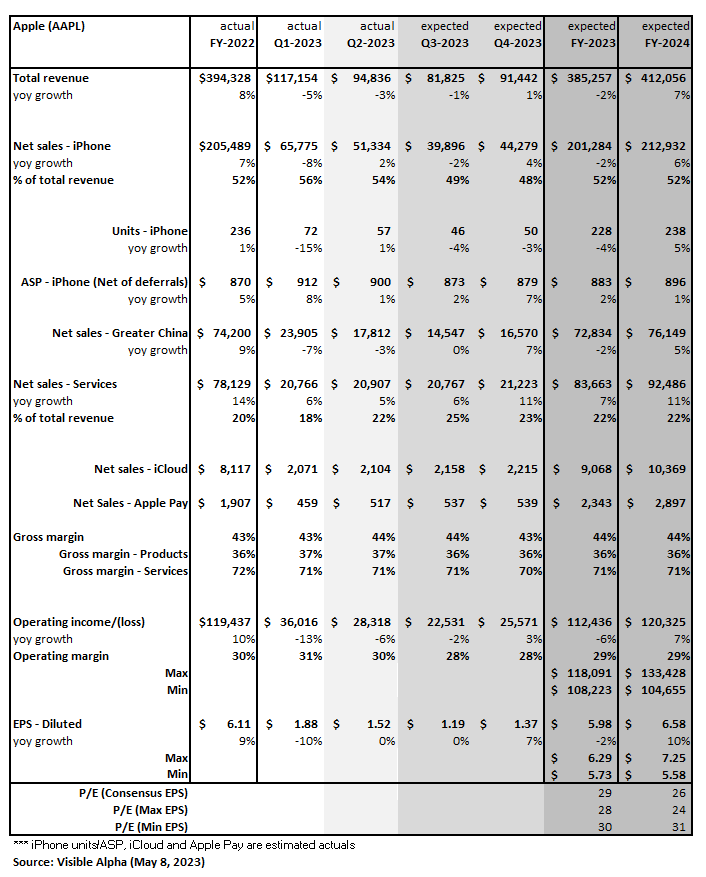

Analysts were expecting Q2 total company revenues to come in at $93B, but AAPL delivered $94.8B, driven by better-than-expected iPhone sales in emerging markets. The company highlighted the opportunity in India, due to its growing middle class. This market may begin to break away from other emerging markets as penetration increases. While India may not generate the same volume of revenues as China’s estimated $74B, it may still increase penetration significantly and make a meaningful contribution to revenue over the next few years.

Coming into earnings, several analysts were expecting the company to guide Q3 to total company revenues of ~$80B, below consensus expectations of $84.4B, driven by an iPhone outlook that was expected by some to come in lower than consensus. The current post-earnings estimate for Q3 has come down to $82B, down -1% year over year, driven by softness in the U.S. and foreign exchange impact. There has been some debate about the outlook for iPhone sell-through units, with a fairly wide range of unit expectations ranging from 40M to 54M for Q3.

New Question: How big can the India market become for iPhone, and at what pace?

-

How did the Services segment perform and what is next for this segment?

For Q2, Services delivered $20.9B, in line with an expected $21B in revenue, up 5% year over year, driven by cloud, music, and ads. For 2023, analysts now expect $83.7B in Services revenues, up 7% from 2022, which is down from the $85B that was estimated prior to earnings. For 2024, analysts currently forecast Services revenue to jump 10% to $92B.

Cloud: For 2023, AAPL is projected to generate $9B in cloud sales with more bullish analysts estimating $11-12B. Based on color from Q2 earnings, growth in cloud looks poised to continue to sustain its growth path.

Apple Pay: There has been increasing buzz around the potential for AAPL’s payments business, due to its partnership with Goldman Sachs. For 2023, analysts, on average, are projecting a 20% increase in transaction volume, and for sales to range from $2-4B.

Margins: Services currently generate a 71% gross margin, nearly double the 36% for the Product segment, and can shift AAPL toward higher profitability. The company’s total operating profit margin is expected to dip to 29% in 2023 and 2024, driven by higher R&D expenses. An increase in the mix toward Services would shift the gross and operating profit margins higher for the company.

Growth: AAPL highlighted its significant installed base of 2B devices with nearly 1B estimated to be iPhone, which may be a great platform for growing ads, cloud, payments and other content revenues (like music, games, and TV). In addition, AAPL highlighted the power and importance of AI to be a game-changer.

New question: What new innovations may come out of the WWDC that could drive higher-than-expected Services revenue?

-

What will AAPL’s performance in China reveal?

AAPL noted that component prices have been normalizing. The company secured better pricing in Q2 and expects this to continue. While AAPL’s supply chain is diverse, supply chain challenges in China seem to be waning, given the company’s color around component prices.

With questions about China’s emergence from lockdown, there is some debate about what the region will deliver for sell-through units in 2023.

China sales were expected to drop -9% year over year to $16.7B in Q2, but came in better at $17.8B, down -3% year over year. There is speculation that the higher sales were driven by increased promotional activity and may have impacted margins. For 2023, analysts were projecting China to deliver $71.5B in revenues, down -4% from 2022 levels. But estimates have increased to $74B, now flat compared to last year. For 2024, growth is expected to resume to $76.6B, up 3% from 2023.

New question: How long will it take for China sales to resume pre-pandemic levels of growth?