Roche’s (SWX: ROG) Vabysmo is the newest therapy to be approved for wet AMD (age-related macular degeneration) and is poised to challenge the dominance of Eylea from Regeneron (NASDAQ: REGN) and Bayer (FRA: BAYN). Vabysmo’s advantage is a longer half-life leading to less frequent injections compared to Eylea, with generally equal efficacy. However, a high-dose version of Eylea, currently under FDA review, may blunt Vabysmo’s advantage.

Advantage of lower frequency of treatments

Lower frequency of intravitreal injections is an advantage as long as safety and efficacy are matched. Intravitreal injections are administered in the eyeball — not a pleasant experience for patients. Roche conducted two Phase 3 clinical trials with Vabysmo in wet AMD patients with a two-year endpoint that demonstrated that 59% and 67% of patients receiving Vabysmo treatments every four months achieved comparable vision gains versus Eylea, which is given every two months. Furthermore, an additional 15% and 14% achieved three-month dosing with comparable efficacy to Eylea in the two respective Phase 3 studies.

Besides high-dose Eylea and Vabysmo, other approaches to reduce injection frequency for wet AMD and other neovascular eye diseases are in clinical trials. Examples include Opthea’s (NASDAQ: OPT) OPT-302 in combination with Novartis’ (NYSE: NVS) Lucentis, and Ocular Therapeutix’s (NASDAQ: OCUL) OTX-TKI in combination with Eylea. These novel combination therapies add on to established treatments to extend durability of efficacy and reduce frequency of injections.

Improved version of Eylea

An improved version of Eylea at a higher dose is under FDA review and is expected to be approved in the summer of 2023. This long-lasting high-dose Eylea is formulated at 8 mg (versus 2 mg for the currently approved Eylea) and will be dosed every 3 to 4 months. Furthermore, it is comparable or even improved in safety and efficacy to Vabysmo. In Phase 3 pivotal trials, 79% and 77% of wet AMD patients on high-dose Eylea maintained vision gains demonstrating similar efficacy to the low-dose Eylea at 3 months and 4 months, respectively. Currently, there is no head-to-head data that compares Vabysmo with the high-dose version of Eylea.

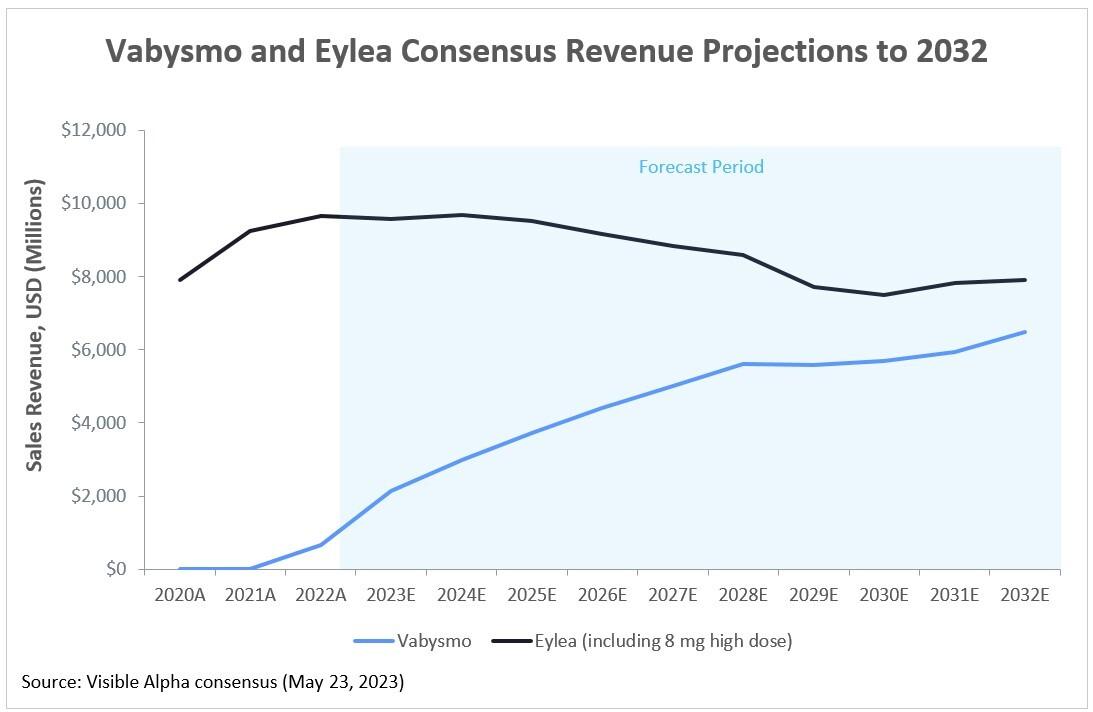

Figure 1: Vabysmo and Eylea consensus revenue projections to 2032

Source: Visible Alpha consensus – May 23, 2023 (Note: Eylea sales revenue as recorded by Regeneron; Vabysmo sales revenue as recorded by Roche; Swiss franc figures for Vabysmo were converted to U.S. dollars at the prevailing exchange rate on May 23, 2023)

Consensus revenue projections for Vabysmo and Eylea

Visible Alpha’s analyst consensus projections depict Vabysmo initially gaining market share over Eylea, but ultimately high-dose Eylea holds its own. Revenues depicted include diabetic macular edema (DME), wet AMD, and other relevant neovascular ophthalmic indications. Note that declining Eylea revenues are also a function of Eylea biosimilars expected to be on the market after May 2024. Eylea’s composition-of-matter patent expires in June 2023 but its market exclusivity as a biologic has been extended through May 2024.

Given the significance of the high-dose Eylea Phase 3 pivotal data, it is perhaps surprising that analysts have not raised their forecasts further. Although some analysts have started to call out high-dose usage of Eylea specifically in their models, overall revenue forecasts have not changed significantly in the months since the Phase 3 study results were first reported in September 2022. Either analysts are more sanguine about the overall impact of the high-dose Eylea or are perhaps waiting for safety and efficacy confirmation from the FDA before making more substantive revisions. In either case, the June 27th 2023 target date for high-dose Eylea review set by the FDA could be a catalyst for further movement. In February of 2023, the FDA granted high-dose Eylea Priority Review, which allows for expedited review within six months.

Mechanisms of action for Vabysmo and EyleaVabysmo (faricimab) is a humanized bispecific antibody that inhibits two pathways by binding to vascular endothelial growth factor (VEGF-A) and angiopoietin-2 (Ang-2). Inhibition of VEGF-A suppresses endothelial cell proliferation, neovascularization, and vascular permeability. Inhibition of Ang-2 promotes vascular stability and desensitizes blood vessels to the proliferative effects of VEGF-A. Eylea (aflibercept) is a recombinant fusion protein consisting of the human VEGF extracellular domain fused to the Fc portion of human immunoglobulin IgG1. Eylea inhibits VEGF-A, preventing the pathology driven by mitogenic, chemotactic, and vascular permeability factors that induce endothelial cell proliferation. |

The bottom line

Both Vabysmo and the high-dose version of Eylea decrease the frequency of injection, which is a major benefit to patients. While Vabysmo and high-dose Eylea will be major players in the imminent wet AMD marketplace, we also anticipate novel therapeutics that reduce frequency of injections in combination with established therapies to make an impact in the years ahead. Furthermore, biosimilar Eylea will influence the Wet AMD market landscape as well. Over time, long-term safety and efficacy data and patient preference will determine market dynamics.