Key Takeaways

|

Revenue projections for Eli Lilly’s (NYSE: LLY) Mounjaro have been rising since its approval for type 2 diabetes (T2D) in 2022. With expected approval for obesity on the horizon, Mounjaro is projected to see dramatic revenue growth ahead.

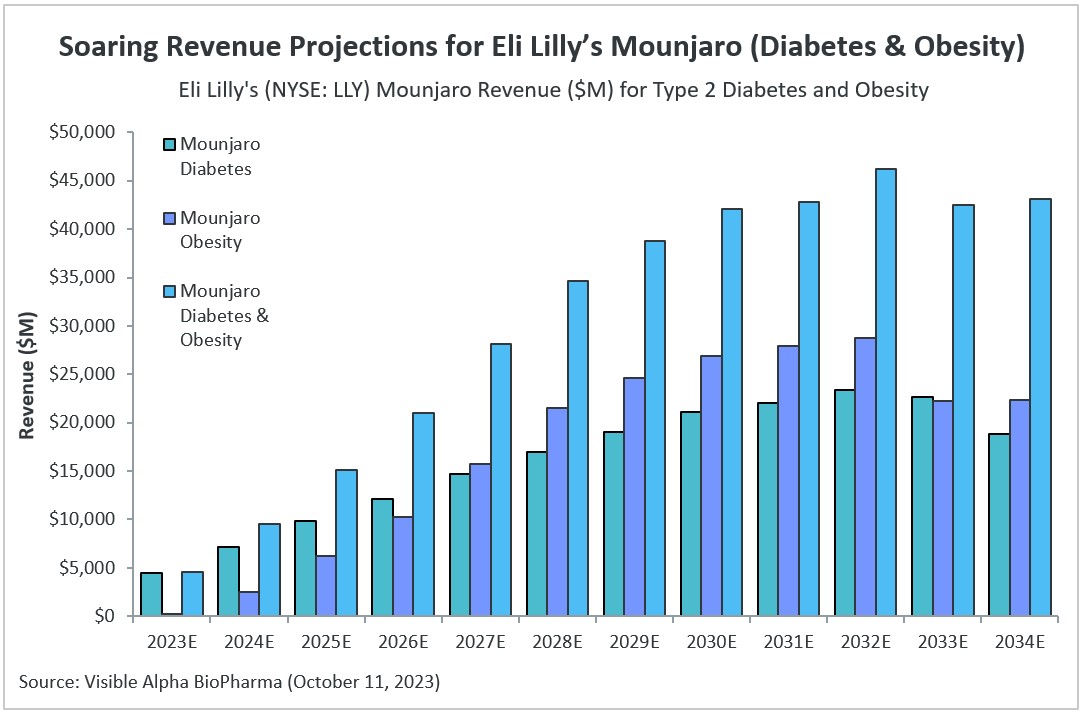

Consensus revenue estimates for Mounjaro have increased substantially since our last evaluation in April 2023. Back in April, according to Visible Alpha consensus, Mounjaro revenue estimates (for both type 2 diabetes and obesity) stood at $20.6 billion for 2030. Currently, 2030 consensus revenue estimates have reached as high as $42.1 billion, more than doubling in six months. Analysts project peak consensus revenue for Mounjaro will be reached in 2032, at an estimated $46.2 billion.

Mounjaro is a GLP-1 receptor agonist approved for type 2 diabetes, but not yet for obesity. It was approved for T2D by the FDA in May 2022, by the European Medicines Agency (EMA) in July 2022, and by the Japanese regulatory body in September 2022.

Mounjaro is expected to gain its first approval for obesity soon – the FDA is likely to approve Mounjaro for obesity by the end of 2023. The likelihood of the FDA approving Mounjaro for obesity is high – based on Visible Alpha BioPharma consensus, the probability of success is estimated to be 97.33%.

Figure 1: Mounjaro global consensus revenue estimates for type 2 diabetes and obesity

Source: Visible Alpha BioPharma (October 11, 2023) (All projections are unadjusted for risk, as the probability of success for obesity approval currently stands at 97.33%. Total diabetes and obesity revenues include unadjusted revenues for smaller indications for which Mounjaro is not yet approved or in early stages of clinical development, including heart failure, kidney disease, NASH, and sleep apnea.)

Investor interest in Mounjaro and GLP-1 receptor agonist drugs

The interest among investors is driven by the significantly improved drug profiles for the next-generation GLP-1 receptor agonist class. These next generation GLP-1 receptor agonists demonstrate meaningful efficacy in glucose control for T2D and weight loss for obesity, acceptable safety/tolerability, and improved dosing convenience for patients.

Furthermore, the finding that GLP-1 receptor agonists are effective in controlling obesity, and not just glucose regulation for T2D, has significance because obesity and T2D are intricately linked, sharing common biology that leads to metabolic dysfunction. Clinical data has also confirmed that GLP-1 receptor agonists reduce the risk of cardiovascular disease. This finding is important because T2D patients are at increased risk of cardiovascular complications.

Adding to the above reasons for interest in these drugs, there has been clear public demand for Mounjaro and other GLP-1 receptor agonist drugs for general weight loss purposes.

Mounjaro belongs to the tirzepatide class (dual GLP-1 receptor agonists). The other next-generation GLP-1 receptor agonists are in the semaglutides class, and include Ozempic, Rybelsus, and Wegovy, all commercialized by Novo Nordisk (NYSE: NVO).

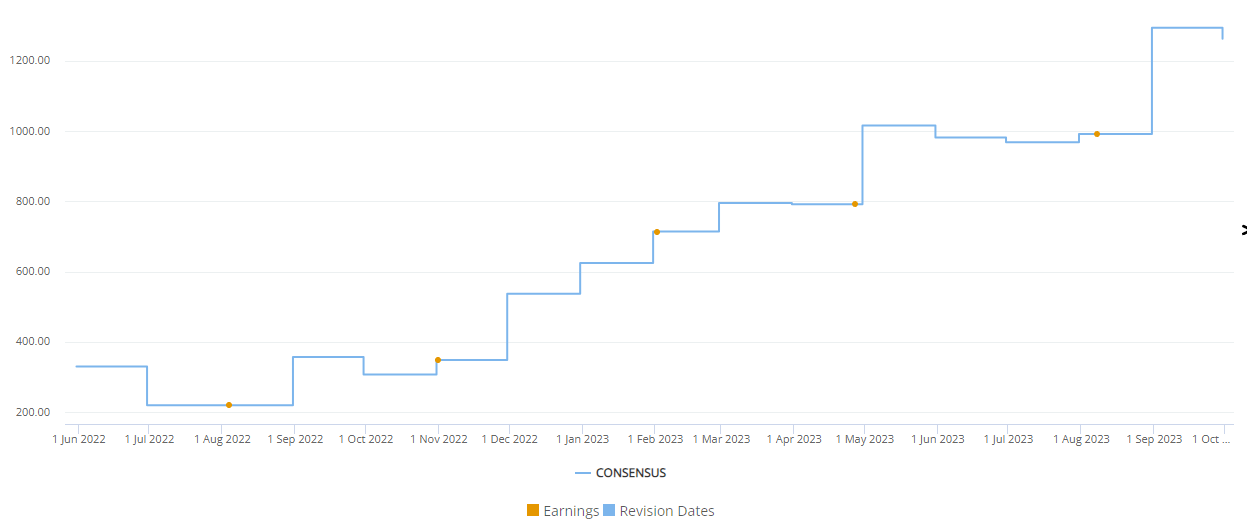

Frequent upward revisions for Mounjaro revenue

Visible Alpha consensus shows that analysts have revised Mounjaro revenue upward multiple times since the drug’s approval by the FDA in May 2022. The upward revisions have been for several reasons, as discussed above – broad market acceptance and revenue projections based on impressive scientific and clinical data showing glucose control, meaningful weight loss for obesity, cardiovascular benefits (not anticipated), acceptable safety/tolerability, and the dual impact on glucose control and obesity to improve metabolic dysfunction. Analysts also take into account off-label use for cosmetic weight loss purposes (not prescribed for T2D or obesity).

Figure 2: Frequent upward revisions for Mounjaro revenue estimates since May 2022 FDA approval

Source: Visible Alpha Insights (October 11, 2023) (Visible Alpha consensus revenue estimates show an increase of more than 3X from June 2022 through September 2023.)