Key Takeaways

|

Cancers harboring KRAS mutations have historically been a challenge to treat. After almost four decades of research, two KRAS mutation-targeting therapies that have already been granted conditional (accelerated) approval by the FDA for non-small cell lung cancer, are undergoing the process towards full approval – Amgen’s (NASDAQ: AMGN) Lumakras and Mirati Therapeutics’ (NASDAQ: MRTX) Krazati.

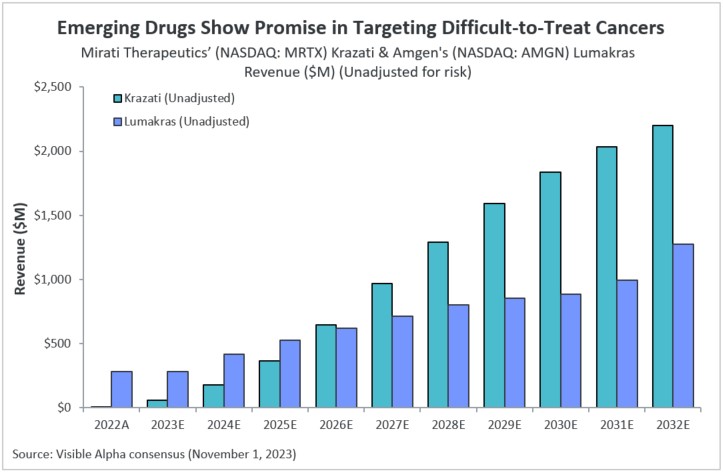

Visible Alpha consensus revenue projections show Krazati at approximately $2.2 billion and Lumakras at approximately $1.3 billion in 2032 global revenues. Based on clinical trial data and recent FDA Advisory Committee views, analysts are wary of Lumakras given the recent regulatory concerns (discussed below), and view Krazati as the potentially superior KRAS inhibitor.

Figure 1: Revenue projections for Amgen’s Lumakras and Mirati Therapeutics’ Krazati

Conditional approvals of Lumakras and Krazati

Amgen’s KRAS inhibitor, Lumakras (sotorasib), was granted conditional approval for non-small cell lung cancer in May 2021, and Mirati Therapeutics’ Krazati (adagrasib) was granted conditional approval for non-small cell lung cancer in December 2022. Lumakras has also received conditional approval by the European Medicines Agency. Krazati was refused conditional approval by the European Medicines Agency, but Mirati Therapeutics will request re-examination.

Confirmatory trials for full approval of Lumakras and Krazati

Amgen has completed Phase 3 confirmatory trials for Lumakras and submitted the application for full approval to the FDA. On October 5, 2023, the FDA Advisory Committee meeting briefing document revealed the negative views of the Advisory Committee on the trial data supporting full approval of Lumakras for non-small cell lung cancer. Several of the points raised by the Advisory committee related to bias in the two arms of the clinical trial. The FDA has not made a decision yet, but it is likely that additional trials may be required in order for Lumakras to be fully approved for non-small cell lung cancer. Analysts have reduced the revenue potential for Lumakras given the regulatory concerns. Lumakras clinical trial data in other tumors such as colorectal cancer or in combination studies may be more positive.

The Krazati Phase 3 confirmatory trials are yet to be reviewed by the FDA. Krazati, in combination (with PD-1) or as a monotherapy, has a better safety profile and efficacy than Lumakras.

Bristol-Myers Squibb to acquire Mirati Therapeutics – driven partly by Krazati potential

On October 9, 2023, Bristol-Myers Squibb (NYSE: BMY) and Mirati Therapeutics entered into an agreement under which BMY will acquire MRTX for $58 per share, valued at $4.8 billion, plus a Contingent Value Right (CVR) potentially worth an additional $1 billion. The transaction is expected to close in the first half of 2024. Both BMY’s and MRTX’s boards have agreed to the terms of the transaction.

Even though the KRAS space faces regulatory challenges, Bristol-Myers Squibb clearly believes that the Krazati confirmatory Phase 3 data will be the basis for full approval in non-small cell lung cancer. The issues with Lumakras that the FDA Advisory Committee raised are specific to Lumakras, and not for KRAS in general. Mirati Therapeutics also has additional promising oncology targets in its pipeline.

About KRAS

KRAS is the most frequently mutated oncogene in cancer. KRAS, a member of the RAS family, is a key regulator of signaling pathways that orchestrate cell proliferation, differentiation, and survival. Mutations in the RAS pathway can drive uncontrolled tumor growth. Effective RAS pathway inhibitor drugs have been elusive for decades – the structural biology and chemistry of RAS has made it a challenge to design effective inhibitors. Both Lumakras and Krazati are selective inhibitors of tumors that specifically harbor a KRAS G12C mutation (i.e. where the mutation results in a glycine to a cysteine substitution) that drives tumor growth.