Nvidia Corp. (NASDAQ: NVDA) will report fiscal Q3 2024 results on Tuesday, November 21, 2023, after the market close. Here are the key numbers that we’re watching.

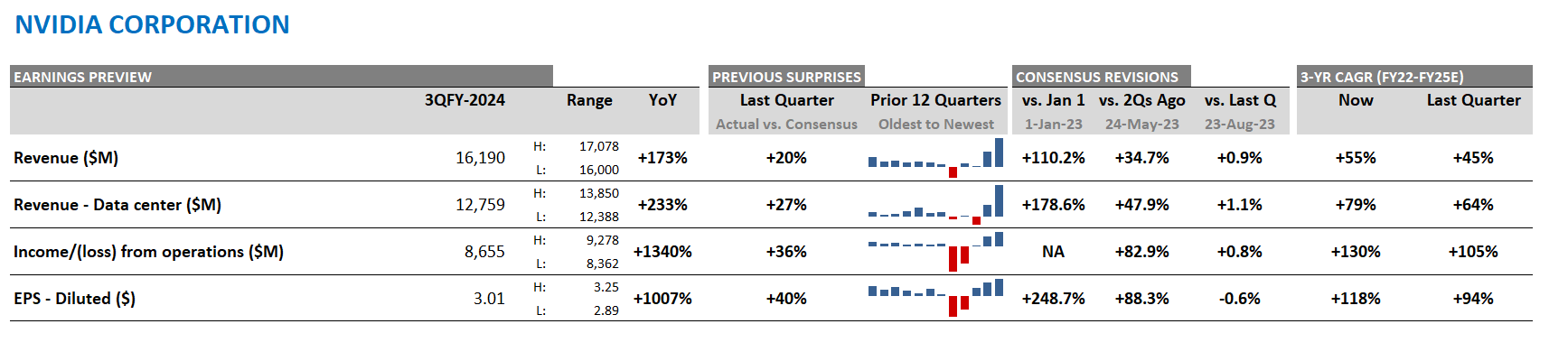

Figure 1: Nvidia – consensus expectations for Q3, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (November 15, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Nvidia Q3 Earnings Preview

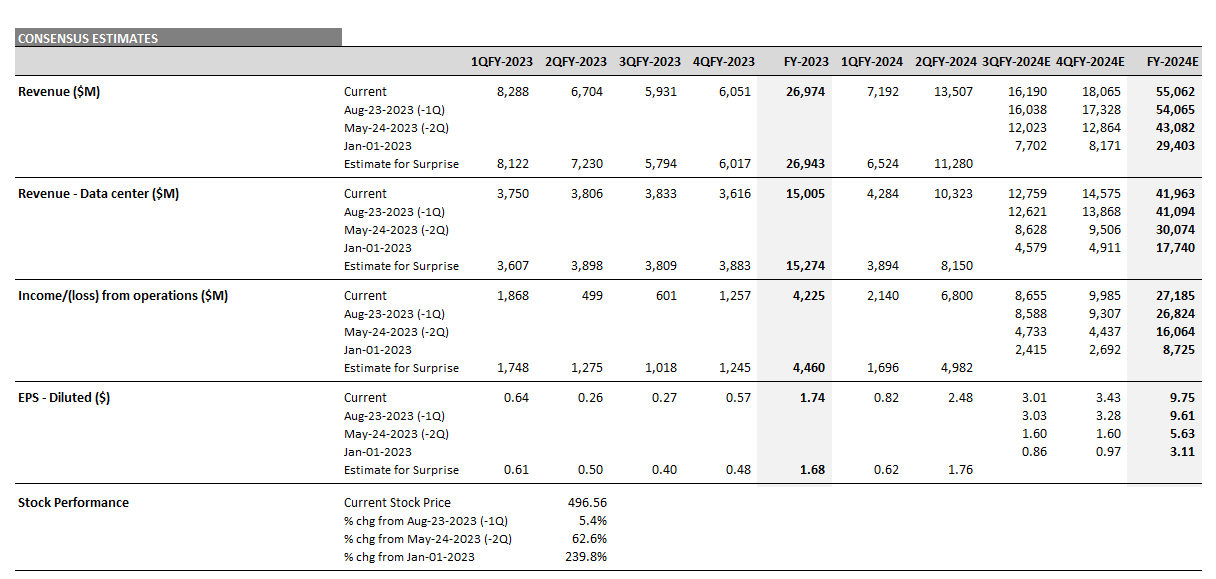

According to Visible Alpha consensus, total revenues expected for Q3 have come up substantially from the beginning of the year, from $7.7 billion to $16.2 billion, driven by increased optimism about the revenue growth of Nvidia’s Data Center segment. This segment has seen its expected top line performance for Q3 increase from a mere $4.6 billion in January to its current projection of $12.8 billion, up 2.8x from the beginning of the year. This revenue surge has been driven by strong demand for its GPUs from Cloud Service Providers, and the move to accelerated computing in the data centers for AI.

While the pace of analysts’ upward revisions to the Data Center segment has stabilized since the Q2 release in late August, it will be important to see if there is another leg up for estimates, driven by higher pricing and volumes, as the Company heads into Q4 and FY 2025. Currently, estimates for FY 2024 have increased an additional $1 billion to $55 billion since the Q2 release, with most of the anticipated additional increase falling in the Q4.

The stock has traded up 5% since last quarter’s July release but is up over 230% year to date. Could the Q3 release provide the next positive catalyst for the stock?

Figure 2: Nvidia consensus estimates

Source: Visible Alpha consensus (November 15, 2023). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on November 14, 2023.

Microsoft Ignite and the Longer-Term Outlook

Nvidia CEO Jensen Huang made an appearance at the Microsoft Ignite conference on November 15, 2023 to discuss the new Nvidia Generative AI (GAI) Foundry Service and the co-inventing partnership with Microsoft where Nvidia’s native stack is hosted on Azure. Huang celebrated the collaborative partnership with Microsoft that helps users create GAI models and will help to amplify Nvidia’s overall ecosystem.

Looking ahead to FY 2025, consensus revenue expectations are at $84 billion, a year-over-year increase of $29 billion, driven almost exclusively by the Data Center segment. But is all the growth already priced in? Huang sees a significant expansion in the addressable market that should continue to benefit Nvidia directly. As GAI blossoms across enterprises and longer-term to heavy industry, both companies are likely to benefit mutually from the growth over time.

Figure 3: Microsoft CEO Satya Nadella and Nvidia CEO Jensen Huang at Microsoft Ignite

Source: Microsoft Ignite (November 15, 2023)