Nvidia Corp. (NASDAQ: NVDA) reported fiscal Q3 2024 results on Tuesday, November 21, 2023, after the market close. What happened during the release and earnings call, and what are the key questions to focus on?

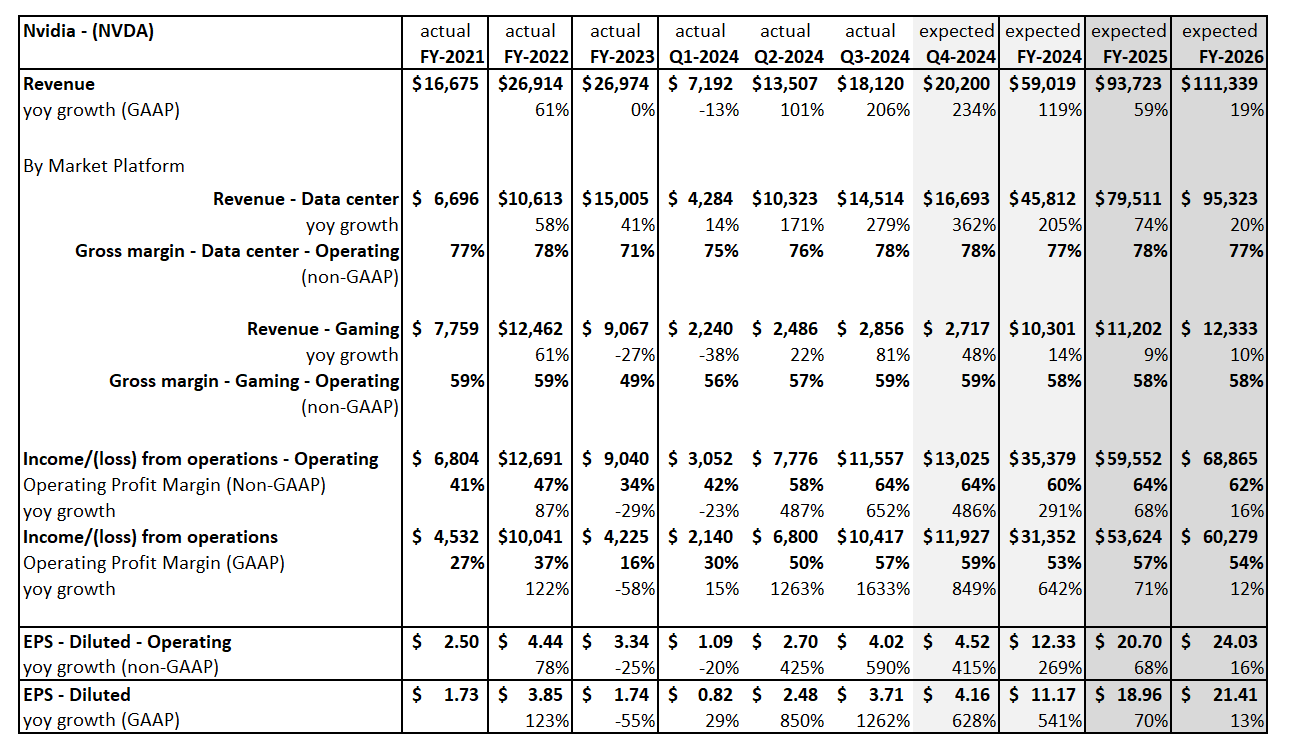

Figure 1: Nvidia – past earnings, Q3 and the outlook

Nvidia Q3 Earnings Release

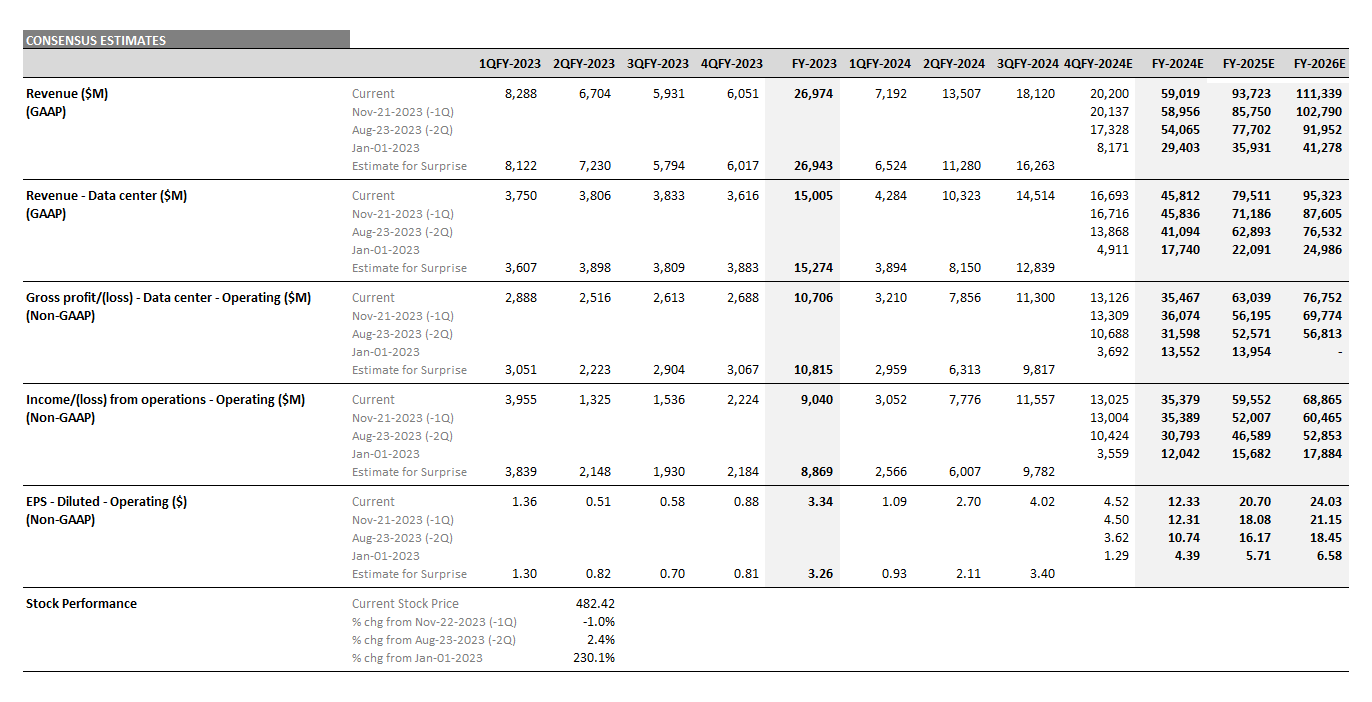

Nvidia delivered total revenues for Q3 of $18.1 billion, beating Visible Alpha’s consensus estimate of $16.2 billion by nearly $2 billion, driven by continued revenue growth of Nvidia’s Data Center segment. The Data Center segment saw its Q3 revenue surge to $14.5 billion, nearly $1.7 billion ahead of the $12.8 billion consensus estimate coming into the quarter. This revenue surge has continued to be driven by strong demand for Nvidia GPUs, particularly from Cloud Service Providers. The Data Center segment saw its non-GAAP gross margin increase from 76% in Q2 to 78% in Q3, returning to FY 2022 levels. This drove a beat on the EPS line with non-GAAP diluted EPS of $4.02/share.

The Gaming segment’s non-GAAP gross margin also increased 200 bps from 57% in Q2 to 59% in Q3, also returning to FY 2022 levels. Currently, the Gaming segment consensus revenue for FY 2024 is $10.3 billion. This business remains dwarfed by the significant 4.5x revenue size and growth in the Data Center business. Beyond the Data Centers, could there be a catalyst for revenue expansion in the Gaming segment? Could the margin in the Gaming segment catch up to the 70s levels seen in the Data Center business?

Nvidia’s China Impact

Toward the end of the quarter, the U.S. government instituted new regulations and requirements that will impact Nvidia’s China business. According to the Q3 Nvidia earnings call, the Company noted that the U.S. government announced a new set of export control regulations for China and a few other markets. Nvidia management explained that these regulations require licenses for the export of some Nvidia products, including the Hopper and Ampere 100 and 800 series. According to CFO Colette Kress, the U.S. government designed the regulation to allow the U.S. industry to provide data center compute products to markets worldwide, including China.

CFO Kress further explained that Nvidia’s sales to China and other affected destinations derived from products that are now subject to licensing requirements have consistently contributed approximately 20% to 25% of data center revenue over the past few quarters. Based on past Data Center revenues, the exposure would be approximately $6-7 billion. In the Q&A session, CFO Kress further highlighted that the export controls will have a negative effect on Nvidia’s China business, and the Company does not have good visibility into the magnitude of that impact even over the long term.

The Outlook

For Q4, Nvidia guided to $19.6-20.4 billion in total revenue with the Data Center segment projected to be up from Q3. The regulatory announcements around China impacted the Q4 guidance. According to CFO Kress, Nvidia sales to China and the other impacted destinations will decline substantially in the fourth quarter, though the Company believes that this will be more than offset by strong growth in other regions. In addition, Nvidia guided total gross margin to continue to be around 75% levels, driven by the strength in the Data Center business.

Looking further out, analysts remain bullish on the Data Center segment. Since the Q3 release last week, analysts have increased their estimates another $8 billion for both FY 2025 and FY 2026 to the Data Center business, driven by continued optimism around GPU demand. These upward revisions are estimated to drop directly to operating profit and, ultimately, EPS. Non-GAAP diluted EPS for FY 2026 is now projected to be $24/share, up 13.6% from November 21.

The stock has traded down slightly since the November earnings release, which may be partially attributed to the Thanksgiving holiday in the U.S., but is up over 225% year to date. Could the FY 2025 outlook in the Q4 release provide the next positive catalyst for the stock?