Number of transactions or processed transactions is the total number of financial transactions that a payment processing company has successfully processed over a given period.

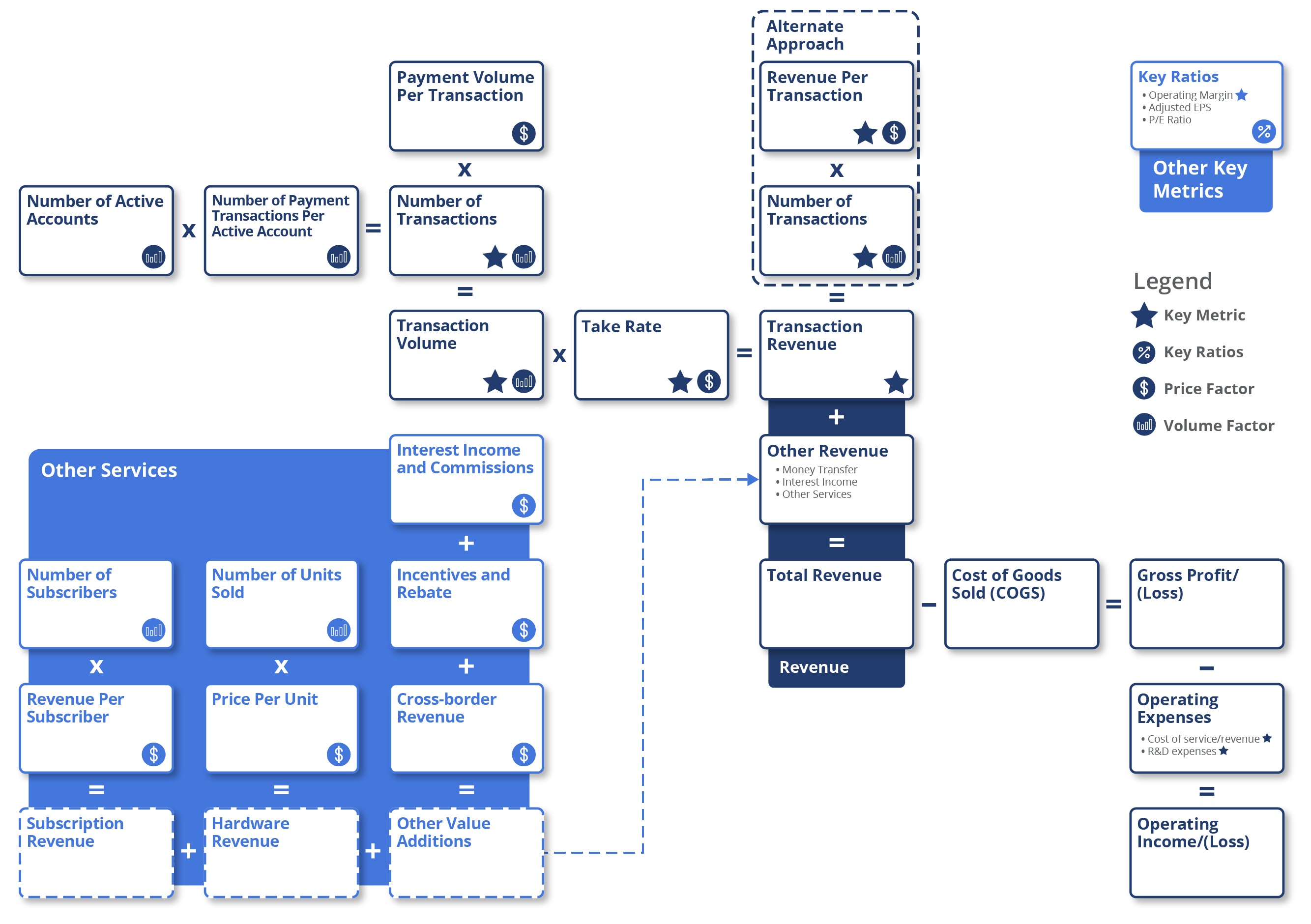

Key performance indicators (KPIs) are an industry’s most important business metrics. When understanding market expectations for the payment processing industry, whether at a company or industry level, some KPIs to consider include:

Visible Alpha’s Standardized Industry Metrics

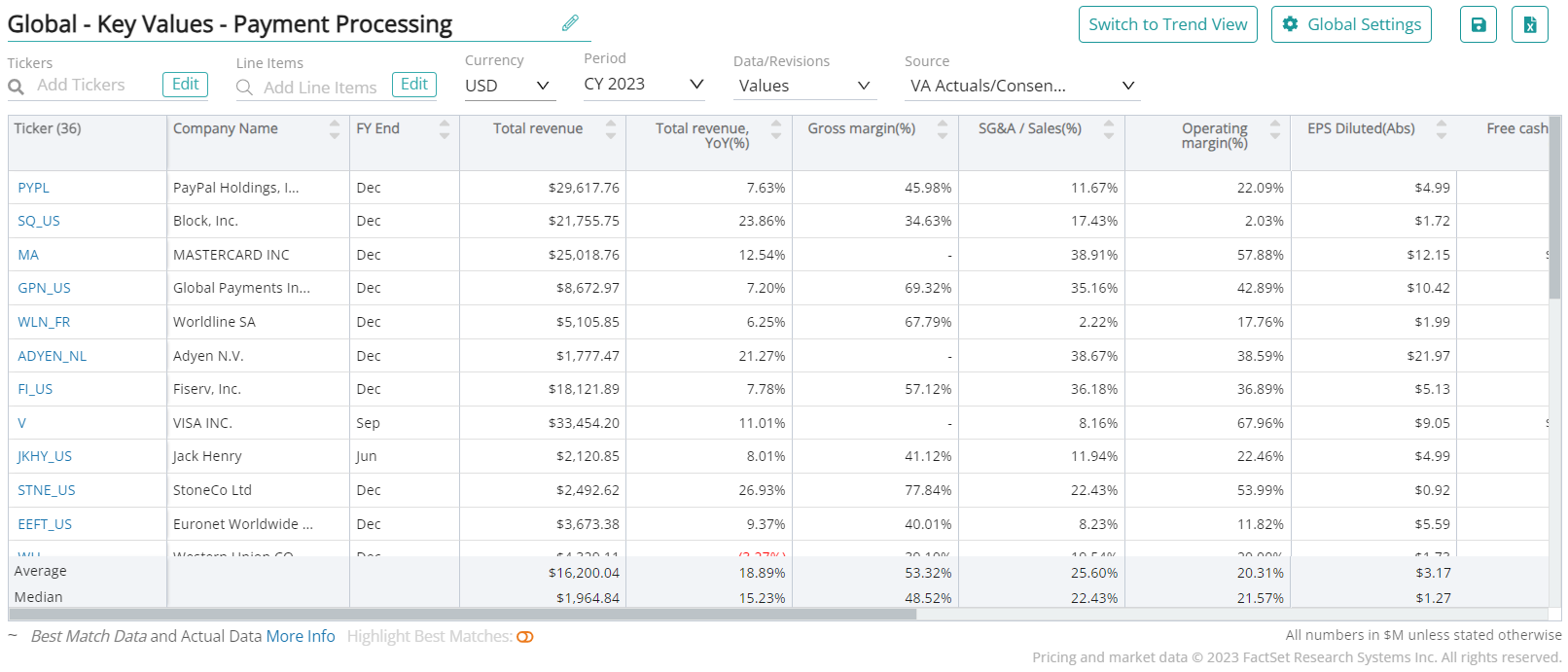

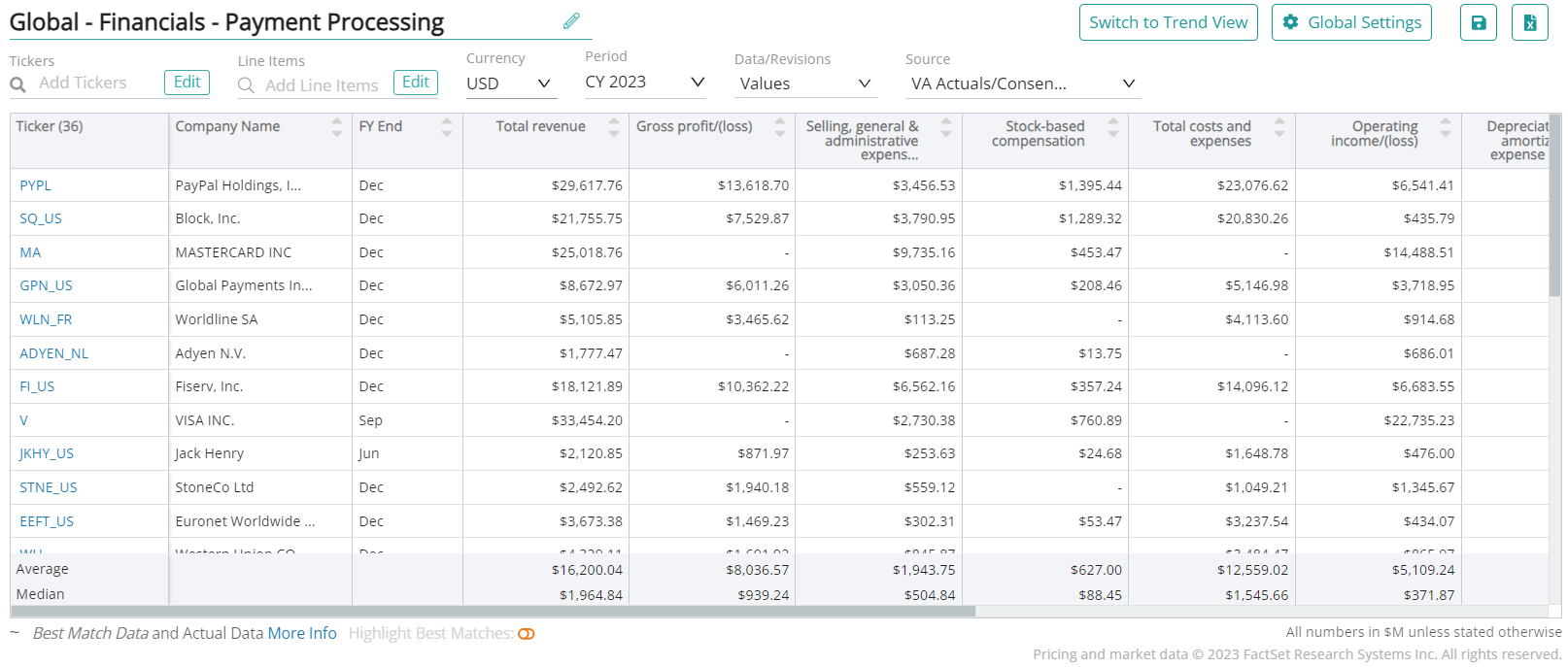

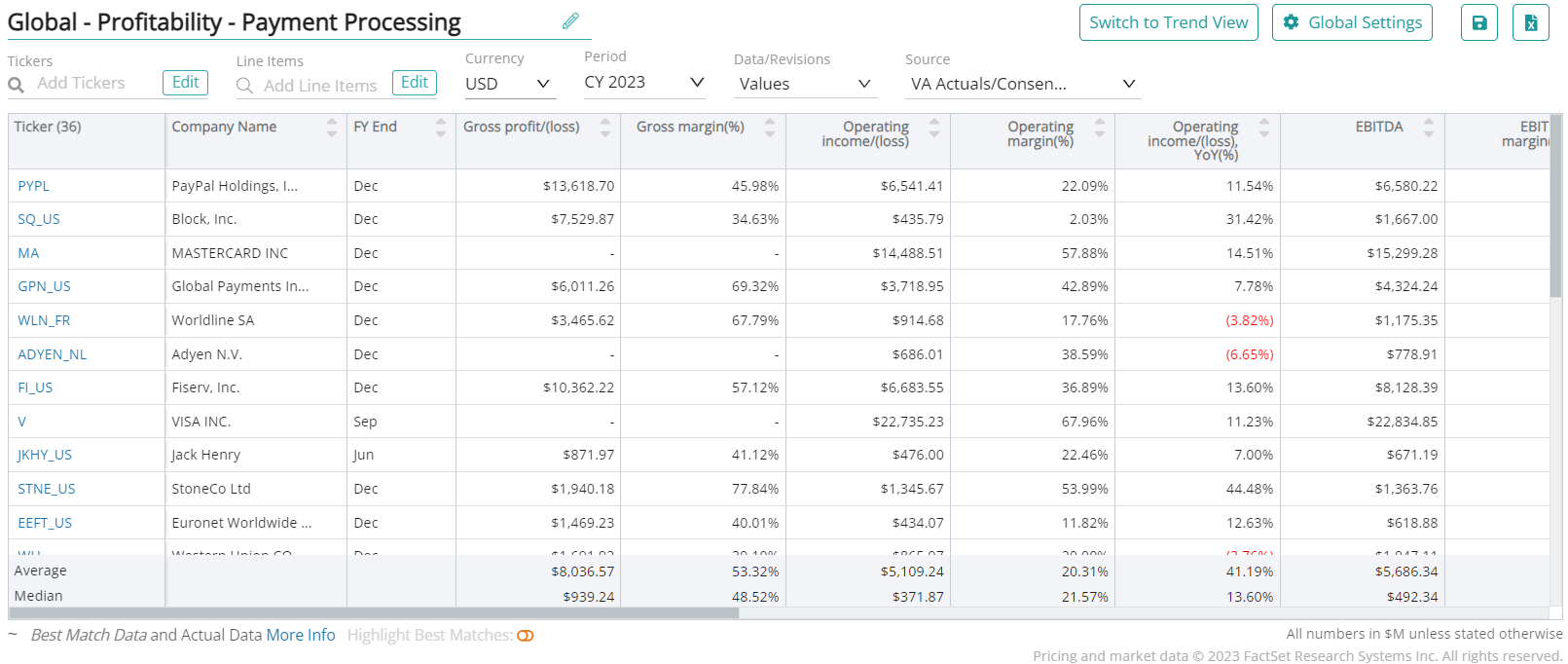

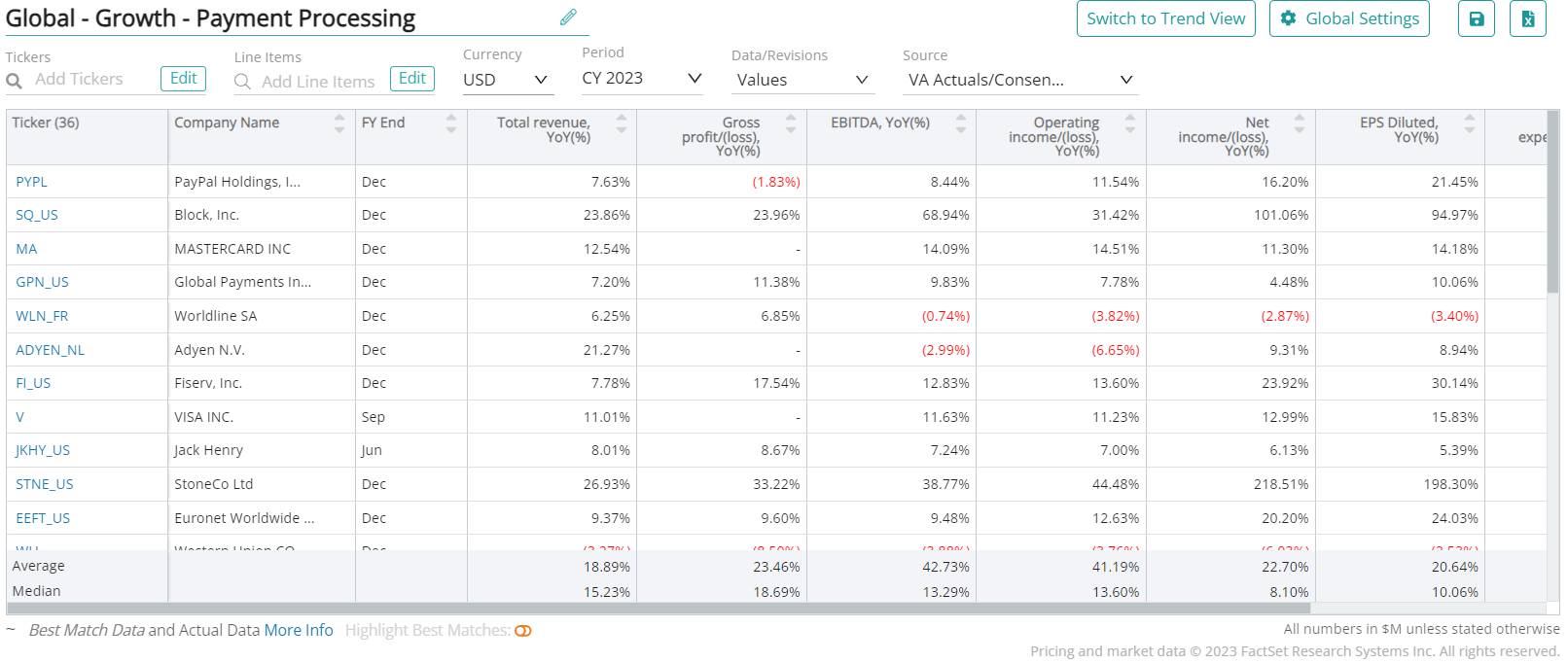

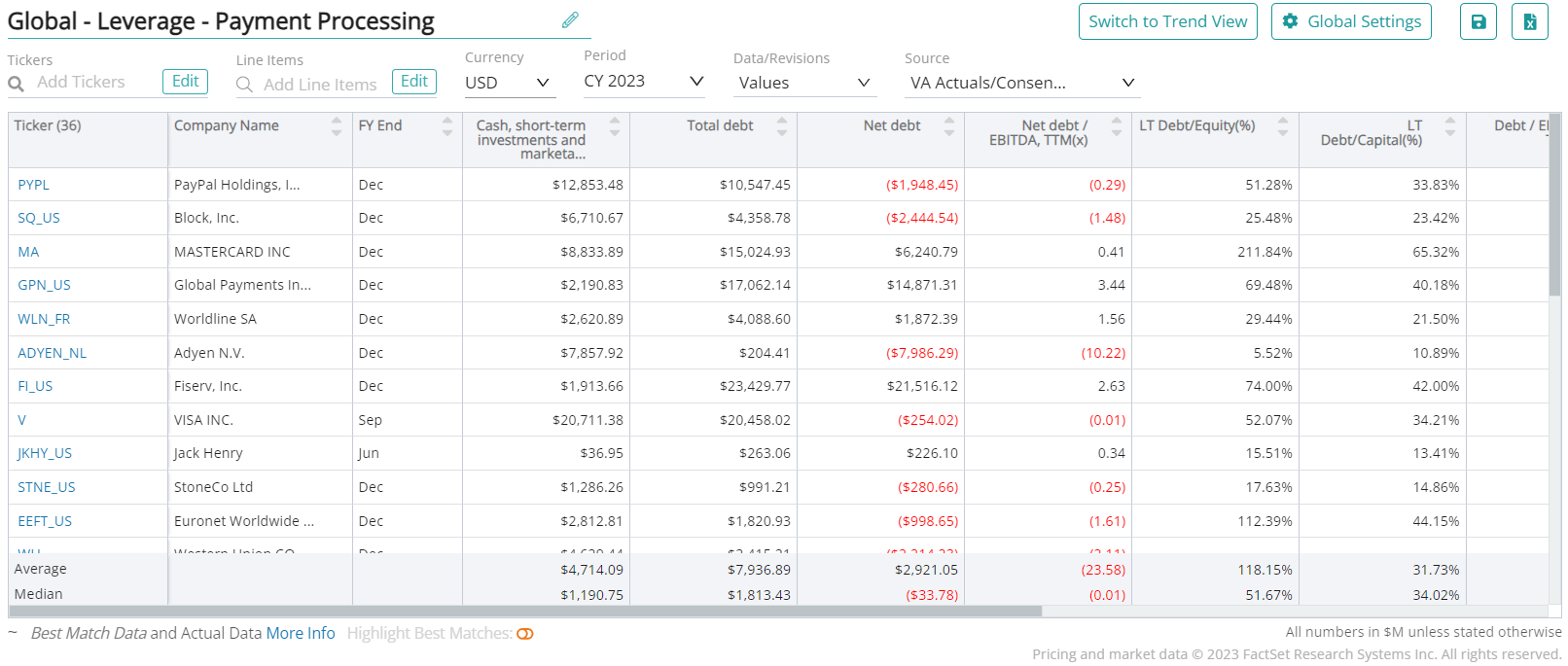

To understand market expectations for the payment processing industry, a key information source is sell-side analyst estimates and consensus forecast data. The buy-side, sell-side, and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst, company, and industry data at a level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of February 2024

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities.

Acquirer

An acquirer is a financial institution that receives and processes a transaction on behalf of the merchant.

Issuer

An issuer is a financial institution that issues a card (debit, credit, or prepaid card) to the buyer or the cardholder.

Incentives / Rebates

Rebates and incentives (contra-revenue) are rewards or benefits provided to customers that meet certain volume targets. These could include discounts, cashback, or other perks offered for using a specific payment method or processing a certain volume of transactions. Rebates are often used to foster loyalty, promote higher transaction volumes, or incentivize the use of particular payment services. Rebates and incentives are recorded as a reduction of revenue when revenue is recognized.

Number of Transactions

Number of transactions or processed transactions is the total number of financial transactions that a payment processing company has successfully processed over a given period.

Processing Fee

Processing fee refers to the fee that a payment processor charges for each transaction it processes. This can also include interchange fees charged by card networks.

Take Rate

Take rate or processing fee, often used interchangeably, is the percentage of transaction amount charged by payment processors as fees for processing a transaction. Take can also include interchange fees and is expressed as a percentage rather than a fixed amount.

Payment Volume

Payment volume also known as transaction volume is the total amount of money processed by a payment processing company over a given period. Payment volume is an important metric for payment processing companies, as it directly impacts transaction revenue.

Revenue Per Transaction

Revenue per transaction measures the average amount of revenue a company generates for each transaction.

Transaction Revenue

Transaction revenue is the revenue earned by payment processing companies for facilitating electronic payments between two parties. This revenue is typically a percentage of the transaction amount, known as the processing fee or merchant discount rate. Transaction revenue is a major source of revenue for payment processing companies.

Subscription Revenue

Subscription revenue is the recurring revenue earned by payment processing companies through subscription-based services that include access to payment processing tools.

Cross-border Revenue

Cross-border revenue refers to the revenue generated by payment processing companies through fees charged to issuers and acquirers when there is a difference between the merchant’s country and the buyer/cardholder’s country. This type of revenue is typically associated with fees related to currency conversion, as well as fees charged for processing foreign payments.

Other Revenue

Other revenue is the revenue earned by payment processing companies from various non-transactional services offered, such as merchant account setup and maintenance fees, chargeback and dispute resolution services, and other value-added services that are not directly related to payment processing.

Cost of Service/Revenue

Cost of service refers to the total cost incurred by a business in providing a particular service.

Research and Development (R&D) Expenses

Research and development (R&D) expenses refer to the costs associated with the activities a company undertakes to discover, design, and create new products, services, or processes or to enhance existing ones.

Operating Margin

Operating margin is a financial metric that measures the profitability of a company’s core business operations and is computed by dividing the operating income of a company by its total revenue.

Download this guide as an ebook today:

Guide to Payment Processing Industry KPIs for Investment Professionals

This guide highlights the key performance indicators for the payment processing industry and where investors should look to find an investment edge, including:

- Payment Processing Industry Business Model & Diagram

- Key Payment Processing Industry Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions