Alphabet Inc.’s (NASDAQ: GOOGL) Google Cloud CEO, Thomas Kurian, kicked off the latest Google Cloud Next conference and Alphabet CEO, Sundar Pichai, provided an introduction that set the stage for discussing the rapid pace at which generative AI (GAI) is moving. What was announced in the keynote and what are the implications relating to potential margin expansion for Google Cloud?

Figure 1: Alphabet CEO Sundar Pichai at Google Cloud Next ‘24

Operating margin improvement

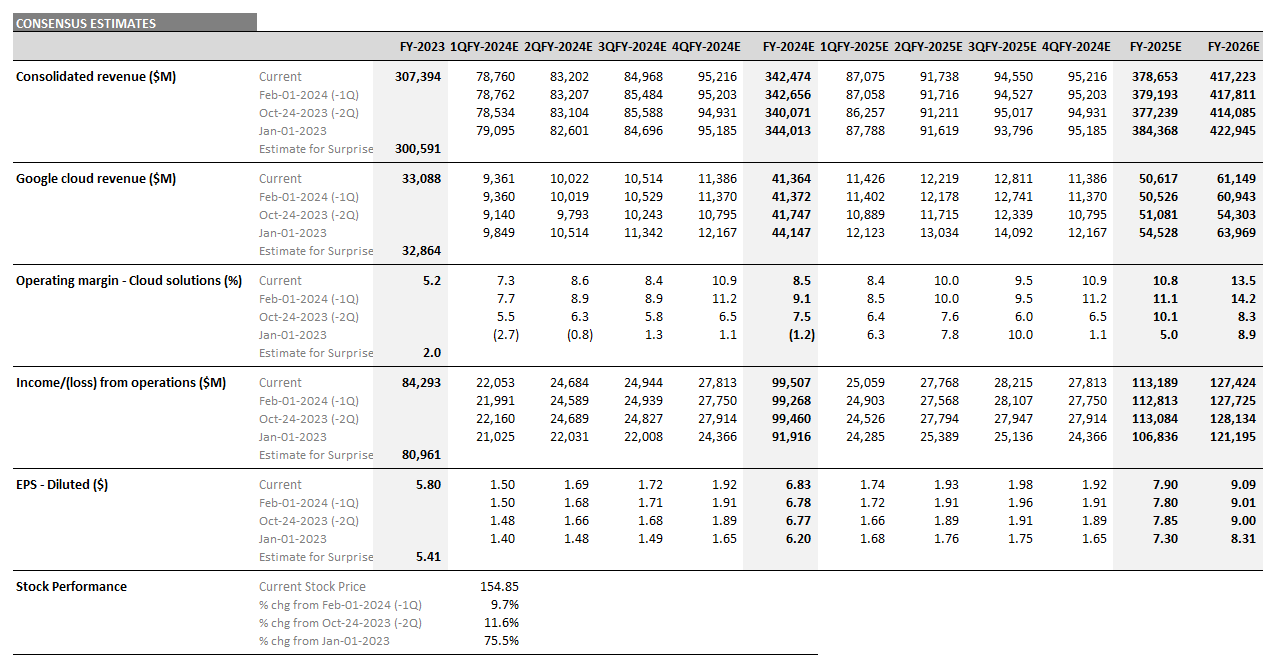

One of the key aspects of the Alphabet investment story is about Google Cloud continuing to improve its operating margin. This business broke even and generated a 5.2% operating profit margin in FY 2023, or $33 billion in revenue and $1.7 billion in operating profit. Based on Visible Alpha consensus, Google Cloud is now expected to generate an 8.5% operating margin, down from 9.1% in February, or $3.5 billion in operating income on $41 billion in revenue, by the end of FY 2024. However, there is significant debate about the Google Cloud business, with operating profit estimates ranging from $1 billion to $5.5 billion.

While the margin improvement for Google Cloud was positive in FY 2023, it remains far from the profitability of some of the company’s Cloud competitors, especially Microsoft. Microsoft delivered a 43% operating profit margin in its Intelligent Cloud business and Amazon’s AWS segment generated a 27% margin last year. In addition, Microsoft and Amazon AWS are each expected to see 200-300 basis points of margin improvement this fiscal year, according to Visible Alpha consensus.

At the Google Cloud Next 2024 conference, there seems to be a greater focus on showcasing how customers are using these new tools across various workflows. Kurian showed a spectrum of different agents with specific use cases for supporting customers, employees, and developers’ needs. Will the latest developments accelerate both revenue and operating profit growth in the Google Cloud business?

Figure 2: Google Cloud CEO Thomas Kurian introduces the CEO of Goldman Sachs

Goldman Sachs CEO David Solomon made a guest appearance at the Next conference. Solomon highlighted how generative AI at the bank is enabling business growth, enhancing client experience, and increasing efficiency. He concluded by stating that it “will yield real value for the business.”

Agents

Google Cloud also showcased Gemini 1.5 Pro and Vertex AI. The focus was on developing agents in enterprises for sales, service, and operational functions. Kurian highlighted that the Vertex AI agent builder can now create human-like conversations, use natural language instructions to control the conversation flow, and improve response quality with vector search.

Figure 3: Google Cloud CEO Thomas Kurian introduces the spectrum of Agents

Aparna Pappu, GM & VP of Google Workspace at Google Cloud, called out that companies are asking for cheaper AI-powered Google Meet and Chat to move away from Zoom, suggesting that the competition in the space may be intensifying. She highlighted that Google Meet outperformed Webex, Microsoft Teams, and Zoom in overall video and audio performance, and will cost $10/user/month. It is worth noting that Duet AI was charging $30/user/month last August. In addition, the company launched Google Vids, an AI-powered video creation app for Google Workspace.

These innovations are designed to add value to the user’s existing workflows by helping to make the user more efficient and productive with their existing tools. However, it is unclear how meaningfully these AI product innovations will drive revenues and profitability in the Google Cloud business segment, especially among small enterprise and individual users.

Google Cloud will need to deepen its monetization with all users to move the needle meaningfully on operating profit, which may prove challenging given Microsoft’s size and profitability in cloud and legacy workplace tools. Could these new Agents help to drive margin expansion for Google Cloud in FY 2024 and beyond?

Figure 4: Google Cloud consensus estimates

Source: Visible Alpha consensus (April 9, 2024). Stock price data courtesy of FactSet. Alphabet’s current stock price is as of the market close on April 8, 2024.

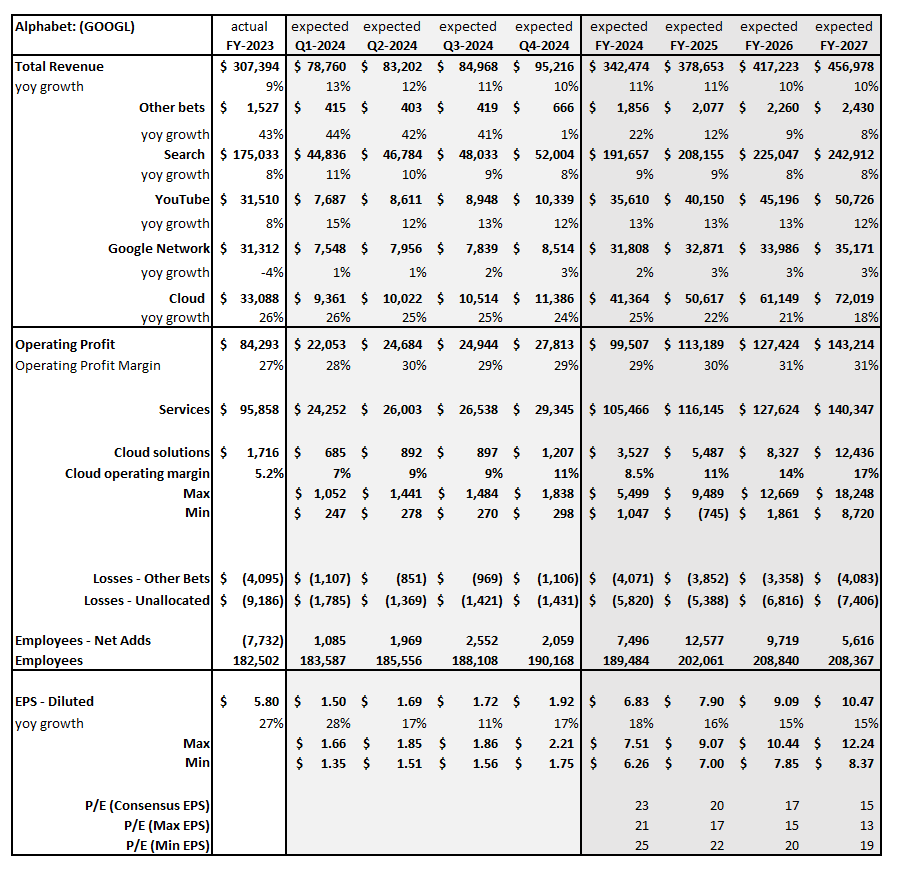

Figure 5: Alphabet’s key financial items

Source: Visible Alpha consensus (April 9, 2024). Stock price data courtesy of FactSet. Alphabet’s current stock price is as of the market close on April 8, 2024.

Final Thoughts

The development and adoption of GAI is in its infancy, but evolving quickly. Google Cloud seems poised to benefit from this technology shift. However, how the profitability of this business will ultimately shake out will be a critical long-term investment question for the stock. With the help of its Agents, will Google Cloud be able to carve out a more profitable place in the cloud landscape and move more quickly toward a double-digit operating profit margin?