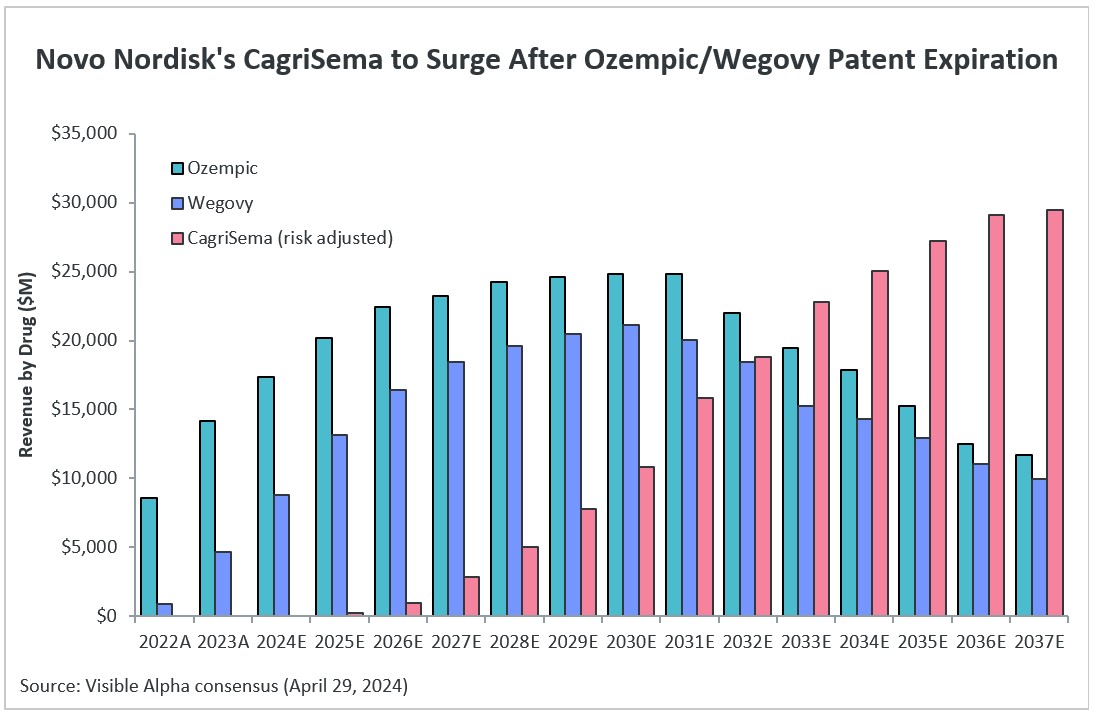

Novo Nordisk (NYSE: NVO) is gearing up early for life after Ozempic and Wegovy patent expiration. The patent covering both Ozempic and Wegovy (semaglutides) is expected to expire in the 2032-33 timeline and generic competition will enter the type 2 diabetes and obesity market. Novo Nordisk has plans in place with CagriSema, a next generation GLP-1-based drug candidate that combines a GLP-1 receptor agonist (semaglutide) with a novel long-acting amylin agonist (cagrilintide). Dual agonism combining two metabolic pathways, GLP-1 and amylin, provides synergistic benefits for obesity/weight management and glucose regulation for type 2 diabetes. Novo Nordisk expects CagriSema to compete with Eli Lilly’s (NYSE: LLY) Mounjaro and Zepbound as the revenue potential of Ozempic and Wegovy declines.

The company is conducting Phase 3 trials with CagriSema for obesity/weight management, type 2 diabetes, and cardiovascular benefits. According to Visible Alpha consensus estimates, the probability of success (POS) for CagriSema approval is around 67% for type 2 diabetes and 66% for obesity/weight management. CagriSema is expected to be on the market in late 2025.

Risk-adjusted revenue estimates based on Visible Alpha consensus project CagriSema revenues to reach $29.5 billion in 2037. Analysts project that as Ozempic and Wegovy revenues decline in the face of semaglutide patent expiry and generic competition in 2032-33 and beyond, CagriSema revenues are set to grow significantly. (See also our latest Visible Alpha GLP-1 Monitor.)