Nvidia Corp. (NASDAQ: NVDA) reported fiscal Q1 2025 results on Wednesday, May 22, 2024. What happened during the release and earnings call, and what are the key points to focus on?

Nvidia’s fiscal Q1 2025 earnings release

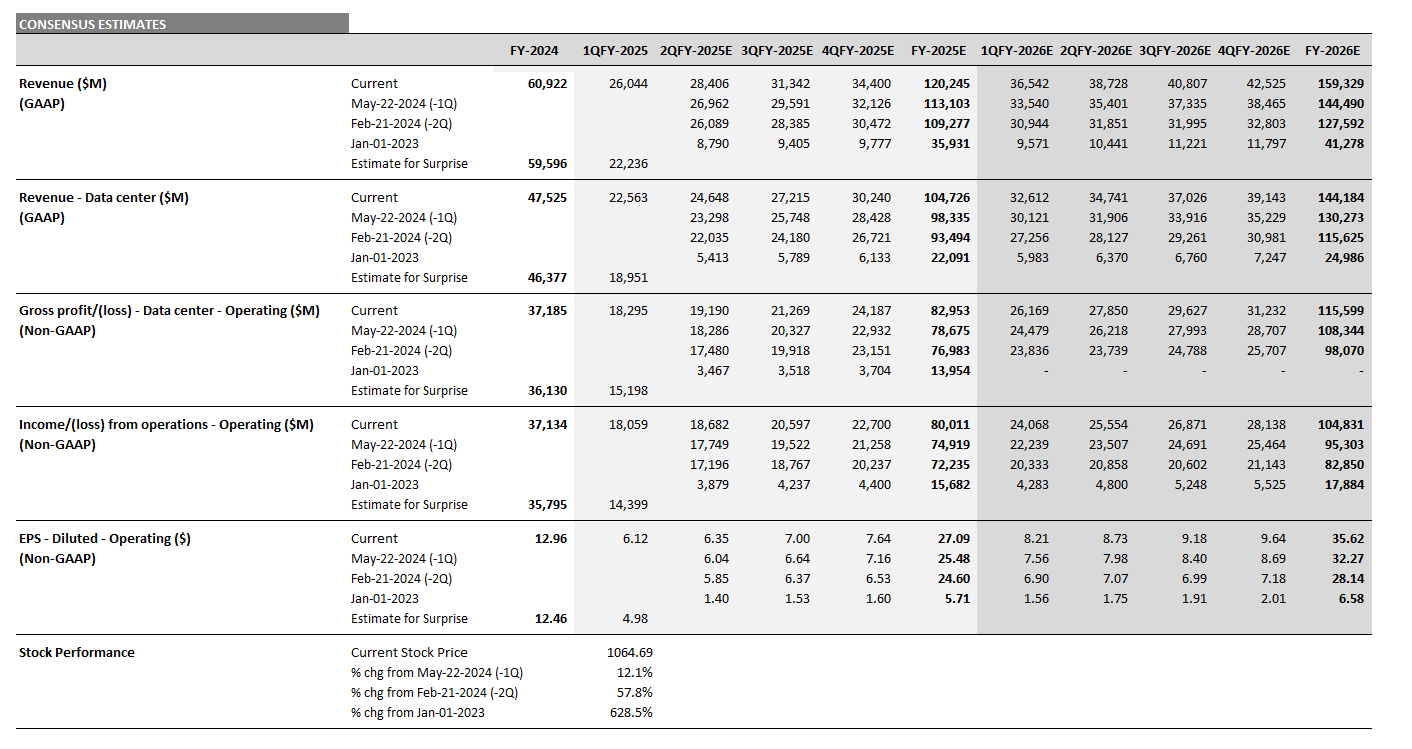

Nvidia delivered total revenues for Q1 of $26.0 billion, beating Visible Alpha’s consensus estimate of $24.7 billion by $1.3 billion, driven by continued revenue growth of Nvidia’s Data Center segment. The segment saw its Q1 revenue surge to $22.6 billion, nearly $1.5 billion ahead of the $21.2 billion consensus estimate coming into the quarter.

This revenue surge has continued to be driven by strong demand for Hopper GPUs, particularly from cloud service providers. On the earnings call, the company highlighted that they are still supply constrained and expect this to continue into next year.

The Data Center segment’s non-GAAP gross margin remained at 79% in Q1, in line with consensus. This drove a beat on the EPS line with non-GAAP diluted EPS of $6.12/share, exceeding consensus of $5.60 by nearly 10%. In addition, Nvidia announced a 10-for-1 forward stock split effective June 7, 2024 and a quarterly cash dividend increased by 150% to $0.01 per share on a post-split basis.

Figure 1: Nvidia estimate trends

Source: Visible Alpha consensus (May 28, 2023). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on May 24, 2024.

The outlook

Near-term growth

For fiscal Q2 2025, Nvidia guided $1 billion ahead of expectations to $28 billion in total revenue, with analysts now projecting the Data Center segment to make up $24.7 billion, up from $23.2 billion. In addition, Nvidia guided total gross margin to continue to be around 75.5% levels, driven by demand continuing to outstrip supply in the Data Center business.

Looking further out, analysts remain bullish on the Data Center segment. Since the Q1 release last week, analysts have increased their full year Data Center revenue estimates another $6.5 billion for FY 2025 to $104.7 billion, driven by continued optimism around GPU demand and the release of Blackwell. According to Visible Alpha consensus, Data Center revenues for FY 2026 are now expected to jump to $144 billion, up from $130 billion on May 22, 2024, with consensus EPS increasing over 10% to $35.62/share.

These upward revisions are likely in response to CEO Jensen Huang’s bullish commentary on the earnings call about the new Blackwell platform and the B-series and GB-series. Huang highlighted that Blackwell is in full production and will ramp in Q3 2025. He also noted that the company “will see a lot of Blackwell revenue this year.” While there is debate among analysts about the quarterly pace and timing of the B-series and GB-series ramps, the long-term expected growth is projected to add to revenues in FY 2026 and FY 2027.

P/E debate: The range of Data Center estimates

The range of estimates has continued to narrow for the Data Center business in FY 2025, suggesting the market has increased conviction in the direction of this segment this year. For FY 2026, however, the range of estimates has narrowed slightly but remains substantial, implying that there is still significant debate about Nvidia’s growth outlook. The top-end estimate expects $189.9 billion, up from $182.6 billion, while the low-end estimate is now at $119.5 billion, up from $95.8 billion, driven by differing views about GPU demand and the ramping pace of new GPUs.

Non-GAAP diluted consensus EPS for FY 2026 is now projected to be $35.6/share, up 20% from the Q1 2025. But there is a nearly $20/share range in expectations, from $28.3/share to $47.5/share, up from $20.1/share to $41.9/share last quarter. Current FY 2026 P/E ratios range from 22X to 38X. For FY 2027, the range expands from 19X to 59X, driven by different assumptions about the timing and magnitude of Data Center revenue growth.

NVDA stock has traded up around 12% since last week’s earnings release, and is up close to 58% since the Q4 release on February 21, 2024. Will the ramp of the new B-series and GB-series drive the Data Center business to beat expectations in FY 2025?

Figure 2: Nvidia consensus estimates

Source: Visible Alpha consensus (May 28, 2024). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on May 24, 2024.

Long-term growth

During the earnings call, Huang emphasized that the industry is going through a major change. He gave his optimistic view on the Data Center’s move to accelerated computing to create AI factories. In addition, he called out that accelerated workloads will save power and cost. Leveraging Nvidia’s accelerated computing capabilities is enabling cloud service providers to provide a foundation for enterprises to begin integrating generative AI into their workflows. What will earnings look like in five years?