Apple (NASDAQ: AAPL) made a number of new announcements during its Worldwide Developers Conference (WWDC) keynote on June 10, 2024, most notably Apple Intelligence. What happened during the conference and what are analysts expecting?

Could Apple become a $5 trillion company?

The arrival of Apple Intelligence at WWDC demonstrated that Generative AI (GAI) is going to get embedded into our daily workflows. Moving beyond tech infrastructure, GAI is evolving into a broad trend likely to provide many productivity and entertainment benefits to consumers through Apple’s massive installed base and ecosystem. With Apple now firmly a part of the GAI movement, the popularity of its new tools and capabilities will likely dictate the magnitude of its earnings potential. The more users get hooked on GAI, the more likely they are to upgrade their hardware and subscribe to more lucrative services.

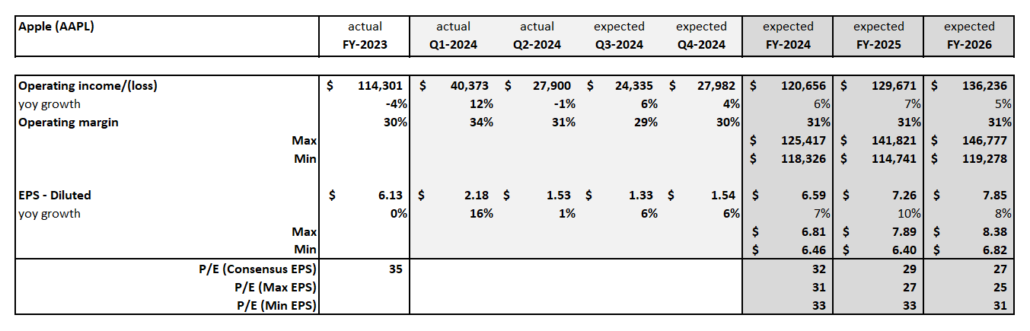

To get to a $5 trillion valuation, Apple needs to generate $180 billion in operating profit and $11.50/share in diluted EPS at a P/E of 30x. Only a few sources expect Apple to generate this level of profitability and not until the end of FY 2032. Currently, the consensus P/E ranges from 27-32x over the next few years and the target price is $210, implying no upside to the share price. If Apple gets the GAI trend right, could profitability come faster than current expectations and drive a wave of upward revisions over the next few years?

Apple Intelligence: Will this drive an upgrade cycle and grow Services?

Apple entered the Generative AI (GAI) movement and announced its version of a new personal intelligence system, Apple Intelligence, at WWDC on June 10, 2024. In the keynote, Craig Federighi, SVP of Software Engineering, showcased the updates and highlighted the new partnership with OpenAI. Apple Intelligence is only available on iPhone15 Pro/Pro Max, select iPads and Macs. Could Apple Intelligence help to drive a new replacement cycle for Apple hardware?

Figure 1: Apple Intelligence

Source: WWDC (June 10, 2024)

ChatGPT and Apple Intelligence will integrate new GAI writing, summarization and image tools later this year. These new capabilities will also work with Siri and Apple’s iCloud. These enhancements have the potential to take GAI mainstream and become part of users’ daily lives. The popularity of these new tools and enhancements could be a catalyst for a new iPhone, iPad and Mac replacement cycle.

Figure 2: OpenAI Partnership: ChatGPT embedded into the iPhone

Source: WWDC (June 10, 2024)

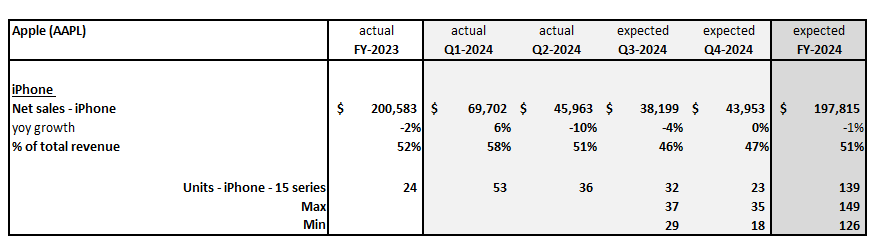

Given the enormous installed base of iPhones, Pre-15 Pro users may be motivated to upgrade their earlier version phones and both expand and extend the pace of the new upgrade cycle. Based on Visible Alpha, analysts expect iPhone 15 unit sales to range from 126 million to 149 million with consensus at 139 million this fiscal year.

Figure 3: Apple iPhone 15 expectations

Source: Visible Alpha (June 18, 2024)

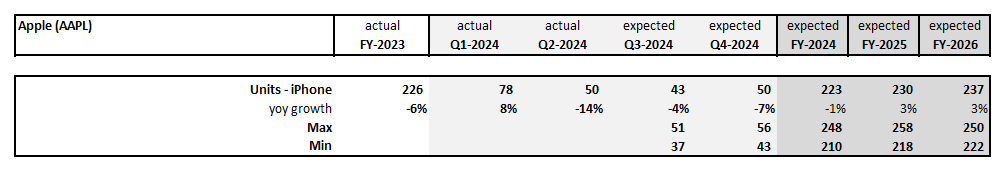

Figure 4: Apple Total iPhone expectations

Source: Visible Alpha (June 18, 2024)

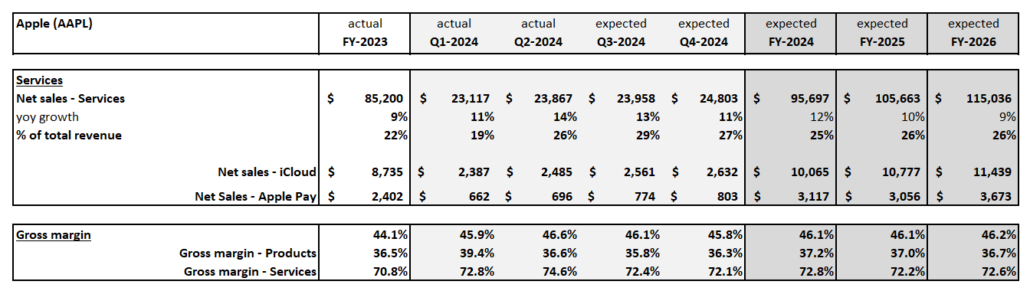

In addition to a potential hardware replacement cycle, Apple Intelligence may help to fuel a surge in Services growth. Services sales are expected to grow 12% this fiscal year, up from 9% last year and to maintain that pace through FY 2026. However, if the new GAI tools gain in popularity and usage, more users may be inclined to subscribe to more Apple Services, like iCloud and Apple Pay. Increases in Services revenue is impactful to the bottom line, since this segment generates ~73% gross margin, nearly 2x the 37% gross margin of hardware products.

Figure 5: Apple Services expectations

Source: Visible Alpha (June 13, 2024)

The success of Apple Intelligence has the potential to drive a hardware replacement cycle, in tandem with increased usage of lucrative Services. This possible dual impact to sales and operating profit may drive further earnings revisions over the next two years, if GAI takes off with consumers.

Figure 6: The Range of Apple expectations

Source: Visible Alpha (June 13, 2024)

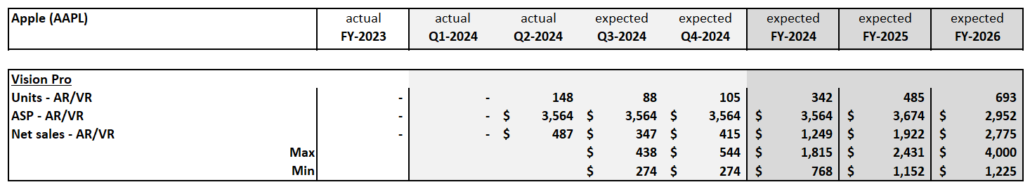

Vision Pro expands

Last year at WWDC, Vision Pro was the big announcement. However, this year, with the Generative AI (GAI) movement broadly driving momentum across the sector, the Vision Pro seems to have taken a backseat to Apple Intelligence. Apple announced Vision Pro roll outs to new international markets over the next month. There was also a significant software update and a growing number of apps. Based on several Visible Alpha sources, Vision Pro is expected to sell close 500,000 units and to generate nearly $2 billion in revenue by the end of FY 2025.

While it is still early days, the high price point and limited functionality have limited the growth expectations. How long will it take the Vision Pro itself to account for $10 billion in revenues? There is also a big question about what level of gross margin the new product will generate and what role it will play in driving more high margin services sales. Longer-term, will Apple Intelligence help drive growth of the Vision Pro?

Figure 7: Analyst estimates for Vision Pro

Source: Visible Alpha (June 13, 2024)