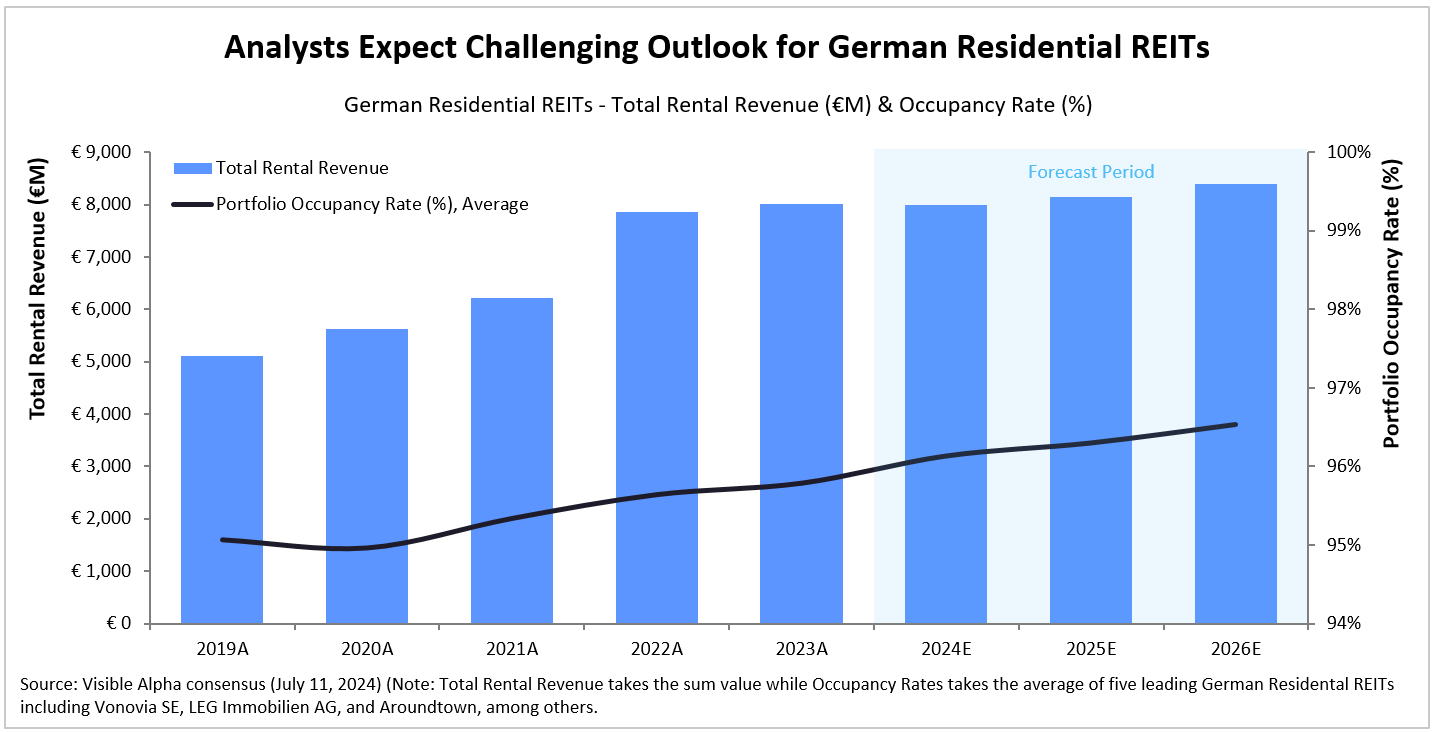

Based on Visible Alpha consensus, German residential REITs are poised for another challenging year in 2024. After experiencing robust average growth of +26% year over year in 2022, rental revenue across key players including Vonovia SE (FWB: VNA), LEG Immobilien (FWB: LEG), Aroundtown (FWB: AT1), Grand City Properties (FWB: GYC), and TAG Immobilien (FWB: TEG), moderated to +2% in 2023. In 2024, analysts expect total rental revenue to marginally decline by -0.3%. This shift contrasts with the peak in 2022, which was driven by low interest rates, now counteracted by inflation and higher borrowing costs.

Based on analyst estimates, Vonovia, LEG Immobilien, and Grand City Properties are estimated to see rental incomes moderate or remain subdued, annually growing by 0.6%, 3%, and 0.7% respectively. TAG Immobilien is projected to see the sharpest decline with rental income sliding -16% from the previous year to €388 million, while Aroundtown is expected to see a -1.7% fall in rental income. Despite maintaining strong portfolio occupancy rates, strict rent control regulations in Germany are anticipated to limit rental revenue growth. These regulations restrict rent increases for existing tenants and impose caps on new leases to ensure housing affordability.