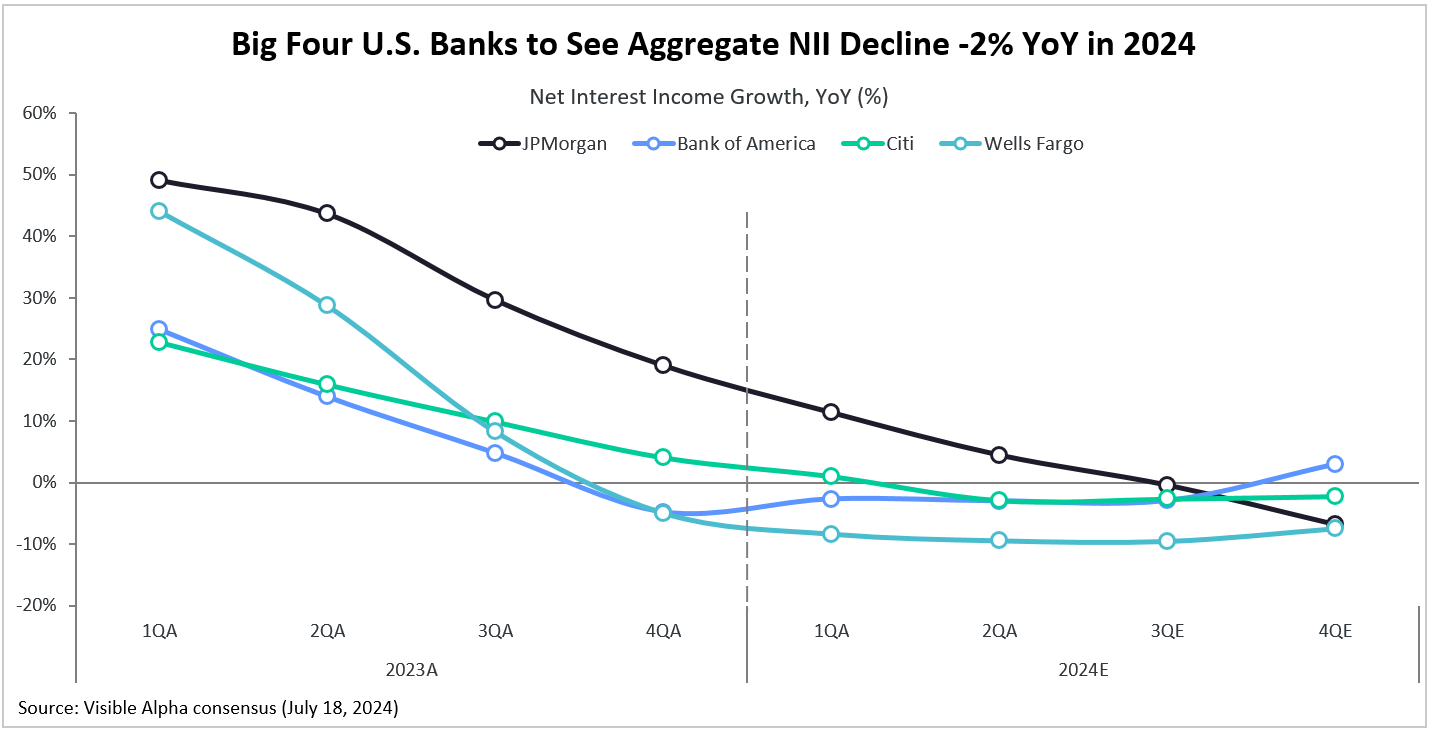

Leading U.S. banks ended the second quarter with a continued recovery in investment banking incomes. This rebound, however, was counteracted by declining net interest income (NII) and margins across the big four U.S. banks. While JPMorgan Chase (NYSE: JPM) saw its net interest income growth moderate to +4% year over year and decline -1.5% sequentially, Citigroup (NYSE: C), Wells Fargo (NYSE: WFC), and Bank of America (NYSE: BAC) all saw NII decline both on an annual and sequential basis.

As the U.S. Federal Reserve keeps interest rates on hold, NII for the big four U.S. banks is expected to see a continued decline in the upcoming quarters, driven by higher deposit costs and muted loan demand. Net interest margin – a key measure of lending profitability – is also estimated to shrink across these leading banks. According to Visible Alpha consensus, Wells Fargo is forecasted to see the steepest NII decline, contracting by -8.7% year over year in 2024 to $48.2 billion. Citigroup’s NII is estimated to decrease by -1.7%, followed by Bank of America at -1.4%. While JPMorgan’s NII is projected to grow, the rate of growth is expected to slow to +1.8% year over year in 2024 (compared to the +34% growth seen last year), totaling $91.4 billion.