Introduction

I went to Japan this August for two weeks. In addition to meeting the intense heat, I sat down with many high-level executives, bureaucrats, and investors to discuss Japan’s future. I have been investing in Japan for many years and was surprised by my observations.

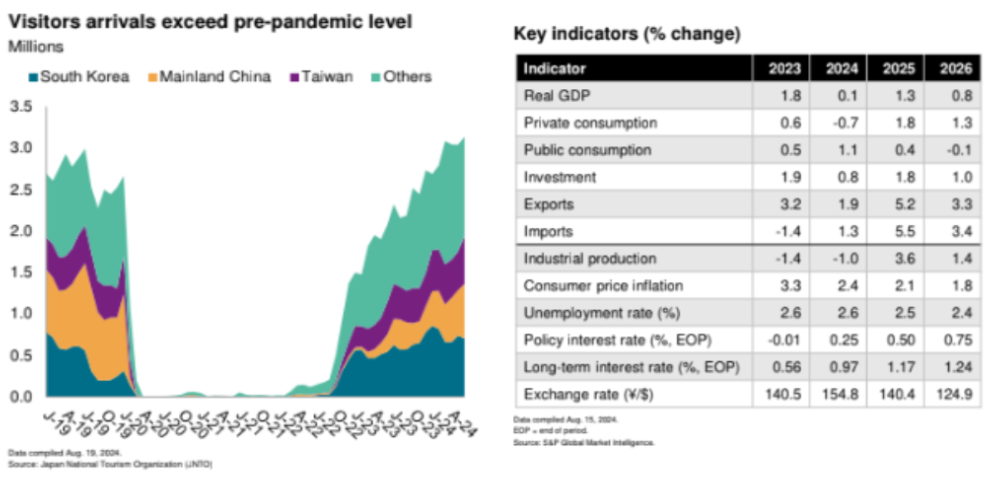

With a very favorable Yen/$ rate, it was refreshing how inexpensive everything Japanese seemed to be in dollar terms. In contrast, imported items, especially from the U.S., were pricey in Yen. Therefore it is no surprise that foreign tourists, especially from the U.S. have increased significantly, helping drive economic activity in the notoriously low-growth market. Japan is importing inflation and consumption.

As the Yen weakened and the dollar strengthened, it was also no surprise that Japan’s $1.8 trillion pension fund, GPIF, has benefited from its 25% allocation to foreign equities benchmarked to MSCI ACWI. This large position benefited from significant exposure to the U.S. and a 20% concentration in U.S. mega-cap technology stocks over the past few years.

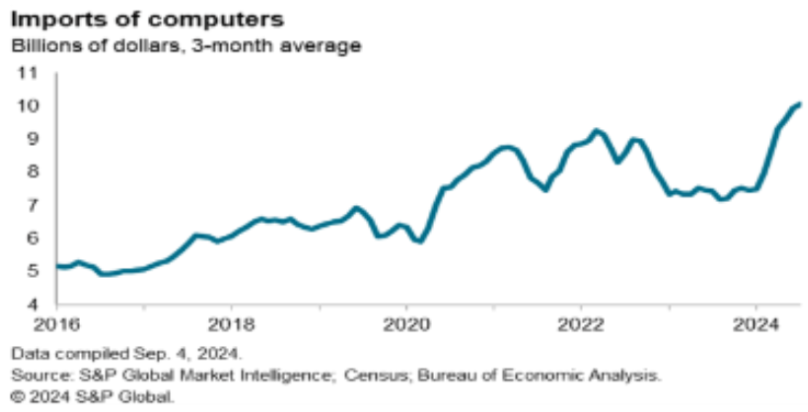

In addition, U.S. imports of computers and accessories have jumped on the back of the AI boom. U.S. companies have likely been taking advantage of the strong dollar and making investments in next-generation technology at better dollar prices, which has probably helped Japanese exporters.

Mrs. Watanabe is a term used to describe Japan’s foreign exchange investors collectively. This group is notorious for taking large positions to benefit from currency and macro moves. Given the extreme currency moves from the past two years, concerns loom about how Mrs. Watanabe and other investors may start to reposition their portfolios. Asset allocation and currencies might shift dramatically as the Fed looks poised to start a path of rate cuts in the U.S.

The Dawn of the AI Revolution

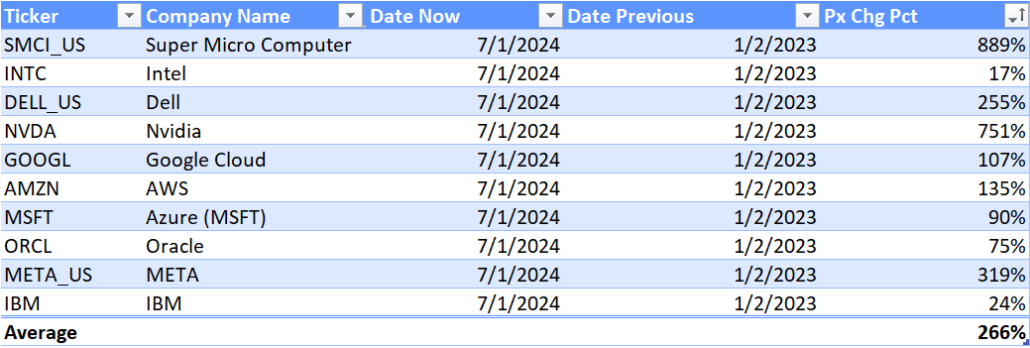

Mega-cap U.S. technology stocks have been a dominant market force since early 2023, driving a significant portion of the upside to U.S./Global indices. At the end of 2022, the Fed’s rate hikes to tame inflation were well underway, supporting dollar strength. Shares bottomed and many of the largest technology companies cut costs and trimmed their headcount in early 2023, while investing in the next generation of AI. Since then, the AI revolution has taken the markets by storm. Companies, like Nvidia (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI), have seen their share prices explode, on the back of the massive surge in CapEx by cloud service providers.

Figure 1: Share Price Performance from January 2023 to July 2024

Top AI-exposed U.S. Technology Stocks

According to the S&P Global Market Intelligence economics team, “imports of computers and computer accessories, collectively, have increased by 60% since December to all-time highs. These two categories, along with semiconductors, account for about half of the 7% increase in nominal imports since December. This is related to massive investments U.S. high-tech companies are making in AI and businesses and consumers upgrading.”

In addition, U.S. technology companies are likely taking advantage of the strong dollar to make these investments. These companies may be able to procure and import next-generation computers and accessories from Japan at lower dollar prices.

Figure 2: Imports of Computers

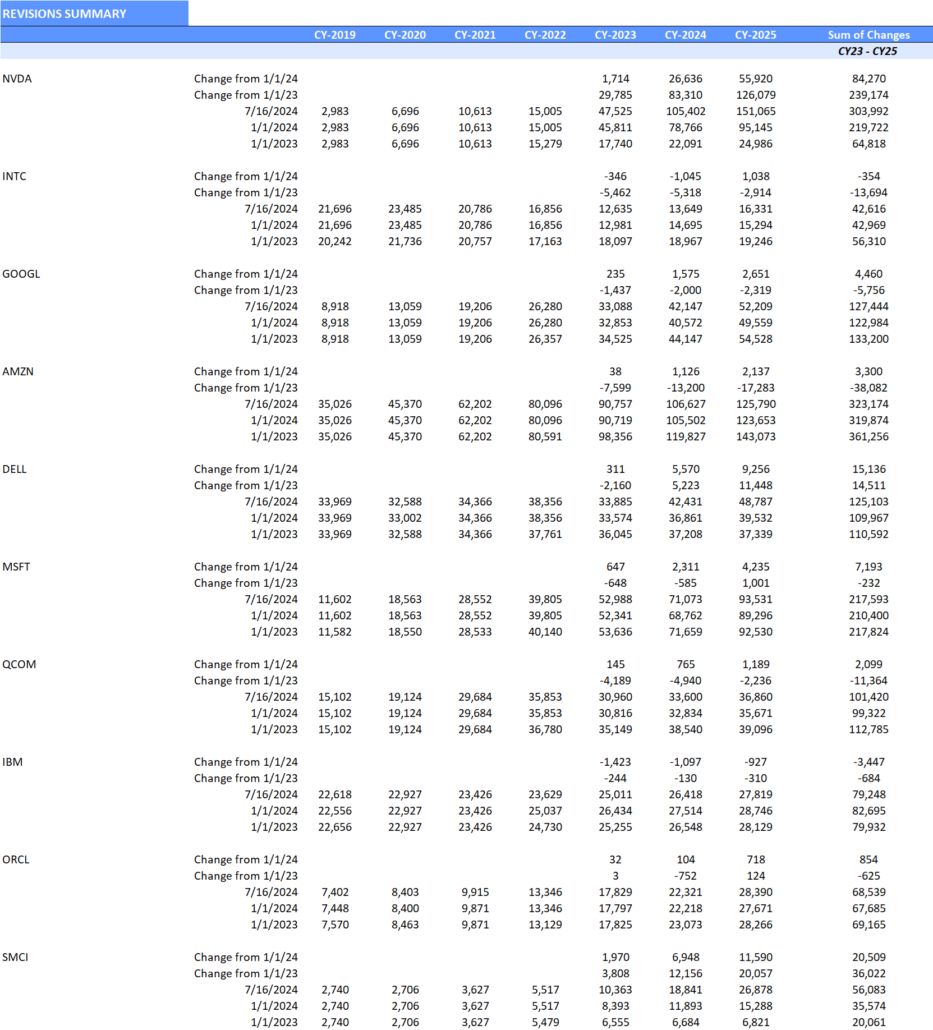

AI-exposed Companies at Crossroads: Squaring Revenues and CapEx

Since January 2024, SMCI + NVDA have driven over $100 billion in upward revisions to AI-exposed revenues. While these two companies have been a driving force behind the AI theme, Alphabet (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), Dell (NYSE: DELL), and Microsoft (NASDAQ: MSFT) have seen estimates increase this year. Expectations have risen and the investment community has been grappling with how best to assess the risk and reward of the AI theme.

Figure 3: AI-exposed Revenue Revisions at Top U.S. Technology Firms

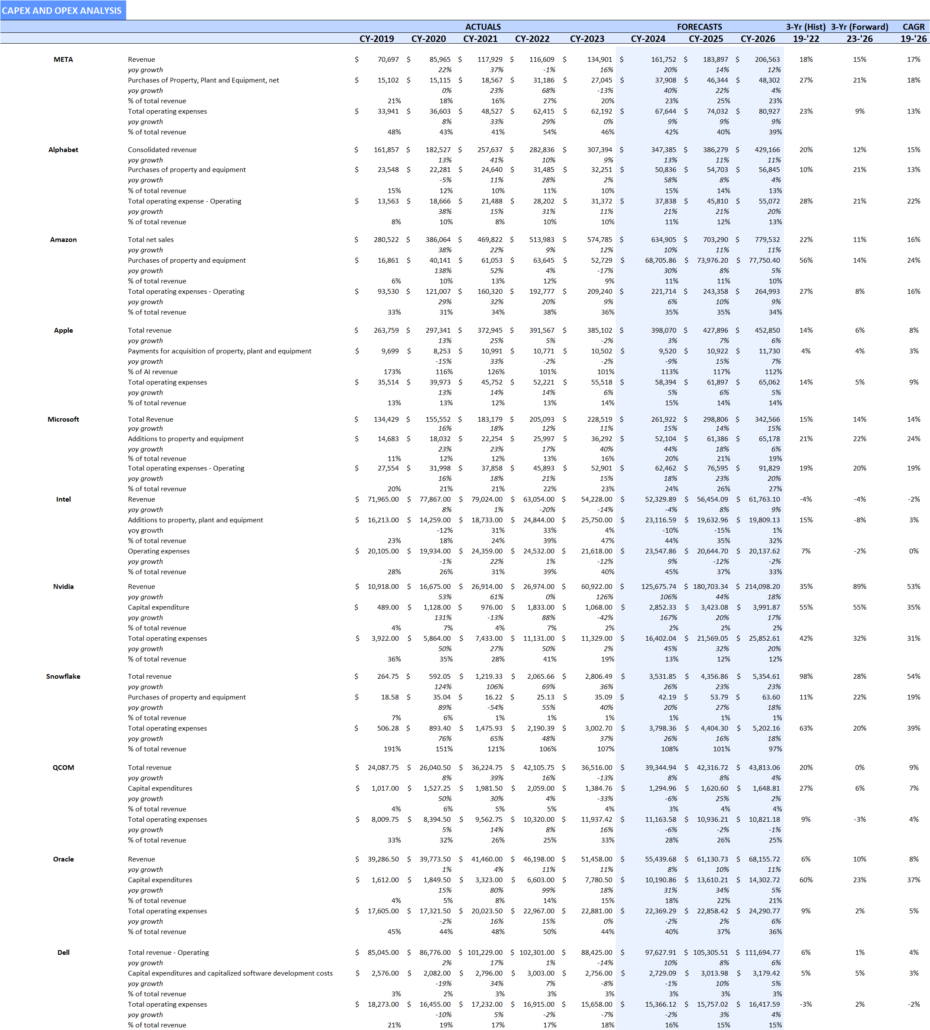

While revenues are likely to benefit from AI exposure, the cost structure and cash flow of these technology companies has changed. Compared to previous years, expected operating expense growth slowed for most of the top AI-exposed firms since early 2023. Companies overhauled talent and reevaluated their cost structures. However, CapEx growth expectations outpaced opex since 2023, as these same companies significantly ramped investment in next-generation GAI infrastructure. With CapEx increasing at a faster pace than AI-exposed revenues, there is concern that the revenue growth from GAI may not materialize with the current expectations.

At the moment, these stocks appear to be at a nexus, as analysts debate whether or not expectations will grind higher on the broad adoption of Generative AI (GAI), especially as Apple (NASDAQ: AAPL) has now entered the race. The world is waiting to see if GAI will deliver on its promises of higher productivity in ways that will generate revenues and an ROI that will justify the significant CapEx investments.

Figure 4: CapEx Growth Relative to Sales Growth Expectations

Shifting U.S. Macro Tides from July 2024

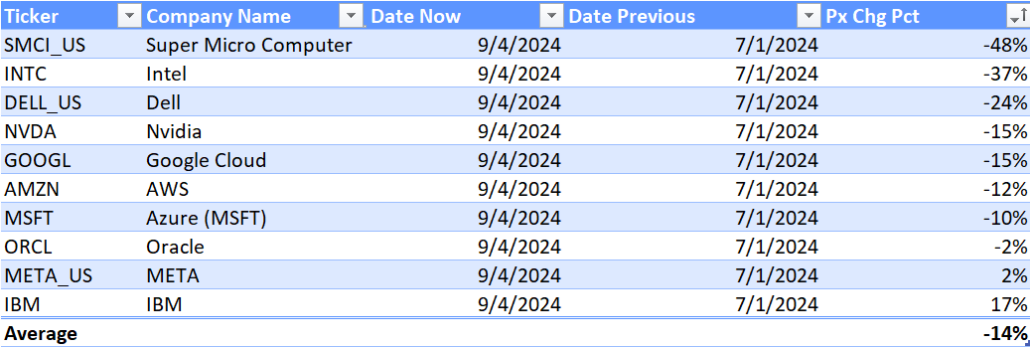

Since the beginning of July 2024, many of the mega-cap U.S. technology stocks that had been outperforming started to see underperformance, especially those most geared to the AI growth story. Mega-cap technology stocks missing expectations in their earnings releases and outlooks were punished in the most recent quarter. Many questions started to emerge about the drivers of the performance and the direction of expectations and upside going forward.

Figure 5: Share Price Performance from July 2024 to September 2024

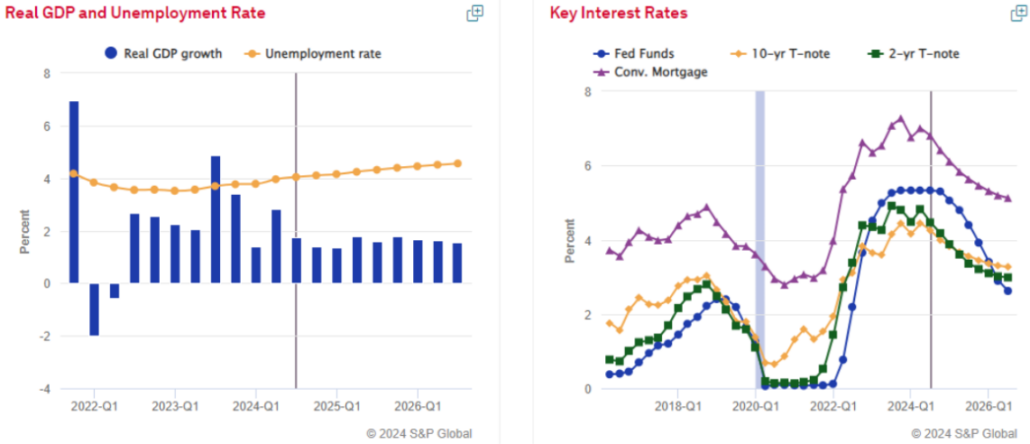

Compounding the complexity of these investment dynamics, the macro backdrop has started to shift and has added to the already fragile situation with the U.S. mega-cap technology stocks. S&P Global Market Intelligence projects September 2024 for the first U.S. rate cut. In the U.S., inflation expectations have come down and there are concerns about the resilience of the labor market, which has contributed to some weakness in the dollar. This dollar decline may impact the investment in AI, as imports of computers and accessories may become more expensive in U.S. dollar terms going forward.

Figure 6: S&P Global Market Intelligence U.S. Outlook

The Japan Factor: Significant Exposure to U.S. Mega Cap Tech

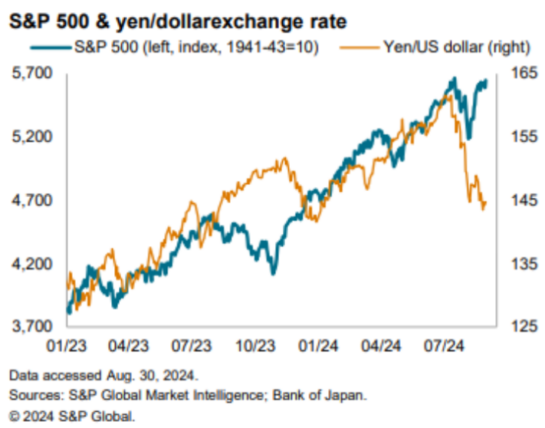

One factor that may be underappreciated by the market is the exposure of U.S. mega-cap tech to Japanese retail and institutional investors. As the Yen and Japanese growth receded over the past few years, Japanese investors were forced to look overseas for returns. This likely led to buying

in both well-known individual U.S. mega-cap technology stocks and the major U.S./global indices, which are heavily concentrated in the largest U.S. mega-cap technology stocks. Adding foreign exposure enabled Japanese investors to diversify their Yen assets both toward global growth and a strengthening U.S. dollar, as inflation surged in the U.S. This strategy has been overwhelmingly successful.

Since January 2021, the Yen has dramatically weakened from 103 to a peak low of 161 JPY for $1 USD and the S&P 500 returned around 50%, giving Japanese investors the double benefit of both stock outperformance coupled with an appreciating dollar. In addition, savvy investors have also leveraged this strategy by executing a carry trade by borrowing Yen at historically low rates and investing the proceeds in U.S. growth stocks.

Figure 7: Correlation of the Yen and the S&P 500 Index

In July, the Yen hit a low at 161/$, a level not seen in decades, leading to whispers that the Bank of Japan may move to reduce the inflation on imported goods. In addition, the weak Yen has led to a surge in exports and foreign tourists that helped drive growth and consumption in Japan’s historically anemic economy, which some suggested was leading to overheating. The U.S. saw a whopping 70% increase in tourists to Japan, which was likely driven by the weaker Yen.

Figures 8: Tourism and Key Economic Indicators

As rumored, the Bank of Japan raised interest rates for the first time in over ten years, surprising carry trade investors who did not believe it would happen. This rate move was followed by weaker-than-expected U.S. job growth, which led to a strengthening in the Yen. In addition, several key U.S. mega-cap tech earnings came in a bit below expectations leading to selling pressure. The combination of U.S. stocks and the currency both moving against carry trade investors forced selling in their positions, fueling volatility in global markets.

Since early August, the S&P 500 has stabilized, despite continued strengthening in the Yen. S&P Global Market Intelligence projects the Yen to continue to strengthen through 2026 and for the Bank of Japan to raise rates again in March 2025. This outlook may reignite volatility in U.S. mega-cap technology stocks and currency markets. However, this time it may not be prompted by a negative response to a carry trade gone wrong, but by a longer-term asset allocation decision by Japan’s retail and institutional investors.

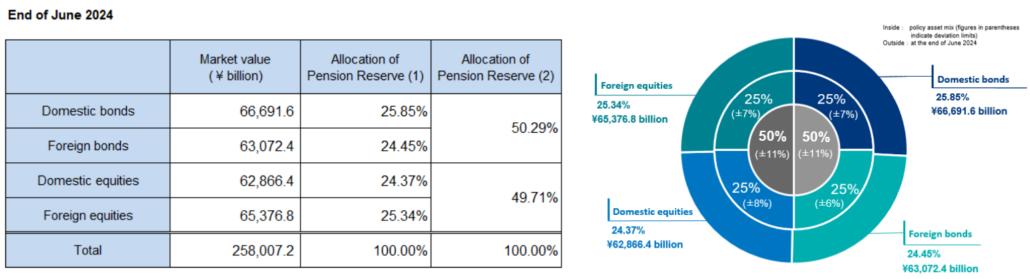

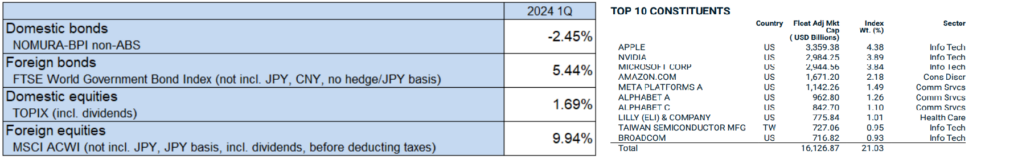

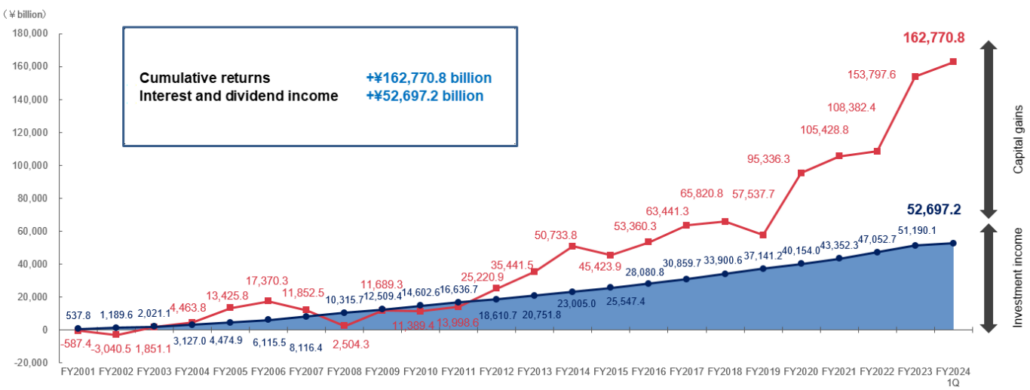

Simply looking at the $1.8 trillion Japan Government Pension Fund (GPIF), 25% is allocated to the MSCI ACWI, approximately $450 billion. This index significantly outperformed the other asset classes, due to the 20% concentration in outperforming U.S. mega-cap technology stocks. GPIF’s approximately $90 billion exposure benefitted both from the AI theme and the strength of the U.S. dollar.

If the GPIF were to decrease its asset allocation to MSCI ACWI by 3%, that would lead to the selling of $10 billion in the U.S. mega-cap technology stocks concentrated in the MSCI ACWI.

While the exposure in GPIF is significant, it is only one example of the asset allocation impact. There is likely broad ownership of these U.S. mega caps across a variety of domestic Japanese retail and institutional investors, who have wanted to diversify their portfolios, benefit from dollar strength, and growth in the U.S. technology stocks. The full magnitude of the exposure to these stocks is difficult to aggregate and fully quantify. However, it is probably significant and may lead to future volatility.

Figures 9: Japan’s Government Pension Holds over $450 Billion in MSCI ACWI

Investment Assets and Portfolio Allocation

(Pension reserves managed by GPIF and the Pension Special Account)

GPIF Q1 2024 Asset Class Performance and MSCI ACWI Index Concentration

Cumulative Returns Since Fiscal 2001

Final Thoughts

As the U.S. tamed inflation, the global macro outlook has started to change. This month, the Fed is expected to start a series of cuts. As the world prepares for this policy shift, we are likely entering a period of a weaker dollar and slower U.S. growth. At the same time, expectations for U.S. mega-cap technology stocks have increased. Their concentration in U.S./Global indices remains significant and may lead to underperformance if these expectations are not met or exceeded. Further compounding these trends, global investors may have to revisit their existing asset allocation and position for the next two years of possibly stronger growth and currencies outside the U.S. As we move into the Q4 of this year and gear up for 2025, will the U.S. mega-cap stocks and the AI trade continue to outperform?