Visible Alpha Insights For Sell-Side Directors of Research

Demonstrate the Unique Value of Both Your Equity Analysts and Your Firm

Today’s sell-side research teams are expected to be nimble, covering more stocks with fewer resources. Visible Alpha provides Directors of Research the ability to both differentiate their firm – and their analysts’ research – from the competition, and grow their coverage universe at a deeper level than before.

Optimize Equity Research Workflows With Visible Alpha

Sophisticated Tools for Deeper and More Efficient Research

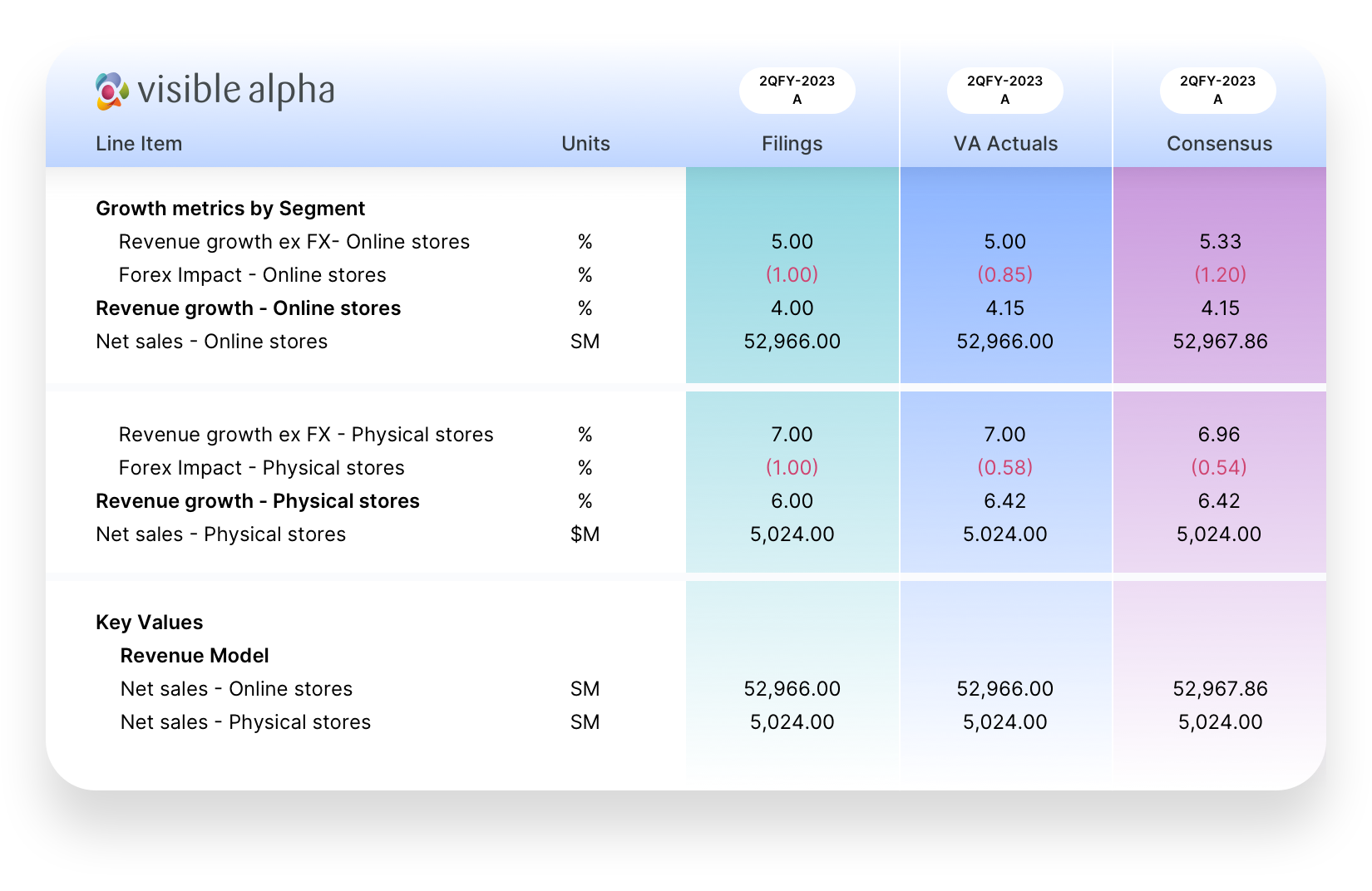

Granular Consensus Data:

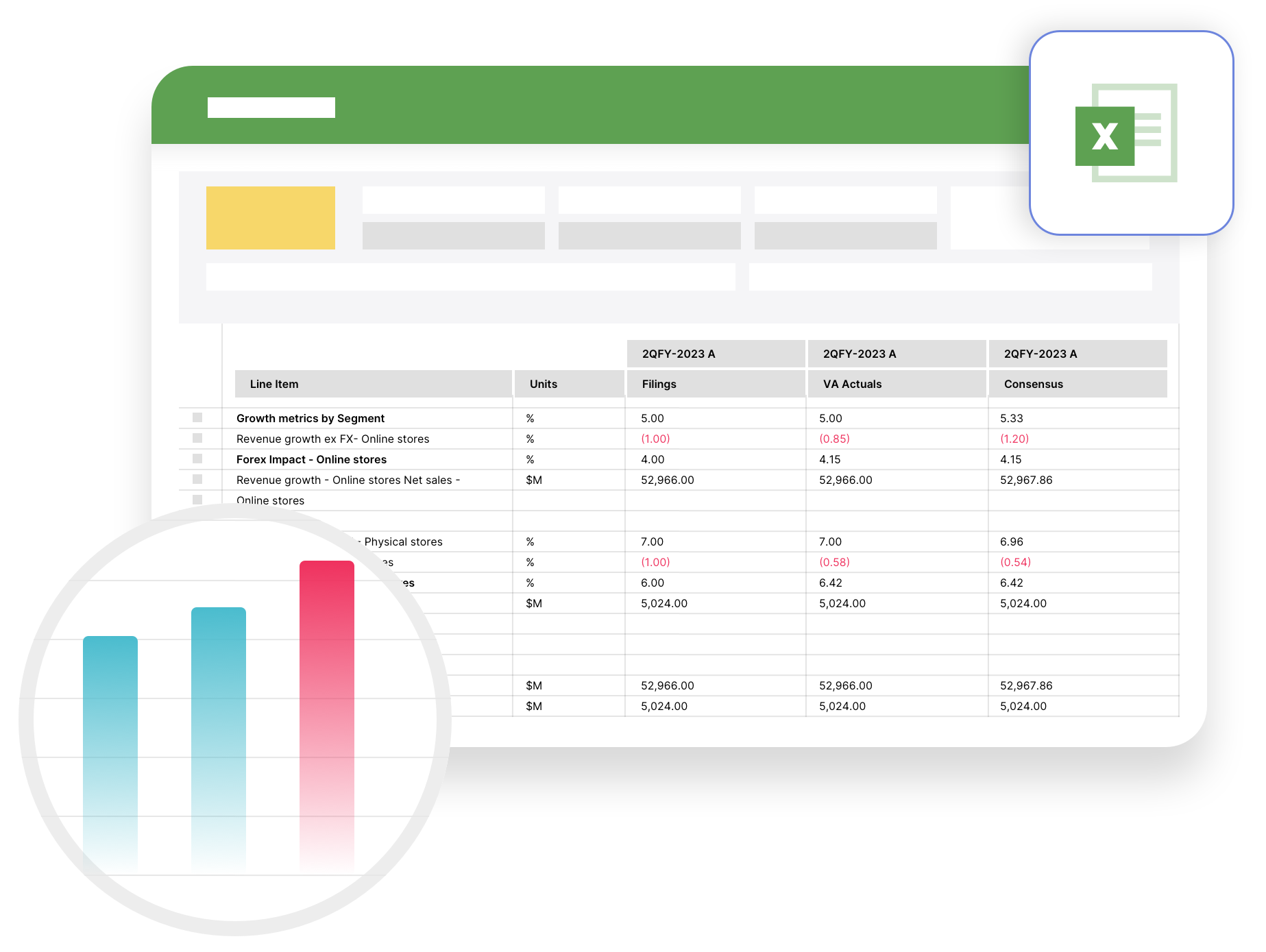

Enable your analysts to undertake more in-depth research, with granular views into both estimates and actuals for the financial line items, operating metrics, and industry KPIs that drive company performance.

Pre-Standardized Line Items:

Streamline your analysts’ modeling workflows with time-saving standardized line items at both the industry and company level.

Easier Peer Benchmarking:

Quickly and seamlessly compare each of your analysts’ company models to market consensus, all within a single platform.

Custom Critical Alerts:

Leverage custom alerts, watchlists, and line-item monitors to receive timely updates on market shifts and stay informed without distractions.

Earnings Season Survival Kit:

Help your analysts to be more prepared for earnings announcements with quick, automated tools for analyzing surprises, revisions, and any implications.

Secure Entitlements Management:

Easily manage buy-side and corporate access to your analysts’ models, research, and target price and ratings data.

Streamlined Model Distribution:

Action model requests and efficiently distribute models on your terms, providing clients with easy and safe access to your firm’s latest numbers.