Martin Pyykkonen, Consulting Analyst

Facebook reported much better than expected 4Q16 results last week and provided some typical overview outlook comments for this year. After these comments, consensus estimates for total spending have moved up, but are still below the company’s outlook comments. Daily Active User (DAU) estimates were modestly revised upward, but now point even more so to non-U.S. markets as the key growth drivers, and global DAU growth is projected to decelerate to <10% by 2018, according to the revised and current consensus.

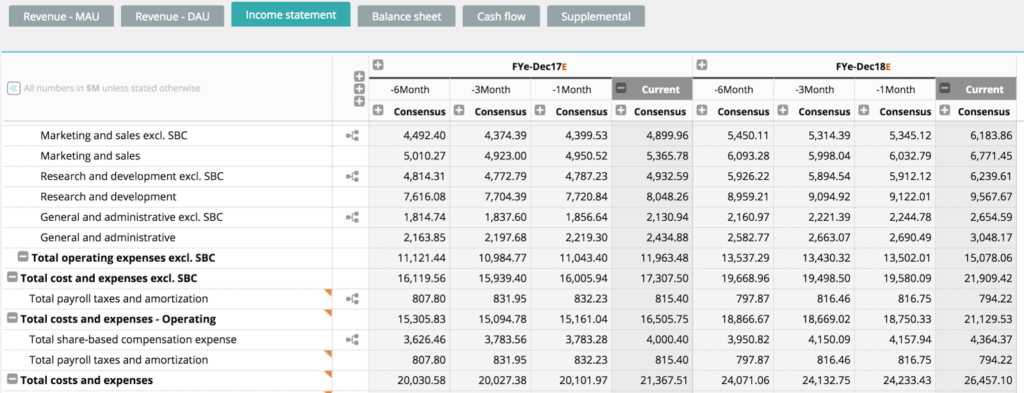

2017 Opex Guidance Exceeds Revised Estimates

Visible Alpha’s current consensus for 2017 GAAP opex is 38.5% year over year growth, which is below the company’s guidance range of 40% to 50% growth this year. We think the Street is assuming FB is overestimating planned expense growth and will come in under plan for the year, as they have done over the past two years. FB’s comments last week, which included an outlook for ‘drastically’ lower revenue growth and ‘aggressive’ spending growth (accelerating during this year towards the back half of the year) are admittedly some managing of street expectations on the company’s part. Consensus total revenue growth for this year is approximately 36%, with GAAP opex increasing 38.5%.

Facebook GAAP and Operating Expenses from Visible Alpha

For illustrative purposes only. Uncover insights hidden inside the stories that consensus does not tell. Request a trial of Visible Alpha today.

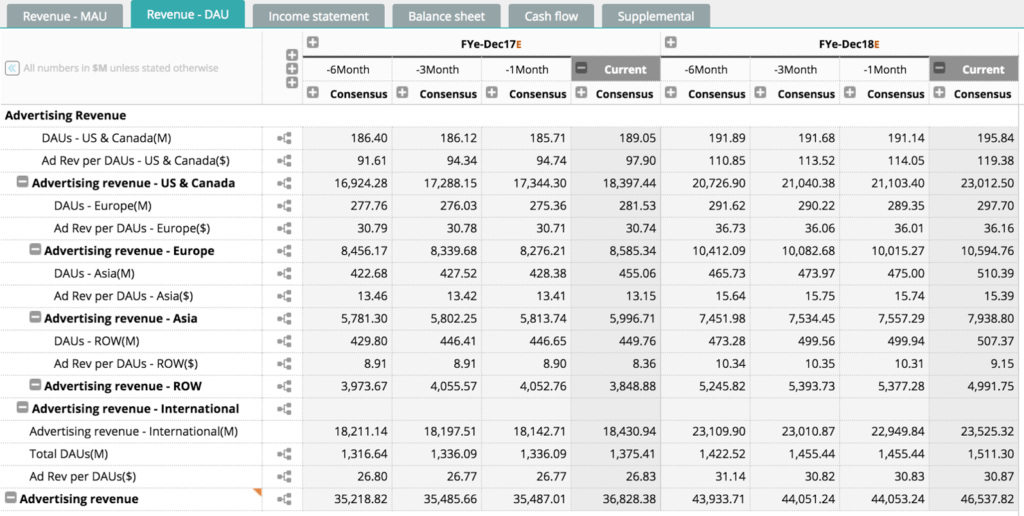

International Leads Daily Active User (DAU) Growth

Current Visible Alpha consensus for DAU growth includes U.S. market deceleration continuing and non-U.S. regions making up a higher percentage of total global DAU growth. Coming into last week’s 4Q16 report for FB, global DAU growth consensus was just less than 10% for 2017 and 2018, but after the report and outlook comments, the 2017 DAU growth consensus spiked up 480bp to 13.1%, with the Asia and ROW geographic regions being the largest drivers of upward consensus revision for this year at approximately 17% growth in each region.

Facebook Revenue Model from Visible Alpha

For illustrative purposes only.

U.S. DAU growth is forecast to decelerate, but even with that the current consensus for 195.8 million DAUs in the U.S. and Canada points to an increasingly saturated market. At this consensus level, greater than 50% of the entire U.S. population is projected to be a daily active user on Facebook.

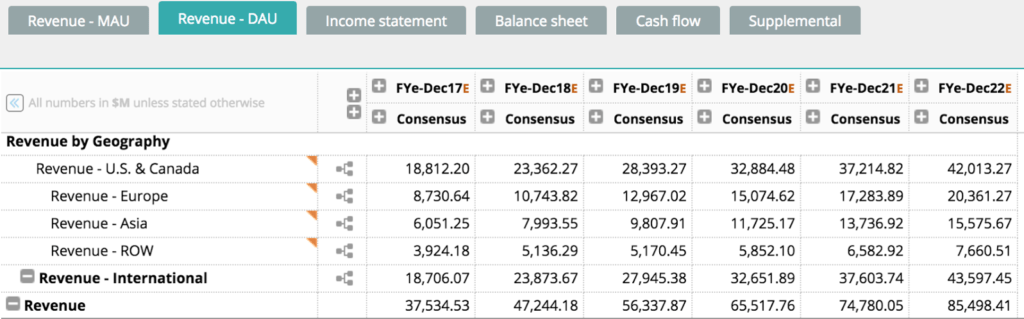

Global DAU Growth Decelerating

The current long term consensus includes all geographic markets decelerating and total global DAU growth decelerating to 5% or 6% by 2020/2021. While current consensus reflects only the core Facebook platform, we expect the company’s future reporting and street consensus will include Instagram DAUs, which are now greater than 450 million, or approximately 35% of Facebook’s core platform global DAUs.

Facebook Geographic Revenue Model (2017-2022) from Visible Alpha

For illustrative purposes only.