Key Takeaways

|

Meta Platforms (NASDAQ: META) reported earnings for Q4 2023 on Thursday, February 1, 2024. What happened during the release and earnings call, and what’s next?

1. What happened in Q4 and what is the outlook?

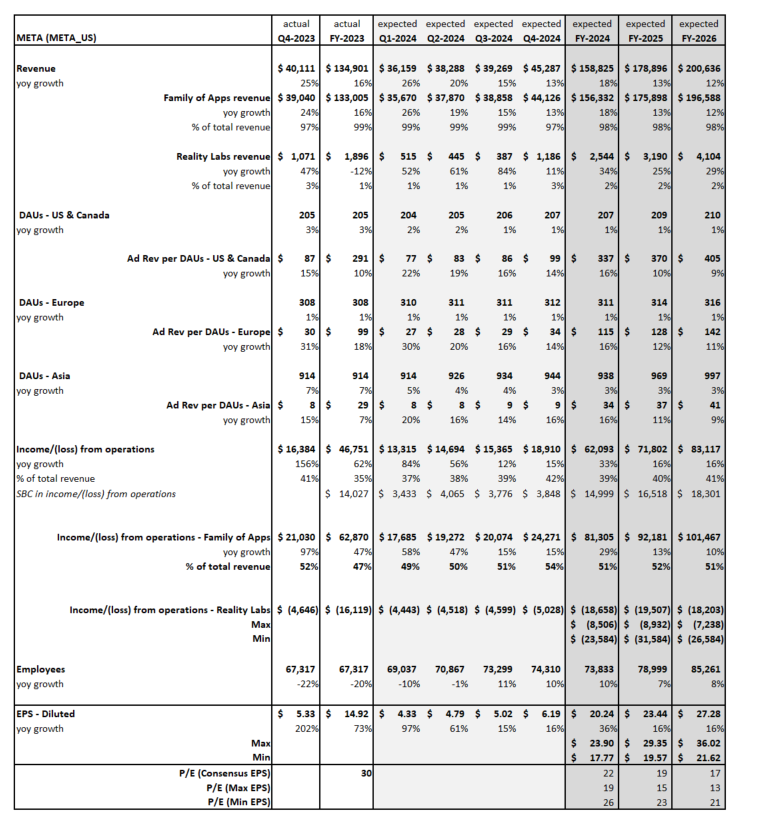

Ads and Quest deliver positive surprises: In Q4, Meta delivered $40.1 billion in sales and $16.4 in operating profit, in line with Visible Alpha consensus expectations. However, the Family of Apps segment surprised by delivering $1 billion better-than-expected revenue and expenses coming in lower, driven by strength across all verticals, including games and e-commerce. Even though Reality Labs costs were higher than expectations, revenues beat Visible Alpha consensus by over 30%, resulting in $1.1 billion, compared to the expected $811.9 million, driven by demand for Quest during the holiday season.

Q1 and 2024 guidance and expectations: Meta guided to $34.5-37 billion in total revenues, $2.5 billion ahead of the $33.2 billion consensus estimate pre-release, driven by continued strength in the Family of Apps business. Analysts now expect revenues to be $7.5 billion higher at $158.8 billion for 2024, as both monetization improves and Threads and Reels gain momentum.

For 2024, Meta guided to OpEx $94.0-$99.0 billion, in line with consensus of $96.7 billion, slightly higher than the $96.0 billion projected ahead of the earnings release. Meta expects higher infrastructure costs and payroll expenses to increase as the workforce moves toward more higher-cost technical roles to support its AI investments.

There is increasing debate about the direction of Reality Labs’ losses. The company expects Reality Labs’ operating losses to increase meaningfully year over year in 2024 as the company focuses on its product development efforts in augmented reality / virtual reality. Prior to the release, analysts expected -$17.8 billion in losses from Reality Labs in 2024. However, consensus estimates are now around -$18.7 billion, with the most conservative analyst forecast at -$23.6 billion, a 48% increase in losses year over year for 2024. Analysts are not in agreement about the level of losses from Reality Labs in 2024, with the range of analyst forecasts increasing significantly to -$8.5 billion to -$23.6 billion in losses, from $14 billion to $22 billion ahead of the quarter.

2. What drove ad revenues, and is this sustainable?

Meta delivered ad revenue of $131.9 billion, up 16% year-over-year in 2023, ahead of expectations and driven by online commerce, CPG, entertainment and media, and gaming verticals. According to CFO Susan Li, strong demand by advertisers in China (especially in gaming and ecommerce) aiming to reach people in other markets led revenue from China-based advertisers to grow to 10% of Meta’s overall revenue ($13.5 billion) and to contribute 5 percentage points to total worldwide revenue growth. This strength from China-based brands presents questions about the sustainability of this spending for Meta. Will Meta be able to grow the $13.5 billion in revenue from China-based firms in 2024 and 2025?

Ad revenue per DAU: Looking at the global breakdown of metrics, all market segments saw ad revenue per DAU increase year over year in 2023. The U.S. was up 10.0%, Europe 18.6%, Asia 6.7%, and RoW 12.1% year over year in 2023. Europe and the U.S. were likely driven by the strong performance of China-based advertisers. Consensus expectations are maintaining positive ad revenue per DAU growth for all geographies for the remainder of 2024, with Europe and the U.S. continuing to have an outsized impact on the metric for the company.

3. Where will CapEx start to have an impact?

While the company plans to focus its investments on AI and the metaverse, Meta expanded the high end of its CapEx guidance by $2 billion to $30-37 billion. This CapEx will likely continue to shift and grow going forward, as the company plans to further invest in infrastructure for AI and monetization.

CapEx ranges: Meta plans to invest in data centers and servers to support its AI ambitions. For 2024, the consensus CapEx increased from $33 billion ahead of the earnings release to $34.5 billion now, putting the CapEx/sales metric at 21.7%. The range of estimates has narrowed from $25.1-37.1 billion to $31.1-37.1 billion now. While Meta is not providing specific guidance beyond 2024, the company did highlight that it may have further needs for foundational research and product development in AI. For 2025, however, analysts expect $37.7 billion in CapEx, or 21% of expected sales. The range level and expected growth of CapEx are projected to be similar to 2023, but to grow to a range of $34.4 billion to $41.7 billion. Given Meta’s ambition in AI, could these CapEx levels begin to tick back up to 22% of sales?