Over the past several months, many large tech firms have highlighted AI strategies with new, embedded-AI capabilities for laptops and smartphones. There is some debate in the market about the enterprise adoption of AI and, if it does happen, what the pace of it will be. Some analysts are forecasting it to be broad and fast, while others question if the adoption will even happen. As we begin to move out of the COVID-era boom in hardware unit sales, will next-generation, AI-enabled laptops and smartphones serve as a catalyst for a new hardware replacement cycle in enterprises?

As the COVID-era hardware units approach the typical upgrade window of 3-5 years and organizations begin to plan for new unit purchases, will organizations upgrade their hardware to leverage the new AI features? Will these new AI features help drive greater revenue and profitability for smartphones and laptops in this next cycle?

Laptops

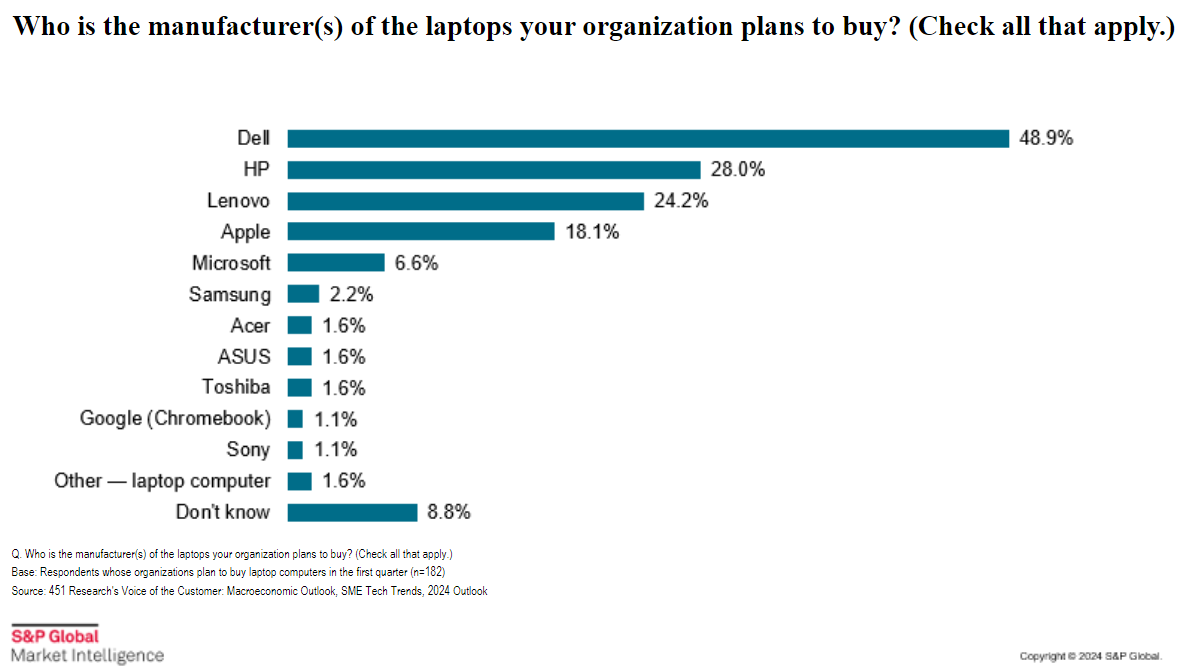

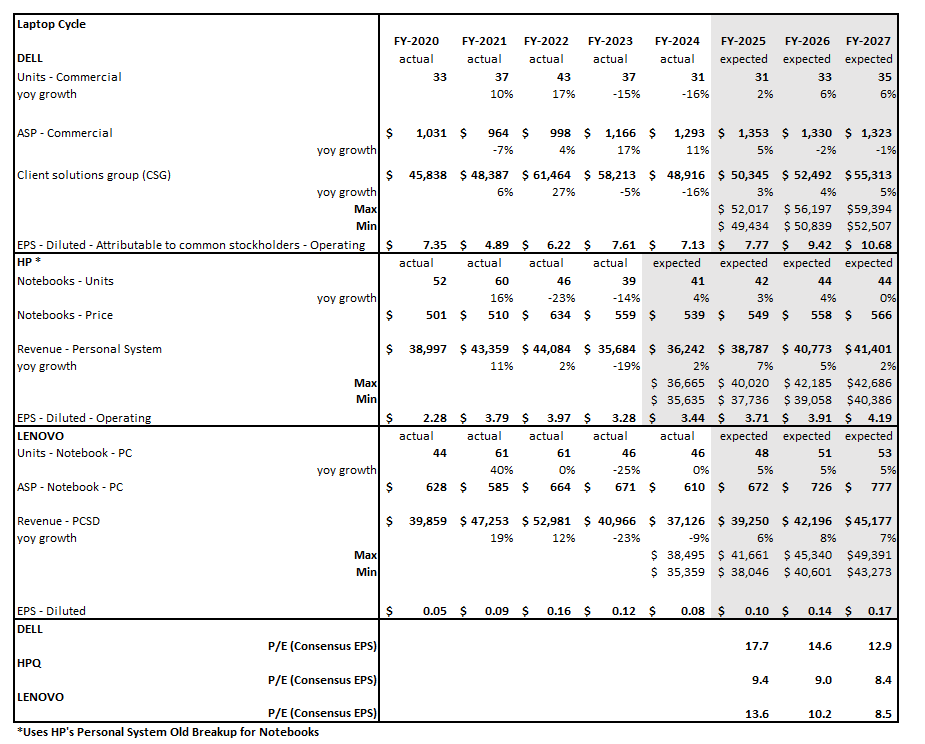

Based on a survey conducted by 451 Research (part of S&P Global Market Intelligence) for 2024, Dell, HP, and Lenovo were the top three laptops that organizations plan to buy. All three recently released new AI laptops. Could these new models be a catalyst?

Based on Visible Alpha consensus, these three laptop manufacturers are estimated to see unit sales 15-25% below the previous demand surge from COVID, while prices are expected to increase. Looking back to FY 2021-2022 when units peaked, can AI help drive upside to current unit expectations at higher price points?

Figure 1: Laptop purchasing survey

Figure 2: Laptop outlook

Source: Visible Alpha consensus (July 1, 2024). Stock price data courtesy of FactSet. Current stock prices are as of the market close on June 28, 2024.

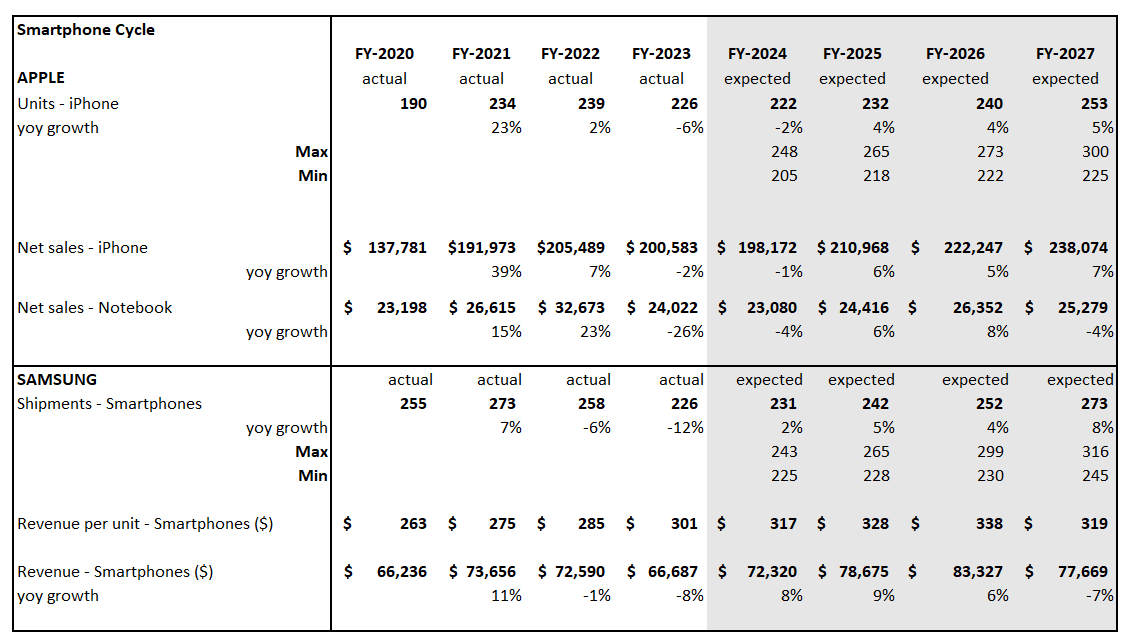

Smartphones

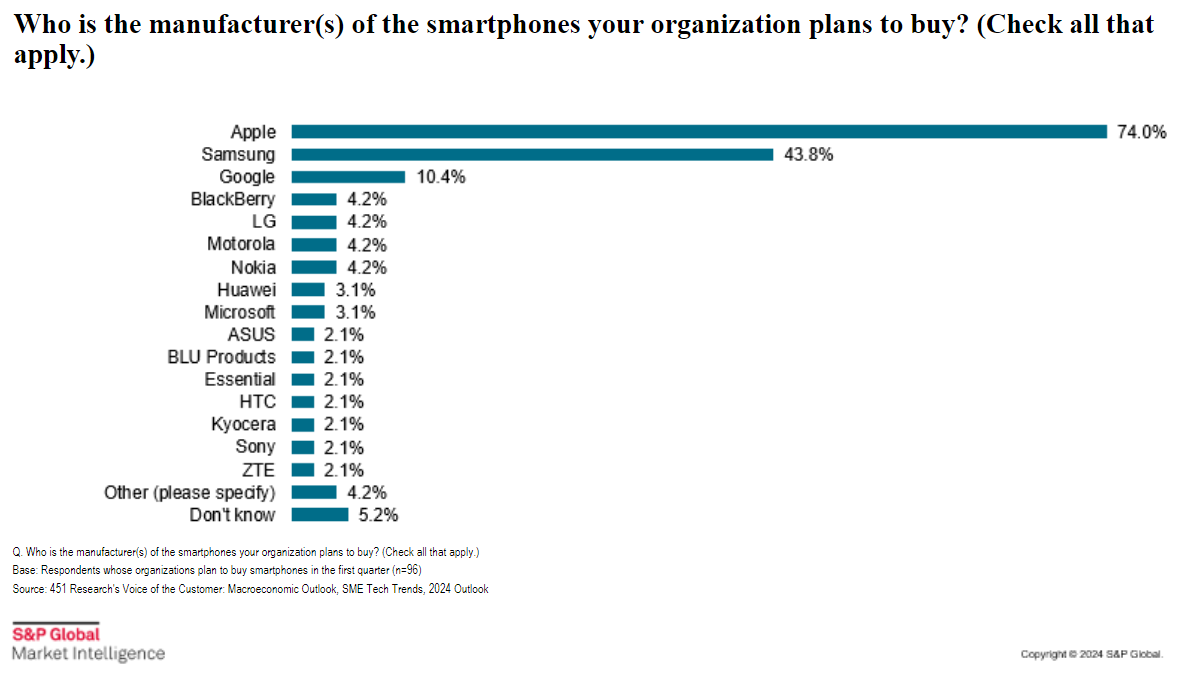

Based on a survey conducted by 451 Research (part of S&P Global Market Intelligence) for 2024, Apple and Samsung were the leading smartphones that organizations plan to buy. Apple just announced Apple Intelligence, which is only available on iPhone15 Pro/Pro Max, select iPads, and Macs. Samsung’s AI phone leverages Google.

Based on Visible Alpha consensus, Apple is estimated to see unit sales exceed the previous demand surge from COVID, with the most bullish estimates exceeding the previous peak by 20-30%. Analysts expect Samsung to hit the previous high of 273 million units by the end of FY 2027, with a few analysts estimating unit sales 10-20% above consensus. Looking back to FY 2021-2022 when units peaked, can AI help drive upside to current unit expectations and lead to further upward revisions?