In 2Q16, American Express and Costco ended their 16-year exclusive-card partnership. The loss was a significant blow to American Express, as Costco made up a significant portion of their billed business and their cards in force. The cut was expected to weigh on results for some time and potentially impact other cobranded partnerships as well.

However, American Express has invested heavily in marketing, rewards, and membership engagement to continue to grow the business. Over the last year, the company has enhanced rewards on many of their cards, including their Platinum card.

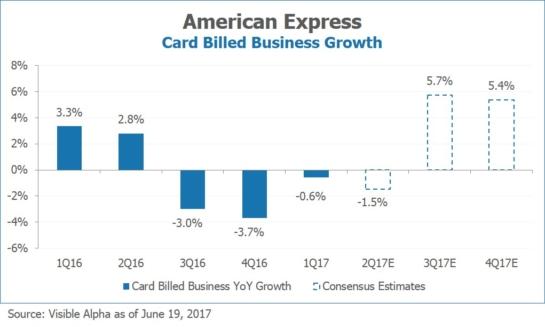

The company’s 1Q17 results showed that the investments are paying off as the Costco breakup moves further into the distance. American Express’s card billed business came in above consensus expectations and the decline was at a much more moderate rate than in 4Q16. Going forward, analysts are now modeling a low-single digit decline in 2Q17 before turning strongly positive in 3Q and 4Q.

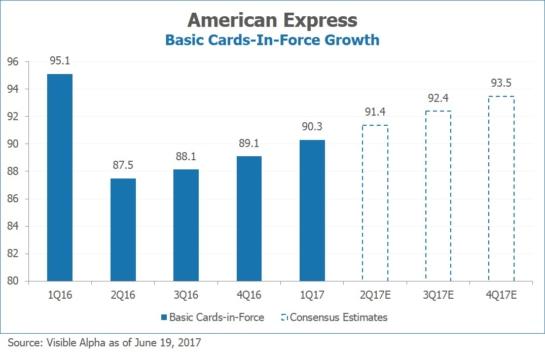

Additionally, the company’s basic cards in force have also continued to grow each quarter since 2Q16. In 1Q, American Express added an additional 1.2 million cards, and analysts expect this to continue to grow consistently in the following quarters.

Get access to the deepest analytics on the companies important to you.

Try Visible Alpha today!

Concerns remain about the competitive environment and the rewards arm race underway. And American Express has guided to a 5 basis point increase in rewards costs for the year as they continue to enhance rewards to stay competitive. However, recent results may make increased investment spend a bit easier to digest.