Apple Inc. (NASDAQ: AAPL) will report fiscal Q1 2024 results on Thursday, February 1, 2024. Here are the key numbers that we’re watching.

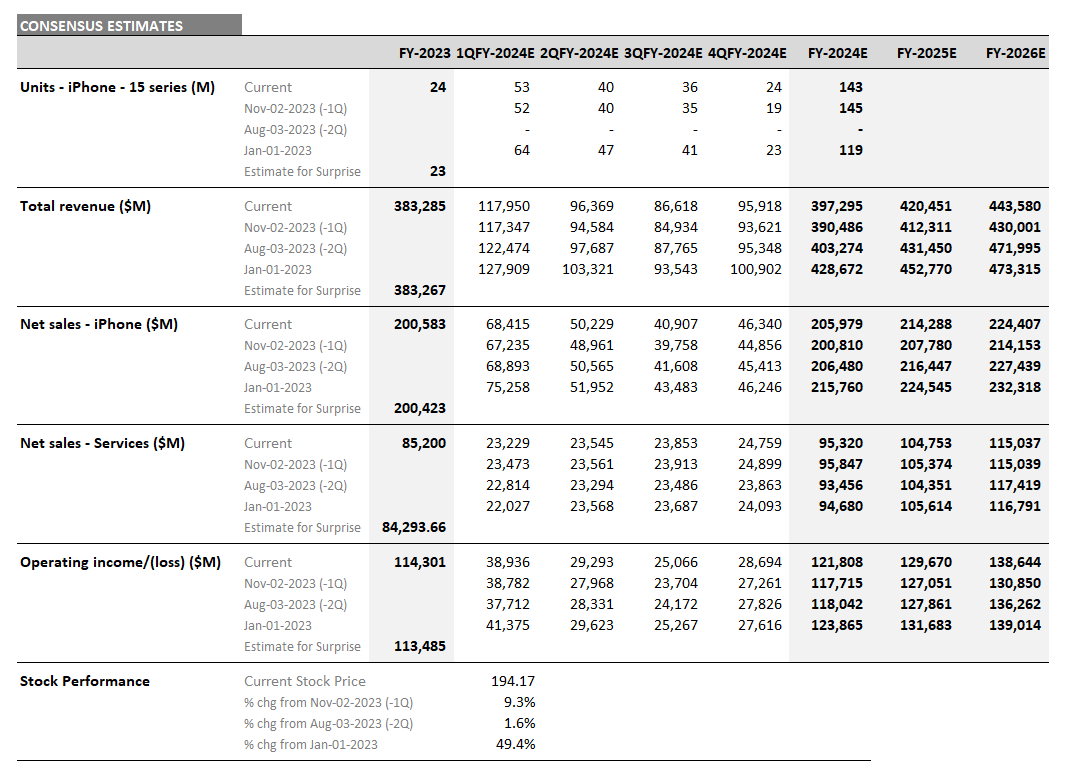

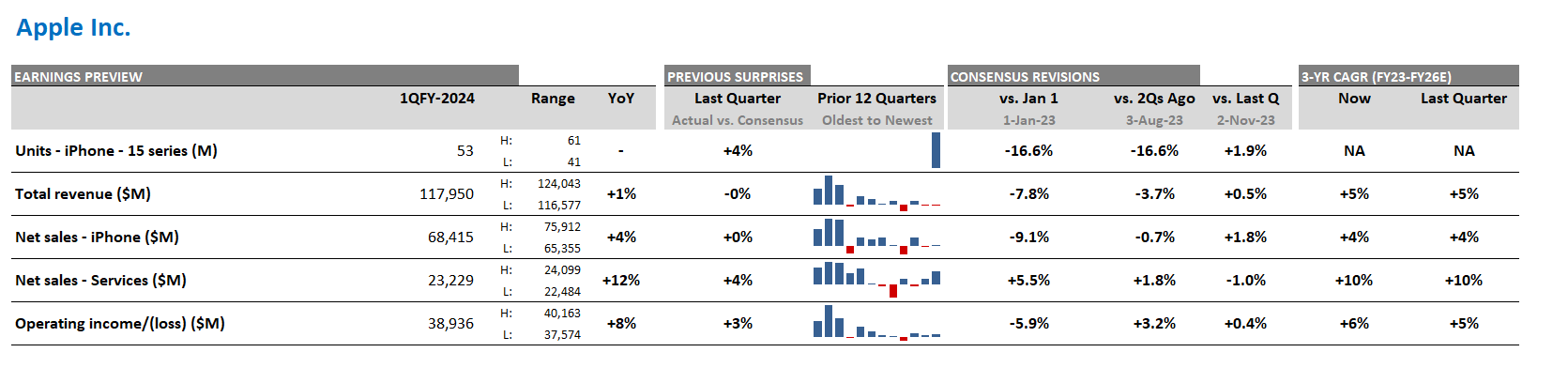

Figure 1: Apple – consensus expectations for Q1, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (January 26, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Apple Q1 2024 Earnings Preview

According to Visible Alpha consensus, total revenues expected for Q1 have come down from the beginning of last year, from $127 billion to $118 billion, driven by decreased optimism about the iPhone. Since November, total expected iPhone unit sales have remained lower at 75 million, driven by debate among analysts about the performance of the new iPhone 15 series during the holiday season. Expected Q4 iPhone units range from 70 million to 82 million, with most of the difference explained by variance in estimates for the iPhone 15 specifically, ranging from 41 million to 60 million units.

While iPhone sentiment has come down, expectations for the high-margin Services segment and for total operating profit have remained consistent since Q3 2023. Gross margin for the Services segment is over 70%, significantly higher than the 36% gross margin for Products. It will be interesting to hear what the company says in the earnings release about growth in Services and if this is enough to offset any sluggishness in iPhone sales.

The stock has traded up 9% since last quarter’s November release, underperforming other Big Tech stocks and the S&P 500. Could the Q1 release provide a positive catalyst for the stock?