Big Tech companies — Meta (NASDAQ: META), Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), and Apple (NASDAQ: AAPL) — reported their latest earnings in April-May 2024. Here’s a recap of those earnings releases, some key takeaways, and the resulting shifts in analysts’ estimates, according to Visible Alpha consensus.

Summary of earnings

For the mega-cap tech companies, this earnings season has been dominated by the momentum around generative AI (GAI). The dynamics of juggling talent and investment in multiple layers of the stack add complexity to the business fundamentals. The mega-cap firms are all, in their own way, enhancing aspects of infrastructure, building off the existing large language models (LLMs) and supporting an environment for creating new GAI apps.

As more and more enterprise data moves to the cloud, Cloud Service Providers are continuing to invest heavily. Competition seems to be increasing, with Microsoft declaring Azure a sharetaker and demand continuing to exceed supply. However, adoption is going to be transformative both for enterprises and individuals, which may prove challenging in some cases. What will be the catalyst that moves us to a fully scaled GAI world?

See our latest AI Monitor for more on the current state and projected growth of the core AI industry.

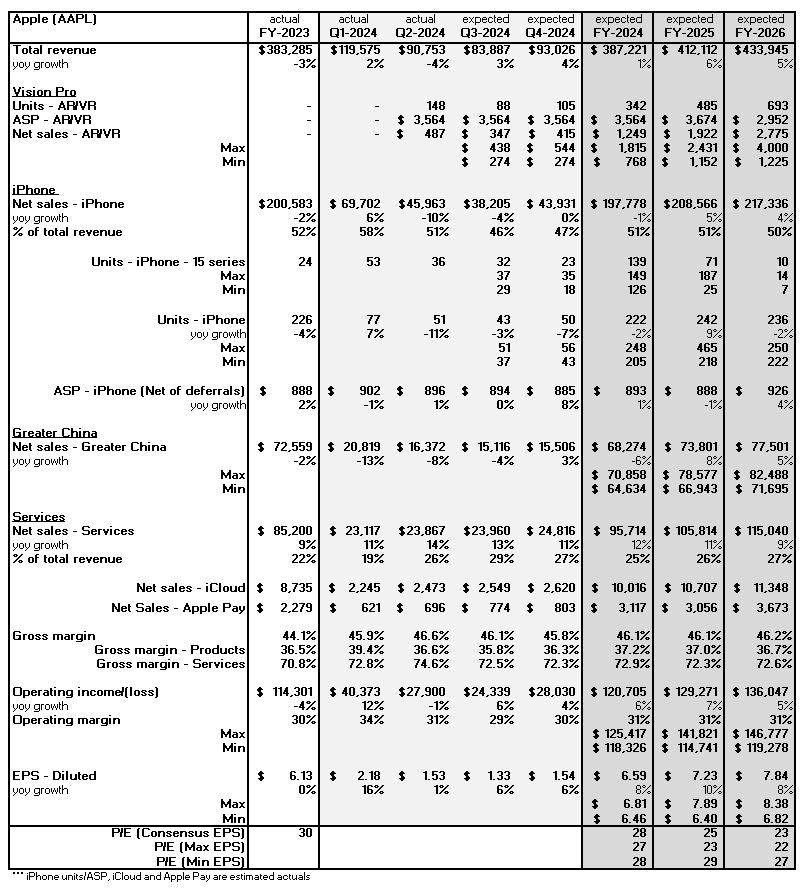

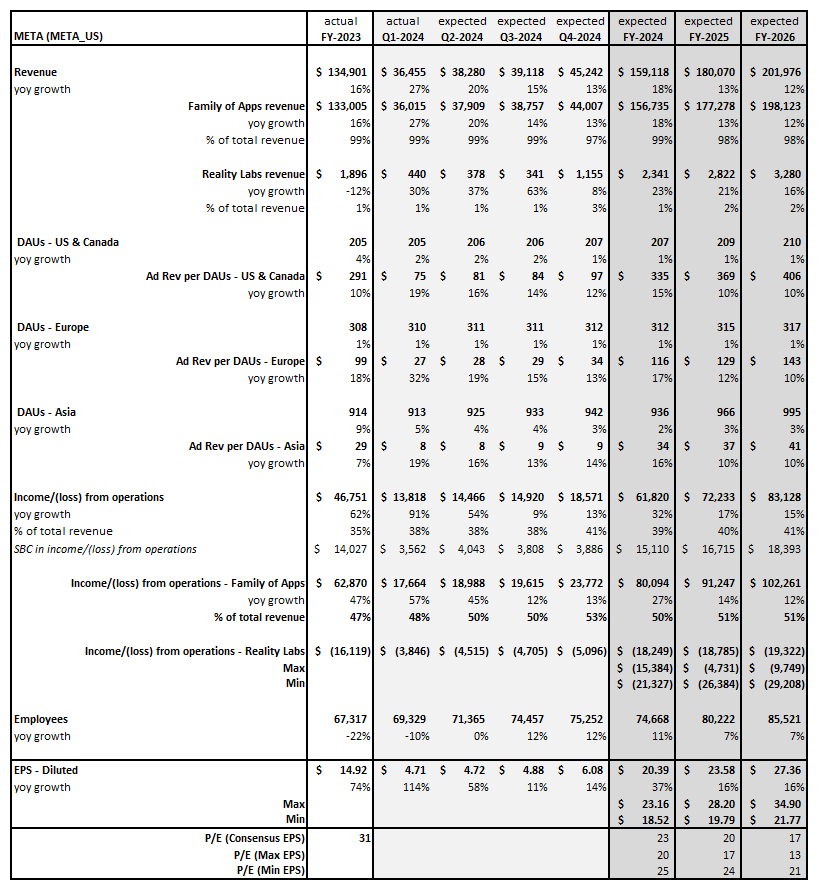

Meta Platforms’ Q1 2024 earnings

According to Visible Alpha consensus, total revenues for Q1 came in inline with expectations at $36.5 billion, driven by solid performance in the Family of Apps segment, especially in the U.S. and Europe. However, operating profit slightly exceeded expectations by around $400 million at $13.8 billion, driven by resilience in the Family of Apps. The company’s revenue outlook for Q2 was in line with expectations, but full-year expense guidance was higher than expectations by $1 billion, as the expense range skewed higher. In addition, CEO Mark Zuckerberg highlighted that the company’s optimism and ambitions in AI are going to drive expenses higher for longer than expected.

For 2024, post-earnings expectations for operating income from the Family of Apps have declined by $1.5 billion to $80.0 billion, driven by higher expenses in the business. In addition, the projected losses from Reality Labs for 2024 have also increased further since the earnings release. Is the year of efficiency officially over?

Meta’s stock has been an outperformer since last quarter, up more than 18%, but has pulled back a bit on the higher expense guidance. Could some new information come out of Meta’s shareholder meeting on May 29?

Figure 1: Meta Platforms revisions

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. META’s current stock price is as of the market close on May 6, 2024.

Figure 2: Meta Platforms consensus estimates

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. META’s current stock price is as of the market close on May 6, 2024.

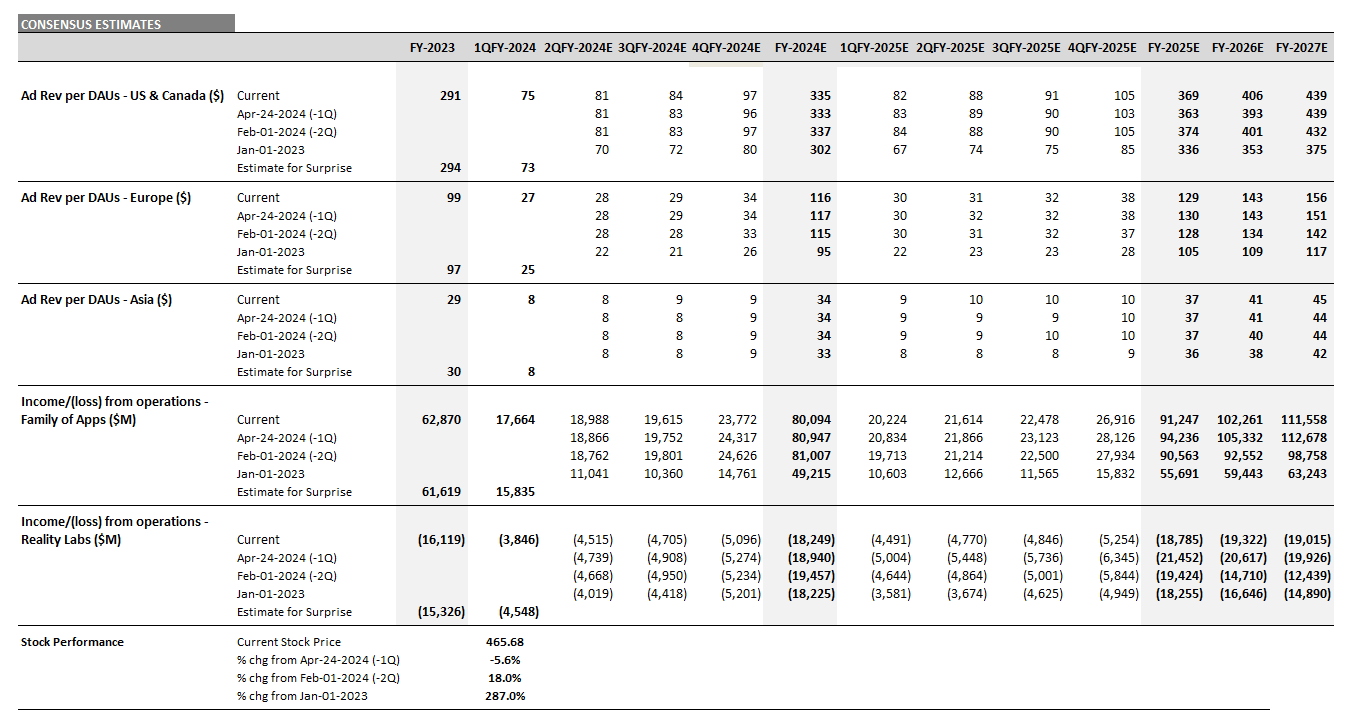

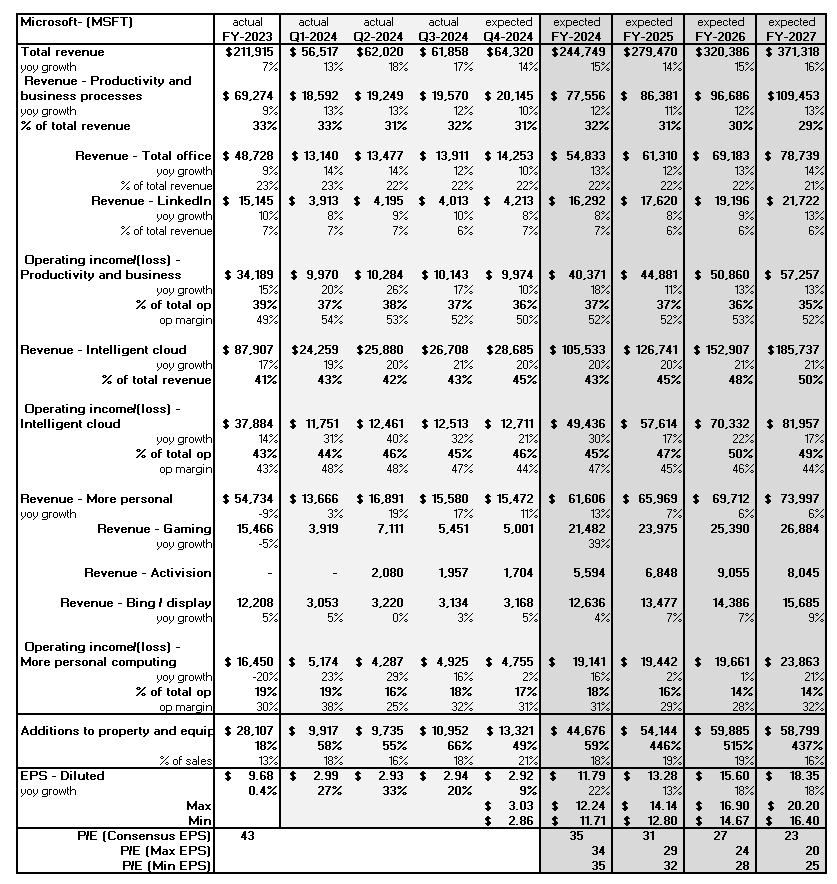

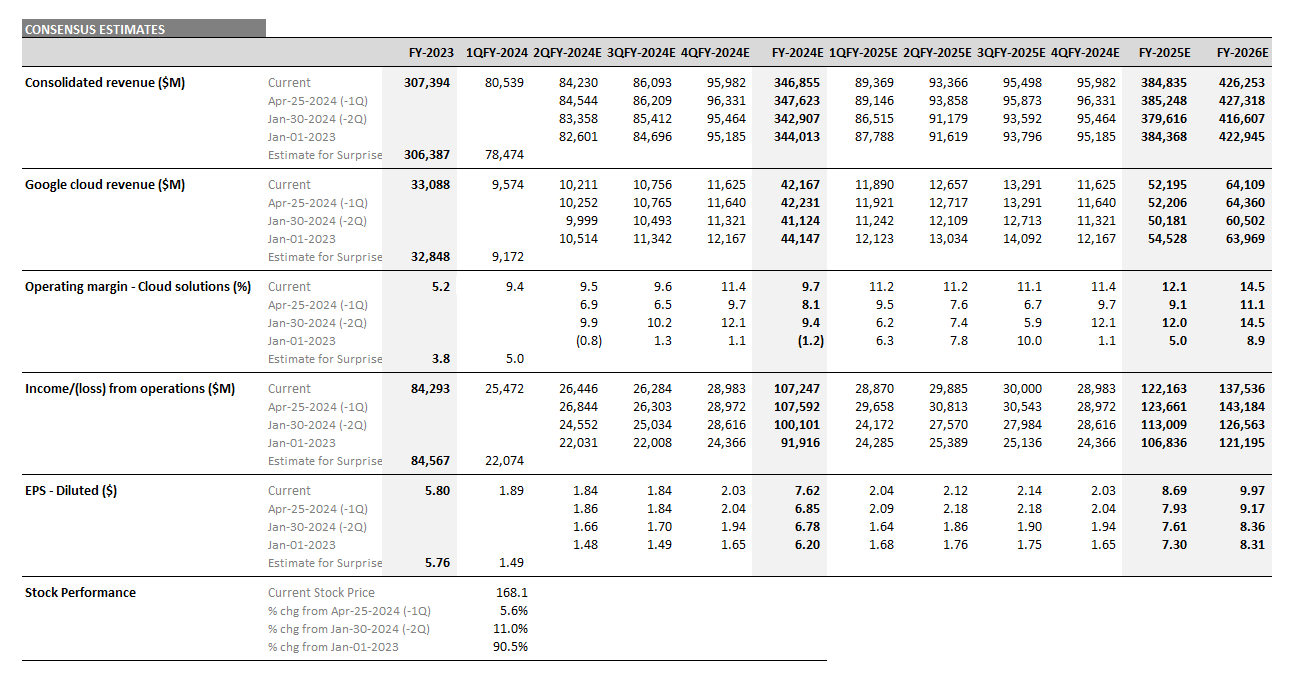

Microsoft’s Fiscal Q3 2024 earnings

According to Visible Alpha consensus, total revenues for Q3 exceeded expectations by $1 billion, coming in at $61.9 billion since October, driven by the Intelligent Cloud segment, which made up over 40% of total revenues and comprised most of the beat. The profitability of the Intelligent Cloud business has been a source of debate among analysts. Ahead of Q3 2024, a consensus of 14 analysts for the Intelligent Cloud segment’s operating profit margin was 45%, but Microsoft delivered a 47% margin, beating consensus by 200 basis points.

Management highlighted that near-term AI demand is outpacing capacity and that Azure has been taking share. For 2024, Intelligent Cloud post-earnings consensus revenue increased by $2 billion and operating profit by $3 billion to reflect a higher margin assumption, driven by Azure. Will the generative AI investments continue to drive upside to fundamentals in Q4 and 2025?

CapEx numbers have continued to increase steadily since last year. According to consensus projections, CapEx estimates have climbed $15 billion from $28 billion in January 2023 to currently $43 billion for FY 2024, up 3x from FY 2019 and outpacing peers. Coming out of this quarter, the 2025 CapEx estimate has increased another $3 billion, moving from $51 billion to $54 billion. Since January 2024, the consensus CapEx estimate has moved up from $45.8 billion to $54.1 billion, increasing over $8 billion and demonstrating the strong pace of investment for AI platforms and tools.

Microsoft stock has been up 11% year-to-date, slightly outperforming the S&P 500. Could the Q4 release help drive further growth and momentum in the stock?

Figure 3: Microsoft revisions

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. MSFT’s current stock price is as of the market close on May 6, 2024.

Figure 4: Microsoft consensus estimates

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. MSFT’s current stock price is as of the market close on May 6, 2024.

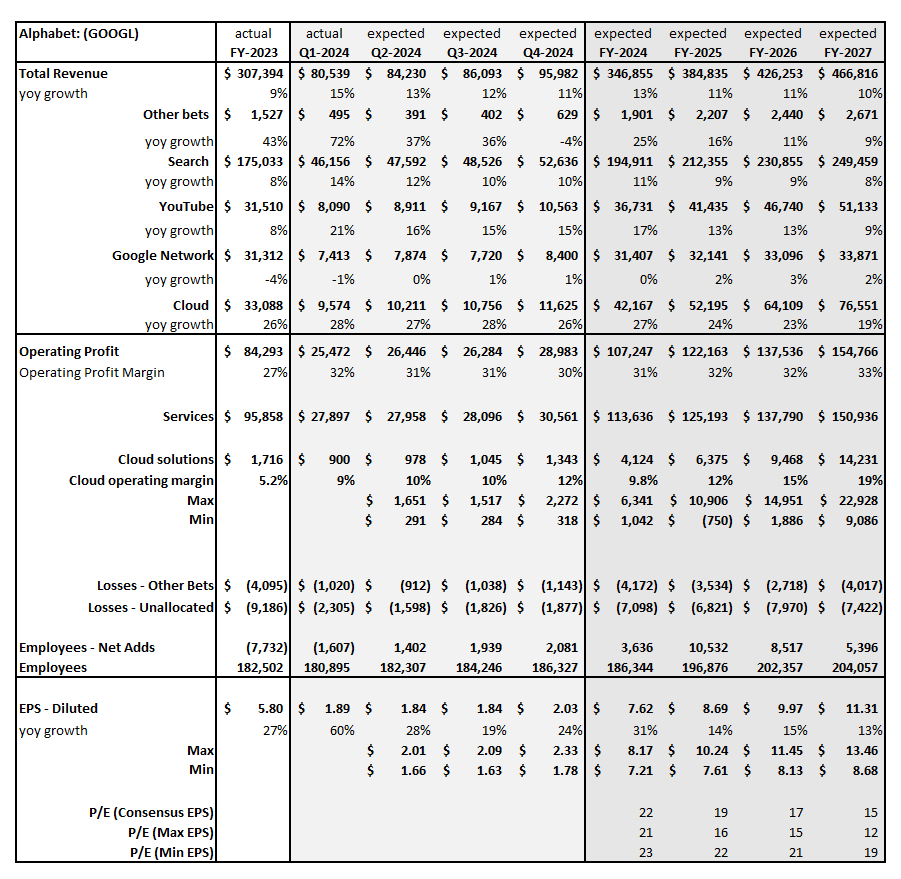

Alphabet’s Q1 2024 earnings

According to Visible Alpha consensus, total revenues for Q1 2024 beat expectations by $1.5 billion, coming in at $80.5 billion, driven by resilience in the Search and YouTube businesses. The sentiment around profitability started improving ahead of the Q1, but Alphabet beat expectations for operating income by $3 billion, delivering $25 billion. Stronger-than-expected profitability in both the Services and Cloud segments led to the surprise.

We have been closely monitoring the profitability trend of the Cloud business, which delivered $33 billion in revenue and a 5% margin in 2023. Ahead of Q1 2024, analyst expectations for the Cloud business margin moved down 140 basis points since January 2024 to a 7.3% operating profit margin. However, the company beat the top-end estimate and delivered a strong 9.4% margin, driven by increases in average revenue per seat. As a result of the strong margin this quarter, analysts revised up estimates by 130 bps and now expect the Cloud business operating profit margin to jump to 9.8% for FY 2024, driven by increased profitability, especially in H2 2024. Longer term, the Cloud business is now projected to hit a 15% margin by FY 2026. Is this expectation achievable?

Alphabet stock has traded up 6% since last quarter’s release and is up 11% since the beginning of the year, outperforming the S&P 500. The stock has reacted positively to the resilience in its core service business and the improving profitability potential of the cloud business. In addition, the company issued a $0.20 share dividend and a $70 billion buyback.

Figure 5: Alphabet revisions

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. GOOGL’s current stock price is as of the market close on May 6, 2024.

Figure 6: Alphabet consensus estimates

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. GOOGL’s current stock price is as of the market close on May 6, 2024.

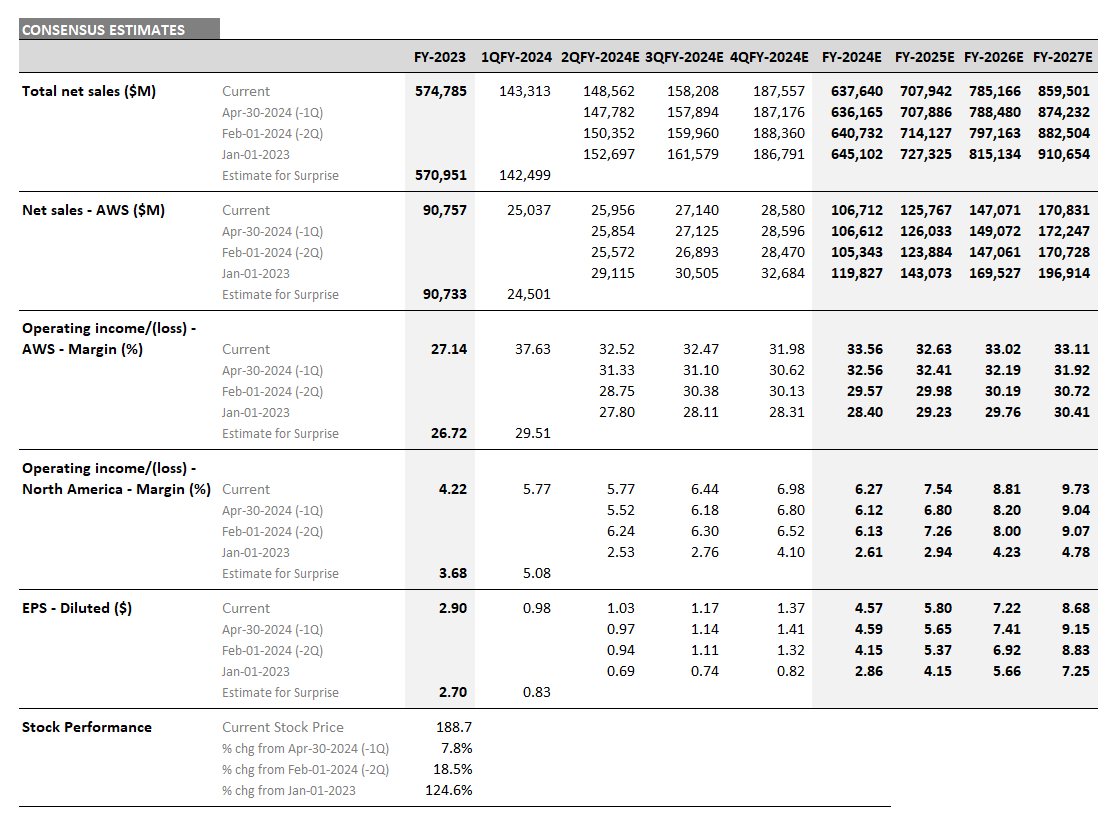

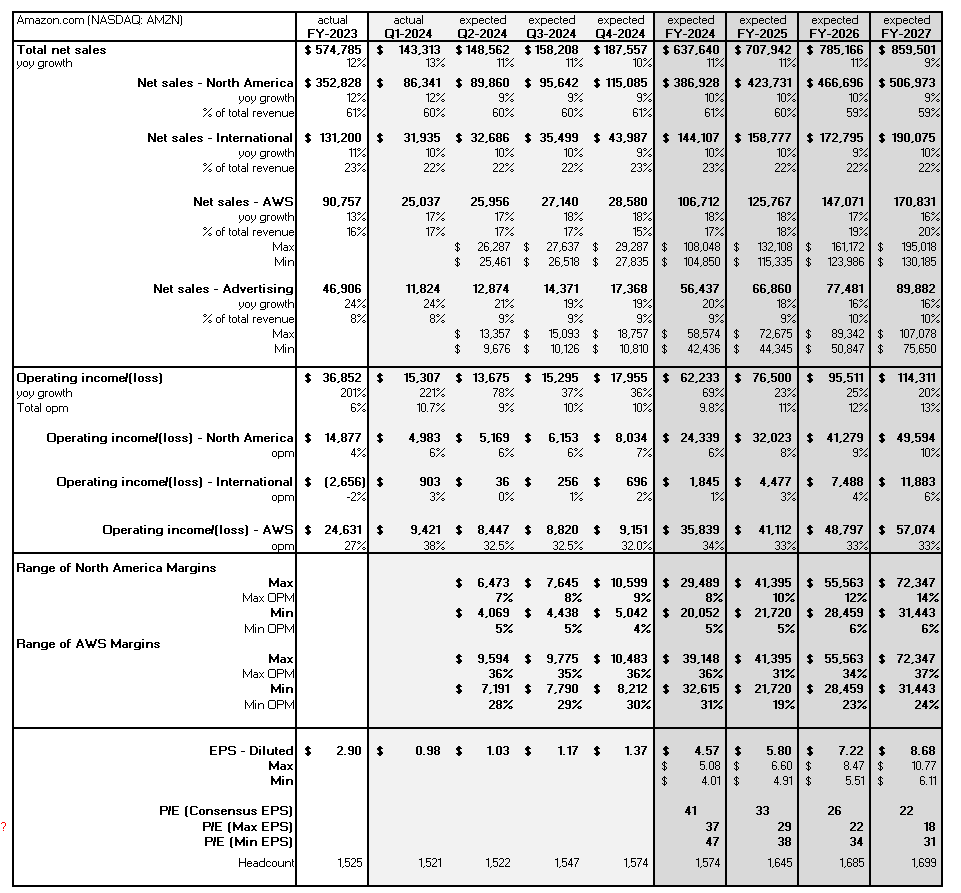

Amazon’s Q1 2024 earnings

Total revenues for Q1 beat expectations by almost $1 billion. Estimates were already moving higher ahead of the quarter, but ended up exceeding the higher end, driven by resilience in Amazon’s North America retail, advertising, and AWS businesses. The strong performance and outlook for the online retail and AWS margins were positive.

The North America retail operating margin has increased significantly to 4.2% in 2023 from losses in 2022. In Q1, the retail margin was at the 5% level, supporting consensus to move to a more upbeat 6-7% level outlook for the rest of 2024.

AWS margin came in very strong at 38% in Q1, well ahead of the consensus estimate of 29%, driven by a combination of managing costs and a change in the estimated useful life of their servers. For 2024, analysts are now expecting a 34% margin, up from 30% pre-Q1. The company expects a reacceleration in AWS growth and high demand for GAI.

The stock has traded up 8% since the Q1 release and 18% since the February release, outperforming the S&P 500. The company guided to revenue of $144-149 billion, slightly below consensus of $150.3 billion, and to operating profit of $10-14 billion, in line with consensus of $12.7 billion. Instead of rewarding shareholders with a dividend and/or buyback, the company opted to increase the pace of its infrastructure CapEx spend in 2024 to support growth in AWS from generative AI. Analysts expect CapEx for 2024 to be $65 billion and to increase further in 2025 to $70 billion, up significantly from $52 billion in 2023.

Figure 7: Amazon revisions

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. AMZN’s current stock price is as of the market close on May 6, 2024.

Figure 8: Amazon consensus estimates

Source: Visible Alpha consensus (May 7, 2024). Stock price data courtesy of FactSet. AMZN’s current stock price is as of the market close on May 6, 2024.

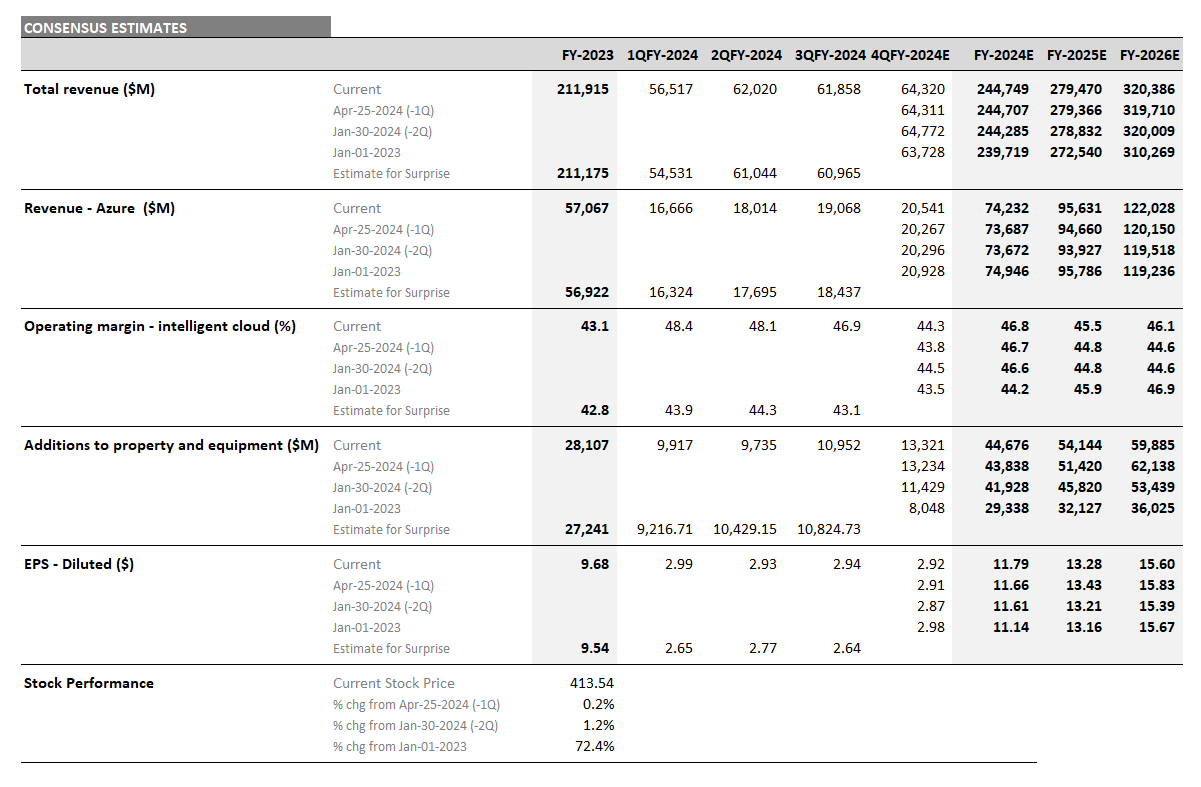

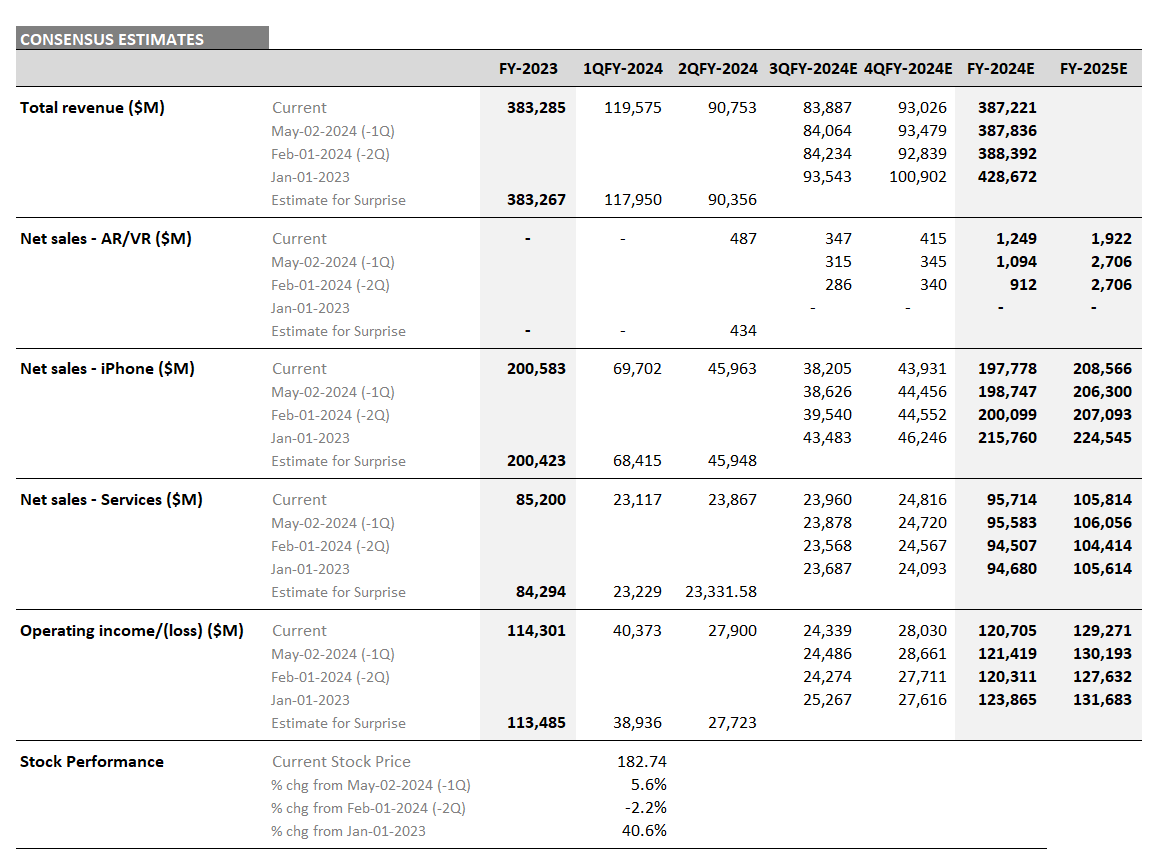

Apple’s Fiscal Q2 2024 earnings

Total revenues for Q2 were in line with Visible Alpha consensus of $90 billion. Revenues of $46 billion from iPhone in Q2 were down 10% year-over-year, due to a strong compare last year. Based on consensus, Q2 iPhone 15 units were in line at 36 million, with estimates ranging from 29 million to 37 million units for Q3. Overall full-year iPhone revenue expectations have continued to trend down since January 2023. Currently, Q3 is expected to deliver $38 billion in iPhone sales and $197 billion for 2024, a small decrease post-Q2.

While iPhone sentiment has come down, expectations for the high-margin Services segment and for total operating profit have remained consistent. In Q2, the Services segment delivered $23.8 billion, up 14% year over year and ahead of consensus. Gross margin for the Services segment was up 180 bps quarter over quarter to 74.6%, significantly higher than the 36.6% gross margin for Products, which was down 280 bps sequentially. The company said that it is seeing increased customer engagement, with the Apple ecosystem supporting the future growth of the Services business. Based on consensus, Services is expected to hit $115 billion at the end of FY 2026, up $20 billion from this year’s estimate of $95.7 billion.

Vision Pro delivered its first set of results this quarter, in line with expectations. In Q2, Vision Pro sold 148,000 units, generating $487 million. For the full year, consensus revenue estimates for the Vision Pro have ticked up from an initial consensus projection of around $900 million to a current $1.25 billion.

The stock has traded up 5% since the Q2, but down 2.8% since last quarter’s release, underperforming the S&P 500, but outperforming more recently, driven by the increase in the dividend and significant share repurchases announced. Could Apple showcase something new with GAI at its upcoming Worldwide Developers Conference that may be a catalyst for the stock?

Figure 9: Apple revisions

Source: Visible Alpha consensus (May 10, 2024). Stock price data courtesy of FactSet. AAPL’s current stock price is as of the market close on May 9, 2024.