Big Tech companies — Netflix (NASDAQ: NFLX) and Alphabet (NASDAQ: GOOGL) — reported their latest earnings in July 2024. Here’s a recap of those earnings releases, some key takeaways, and the resulting shifts in analysts’ estimates, according to Visible Alpha consensus.

Netflix and Alphabet: Is the Ad landscape shifting?

Netflix and Alphabet missed expectations in a few key areas, leading to stock price underperformance since the earnings releases. At Netflix, while Q2 was solid, the Q3 revenue guidance came in a bit below consensus. At Alphabet, YouTube revenues came in below consensus, while Other Bets and Unallocated losses increased more than expected in Q2, leading to lower Q3 estimates.

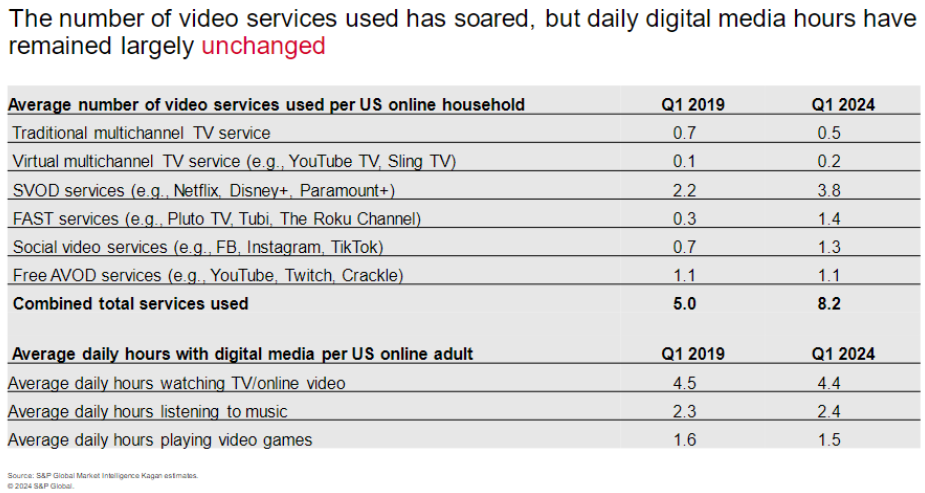

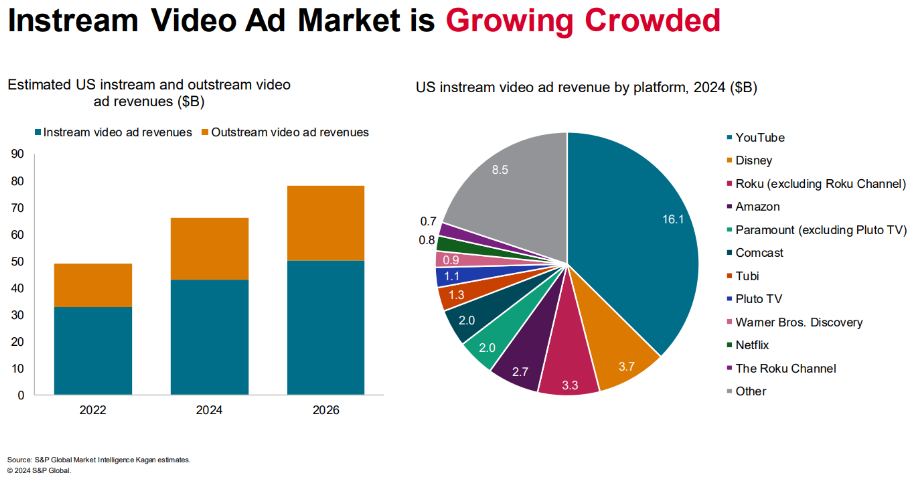

Based on data from the Kagan Media and Telecom Summit, the environment for Netflix and YouTube looks to be getting tougher. While consumers are not spending more time on digital media, they have been increasing the number of digital services used. In 2019, consumers used 5 services, but this increased by over 50% to now 8 services, driven by SVOD (Netflix, Disney+) and FAST (Tubi, Roku). Furthermore, the Instream Video Ad market is expected to grow increasingly more crowded. Could this potentially tougher landscape explain some of the issues facing Netflix and YouTube? Could Amazon and Meta’s earnings and outlooks also be impacted?

Netflix Q2 and Outlook

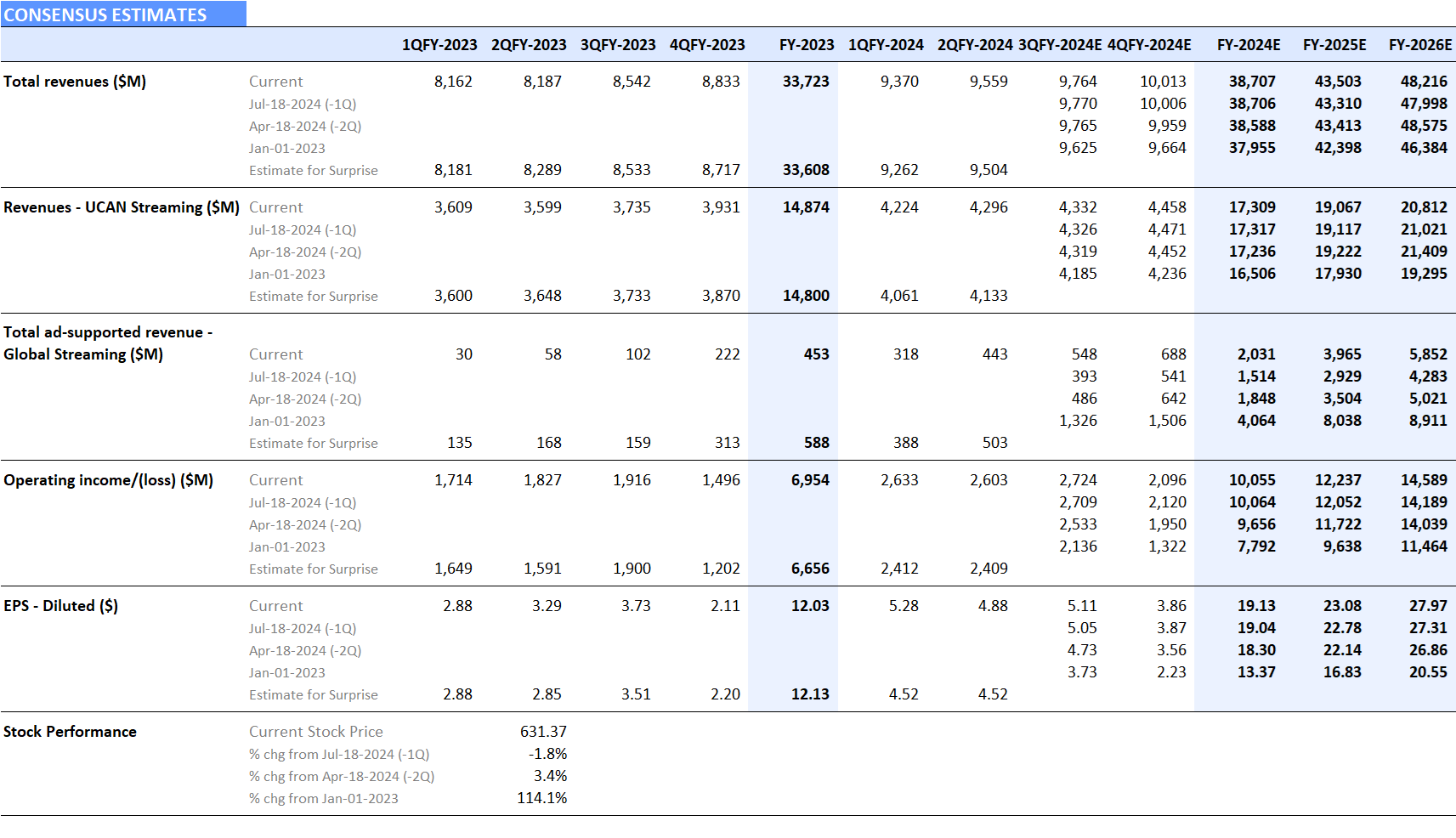

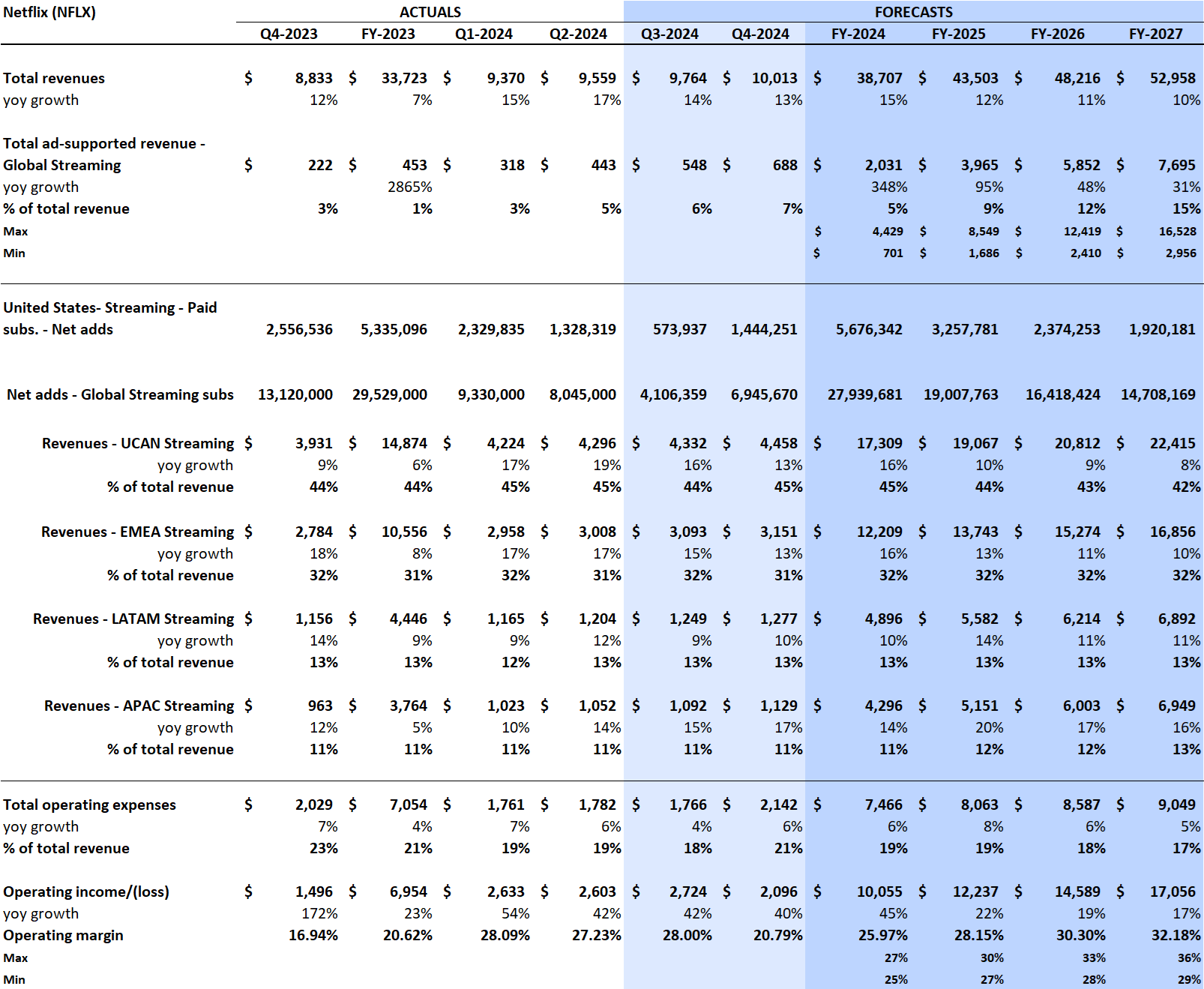

Q2 performance: Netflix Inc. (NASDAQ: NFLX) reported Q2 2023 results on Thursday, July 18, 2024. Q2 revenue of $9.6 billion was slightly ahead of consensus estimates, driven by strong net adds. The company reported 8 million new subscribers, driven by overseas regions. The UCan market added 1.45 million new subscribers, which was down 3.3%, while APAC and LATAM showed strong double-digit increases. Netflix delivered a Q2 operating profit of $2.6 billion and a 27% operating profit margin, slightly ahead of consensus estimates coming into the quarter.

While the Company raised guidance, its new revenue outlook for Q3 came in below expectations. Pressure seems to be coming from Paid Sharing and the Ad Tier. The stock has underperformed since reporting on July 18, 2024.

Q3 2024 expectations: The company guided Q3 to 14% year-over-year growth with revenue of $9.7 billion, a bit below consensus estimates of $9.8 billion. Revenues are expected to be supported by the continued paid-sharing, growth of the ads business, and further monetization. Operating margin is expected to be 28.1%, a bit better than expectations.

FY 2024 expectations: The company expects to grow revenues by increasing engagement trends and reducing churn with a more diverse entertainment offering. Gaming and the growth of ads could be key drivers in H2 2024. According to consensus, analysts expect the company to generate a 26% margin from revenue of $38.7 billion and $10 billion in operating profit in FY 2024, which has not changed much since April 2024 and is in line with Netflix’s guidance.

Longer-term: Based on Visible Alpha consensus, the operating profit margin is expected to grow from 26% in FY 2024 to 32% in FY 2027. Currently, consensus estimates the operating margin to hit 30% in FY 2026, and for this to exceed 32% by the end of FY 2027, which may be aggressive given the investment likely required to scale the ads business. There is significant debate among analysts with respect to FY 2027 margin estimates, which range from 29% to 36%. This margin growth is expected to take FY 2024 expected diluted EPS from $19.13/share to $33.33/share or 20x FY 2027 P/E.

Netflix consensus revisions

Source: Visible Alpha consensus (July 25, 2024). Stock price data courtesy of FactSet. NFLX’s current stock price is as of the market close on July 24, 2024.

Netflix Ads Business

According to the company, in Q2, the Ads tier grew 34% quarter-on-quarter and accounts for 45% of new sign-ups and continues to scale. In the Q2 shareholder letter and earnings call, management highlighted that the Ad Tier enables lower prices and additional revenue and profit.

Netflix remains upbeat about the long-term opportunity, given the size of their user base. The company continues to work on advertising business features, both to scale and to build out the technical capabilities. In particular, the company called out giving advertisers more effective ways to buy Netflix.

Long-term ad-supported revenue expectations: Currently, consensus projects total ad-supported revenue to expand to nearly $7.7 billion by the end of FY 2027, up nearly 4x from FY 2024 of $2 billion. There is a significant range of views on the magnitude of this growth. For FY 2027, analyst estimates range from $3 billion to $16.5 billion.

Netflix consensus estimates

Source: Visible Alpha consensus (July 25, 2024). Stock price data courtesy of FactSet. NFLX’s current stock price is as of the market close on July 24, 2024.

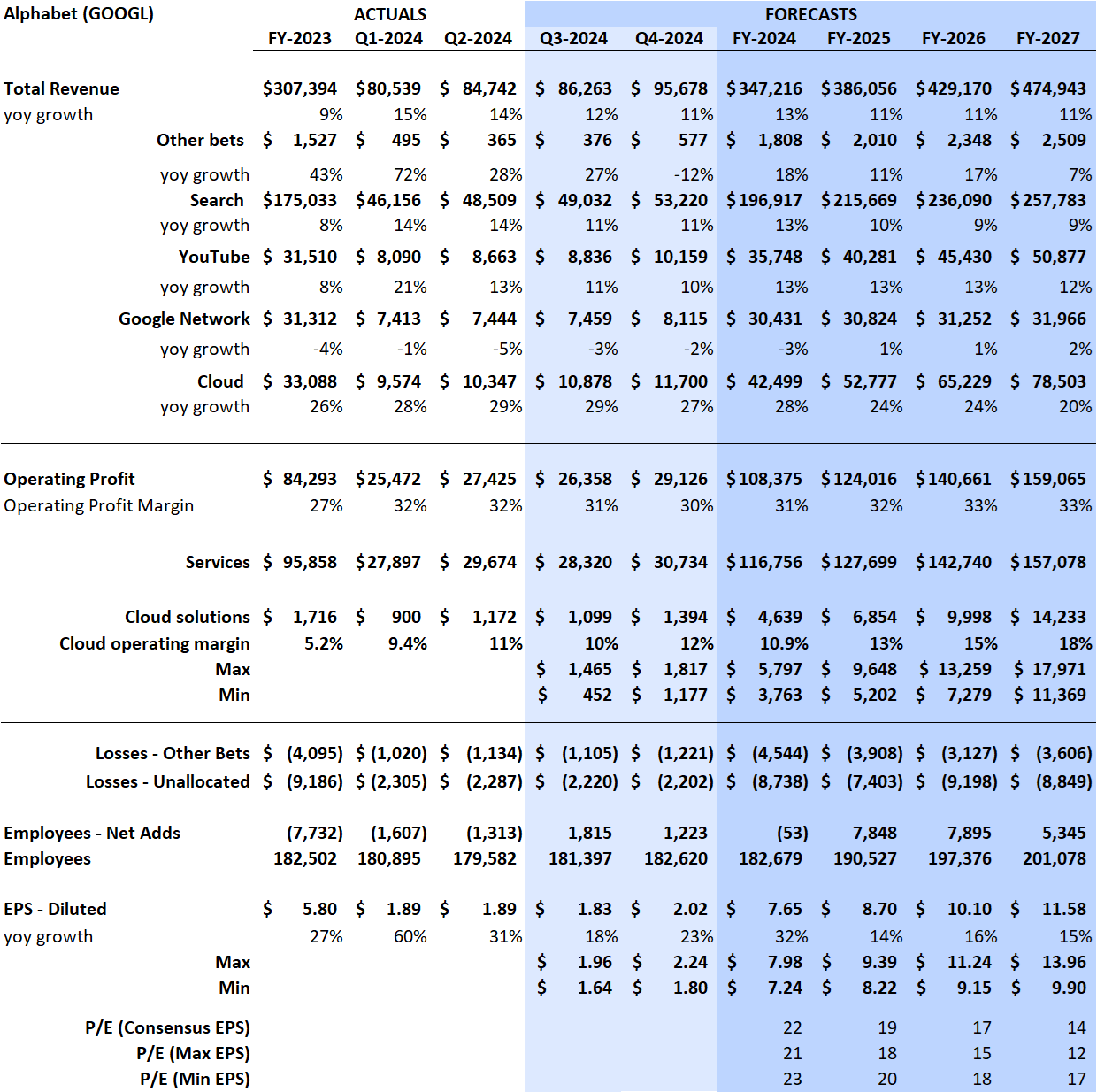

Alphabet’s Q2 and Outlook

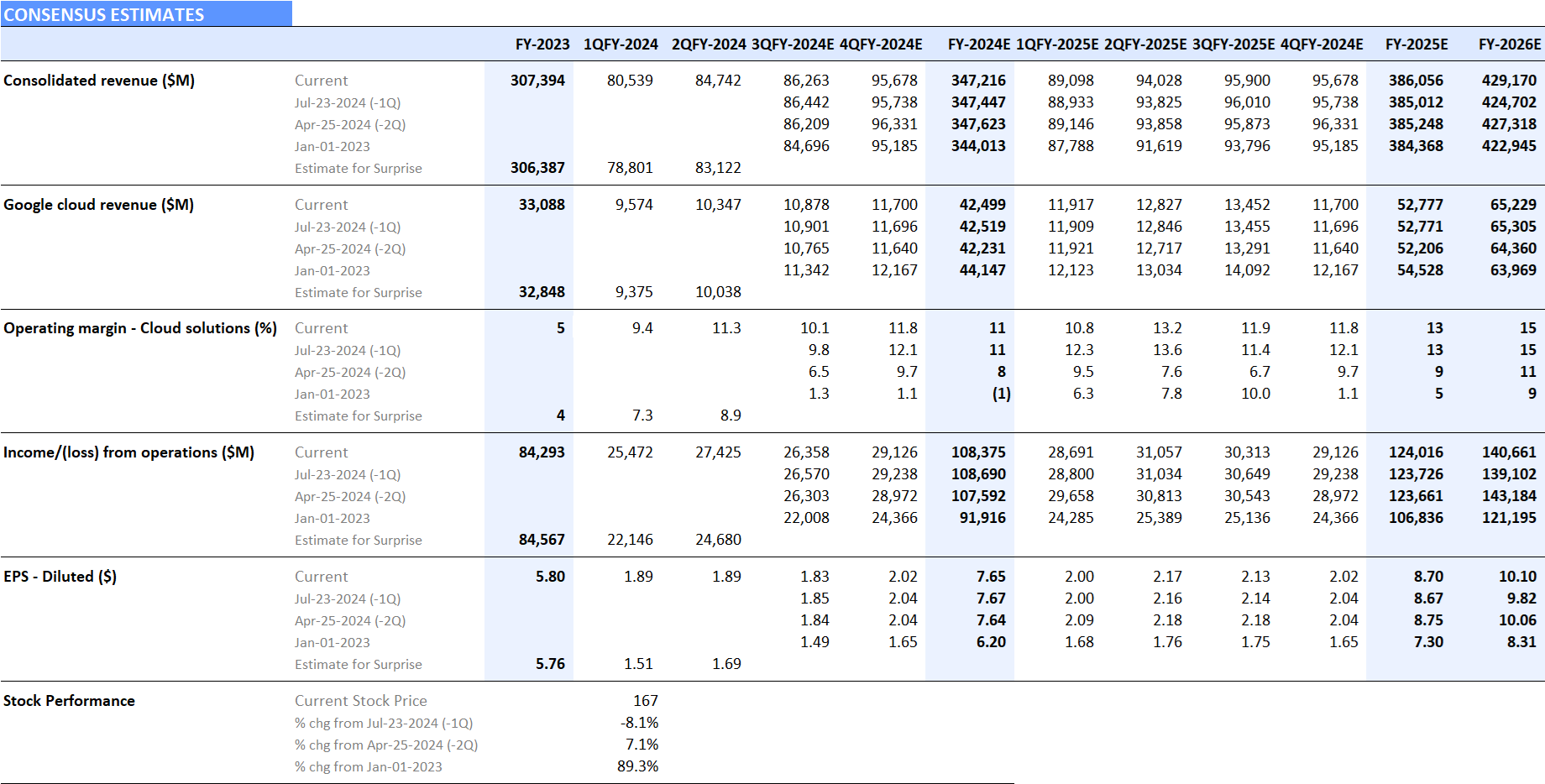

Q2 performance: Alphabet (NASDAQ: GOOGL) reported Q2 2023 results on Tuesday, July 23, 2024. According to consensus, total revenues for Q2 2024 of $84.7 billion were in line, driven by strength in Cloud, resilience in Search, but softness in YouTube. The sentiment around profitability started improving from Q1, but Alphabet beat expectations for operating income by nearly $1 billion, delivering $27.4 billion. Stronger-than-expected profitability in both the Services and Cloud segments were positive. However, the losses in the Other Bets and Unallocated line came in higher than consensus at -$3.3 billion in Q2 2024, diluting some of the positive impact from Search and Cloud.

The combination of YouTube coming in below consensus and the Q3 outlook has caused shares to decline nearly 10% this week.

Q3 2024 and 2024 expectations: Revenues are expected to be $86.3 billion, driven by 11% year-over-year growth in Search and YouTube and 29% in Cloud. Expectations for YouTube came down from pre-quarter consensus of 15%, suggesting a softer outlook than originally projected. Based on commentary from the call, Alphabet is expected to see margin headwinds in Q3 as investments will be pulled forward. Consensus operating profit has started to decrease slightly, indicating we may see further downward revisions to Q3 profitability. In addition, the Other Bets and Unallocated losses are expected to remain at -$3.3 billion in Q3 and Q4 2024.

Consensus capex is at close to $13 billion for Q3 and Q4 2024 and is projected to be over $50 billion for FY 2024. There is some concern that the expected revenue growth of 11-13% outlook is not enough to justify the capex more than doubling, moving from $24.6 billion at the end of 2021 to an expected $50.8 billion at the end of this year.

The Cloud margin: We have been closely monitoring the profitability trend of the Cloud business. Ahead of Q2 2024, the consensus Cloud margin was 9.6%, but this business delivered a better-than-expected 11.3% margin in Q2 2024, driven by AI products and infrastructure. As a result of the strong margin this quarter, analysts revised up estimates. Since April the expected margin has now increased by nearly 300 bps. Consensus now expects the Cloud business operating profit margin to be 10.9% for FY 2024, driven by increased profitability, especially in Q4 2024. Longer term, the Cloud business is now projected to hit a 15% margin by FY 2026.

Alphabet revisions

Source: Visible Alpha consensus (July 25, 2024). Stock price data courtesy of FactSet. GOOGL’s current stock price is as of the market close on July 24, 2024.