In recent years, a popular indicator to measure the health of software companies has been the Rule of 40. The Rule of 40 helps investors gauge a company’s operating performance and measures the balance between its growth and profitability. It suggests that the sum of a software company’s sales growth and profit margin (or free cash flow margin) should be equal to or greater than 40%. Investors increasingly reward companies that perform well on this marker with higher valuations. However, a look at analyst estimates on revenue growth and EBITDA margins of software companies on our Insights platform shows that only a comparatively small percentage of software companies sustain a value above the 40% mark.

Using Visible Alpha consensus estimates, we analyzed data for 100 U.S.-based software companies across application software, system software, and internet software & services that launched their IPOs between 2019 – 2021. Of the 100 companies, only 35 companies posted growth in excess of 40% in 2022. Furthermore, analysts project this number to fall to 28 by 2023.

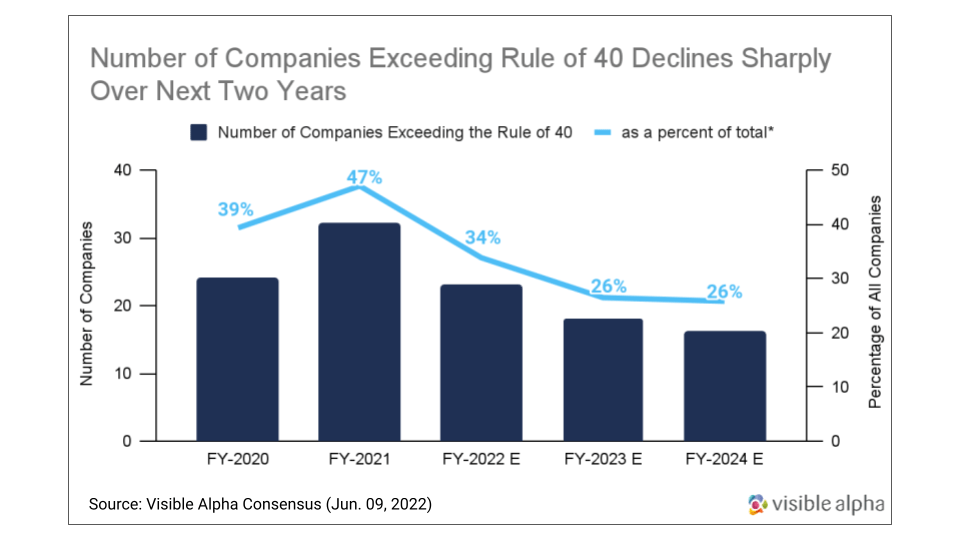

Of the 100 companies we tracked, 68 companies were in the application software industry. Analyst estimates suggest that only 23 application software companies will exceed the Rule of 40 in 2022 vs. 18 by 2023 and 16 by 2024.

*includes 68 application software companies.

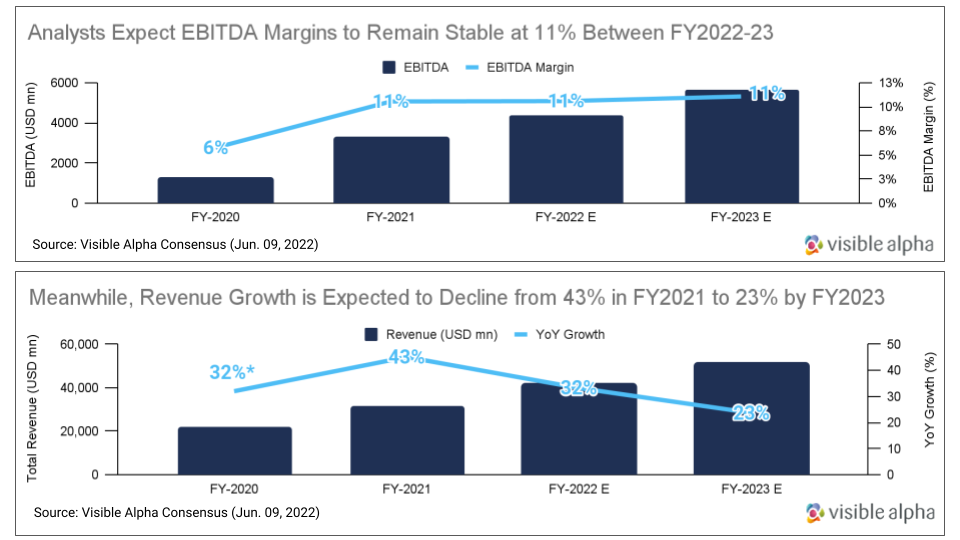

With revenue growth and EBITDA margin being the two main drivers for the Rule of 40, a closer look at analyst estimates suggests that most application software companies operating at the Rule of 40 have strong and stable EBITDA margins. On the other hand, analysts project revenue growth to decline by double digits in forecasted years.

*excluding five application software companies; BRZE_US, CXM_US, GTLB_US, IOT_US, and IRNT.

Leading Companies

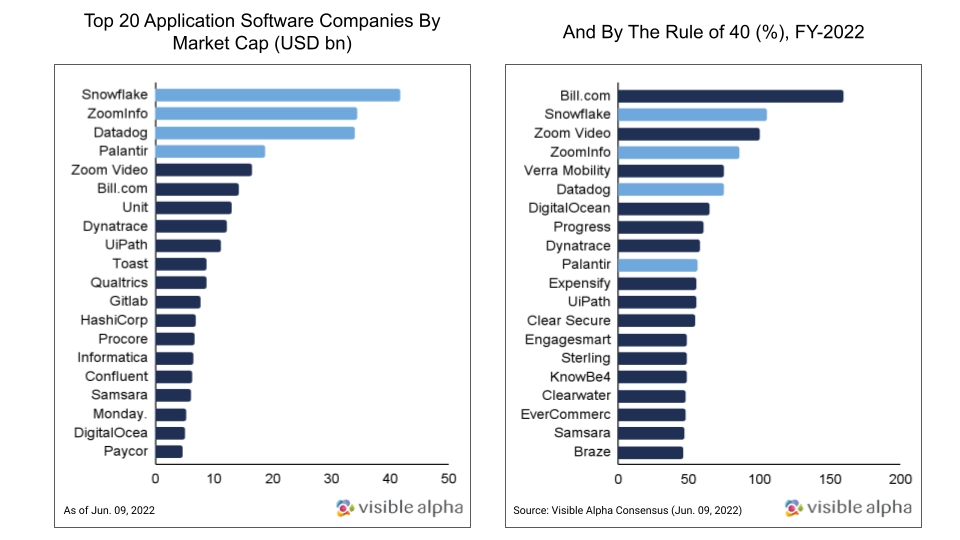

So how are some of the leading application software companies performing when it comes to the Rule of 40? Narrowing our focus, we look at the top four companies by market capitalization on our Insights platform: Snowflake (SNOW_US), Datadog (DDOG_US), Palantir Technologies (PLTR_US), and ZoomInfo Technologies (ZI_US).

Top Companies

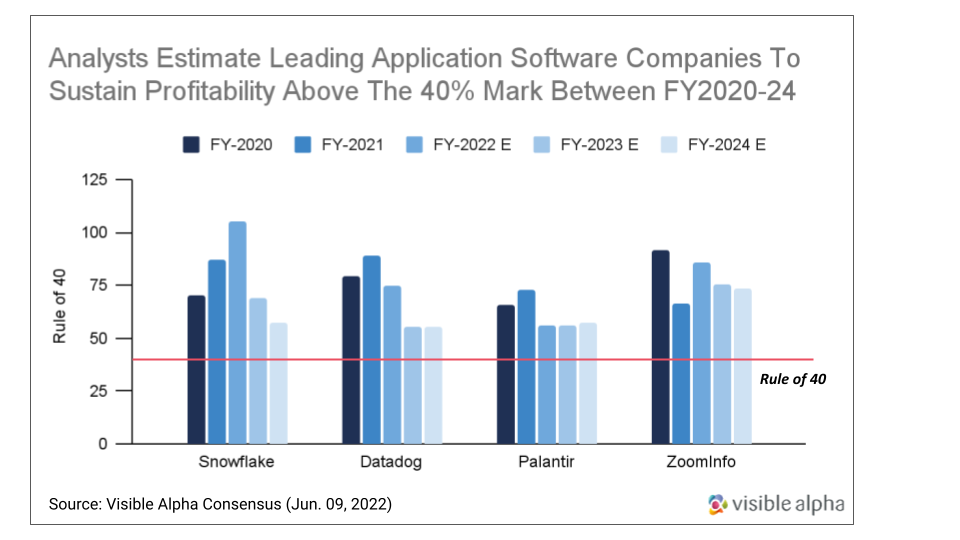

In the section below, we compare the performance of these four companies using the two measures that feed into the calculation of the Rule of 40 principle.

Unlike many application software companies with low or negative profitability, analysts believe Datadog, Palantir, and ZoomInfo will deliver improving or strong EBITDA margins over the next few years. Snowflake is expected to become EBITDA positive in 2023 with an EBITDA margin of 3.3%. On the other hand, ZoomInfo, Palantir, and Datadog are projected to maintain strong profitability with margins at 44%, 29%, and 18% respectively, in the same year.

Analyst estimates for Palantir and ZoomInfo also suggest they are following a balanced approach to growth and profitability between 2020-24. Revenue growth accounts for 56% of Palantir’s 5-year average of the Rule of 40 while accounting for 51% of ZoomInfo’s 5-year average of the Rule of 40.

Snowflake and Datadog, on the other hand, are predominantly high revenue growth companies. Revenue growth accounts for 134% in Snowflake’s 5-year average of the Rule of 40 (to offset losses) and 75% in the case of Datadog.

Supported by Growth

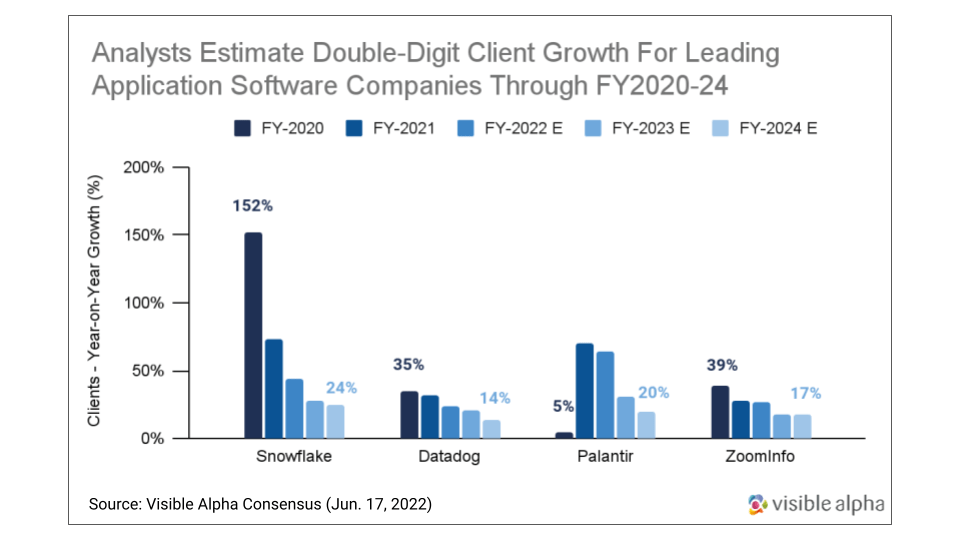

These projections are backed by robust client growth, as all four companies focus on client acquisition. Palantir is projected to expand its client base at a CAGR of 34% between 2020 and 2024, followed by Snowflake at 32%, Datadog at 18%, and ZoomInfo at 17%.

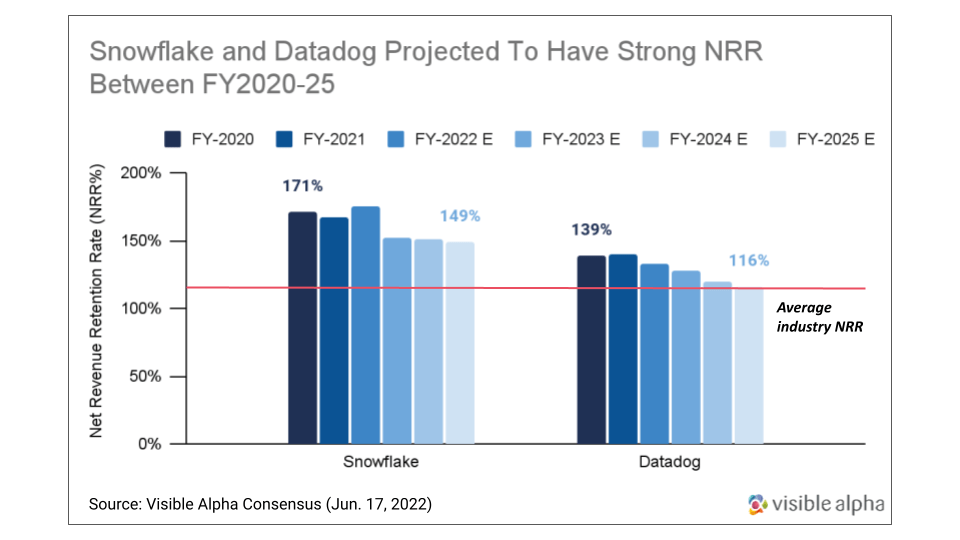

Along with a strong expansion in the number of clients, analysts also estimate that Snowflake and Datadog will benefit from growth in their existing user base. Both companies report industry-leading net revenue retention rates (NRR). While most software companies have an NRR of between 110-120%, Snowflake and Datadog exceed the industry average with rates of 152% and 133%, respectively in 2022.

Furthermore, looking at remaining performance obligations (RPO), analyst estimates show Snowflake’s RPO grew by 99% in 2022, followed by Palantir at 84%, Datadog at 57%, and ZoomInfo at 55%. For Snowflake and Palantir this growth is faster than the growth in deferred revenue. Given that RPO is the value of all the customer contracts signed that the companies have yet to deliver against, recognized revenue for these companies will likely continue to show accelerating growth rates.

While many application software companies fail to operate at the Rule of 40, overall, these four companies have consistently fared well on the principle, and based on analyst estimates, have been able to balance revenue growth and EBITDA margins. All four companies continue to diversify their products and services, have been expanding their efforts on customer acquisition, and have been growing inorganically via mergers and acquisitions.