Broadcom (NASDAQ: AVGO) will report fiscal Q1 2024 results on Thursday, March 7, 2024, after the market close. Here are the key numbers that we’re watching.

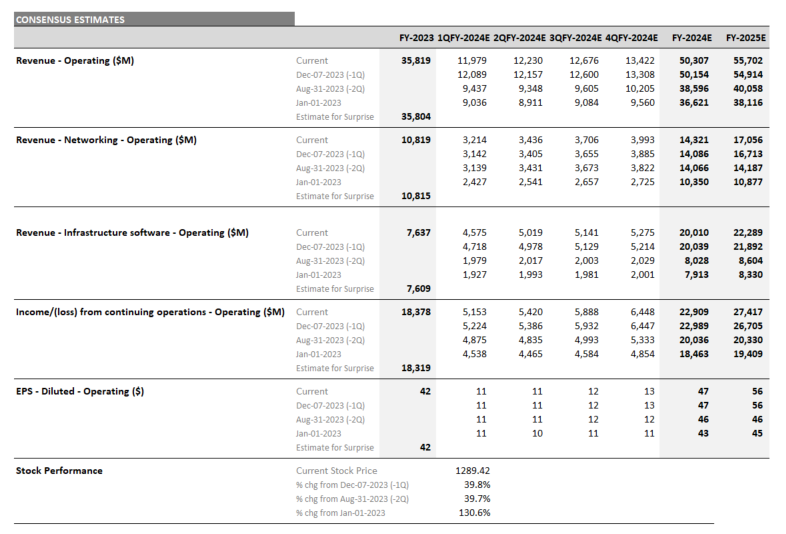

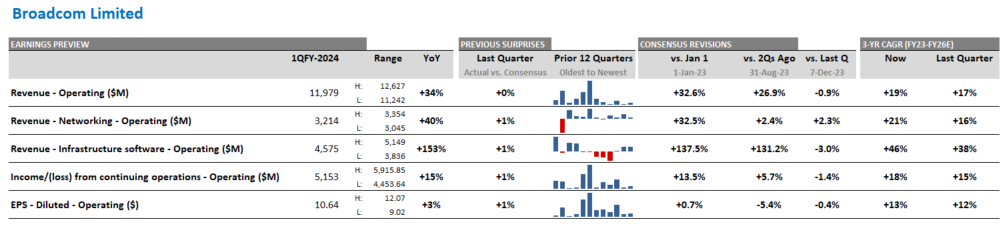

Figure 1: Broadcom – consensus expectations for Q1 2024, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (February 29, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Broadcom Q1 2024 earnings preview

In FY 2023’s final earnings release, the company did not provide a quarterly breakdown of guidance for FY 2024 in its outlook commentary. According to Visible Alpha consensus, total revenues of $12.0 billion and operating income of $5.1 million are expected for Q1 2024. Current estimates are notably higher than the initial projection in January 2023, in part due to the acquisition of VMware, but have not moved much from last quarter’s earnings release in December 2023.

With AI projected to offset weakness in other semis, consensus is expecting a mild $7.4 billion in revenue, up 4% year over year, with a 69% gross margin in Q1 in the Semiconductor Solutions business. Last quarter, the company highlighted that AI generated $1.5 billion in revenue, making up 20% of semis revenues and projected to expand to 25%. Revenue in Q1 from Networking is projected to generate $3.2 billion, up 40%, driven by demand from hyperscalers for AI accelerators, networking, routers and switches to scale out data centers. For FY 2024, analysts expect the Networking segment to grow 32% year over year to $14.3 billion.

The Infrastructure Software segment is set to generate revenues of $4.6 billion, up 153%, in Q1 due to the acquisition of VMware. The continued integration of VMware is expected to further fuel revenues and cost synergies in FY 2024, bringing Infrastructure Software revenues to $20 billion. In the last earnings call, the company highlighted their strategic decision to divest VMware’s non-core assets and to transition it to a subscription model to optimize revenue and margins. What new updates on VMware will the company provide in Q1?

For FY 2024 and FY 2025, Visible Alpha consensus expects growth to be driven by the strength of Broadcom’s AI-related revenues in its semis segment and progress in the integration of VMware, while core semis are projected to remain stagnant.

The stock has traded up 40% since last quarter’s December release, and is up over 130% since January 2023. Could the Q1 release provide the next positive catalyst for the stock or are expectations largely priced in for now?