Dell Technologies (NYSE: DELL) reported fiscal Q1 2025 results on Thursday, May 30, 2024. What happened during the release and earnings call, and what are the key points to focus on?

Dell’s fiscal Q1 2025 earnings release

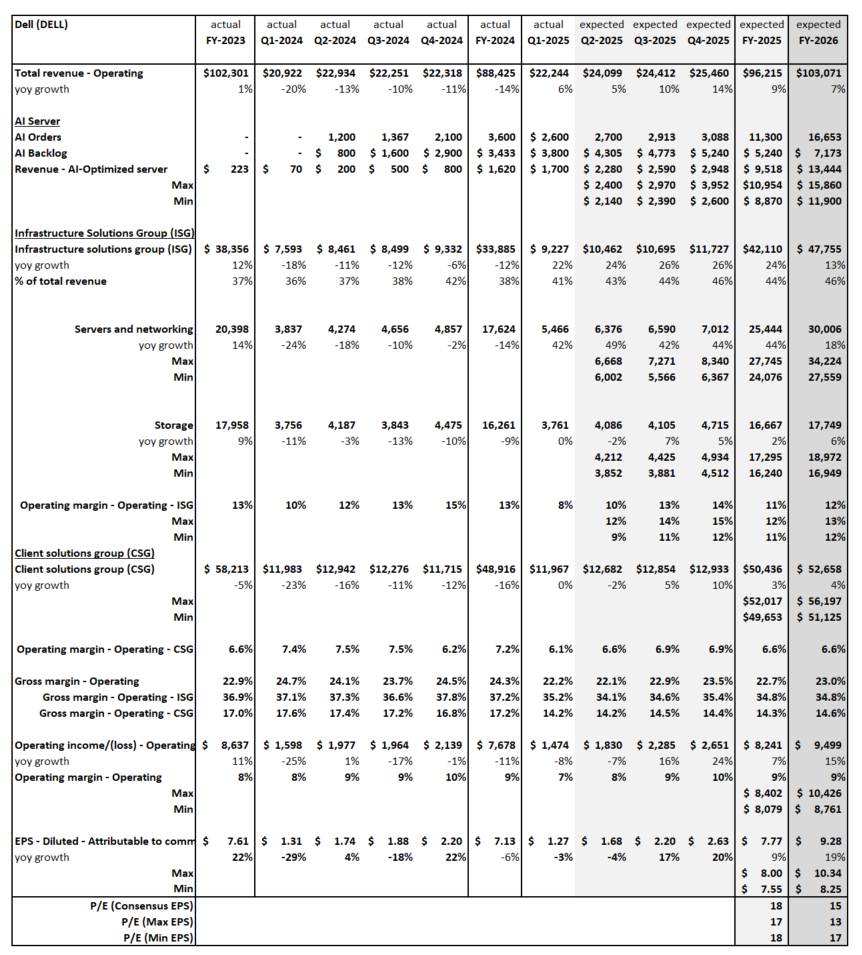

Dell delivered total revenues for Q1 of $22.2 billion, beating Visible Alpha’s consensus estimate of $21.5 billion by $0.7 billion, driven by strong demand for AI servers. The Infrastructure Solutions Group (ISG) segment saw its Q1 revenue surge to $9.2 billion, slightly ahead of the $9.0 billion consensus estimate coming into the quarter.

Based on three Visible Alpha sources prior to the earnings release, the AI server backlog was estimated at ~$3.5 billion. In addition, in their notes ahead of the quarter, a few analysts called out the potential for the AI server backlog to meet or exceed $4 billion on higher-than-expected orders. This backlog expectation seemed to create some over-optimism about Dell’s growth momentum. While the company delivered a respectable AI server backlog of $3.8 billion in Q1, the disappointment in the stock came from the lack of ISG operating profit growth generated by an additional $1.7 billion in AI server shipments year over year in Q1.

The ISG segment’s non-GAAP gross margin came in at 35.2% in Q1, a bit below consensus of 36.4% and down from 37.1% in Q1 2023. This decline in gross margin contributed to the miss on the ISG operating profit margin, which delivered an 8% margin, missing the 10% expected. ISG operating profit was expected to generate nearly $900 million in Q1 2024 but instead the company reported $736 million, almost flat with last year’s $740 million. This performance implied that the $1.7 billion surge in AI server orders year over year did not see enough profitability to offset the seasonally low profitability of the traditional storage and server lines in Q1.

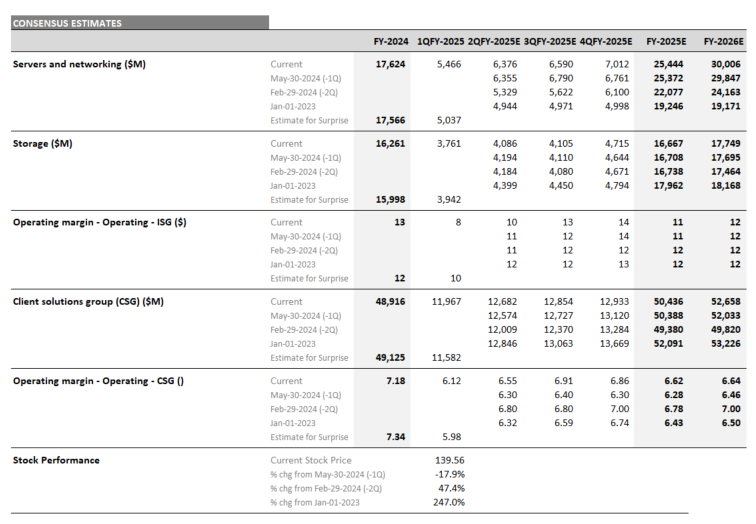

Figure 1: Revisions of Dell estimates

Source: Visible Alpha consensus (June 3, 2024). Stock price data courtesy of FactSet. Dell’s current stock price is as of the market close on May 31, 2024.

The outlook

Near-term growth

For fiscal Q2 2025, Dell guided ahead of the expected $23.0 billion to $23.5-24.5 billion in total revenue, with analysts now projecting $24.1 billion for Q2. The ISG segment revenue is projected to make up $10.5 billion, up from $9.2 billion in Q1, and to see its margin improve quarter over quarter. The company called out expected improvements in the storage business and said that they expect ISG margins to expand to 11-14%. The ISG consensus margin for Q2 is expected to be 10.4%, down from 11.8% ahead of the release.

Long-term outlook

Dell guided FY 2025 revenues to $93.5-97.5 billion, in line with the $96.2 billion expected by analysts. In addition, the company highlighted that ISG will deliver 11-14% long-term margins. Currently, Visible Alpha consensus is projecting ISG operating profit margin to jump from 8% in Q1 this fiscal year to over 12% by the end of fiscal year 2026.

Looking further out, analysts remain bullish on the demand for AI servers. Based on four sources, analysts expect to see AI server revenue generate $9.5 billion in FY 2025 and to expand to $13.4 billion in revenue in FY 2026.

ISG revenue is expected to grow to $47.8 billion in FY 2026, with nearly all of the year-over-year increase coming from the AI servers. ISG profitability is expected to return to 11.5% operating profit margin this year and to increase to 12.1% by FY 2026.

According to Visible Alpha consensus, EPS is expected to grow nearly 20% from $7.77/share in FY 2025 to $9.28/share in FY 2026. Estimates range from $8.25/share to $10.34/share, putting the FY 2026 P/E consensus at 14x, and in the 13x-16x range.

DELL stock has traded down around 22% since last week’s earnings release, but is up around 40% since the Q4 release on February 29, 2024. Will the ramp in AI servers continue? Will ISG profitability return to beat expectations and be a catalyst in FY 2025?