China’s property market has been in a prolonged downturn since 2022. The spillover impact of the country’s real estate crisis, coupled with a general slowdown in China’s economy after the COVID-19 pandemic has had a profound impact on the country’s cement manufacturers. Visible Alpha consensus estimates for key Chinese cement companies, including China National Building Material (HKG: 3323), Anhui Conch Cement (SSE: 600585), and China Resources Cement (HKG: 1313), reveal a challenging outlook for the cement industry in the forecast period.

In contrast, as previously discussed in an earlier article, the Indian cement industry is poised for growth. Major players in the industry, including UltraTech Cement (NSE: ULTRACEMCO), ACC (NSE: ACC), and Ambuja Cements (NSE: AMBUJACEM), are expected to achieve steady growth. According to Visible Alpha consensus, revenues for UltraTech Cement, ACC, and Ambuja Cements are forecasted to increase by +13%, +12%, and +12% year over year respectively in 2023 for these Indian cement companies.

Concrete concerns: Muted revenue projections for China’s cement manufacturers

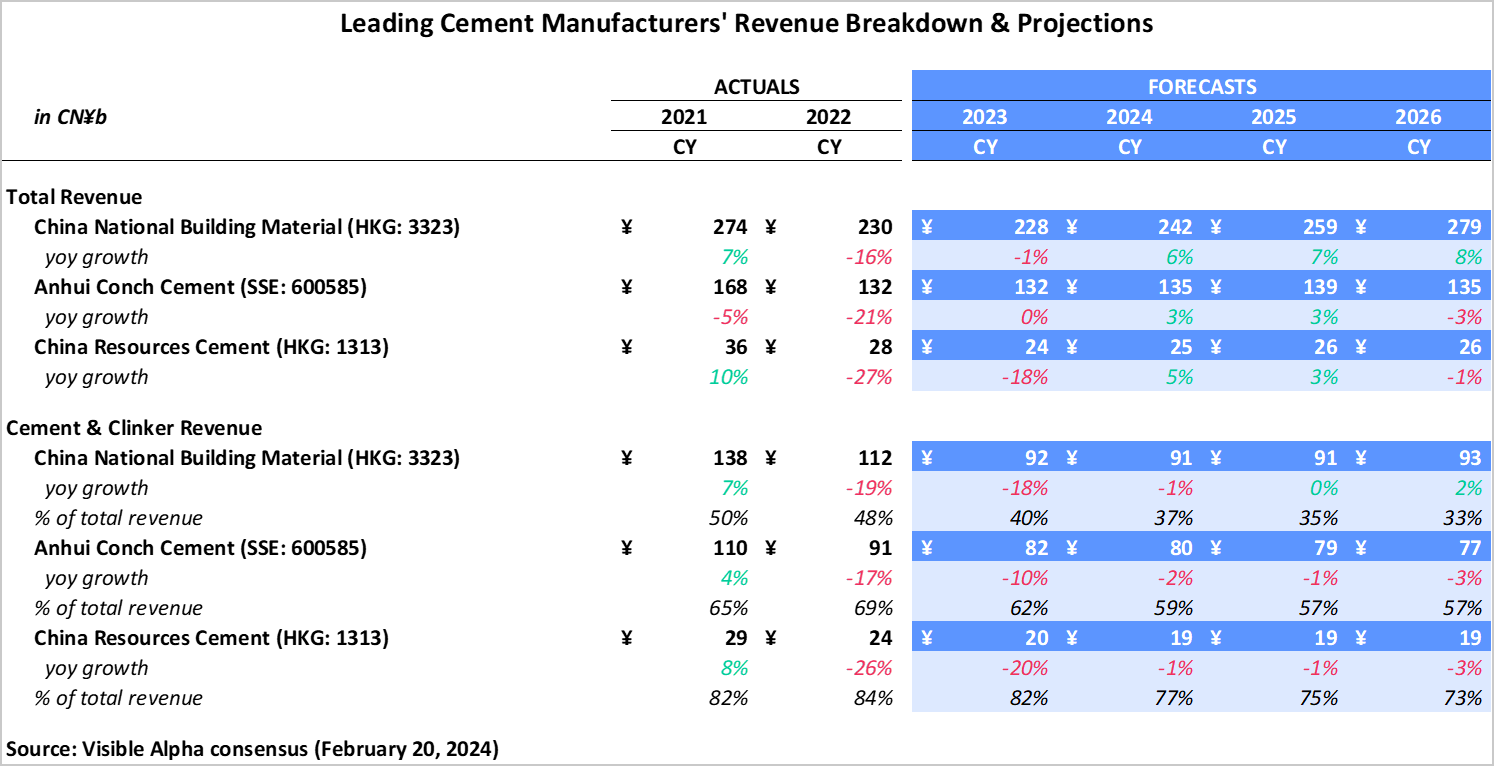

After implementing continuous COVID-19 response measures since 2020, China re-opened its doors to the world in December 2022. However, the depressed real estate market, declining demand, and falling prices have led cement revenues for key players, including China National Building Material (HKG: 3323), Anhui Conch Cement (SSE: 600585), and China Resources Cement (HKG: 1313), to decline since then. In 2022, China National Building Material, China’s leading cement producer, reported a -19% year-over-year decline in total cement and clinker revenue.

Having been impacted by pandemic-related restrictions as well as domestic and international headwinds, the country’s cement industry is now starting a fresh chapter with new obstacles. The cement downcycle is expected to persist through 2023, driven by China’s developer credit crisis. According to Visible Alpha consensus, Chinese cement companies are expected to continue to see a declining trend in 2023, with China National Building Material estimated to see a -18% year-over-year decline in cement and clinker revenues. Anhui Conch Cement, which observed a -17% decline in cement and clinker revenue in 2022, is expected to continue to see revenues decrease by -10% in 2023. Similarly, China Resources Cement is anticipated to experience a -20% decline in cement and clinker revenues in 2023, following a -26% decrease in 2022. Looking forward, analysts expect revenues to continue to decline in 2024, across all key players, albeit less aggressively. Further, revenues are forecasted to remain significantly below pre-pandemic levels until 2028.

Figure 1: Leading cement manufacturers’ revenue breakdown and projections

Dwindling prices and shrinking volumes

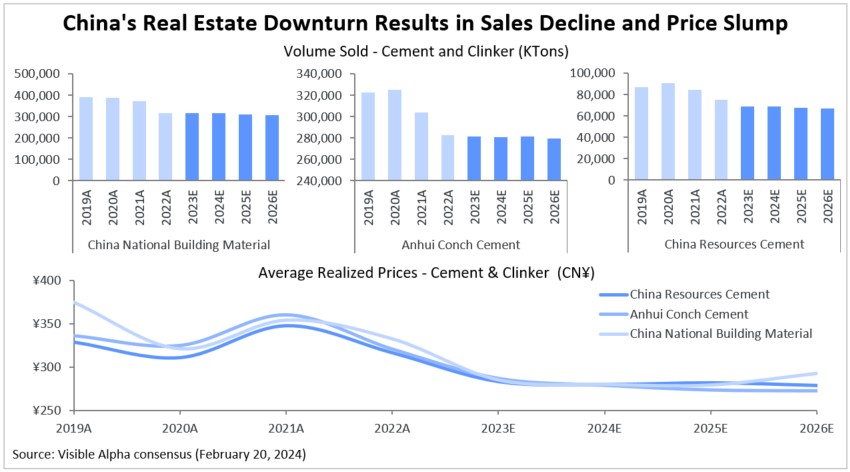

The slowdown in revenue projections is also reflected in the average realized price and sales volume projections for the three cement companies. Amid China’s worsening property downturn, average realized prices for all three manufacturers have been on a decline. Prices dropped by -6%, -11%, and -16% year over year in 2022 for China National Building Material, Anhui Conch Cement, and China Resources Cement, respectively. Based on Visible Alpha consensus, prices are projected to decline further in 2023. China National Building Material is estimated to see a decline of -14% year over year, with prices reaching an estimated low of CN¥285 per ton of cement in 2023. Similarly, Anhui Conch Cement’s cement prices are projected to fall -11% year over year, and China Resources Cement by -13%. Growth is estimated to remain almost flat in the forecast period.

Similarly, the sales volume of cement & clinker fell drastically in 2022, and projection estimates suggest further declines in 2023 and the forecast period beyond.

Figure 2: China’s real estate downturn results in sales decline and price slump

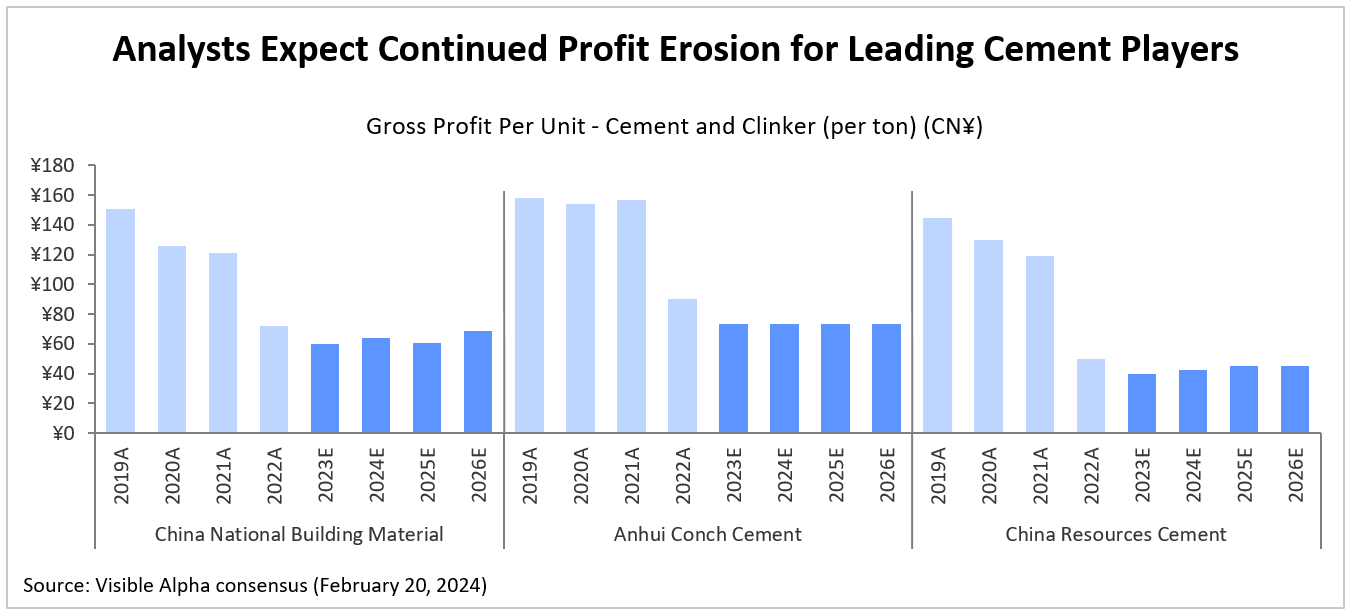

From peak profits to margin erosion

2017-2019 was a period of exceptionally high profits for Chinese cement companies. This was fueled by a thriving real estate sector and unprecedented cement demand. In 2019, China National Building Material achieved a gross margin of 40%, while Anhui Conch Cement reached 32% and China Resources Cement hit 40%. However, as revenue, ASPs, and volumes come under pressure, gross margins have also taken a hit. Gross margins have been on a decline since 2020, and are estimated to reach their all-time low in 2023. China National Building Material is estimated to see gross margins reach 16% in 2023, while Anhui Conch Cement and China Resources Cement are estimated to see gross margins decline to 18% and 14% respectively.

On a per-ton basis, these cement companies are expected to see their gross profits per unit of cement & clinker almost halve in 2023. Shrinking demand, falling prices, and high costs are estimated to shrink China National Building Material’s gross profits to CN¥60 per ton of cement & clinker. This is compared to CN¥151 per ton of cement & clinker in 2019. Similarly, Anhui Conch Cement’s gross profits per unit are estimated to decline to CN¥73 per ton of cement & clinker, and China Resources Cement to CN¥40 per ton.

Figure 3: Continued profit erosion for leading cement players

We have examined three Chinese cement companies, delving into several key performance indicators (KPIs) such as cement revenues, average realized prices, volume sold, and gross margins. For a more comprehensive insight into the various factors influencing the broader cement industry and where investors should look to find an investment edge, please refer to our recently published Guide to Cement Industry KPIs.