Nvidia Corp. (NASDAQ: NVDA) reported fiscal Q4 2024 results on Wednesday, February 21, 2024. What happened during the release and earnings call, and what are the key points to focus on?

Nvidia’s Q4 2024 earnings release

Nvidia delivered total revenues for Q4 of $22.1 billion, beating Visible Alpha’s consensus estimate of $20.5 billion by over $1.5 billion, driven by continued revenue growth of Nvidia’s Data Center segment. The segment saw its Q4 revenue surge to $18.4 billion, nearly $1.5 billion ahead of the $16.9 billion consensus estimate coming into the quarter. This revenue surge has continued to be driven by strong demand for Nvidia GPUs, particularly from cloud service providers. In addition, the company noted that 40% of the Data Center revenues are now from AI inferencing. The Data Center segment saw its non-GAAP gross margin increase from 76% in Q2 to 79% in Q4, exceeding FY 2022 levels of 78%. This drove a beat on the EPS line with non-GAAP diluted EPS of $5.16/share.

The Gaming segment’s non-GAAP gross margin increased another 200 basis points from 57% in Q2 to 59% in Q4, returning to FY 2022 levels. Currently, consensus revenue projections for the Gaming segment for FY 2025 is $11.5 billion. This business remains dwarfed by the significant 8X projected revenue size and growth in the Data Center business in FY 2025. Beyond the Data Centers, could there be a catalyst for revenue expansion in the Gaming segment? Could the margin in the Gaming segment catch up to the 70s levels seen in the Data Center business?

China update

Toward the end of the last quarter, the U.S. government instituted new regulations and requirements that have impacted Nvidia’s China business. According to the Q3 Nvidia earnings call, the company noted that the U.S. government announced a new set of export control regulations for China and a few other markets. Nvidia management explained that these regulations require licenses for the export of some Nvidia products, including the Hopper and Ampere 100 and 800 series. According to CFO Colette Kress, the Data Center business declined significantly in China in Q4, but the company has started shipping alternatives that do not require a license for the China market. CEO Jensen Huang further explained that Nvidia reconfigured its products in a way that will allow it to compete within the specifications of the new China restrictions.

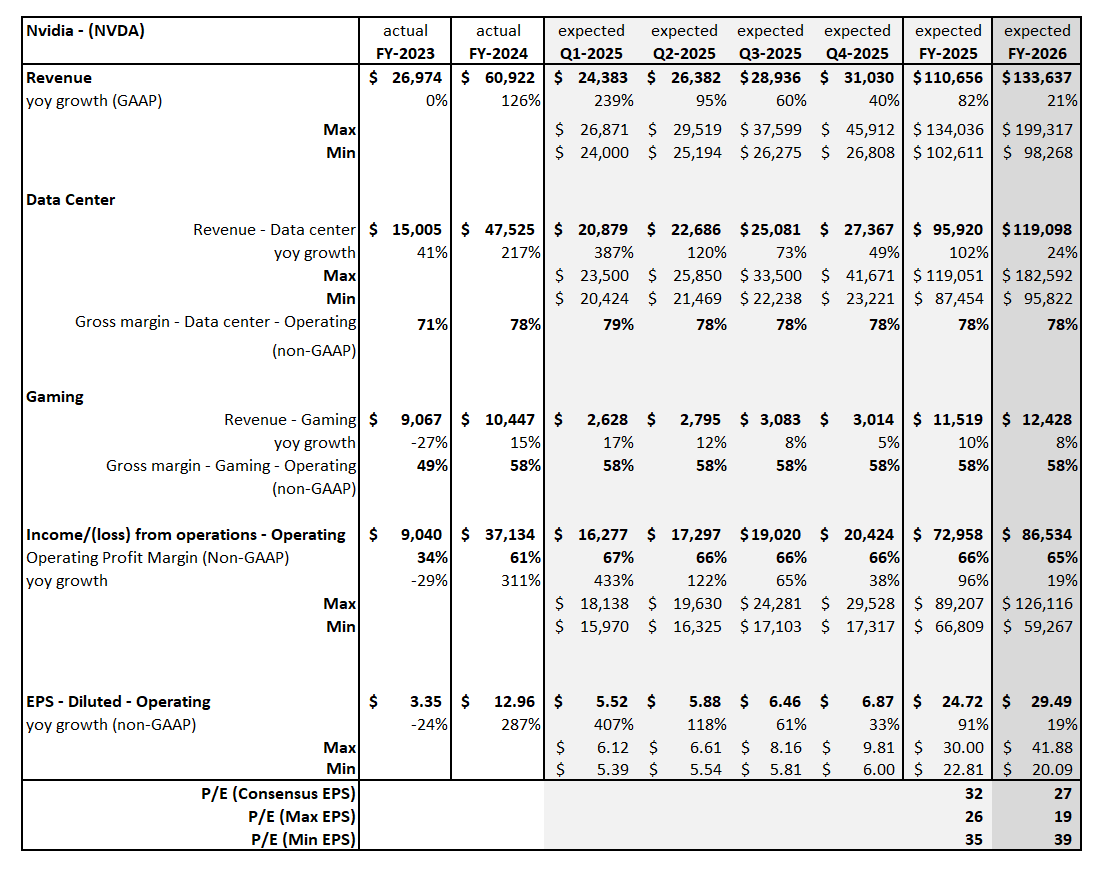

Figure 1: Nvidia – past earnings and the outlook

The outlook

Near-term growth

For fiscal Q1 2025, Nvidia guided nearly 10% ahead of expectations to $23.5-24.5 billion in total revenue, with analysts now projecting the Data Center segment to make up $20.9 billion, up from $18.3 billion. In addition, Nvidia guided total gross margin to continue to be around 77% levels, driven by demand continuing to outstrip supply in the Data Center business.

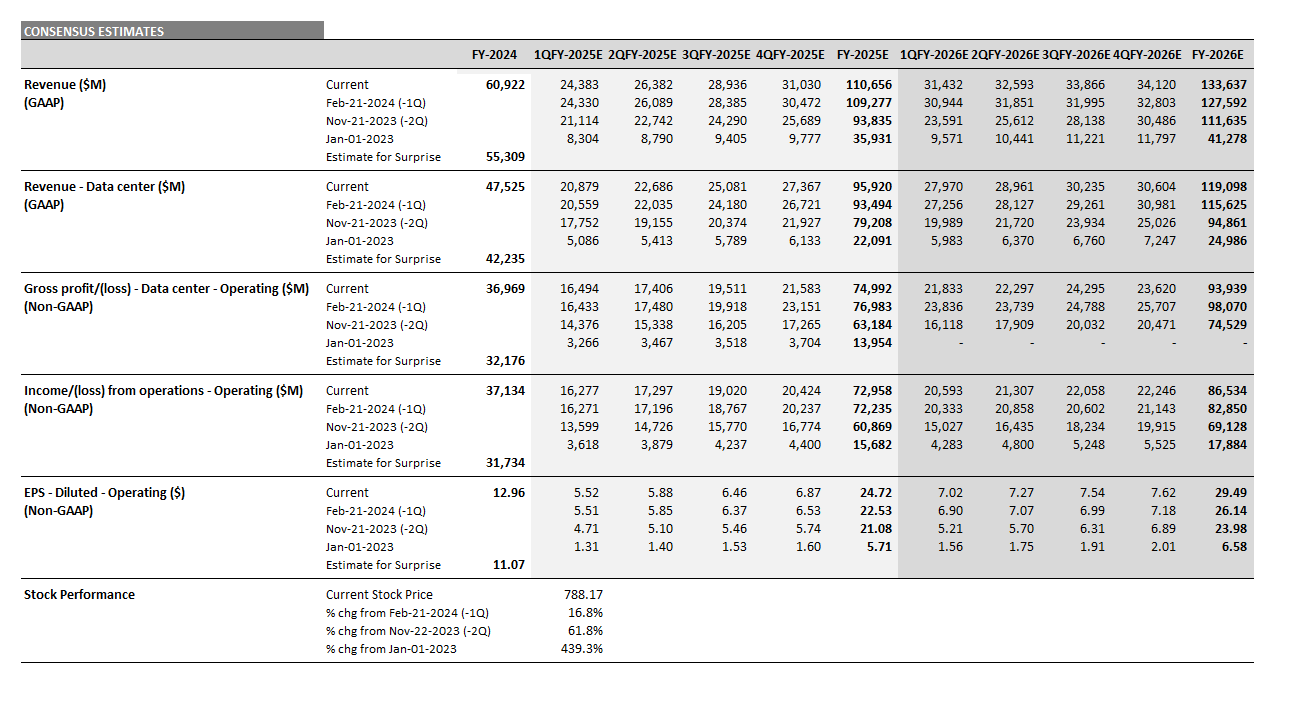

Looking further out, analysts remain bullish on the Data Center segment. Since the Q4 release last week, analysts have increased their Data Center revenue estimates another $4 billion for FY 2025, driven by continued optimism around GPU demand. According to Visible Alpha consensus, revenues from this business are expected to double from FY 2024 to nearly $96 billion. These upward revisions are estimated to drop directly to operating profit and, ultimately, EPS.

P/E debate: The range of Data Center estimates

The range of estimates has narrowed by nearly 50% for the Data Center business in FY 2025, suggesting the market has increased conviction in the direction of this segment this year. However, for FY 2026, the range of estimates remains substantial and implies that there is significant debate about Nvidia’s growth outlook. The top-end estimate expects $182.6 billion, while the low-end estimate is at $95.8 billion for the Data Center segment. Non-GAAP diluted consensus EPS for FY 2026 is now projected to be $29.5/share, up 23% from November 21, but ranges from $20.1/share to $41.9/share with current P/E ratios at 39X to 19X.

NVDA stock has traded up nearly 17% since last week’s earnings release, and is up close to 62% since the Q3 release. Will the Data Center business continue to beat expectations in FY 2025 and continue to drive upside in the stock?

Figure 2: Nvidia consensus estimates

Source: Visible Alpha consensus (February 26, 2024). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on February 23, 2024.

Long-term growth

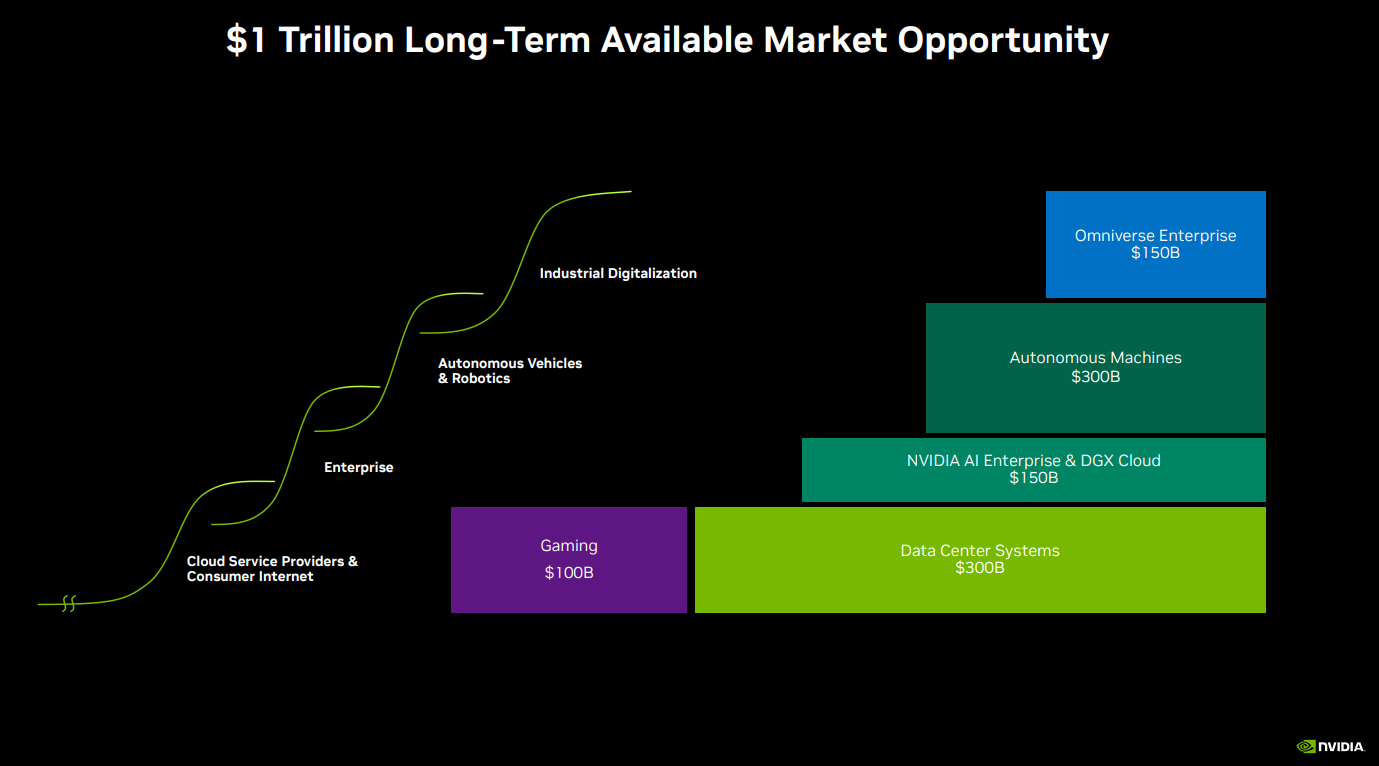

Toward the end of the earnings call, CEO Jensen Huang gave his optimistic estimation of the direction of the market over the next five years. He highlighted that software is necessary for accelerated computing, and this need will support the company’s continued growth. In addition, he called out that he believes the move to accelerated computing and generative AI will drive a doubling of the world’s Data Center infrastructure installed base and will represent an annual market opportunity in the hundreds of billions.