Eli Lilly (NYSE: LLY) plans to acquire DICE Therapeutics (NASDAQ: DICE) for approximately $2.4B in cash. This purchase price represents a share price of $48, which is around a 40% premium to the 30-day volume-weighted average trading price of DICE as of the last trading day before the June 2023 announcement date. The transaction is expected to close in Q3 2023. The acquisition is being driven by DICE’s innovation in oral drug development and its lead IL-17 inhibitor for psoriasis.

DICE has developed a medicinal chemistry technology platform that enables the development of small molecule drugs that can disrupt protein-protein interfaces (PPI). The first utility of this innovation is the development of oral inhibitors of already-validated targets for which biologic drugs administered systemically by injection are on the market.¹

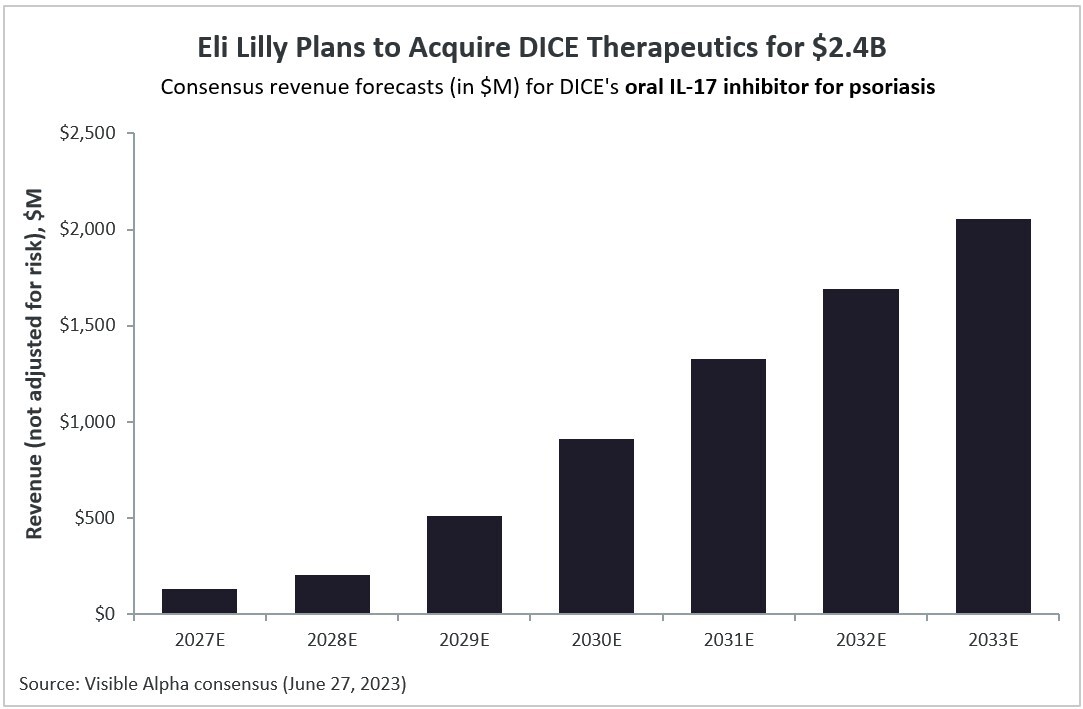

DICE’s lead oral drug program targets interleukin-17 (IL-17) for psoriasis (plaque psoriasis), an autoimmune disease. Visible Alpha’s consensus revenue estimates project DICE’s oral IL-17 inhibitor will generate over $2B in global revenues in 2033 for psoriasis, based on approval in 2027. The program is currently in Phase 2 trials. According to Visible Alpha consensus, the probability of approval is 54% (the risk-adjusted consensus revenue estimate for 2033 is $959M).

Figure 1: Visible Alpha consensus revenue estimates project over $2B globally for DICE’s oral IL-17 inhibitor for psoriasis

About IL-17

IL-17 is a proinflammatory cytokine that is important in mounting an immune response against infections. Under disease conditions or loss of immune regulation, IL-17 is released by immune cells and interacts with other proinflammatory cytokines to drive an unregulated and misdirected immune response. This misdirected immune response progresses the pathology of inflammatory and autoimmune diseases such as psoriasis, among others.²

LLY pipeline includes a biologics-based IL-17 inhibitor antibody on the market

LLY markets IL-17 inhibitor antibody Taltz (ixekizumab). Taltz was approved by the FDA in 2016 for moderate to severe plaque psoriasis and subsequently for other indications. Taltz is currently approved for plaque psoriasis, psoriatic arthritis, ankylosing spondylitis, and axial spondyloarthritis. In 2022, Taltz generated revenues of $2.48B across all indications. Besides Taltz, there are currently three other approved IL-17 inhibitor antibodies on the market. There is no oral IL-17 inhibitor approved at present.

Favorable market landscape for an oral IL-17 inhibitor

An oral IL-17 inhibitor with equal or better efficacy and safety would be favored over an IL-17 antibody that is injected. An oral IL-17 inhibitor is expected to improve patient compliance (which leads to improved efficacy) and can expand market share into the mild/moderate psoriasis disease segment of patients that are not yet on IL-17 injections or may be hesitant about choosing to take injections.

LLY made its decision based on robust preclinical data and proof-of-concept Phase 1 clinical studies in healthy volunteers and mild/moderate psoriasis patients. The data demonstrated encouraging efficacy and safety that matches or improves over currently marketed antibody-based IL-17 inhibitors.

Challenges in developing oral drugs that replace biologics administered by injectionDeveloping oral drugs to replace biologics-based drugs (antibodies, peptides, fusion proteins) that are administered by injection (parenterally) would be a major advance in therapeutic drug development. Biologics-based drugs are proteins and peptides that are quickly acted on by gastrointestinal enzymes — proteolytic enzymes that break down proteins into amino acids. In the past, attempts at oral delivery of biologics were based on several approaches. These include enclosing the protein/peptide biologic drug within a protective lipid-based envelope or modification by chemical or biophysical approaches to prevent degradation by gastrointestinal enzymes³. However, even if the protein/peptide-based drug circumvents degradation by gastrointestinal enzymes, there is the risk of immune activation, especially if the protein/peptide resembles microbial origin. Besides oral delivery, intranasal and inhaled delivery of smaller molecular weight protein drugs or peptides (such as insulin) are also an area of research and development. An inhaled insulin developed by Pfizer (Exubera) was approved by the FDA in 2006 for type 1 and type 2 diabetes. Exubera was a commercial failure due to lung function risk, hypoglycemia, and the need for constant monitoring — reflecting the challenges of protein/peptide drug delivery other than via injection. DICE’s technology platform and business model is appropriately suited to developing oral small molecule inhibitors that disrupt PPI. DICE’s pipeline of small molecule oral drugs can potentially replace already marketed biologics administered by injection. For example, there are currently marketed antibodies directed against integrins and PD-1, aside from antibodies against IL-17. The advantage of oral drug delivery over injections is obvious — patients do not want to be injected or self-inject. Additionally, there are significant advantages related to patient compliance that lead to improved efficacy and subsequently better outcomes. DICE’s DELSCAPE technology platformThe DELSCAPE platform uses DICE’s expertise in medicinal chemistry. It leverages DNA-encoded libraries (DELs) in a proprietary manner that makes it possible to develop oral small-molecule drugs that block PPIs. The oral small-molecule drug delivery technology is based on designing and defining PPIs that can be blocked to prevent biological signaling pathways that progress diseases. Identification of such PPIs is important since typically PPIs involve large complementary binding domains that are not amenable to being blocked effectively by small molecules¹. DICE has overcome this challenge by identifying small-molecule inhibitors of PPIs that act at a distance away from the PPI interface by perturbing the structure of one of the PPI pairs.¹ |

The bottom line

The LLY acquisition of DICE enhances and complements its pipeline and provides an innovative technology platform to develop additional small-molecule oral drugs in the autoimmune and inflammatory space. The acquisition of DICE provides LLY with a discovery engine that develops oral drugs in therapeutic areas currently dominated by injectable drugs — an unmet need with large market potential.

References

- DICE Therapeutics Information

- Ge et al; Biology of Interleukin-17 and Its Pathophysiological Significance in Sepsis. Front. Immunol., 28 July 202

- Peachey; Moving towards oral delivery of biologics. European Pharmaceutical Review. February 2023