Key Takeaways

|

Since March 2022, the U.S. Federal Reserve has hiked its benchmark rate 10 times and recently raised its target federal funds rate yet again to 5.25-5.5%. Although inflation in the U.S. has started to cool, it remains well above the Fed’s 2% target. Higher interest rates have made borrowing more expensive and saving more attractive to depositors. The desire to earn higher returns on savings is seeing depositors move away from non-interest-bearing accounts.

Here, we take a look at analysts’ expectations for the top five U.S. national banks: JPMorgan Chase (NYSE: JPM), Bank of America (NYSE: BAC), Wells Fargo (NYSE: WFC), Citigroup (NYSE: C), and PNC (NYSE: PNC). We also look at leading U.S. regional banks: KeyCorp (NYSE: KEY), Truist Financial (NYSE: TFC), Fifth Third Bancorp (NASDAQ: FITB), and Capital One Financial (NYSE: COF).

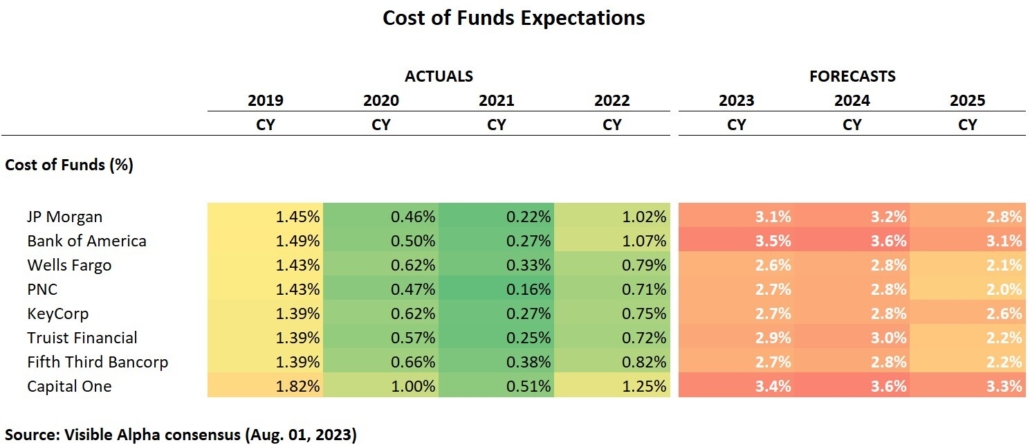

From recent earnings releases, the top five U.S. national banks saw non-interest-bearing deposits collectively decline by $108 billion in 2Q 2023. Analysts expect these deposits to continue to decline in the coming quarters, albeit less aggressively. Based on Visible Alpha consensus, non-interest-bearing deposits are collectively projected to decrease by 13% year-over-year for these banks in 2023.

Figure 1: YoY Change in Non-Interest-Bearing Deposits

Note: YoY growth calculated based on the quarterly aggregates of average non-interest-bearing deposits for JPMorgan Chase (NYSE: JPM), Bank of America (NYSE: BAC), Wells Fargo (NYSE: WFC), Citigroup (NYSE: C), PNC (NYSE: PNC), KeyCorp (NYSE: KEY), Truist Financial (NYSE: TFC), Fifth Third Bancorp (NASDAQ: FITB), and Capital One Financial (NYSE: COF).

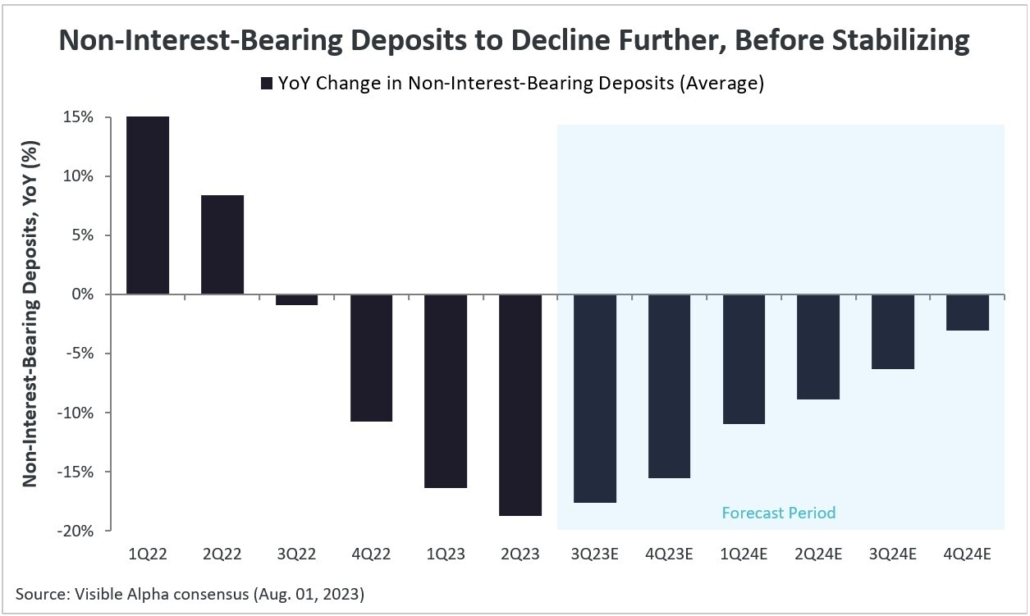

The chart below highlights analyst expectations for the average growth of non-interest-bearing deposits in 2023:

Figure 2: 2023 Expectations for Non-Interest-Bearing Deposits

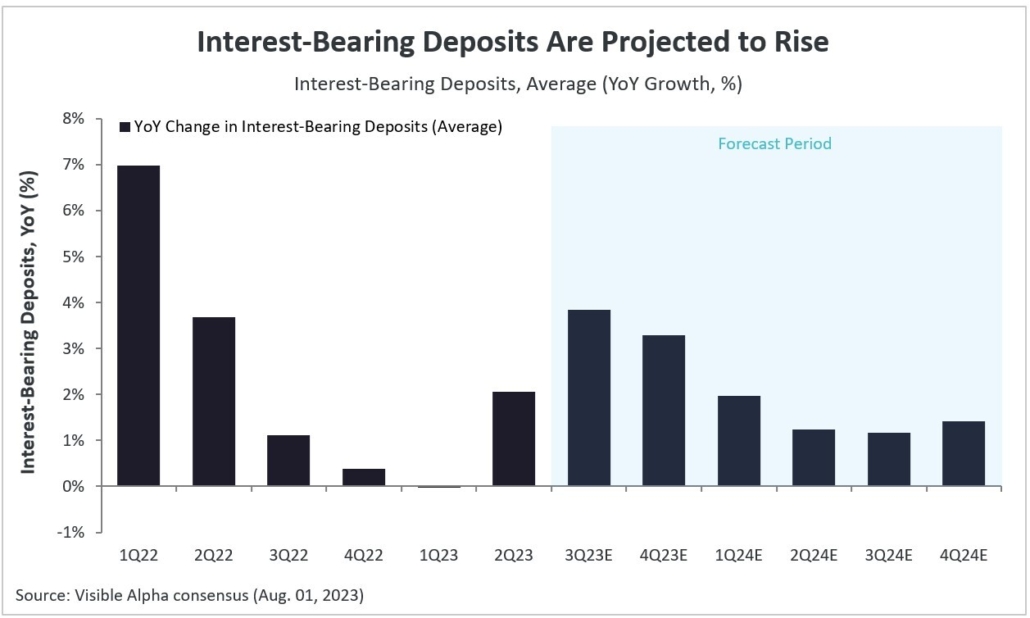

In contrast, interest-bearing deposits are seeing steady growth as institutional investors move their funds away from non-interest-bearing accounts towards those that offer higher yields. Average interest-bearing deposits collectively increased by $75 billion for the nine banks in 2Q 2023 from 1Q 2023.

Figure 3: YoY Change in Interest-Bearing Deposits

Note: YoY growth calculated based on the quarterly aggregates of average interest-bearing deposits for JPMorgan Chase (NYSE: JPM), Bank of America (NYSE: BAC), Wells Fargo (NYSE: WFC), Citigroup (NYSE: C), PNC (NYSE: PNC), KeyCorp (NYSE: KEY), Truist Financial (NYSE: TFC), Fifth Third Bancorp (NASDAQ: FITB), and Capital One Financial (NYSE: COF).

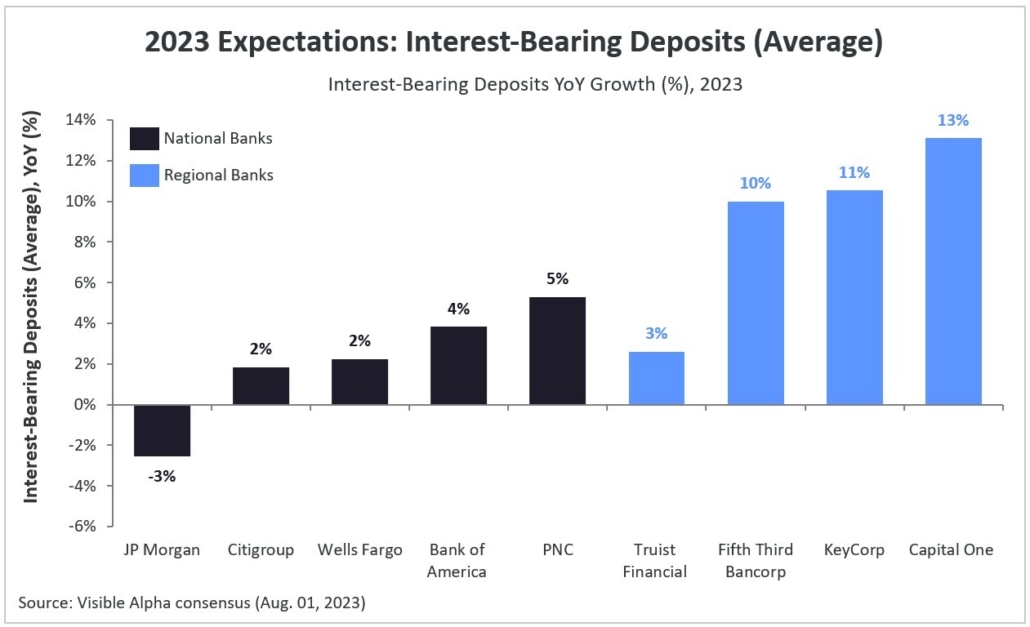

The chart below highlights analyst expectations for the average growth of interest-bearing deposits in 2023:

Figure 4: 2023 Expectations for Interest-Bearing Deposits

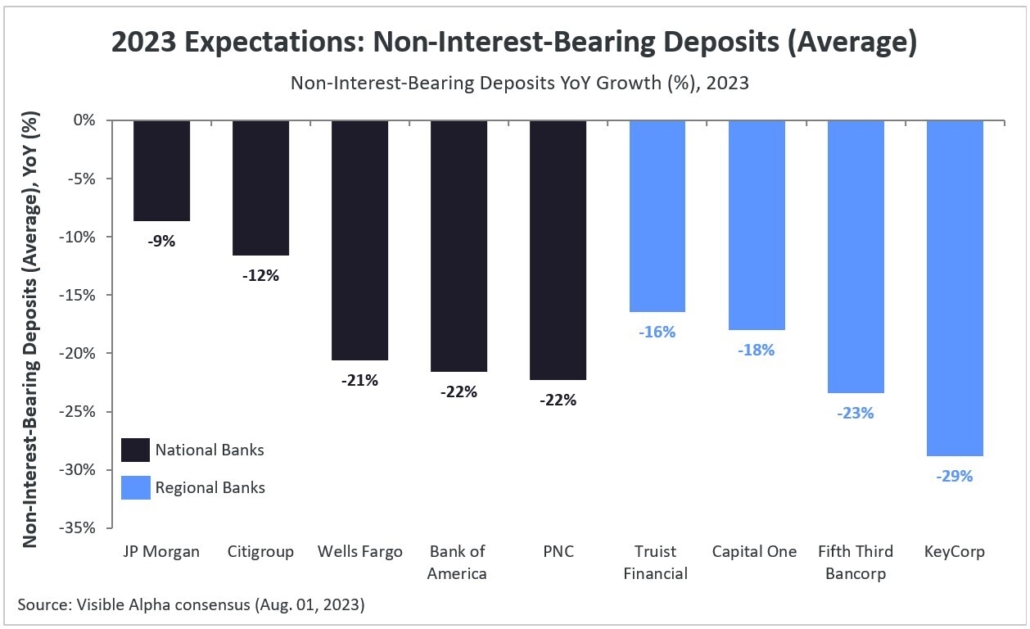

The shift towards interest-bearing deposits is expected to lead to a steady rise in funding costs for the leading banks. Based on Visible Alpha consensus, analysts project increases throughout 2023, as borrowing costs and deposits surge while loan volumes diminish. The cost of funds is projected to ease starting in 2025.

Figure 5: Cost of Funds Projections for Major Banks