Investors pay close attention to the U.S. Food and Drug Administration’s (FDA) approval process. The FDA’s stance on innovation as it relates to safety and efficacy is crucial to any investment in therapeutic drug development. Innovation in drug development moves at the pace of the FDA.

Here, we provide consensus revenue projections for several newly approved therapeutic drugs with significant market potential. In the 2022 FDA approvals class, drug development innovation was evident with the approval of several first-in-class mechanism-of-action drugs. Notably, a high proportion of orphan drugs were approved, but there were fewer approvals overall in comparison to previous years.

Numerous innovative FDA therapeutic drugs approved in 2022 have significant market potential

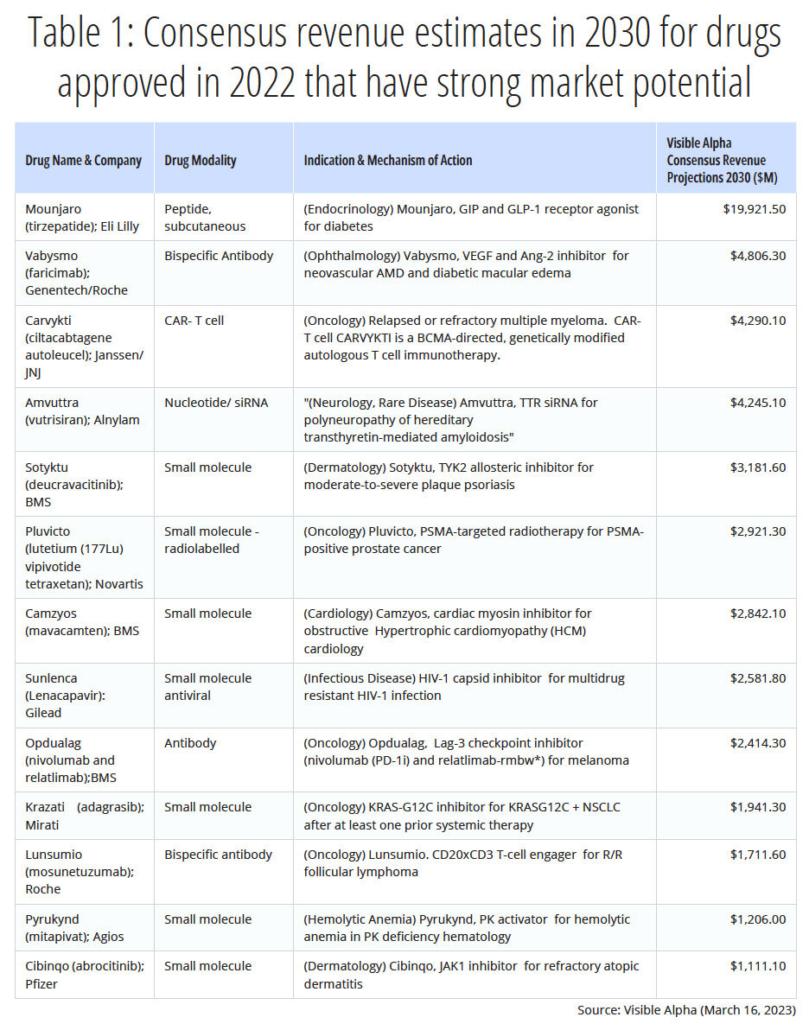

We provide consensus revenue projections for the year 2030 for thirteen therapeutic drugs approved in 2022 (See Table 1). A seven- or eight-year commercial sales period from 2022 through 2030 may or may not allow for peak sales to be reached – this varies from drug to drug and disease indication. However, the Visible Alpha consensus revenue projections provide a meaningful snapshot of the sales potential of high revenue-generating drugs from the class of 2022. Consensus revenue projections for the remaining FDA drugs approved will be published in upcoming updates.

Eli Lilly’s Mounjaro leads the list in revenue potential

Among the most notable newly approved drugs is Eli Lilly’s (LLY) Mounjaro, with a 2030 consensus revenue estimated at almost $20 billion. Mounjaro is in the glucagon-like peptide-1 (GLP-1) receptor agonist-based drug class that is effective against type 2 diabetes and obesity i.e., FDA-approved for type 2 diabetes, but also prescribed off-label for weight loss. In the recent past, investors may be aware of the intense interest in GLP-1-based drugs for weight loss.

Mounjaro belongs to the tirzepatide class, a next-generation GLP-1 pathway modulator that improves over the semaglutide class on the market. Tirzepatide is a GLP-1 receptor agonist and additionally a glucose-dependent insulinotropic polypeptide (GIP) receptor agonist, while semaglutides are GLP-1 receptor agonists exclusively. Semaglutides include Novo Nordisk’s (NOVOB_DK) Ozempic, with consensus revenue estimates in 2030 of approximately $17.5 billion, Rybelsus, with consensus revenue estimates in 2030 of $7.2 billion, and Wegovy, with consensus revenue estimates in 2030 of $8.8 billion.

Some of the other notable drugs with strong market potential spanning innovation in siRNA, CAR T-cells, and bispecific antibody technology-based mechanism of action include:

- Alnylam’s (ALNY) Amvuttra, with 2030 consensus revenue estimates at $4.2 billion. Amvuttra is a transthyretin-directed small interfering RNA (siRNA or RNAi) indicated for the treatment of polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults, a rare genetic disease characterized by scarring in multiple organs.

- Johnson & Johnson’s (JNJ) Carvykti, with 2030 consensus revenue estimates at $4.3 billion. Carvykti is a genetically modified autologous CAR T-cell directed against B-cell maturation antigen (BCMA) for relapsed or refractory multiple myeloma.

- Genentech/Roche’s (ROG_CH) Vabysmo, with 2030 consensus revenue estimates at $4.8 billion. Vabysmo is a bispecific antibody targeting VEGF and Ang-2 for wet AMD and diabetic macular edema.

Additional commentary on FDA drug approvals in 2022

The FDA’s Center for Drug Evaluation and Research (CDER) and Center for Biologics Evaluation and Research (CBER) published their 2022 drug approvals earlier this year. Innovation in therapeutic drug development has been a constant, especially over the last decade, and 2022 was no different.

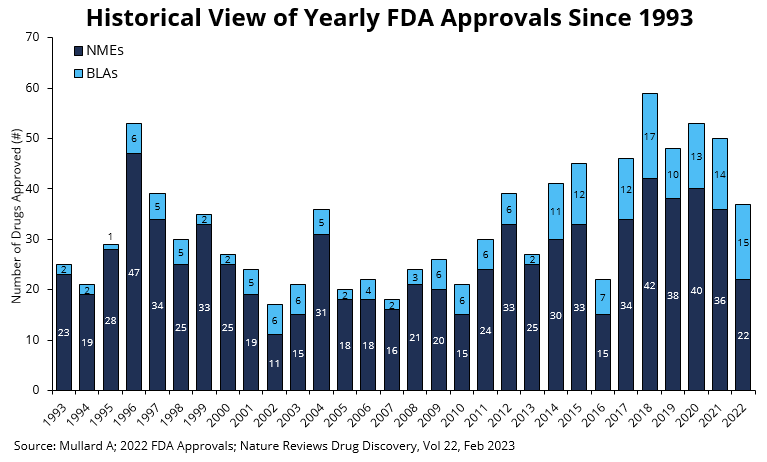

A total of 37 novel drugs were approved by CDER either as new molecular entities (NMEs or small molecule drugs) under a New Drug Application (NDA) or as new therapeutic biological products – large molecule drugs that include antibody-based therapeutics, enzymes, peptides – under a Biologic License Application (BLA). As depicted in Table 2, of the 37 new drugs approved by CDER, two were contrast agents for magnetic resonance imaging for disease evaluation.

The decrease in drug approvals by CDER is not due to a reduced number of applications. It is not clear if the decrease in drugs approved is due to an increase in rejections since the FDA does not publish complete response letters (CRLs). CRLs are letters that indicate the FDA’s reasons for withholding approval and explain which additional data might support an approval decision. It is up to the drug developer to communicate to the public about the CRL findings. Public companies must make a public announcement to their stockholders since it is a material event. Drug development companies see risk in the FDA publishing CRLs since there could be risk in confidential information being exposed about proprietary drugs in development. It is likely that the reduced approval is a post-COVID-19 effect or a cyclical event as occurred in 2016 (see Figure 1).

In addition to CDER’s approvals, the FDA’s CBER branch that regulates vaccines, blood products, cell therapies (including CAR T-cells), and gene therapies approved 14 BLAs. Of the 14 approved, we classify a subset of 8 as novel therapeutic drugs (depicted in Table 3). The remaining 6 were not novel therapeutics and fall in the diagnostics, screening agents, or cell therapy manufacturing protocol approvals.

Tables 2 and 3 include modality, indication, and mechanism of action for the CDER and CBER approvals in 2022.

Highlights of drugs approved in 2022

Center for Drug Evaluation and Research

- Total CDER drug approvals in 2022 decreased compared to the previous 5 years during which a record number of drugs were approved (see Figure 1). In 2022, there were 37 new drugs approved by the FDA, down from 50 in 2021 and 53 in 2020.

- Of the 37 drugs approved, 22 were NMEs and 15 were biologics – biologics made up 40.5%.

- Notably, 20 of 37 drugs approved by CDER, or 54% of novel drug approvals, were for rare or orphan diseases.

- Within the biologics category, new mechanisms include those that go beyond conventional antibodies, fusion proteins, peptides, and enzymes. These new mechanism drugs include bispecific proteins and antibody–drug conjugates – Genentech’s Vabysmo, Immunocore’s Kimmtrak, JNJ’s Tecvayli, Roche’s Lunsumio, and Immunogen’s Elahere.

- In the NME category, the new mechanism included a next-generation small interfering RNA (siRNA) drug, making it the 6th siRNA drug approved – Alnylam’s Amvuttra.

- Novartis’ Pluvicto, another NME, marks a new class of targeted radiopharmaceuticals that target tumor antigens and are linked to tumor-destroying radioactive isotopes generating precision radiation therapy.

- The number of drug applications CDER received in 2022 was generally similar in number to applications in the past few years.

- Innovation can also be exemplified by a measure of drugs that are first in class, i.e., these drugs have mechanisms of action different from those of existing approved drugs – 20 of the 37 novel drugs approved, or 54%, were first in class.

Center for Biologics Evaluation and Research

- Approvals by CBER also reflected innovation as manifested by novel gene therapy, CAR T-cell immunotherapy, and the first fecal microbiota approvals.

- There were approvals of four gene therapy drugs: Zynteglo, Skysona (Bluebird Bio), Hemgenix (CSL Bering), and Adstiladrin (Ferring).

- The 6th CAR T-cell therapy was approved – Carvykti (Legend and Johnson & Johnson) targeting B-cell maturation antigen.

- Rebyota (Rebiotix, Ferring) marks the first fecal microbiota therapy delivered as a rectal enema – a novel drug class that harnesses the therapeutic utility of a healthy microbiota.

Figure 1:

Figure 1: New molecular entities (NMEs) and biologics license applications (BLAs) approved by the FDA’s Center for Drug Evaluation and Research (CDER) branch since 1993. Note that CBER approvals are not depicted here. The 37 drug approvals in 2022 were lower than the highs of the last 5 years. (Adapted from Nature Reviews Drug Discovery; Vol 22, Feb 2023)

References

- Novel Drug Approvals for 2022 (https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2022)

- 2022 Biological License Application Approvals (https://www.fda.gov/vaccines-blood-biologics/development-approval-process-cber/2022-biological-license-application-approvals)

- Mullard A; 2022 FDA Approvals; Nature Reviews Drug Discovery; Vol 22, Feb 2023