Gilead reported 1Q17 earnings last week and missed earnings expectations. The miss was largely driven by its Hepatitis C (HCV) franchise, which was down 40% YoY.

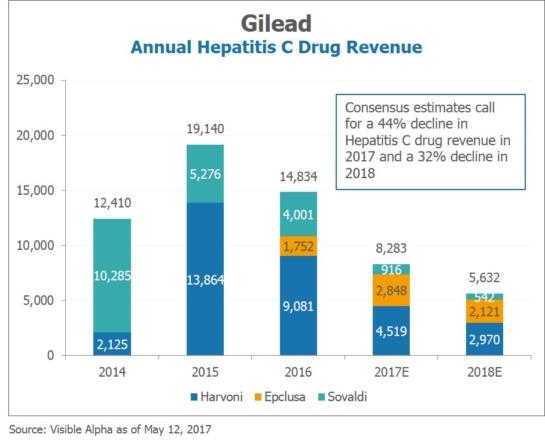

HCV is one of Gilead’s most successful franchises, with Harvoni being one of the fastest drug launches in the sector’s history. Gilead’s HCV revenue reached $19 billion at its peak in 2015.

However, revenue began to decline in 2016 and in 4Q16, with management guiding to HCV 2017 revenue of $7.5 – 9 billion, representing a 40-50% decline. The decline is expected to be driven by decreased patient starts, increased competition (and thereby market share losses and pricing pressure), and tough comparisons.

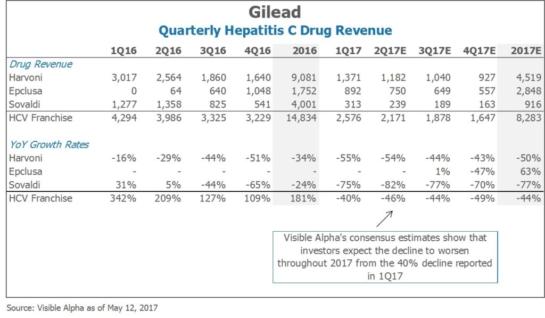

With the recent 1Q17 results showing continued weakness in the HCV franchise, investors are now concerned about the franchise and its growth trajectory moving forward. Visible Alpha consensus estimates show that analysts now expect the HCV franchise to be within the low end of management’s guidance for 2017, and for continued declines in 2018.

By quarter, analysts expect the declines to worsen through the remainder of the year from the -40% YoY growth reported in 1Q17. Consensus estimates for 2Q17 call for a 46% YoY decline in the HCV franchise.