In Q1 of 2018, we added 307 companies to the Visible Alpha coverage universe. While our initiations ranged across all sectors, the 5 with the most companies were Industrials (50), Materials (44), Health Care (42), Financials (40) and Technology (36). Additionally, we added 170 companies domiciled in the Americas, 12 in APAC and 125 in EMEA.

Of the 307, we highlighted 5 companies that have a high level of interest from investors. With each company, we note an interesting line item the Street is watching and identify its consensus line found within the Visible Alpha Insights platform.

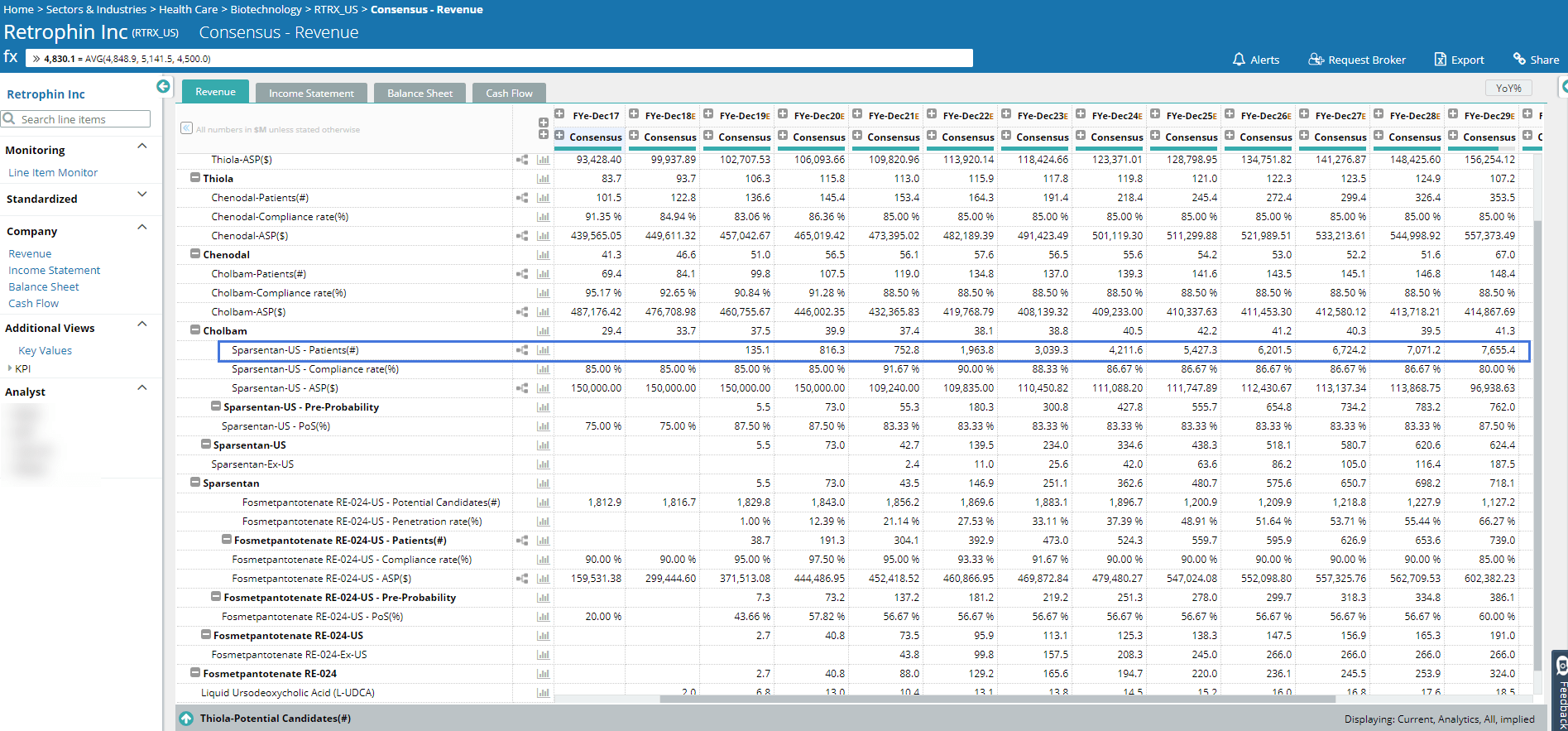

Retrophin (RTRX_US) |

Sector: Healthcare

Industry: Biotechnology Interesting line item: Sparsetan – US – Patients (#) |

Nephropathy is a highly morbid kidney disease with no approved therapy and a prevalence of ~165K in the US. Retrophin is developing Sparsentan to address this issue, and is currently in Phase 3 clinical trials. If they can get FDA approval, this would represent a significant revenue opportunity for the company.

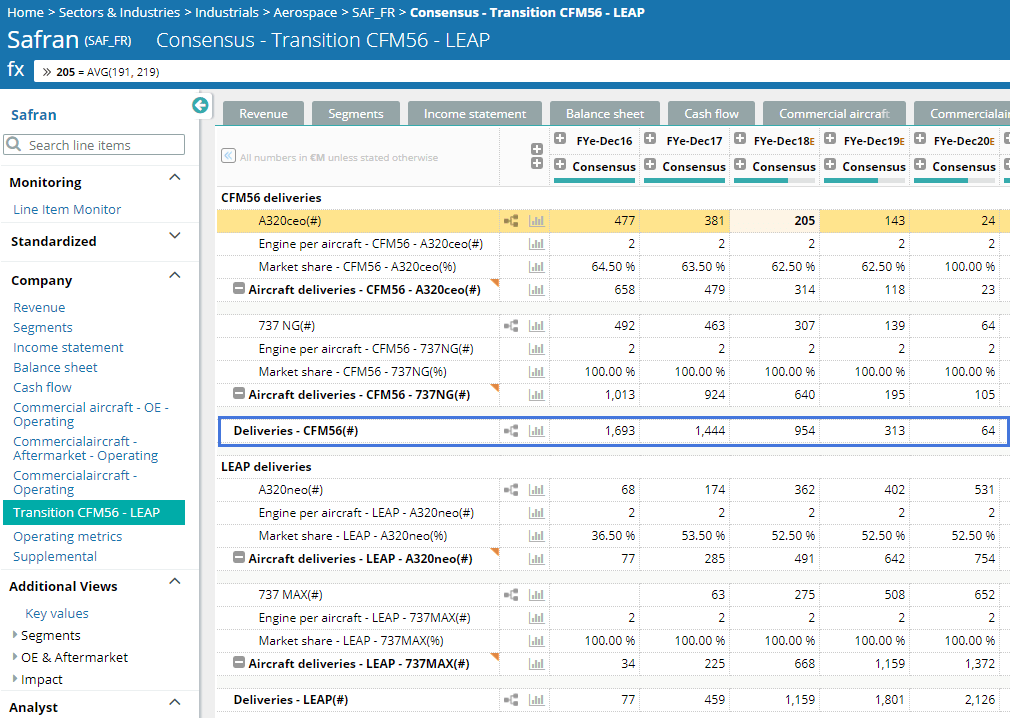

Safran (SAF_FR) |

Sector: Industrials

Industry: Aerospace Interesting line item: Deliveries – CFM56 (#) |

Safran will replace the CFM56 with LEAP. This is a key product as it is intended to compete with the Pratt & Whitney PW1000G in the single-aisle jetliner market.

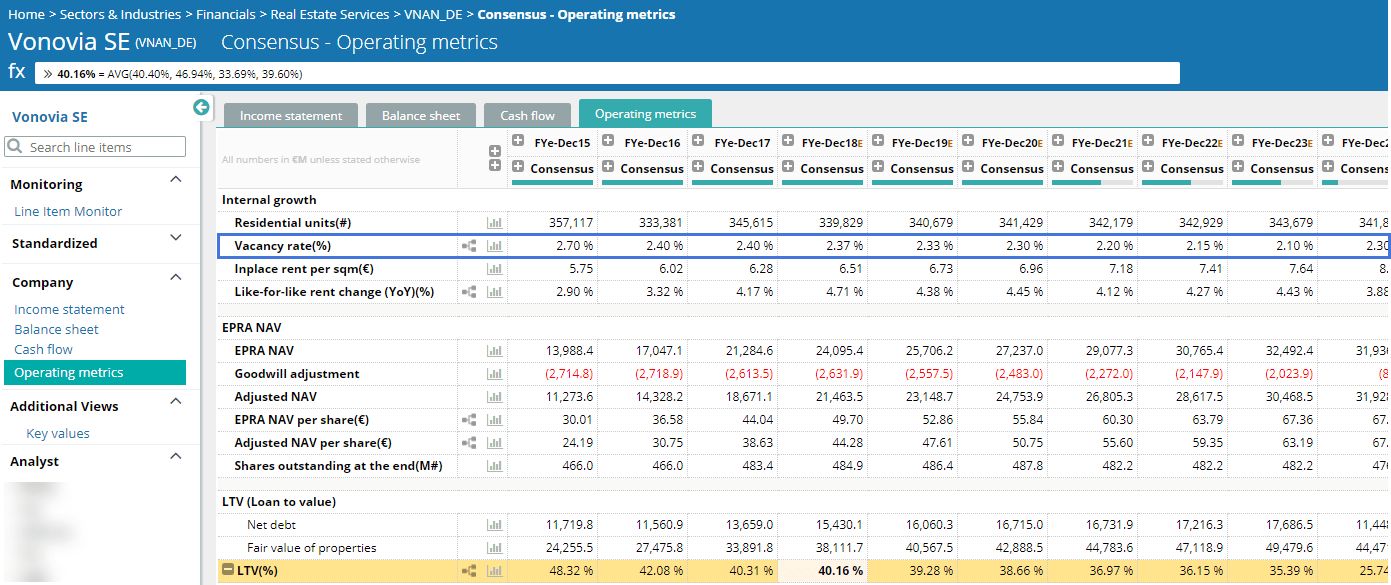

Vonovia SE (VNAN_DE) |

Sector: Financials

Industry: REITs Interesting line item: Vacancy Rate |

German REITs have seen strong performance driven by supply/demand imbalances and historically-low vacancy rates.

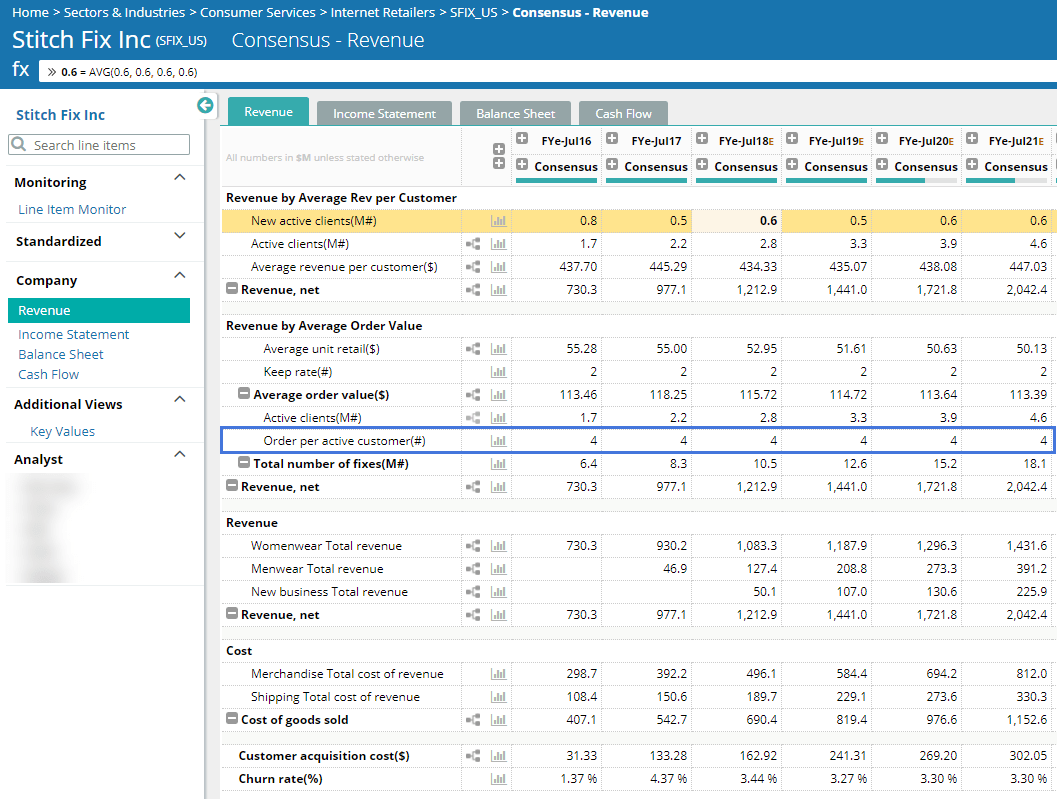

Stitch Fix (SFIX_US) |

Sector: Consumer Services

Industry: Internet Retailers Interesting line item: Orders per Active Customer |

Stitch Fix is an online retailer that uses data to provide personal apparel recommendations to each customer. Investors are focused on near-term trends and how well the recommendations are resonating with customers.

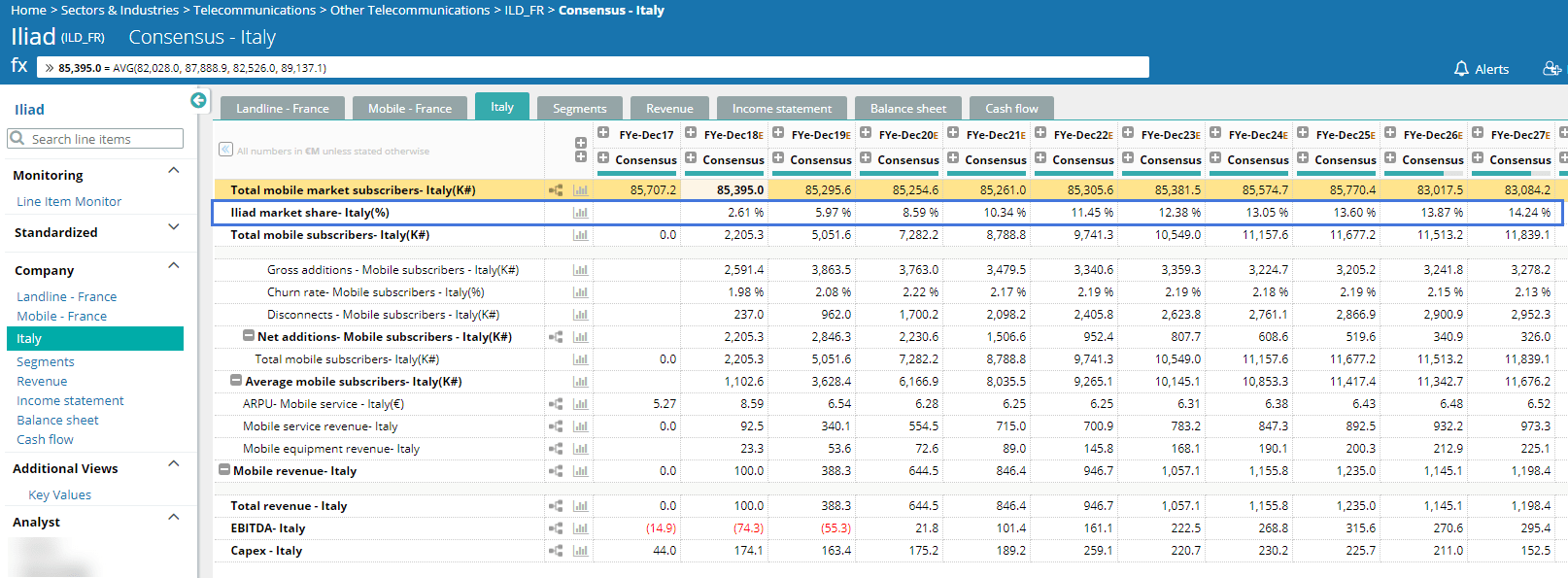

Iliad (ILD_FR) |

Sector: Telecommunications

Industry: Other Telecommunications Interesting line item: Iliad Marketshare – Italy |

Iliad entered the French markets in 2012 offering steep pricing discounts to incumbents, and today owns 18% market share. Now, Iliad is entering the Italian market with a similar strategy.