Intel’s Data Center Group (DCG) is a major focus for investors as it has historically posted strong, double-digit revenue growth and has largely offset flat to negative growth in its Client Computing Group (CCG) segment. The DCG segment also has higher operating margins, which further bolsters overall earnings for the company.

Slowing Growth in Intel’s Data Center Group

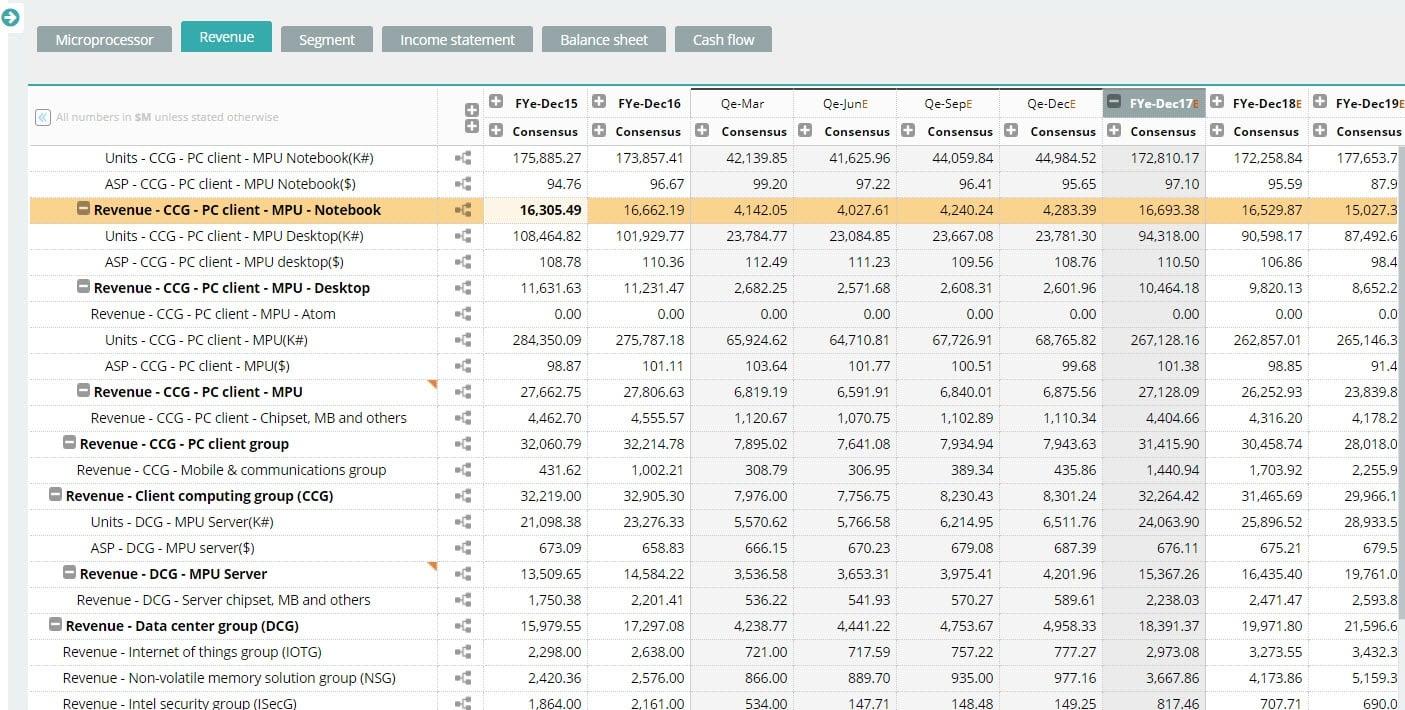

Over the last year, the stock has traded sideways as investors have become concerned over slowing growth in DCG. Segment revenue growth has slowed from the double-digits to the high-single digits in recent quarters, and management noted that they expect high-single digit growth for 2017. The deceleration has been driven largely by the enterprise market, which has declined for several quarters. Management has noted that they believe much of the enterprise market is shifting towards the public cloud at a faster rate than they expected.

Management’s Perspective

However, management continues to believe that the segment can grow in the double-digits longer-term. Management has cited a number of factors for their longer-term bullishness. The company expects continued strength in the cloud, networking, and storage markets. Additionally, the company will be refreshing its products in the second half of the year, which has historically driven strong average selling price (ASP) growth. Given the performance boost from the upcoming “Purley” server platform, it would not be a surprise if they drove similar ASP growth rates this year.

Analysts’ Perspective

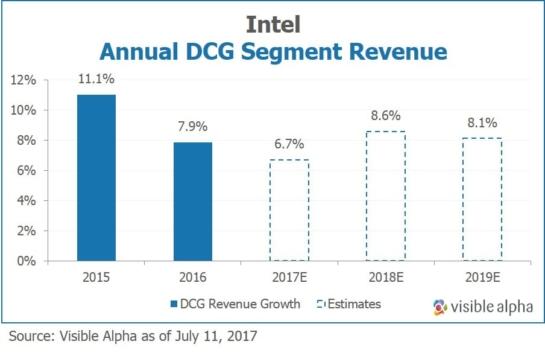

Analysts seem to partially agree with this view, but are not fully convinced. Consensus estimates show that analysts expect revenue growth in the mid-single digits for 2017. Beyond that, growth is expected to accelerate to the high-single digits, but remain below its longer-term double-digit target.

Competition from Nvidia, Cavium and AMD

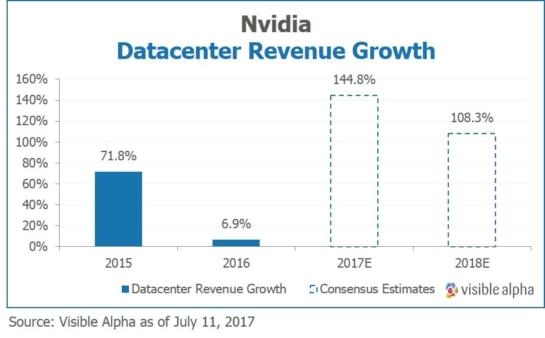

One reason for muted expectations is the competitive outlook. Nvidia’s (NVDA) Datacenter segment has made large gains in recent quarters, and analysts expect segment growth to jump to over 100% annually over the next two years. Investors also have an eye on competition from Cavium and AMD.

Access Deep Forecast Data on 1600+ Companies

Visible Alpha has extensive coverage of Intel and its competitors. The segment-level data for Intel and its competitors can be found on each company’s respective page within their “Revenue” template views. Investors can also find more detailed estimates on units, ASP, and sub-segment data. Learn more or request a free trial today!