Alphabet Inc. (NASDAQ: GOOGL) reported earnings for Q3 2023 after the market close on Tuesday, October 24, 2023. What happened during the release and earnings call, and what’s next?

What happened in Q3?

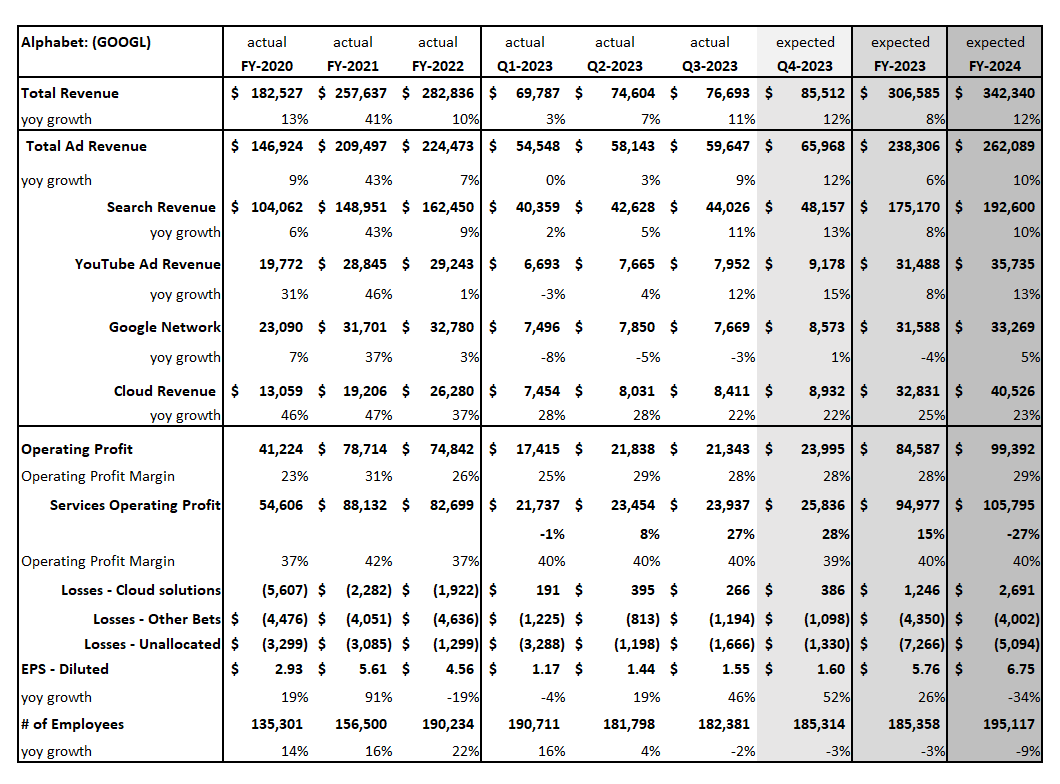

Alphabet Inc. (NASDAQ: GOOGL) reported earnings a bit below expectations for Q3 2023 after the market close on Tuesday, October 24, 2023, driving the stock down after the release. Alphabet’s core business of Search and YouTube delivered revenues 1.5% ahead of expectations. However, the Cloud and Network search businesses together were -3% below expectations. In particular, the Cloud business appeared to lose share in the quarter and AI efforts seem to be behind competitors, which likely contributed to higher-than-expected costs.

More concerning, the operating profit margin of 27.8% for Alphabet overall came in 70 basis points below expectations, driven by a combination of higher-than-expected losses in other businesses and a cloud margin nearly 200 basis points below estimates. Coming into the quarter, analysts were expecting Alphabet to maintain the same 5% margin it achieved in Q2 for the cloud business, and the level of losses for the other bets and unallocated segments to remain around $2 billion. In Q3, however, the cloud margin dipped to 3% and the other bets and unallocated losses jumped 42% quarter-over-quarter to $2.9 billion.

Question: Will Google Cloud margin improve in Q4 or stay around 3%?

Q4 and Beyond

Looking ahead, the revenue growth from the Cloud business is expected to be an outsized chunk of Alphabet’s total revenue growth for FY 2024, meaning it is growing at a much faster 20-25% pace than the 10% expected year-over-year growth for Alphabet’s core Search and YouTube revenue streams. While Cloud revenues are expected to hit $40 billion in FY 2024 and almost $50 billion by FY 2025, profitability remains a looming concern.

Analysts were initially projecting the Cloud business to generate a 5% margin in Q4, but this estimate has ticked down to 4.4% since the release. For FY 2024, analysts are expecting Cloud revenues to grow to $40 billion, up 23% year-over-year, and operating income to more than double from an expected $1.3 billion in FY 2023 to $2.7 billion. Analysts project a strong 6.6% operating profit margin in the Cloud business in FY 2024 and for this margin to jump to 13% by the end of FY 2026, which may be aggressive given the Cloud margin performance in Q3 and lower expectations into Q4 2023.

Question: Will Vertex AI help to drive share gains and margin expansion going forward?

In addition, the other bets revenues are expected to remain just over $1 billion, but losses are expected to decrease around $2.5 billion year-over-year in FY 2024. Losses for these line items are projected to be over $11.5 billion in FY 2023 and to decline to $9 billion in FY 2024 and $8 billion in FY 2025. Given the performance this quarter, questions remain about how Alphabet may reduce these losses.

While the company has a strong cash position of $120 billion, CapEx is projected to increase $12 billion from an expected $31 billion in FY 2023 to $43 billion in FY 2026. In order to catch up to competitors in the AI space, further investments and CapEx may be required.

Question: Will Alphabet be able to rein in these losses, while still innovating and maintaining its strong cash position in 2024?

Figure 1: Alphabet’s Key Financial Items

Source: Visible Alpha consensus (October 27, 2023)

Source: Visible Alpha consensus (October 27, 2023)