Alphabet Inc. (NASDAQ: GOOGL) reported earnings for Q4 2023 after the market close on Tuesday, January 30, 2024. What happened during the release and earnings call, and what’s next?

Ads revenue was disappointing: Is the profitability of this business sustainable?

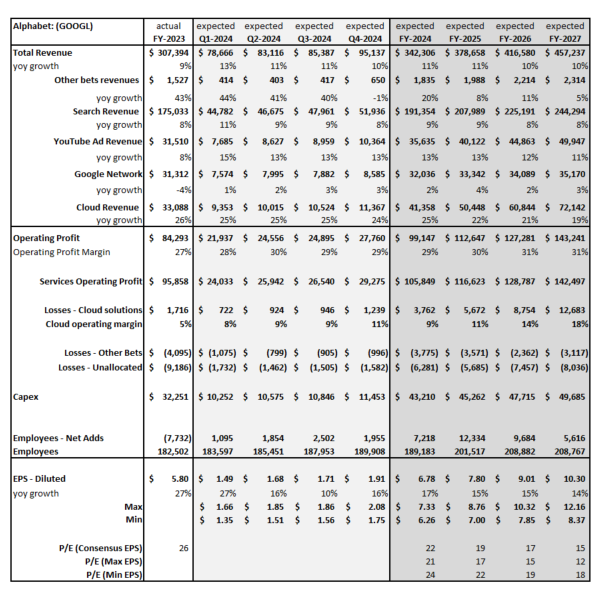

Alphabet reported earnings a bit below expectations for Q4 2023, driving the stock down more than 6% after the release. Alphabet’s core business of Search and YouTube delivered revenues in line with consensus expectations, while the Network search businesses together were -3% below expectations. On an FX-neutral basis, the ad segment only grew 2%, driven only by retail promotions and APAC. Looking ahead to Q1, the company noted on the earnings call that they expect the Ads business to continue to see consumer cost consciousness drive promotional activity.

Given the strong pace that AI is gaining momentum, there are questions about the sustainability of the Ads business model for Alphabet. Based on Visible Alpha consensus, analysts are expecting Google Advertising revenue to be $305 billion by FY 2026, up 28% from FY 2023 levels. Is this too aggressive?

Operating margin was disappointing: How much cost will be pulled out of the business?

The overall operating profit margin of 27.5% for Alphabet came in 60 basis points below Visible Alpha consensus expectations, driven by a combination of higher-than-expected losses in Unallocated businesses. Coming into the quarter, analysts were expecting Alphabet’s level of losses for the Other Bets and Unallocated segments to remain around $2.4 billion, but these surged to nearly $4 billion, driven by reduction in force costs. On the earnings call, the company noted a further $700 million severance expense in Q1.

Ruth Porat, President and Chief Investment Officer, explained that the company will continue to streamline operations, its real estate portfolio, and its vendor spend, supporting slower expense growth. It is worth noting that the company still has not announced a new CFO to replace Porat. Operating expenses currently hover around $90 billion, but are expected to continue to grow to $105 billion by FY 2025, according to Visible Alpha consensus. Research & Development and Sales & Marketing costs make up 80% of the company’s expense base. How will Alphabet continue to drive innovation and competitive positioning in the Ads and Search businesses while reducing costs?

The Cloud bounced in Q4: Will it hit $50 billion in revenues and an 11% margin in FY 2025?

The Cloud business showed quarter-on-quarter improvement with revenues that beat consensus by 2.7%, driving a 9% operating profit margin. In particular, the Cloud business appeared to benefit from cost optimizations getting worked through, combined with the early adoption of AI solutions.

Looking ahead, the revenue growth from the Cloud business is expected to be an outsized chunk of Alphabet’s total revenue growth for FY 2024, meaning it is growing at a much faster 20-25% pace than the 10% expected year-over-year growth for Alphabet’s core Search and YouTube revenue streams. Compared to last quarter, expectations for Cloud sales did not change much after the Q4 earnings release. Cloud revenues are projected to be $41 billion in FY 2024 and $50 billion in FY 2025. However, Visible Alpha consensus estimates for operating profit margin coming into the quarter jumped significantly after the earnings release from 6% to 9% in FY 2024 and from 9% to 11% in FY 2025. Is it too soon to assume that Cloud margin will remain at or above Q4’s 9% level?

Playing catch-up in AI: Cash decline and a CapEx surge

In order to catch up to competitors in the AI space, further investments and CapEx are required.

While the company has a strong cash position of $111 billion, it is worth flagging that this number is down nearly $10 billion from $120 billion in Q3, and its lowest level since FY 2018.

In Q4, CapEx jumped more than expected by $3 billion quarter-on-quarter to $11 billion, “driven overwhelmingly by investment in technical infrastructure, with the largest component for servers, followed by data centers,” according to Ruth Porat on the earnings call. Porat further explained that this uptick in CapEx reflects Alphabet’s “outlook for the extraordinary applications of AI to deliver for users, advertisers, developers, Cloud enterprise customers, and governments globally and the long-term growth opportunities that it offers.”

In addition, Porat guided for CapEx to be “notably larger” in 2024, implying that investment is going to be pulled forward and seems to be chasing Microsoft. Microsoft’s CapEx started to surge meaningfully last year and is projected to hit $42 billion, which likely enabled it to take a lead in AI. Based on Visible Alpha consensus, Alphabet’s CapEx is expected to surge by $11 billion from $32 billion in FY 2023 to $43 billion in FY 2024, which now matches Microsoft’s CapEx levels. Longer term, too, Alphabet’s CapEx expectations jumped to $48 billion in FY 2026, up from $43 billion last quarter. Will Alphabet’s investments in AI start to give it an edge without burning more cash?