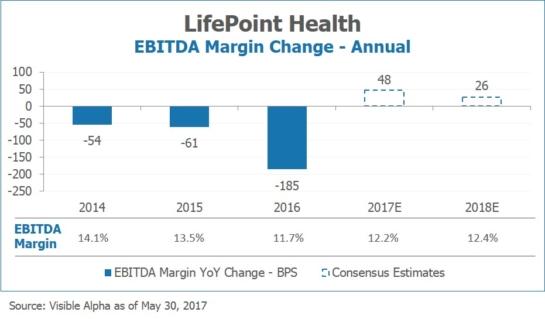

LifePoint Health acquired eight healthcare facilities between 2015 and 2016 with a goal of bringing their EBITDA margins from single digits to double digits. Over one year later, investors are now looking for LifePoint Health to demonstrate overall company EBITDA margin expansion driven by operating efficiencies at those acquired hospitals.

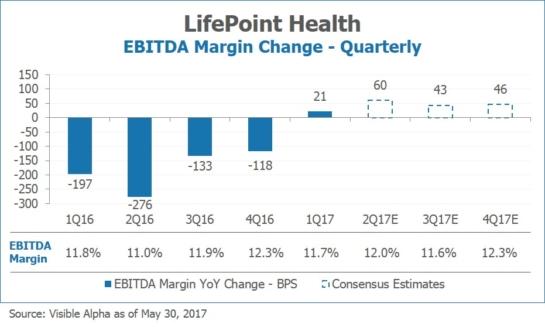

The company recently reported 1Q17 results in late April which had a mixed set of takeaways for the company’s margin outlook. On the positive side, the company reported the first quarter of EBITDA margin expansion in some time driven by improving EBITDA margins at the acquired hospitals. On the negative side, the EBITDA margin increase slightly missed consensus estimates, driven in part by higher labor expense. With the mixed results in 1Q17, how do analysts expect the rest of the year to play out?

Visible Alpha’s consensus estimates show that analysts continue to model EBITDA margin expansion for the remainder of the year. Analysts model 60 basis points of EBITDA margin expansion in 2Q and a lower degree of margin expansion in 3Q and 4Q.

Go beyond consensus with Visible Alpha. Learn how you can uncover deeper insights within analyst models.

Beyond this year, analysts are also modeling margin expansion in 2018, although to a lower magnitude. Management’s ongoing acquisitions could act as a potential drag on EBITDA margin expansion, since LifePoint targets companies with low EBITDA margins.