In our weekly round-up of the top charts and market-moving analyst insights: Memory chip makers are expected to see revenues decline in 2023; Pfizer’s (NYSE: PFE) Elrexfio marks the third bispecific antibody approved for multiple myeloma by the FDA; Lynas Rare Earths (ASX: LYC) is projected to experience a decline in revenue in 2023-24; and U.S. oil refiners are expected to see a decrease in gross profit per unit between 2023-2025.

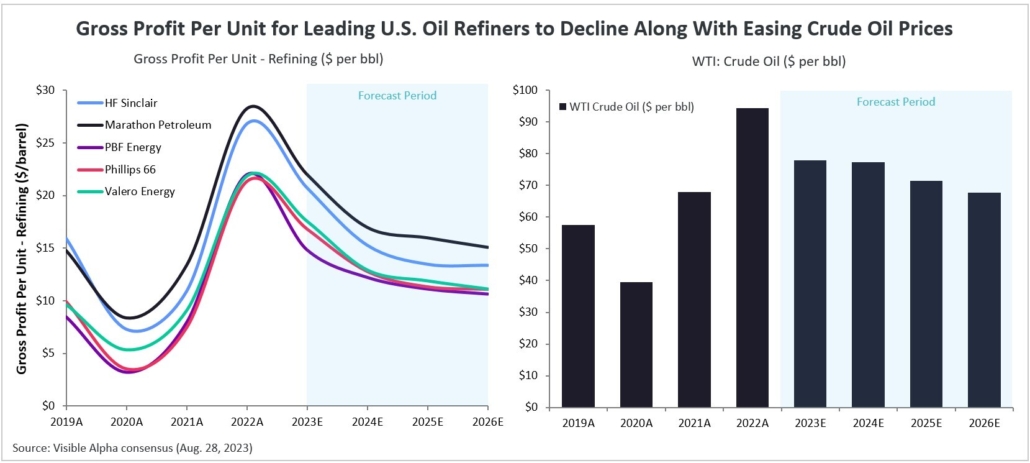

Memory Chip Manufacturers to See Revenue Dip in 2023, Recovery from 2024 Onward

Memory chip makers, including SK hynix (KRX: 000660), Micron Technology (NASDAQ: MU), Nanya Technology (TWSE: 2408), and GigaDevice Semiconductor (SSE: 603986) are expected to see revenues decline in 2023, according to Visible Alpha consensus. The memory semiconductor industry is dealing with overcapacity and excess inventory coupled with sluggish demand. This has been placing downward pressure on average selling prices (ASP) of DRAM (Dynamic Random-Access Memory) and NAND memory technologies. Analysts expect both DRAM and NAND revenues to decline in 2023 as sluggish demand and high inventory eat into ASPs. However, these companies are expected to see revenue rebound starting in 2024 as the market potentially transitions towards undersupply.

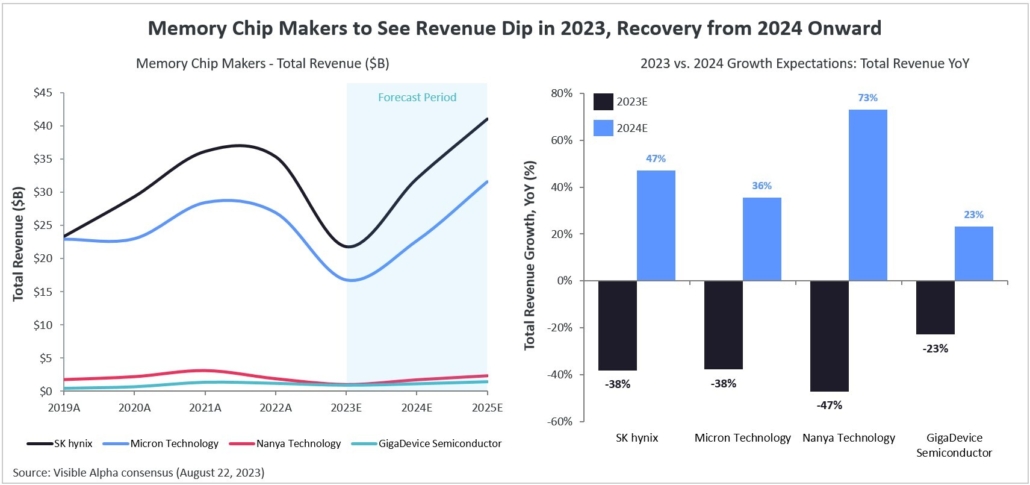

Pfizer Enters Race for Bispecific Antibody Treatment of Multiple Myeloma

Pfizer’s (NYSE: PFE) Elrexfio marks the third bispecific antibody approved for multiple myeloma by the FDA – Elrexfio was granted accelerated (conditional) approval by the FDA on August 14, 2023. The other two bispecific antibodies approved for multiple myeloma belong to Johnson & Johnson (NYSE: JNJ): Tecvayli (approved in October 2022) and Talvey (approved on August 10, 2023).

According to Visible Alpha consensus, analysts’ expectations for the probability of success of full approval for Elrexfio is 59%, reflecting the risk associated with a successful registration (Phase 3) trial for full approval. Visible Alpha consensus risk-unadjusted revenue projections of close to $1.8 billion in 2031 (peak) are significantly lower than PFE’s guidance of $4 billion in peak sales. Peak risk-adjusted revenue expectations in 2031 are $971M.

Elrexfio (elranatamab) is a bispecific antibody that targets B-cell maturation antigen (BCMA) and CD3 on T cells. Elrexfio is a T cell engager that activates T cells, which results in killing multiple myeloma tumor cells.

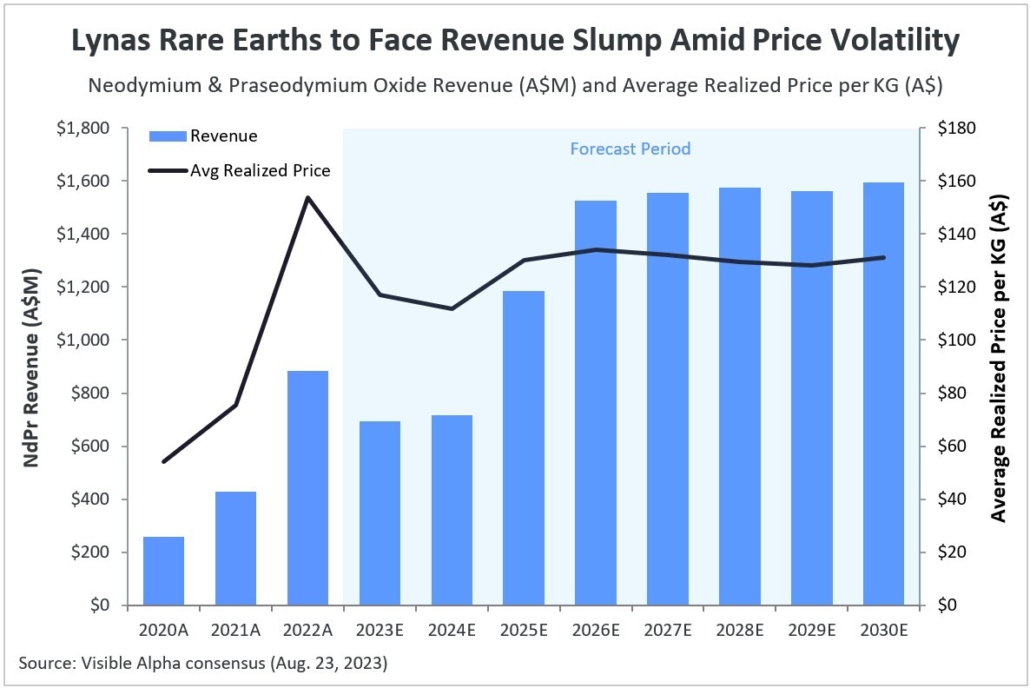

Lynas Rare Earths to Face Revenue Slump Amid Price Volatility

Lynas Rare Earths (ASX: LYC), an Australian rare-earths mining and processing company, is projected to experience a decline in revenue in 2023-24, according to Visible Alpha consensus. This decline is primarily attributed to an expected decrease in revenue generated from neodymium and praseodymium (NdPr) oxide, which constituted 96% of the company’s total revenue in 2022. NdPr are essential components in the manufacturing of high-performance magnets that are used in electronics, electric and hybrid vehicles, and wind turbines, among others.

Prices of rare earth minerals have declined over the past year due to increased supply from China and softer demand from renewable energy companies and the automotive sector. Analysts anticipate that the lower average realized prices from NdPr will be key to pushing down revenue expectations between 2023-24. However, it is expected that revenues and, to a lesser extent, prices will rebound starting in 2025.

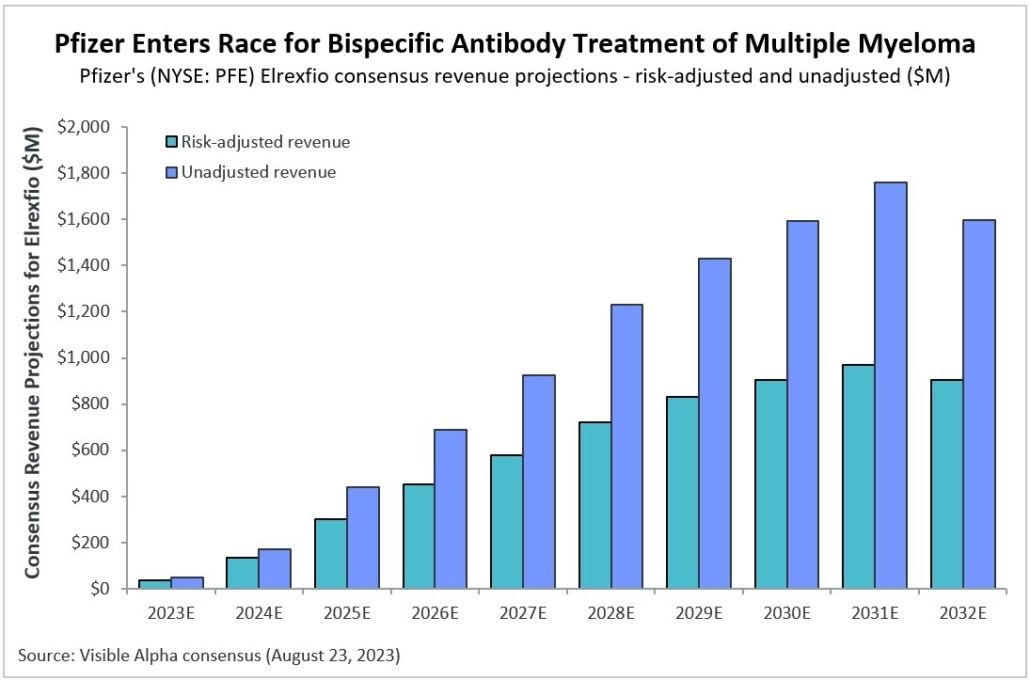

Gross Profit Per Unit for Leading U.S. Oil Refiners to Decline Along With Easing Crude Oil Prices

According to Visible Alpha consensus estimates, Phillips 66 (NYSE: PSX), Valero Energy (NYSE: VLO), Marathon Petroleum (NYSE: MPC), PBF Energy (NYSE: PBF), and HF Sinclair (NYSE: DINO) are projected to see a decrease in gross profit per unit between 2023-2025. U.S. refiners enjoyed bumper profits in 2021-22, as Western sanctions on Russia and COVID lockdowns in China crimped global fuel supplies at a time when demand was recovering from pandemic lows, creating increased demand for U.S. crude oil. In 2023, however, rising oil exports from Russia and China are expected to dampen the demand for U.S. crude derivatives.

The decline in profits is also partly due to the anticipated decline in crude oil prices during the forecast period. Lower crude oil prices translates to reduced prices for refined products, impacting margins for refiners. Crude oil prices are anticipated to decrease to an average of $78 per barrel (bbl) in 2023, down from the peak levels observed last year. Despite the decline, profits are generally still expected to maintain above pre-pandemic levels.