Meta (NASDAQ: META) & Apple (NASDAQ: AAPL) will report results next week. Here are the key numbers that we’re watching.

Meta (META) Q2 2024 Earnings Preview

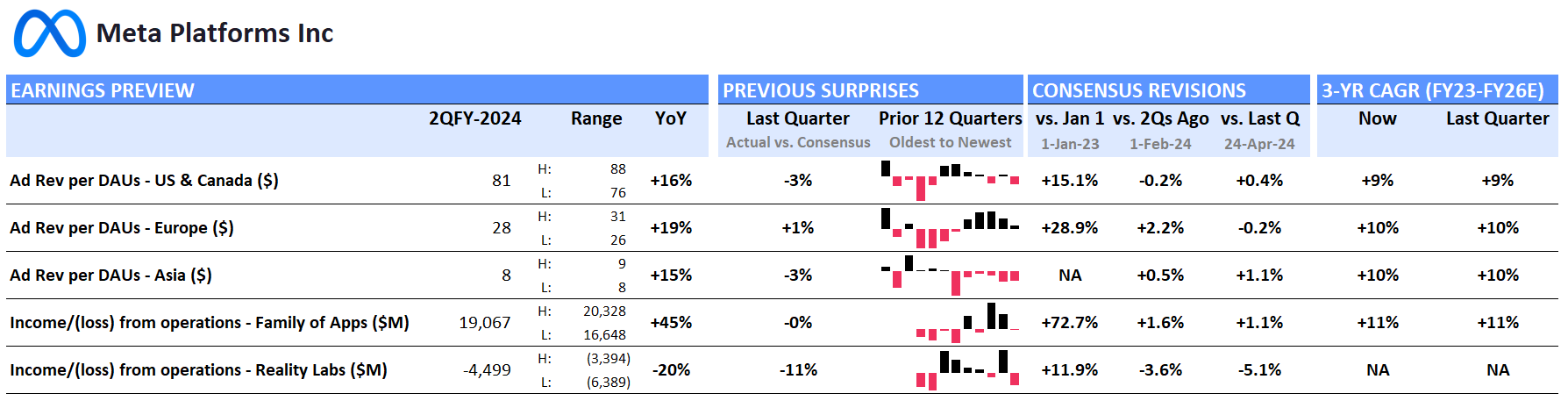

Meta Platforms – consensus expectations for Q2 2024, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (July 24, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

According to Visible Alpha consensus, estimated total revenues for Q2 have moved up to $38.3 billion, driven by better expected DAU performance in the Family of Apps segment across geographies, especially in the U.S. and Europe. On the cost front, expectations for operating profit have increased to $19.1 billion, up from last quarter, but there is some debate among analysts. Into Q2 for the Family of Apps’ income from operations estimates range from $16.6 billion to $20.3 billion. For 2024, expectations for operating income from the Family of Apps have ticked down to $80.6 billion from $81 billion since last quarter, driven by tempered views about efficiency in the business.

In addition to the continued expected efficiencies in the Family of Apps segment, projected losses from Reality Labs for 2024 have decreased further since last quarter, suggesting efficiency is expected to continue to have an impact here too. Will Meta be able to continue managing costs in 2025?

The stock has been flat since last quarter. What new information will come out of the Q2 release that could potentially be a catalyst?

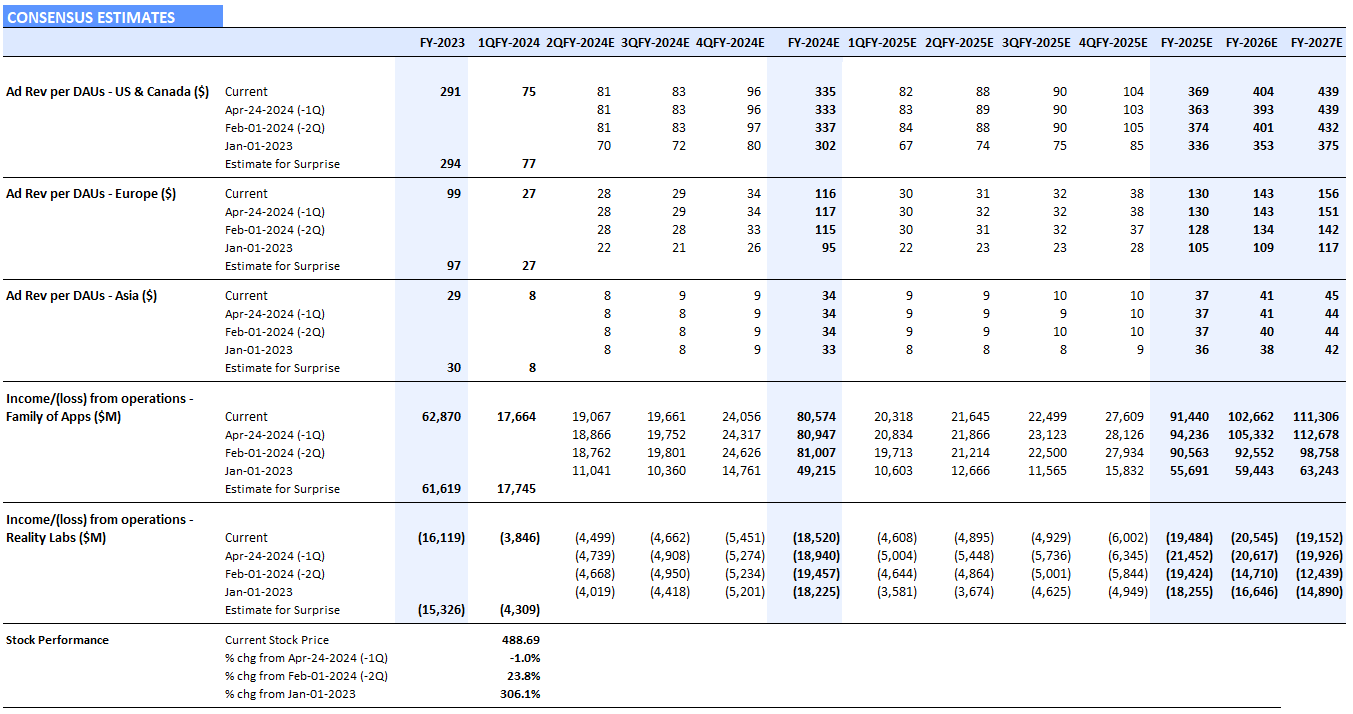

Meta Platforms consensus estimates

Source: Visible Alpha consensus (July 24, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date. Stock price data courtesy of FactSet. META’s current stock price is as of the market close on July 23, 2024.

Apple’s Fiscal Q3 2024 Earnings Preview

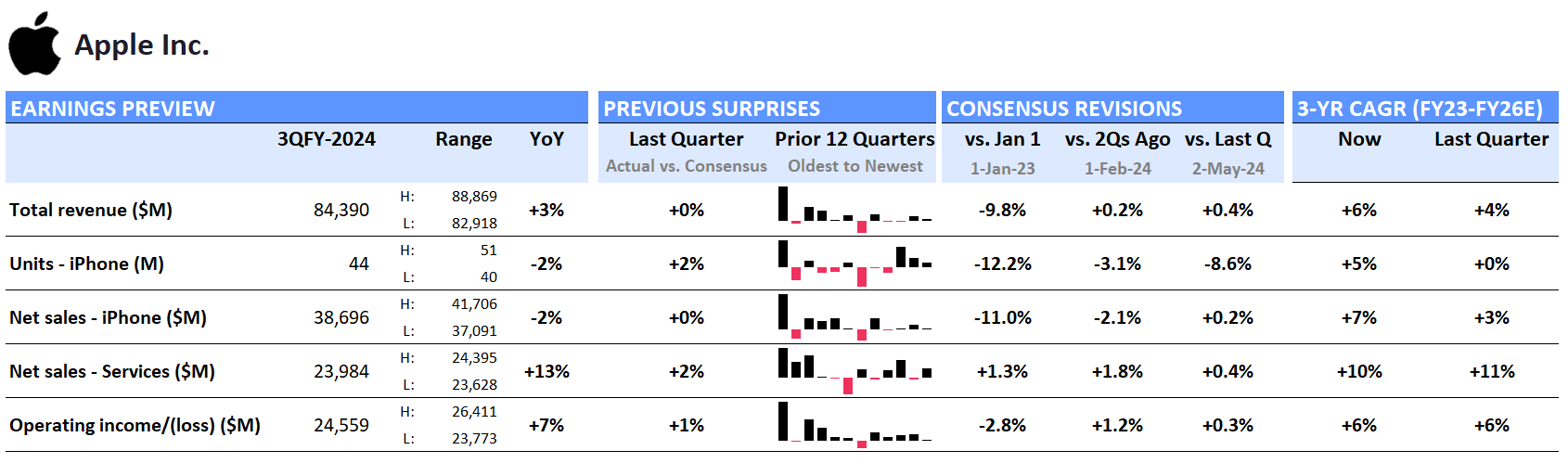

Apple – consensus expectations for Q3 2024, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (July 24, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Total revenues expected for fiscal Q3 have ticked up from the beginning of last year, according to Visible Alpha consensus, from $84 billion to $84.4 billion, driven by slightly increased optimism about the iPhone. Expected Q3 iPhone 15 units range from 29 million to 37 million, with consensus at 34 million or 77% of total iPhone units. Currently, Q3 is expected to deliver $38.7 billion in iPhone sales and $199 billion in 2024. Overall full-year iPhone revenue expectations have trended up since early 2024. Could the new Apple Intelligence capabilities help to drive upgrades?

In addition to the slightly improved iPhone sentiment, expectations for the high-margin Services segment also edged up for Q3 and FY 2024. Gross margin for the Services segment is over 70%, significantly higher than the 36% gross margin for Products. It will be helpful to hear what the company says in the earnings release about growth in Services and the role of Apple Intelligence.

Vision Pro will show results this quarter. In Q3, analysts estimate 72,500 units to be sold, generating $300 million. For the full year, consensus revenue estimates for the Vision Pro have remained flat at $1.2 billion.

The stock has rebounded since last quarter trading up 30% since the Q2 release, outperforming other Big Tech stocks and the S&P 500. Could the Q3 release provide another positive catalyst for the stock?